In a follow-up on the hepatitis A epidemic in the Czech Republic in 2025, the outbreak that started last April in isolated areas of Ostrava, has grown to 2,141 cases and 26 deaths, ten of them in Prague.

This compares to last year when 676 people…

In a follow-up on the hepatitis A epidemic in the Czech Republic in 2025, the outbreak that started last April in isolated areas of Ostrava, has grown to 2,141 cases and 26 deaths, ten of them in Prague.

This compares to last year when 676 people…

Actors Emilia Clarke and Bob Odenkirk were just two of the many celebrities who had birthdays last week.

In case you missed any of last week’s birthdays, here’s a roundup of our daily famous birthdays lists that took place between October 20-…

Recently, Mashable sat down with Sarah Bond, president of Xbox, who said that the next-gen Xbox console would offer a premium, high-powered experience. Now, Windows Central reports that the future…

Explore this week’s Macro Trends insights from Macrobond with the first installment below.

The US government remains in shutdown, leaving markets with very limited access to official economic data. Still, there is broad expectation that the Fed will move ahead with a rate cut this week:

Markets brace for a Fed rate cut as the US data blackout leaves investors searching for signals.

Insights:

Markets are fully pricing a 25 bp rate cut, with attention shifting to forward guidance rather than the decision itself.

The Fed’s dot plot still signals a gradual easing path, while Fed funds futures expect a faster decline toward ~3% by 2026. That divergence will drive the market reaction.

Insights:

Stephen Miran was sworn in as a member of the Federal Reserve Board of Governors on September 16, 2025.

With Miran joining the FOMC, the dot plot took on a new shape — as he stood out as the only member projecting a Fed funds rate below 3%, signaling significant cuts.

The new Fed governor will likely attract extra attention, especially as discussions around Powell’s eventual successor gain momentum.

Insights:

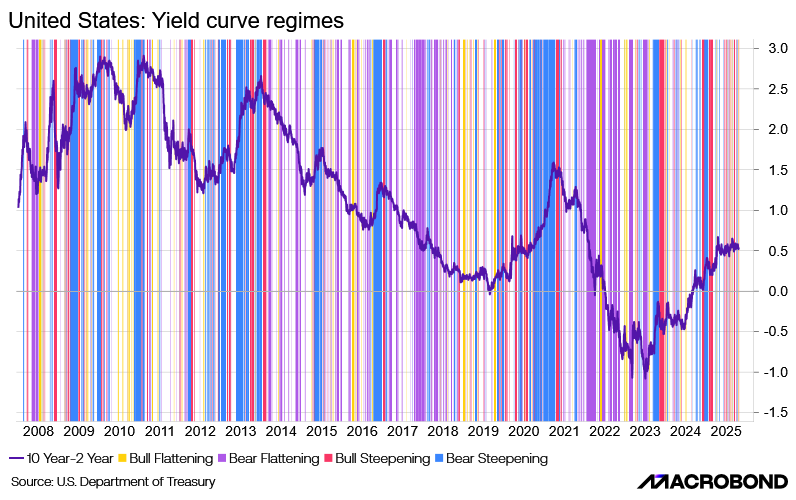

The Federal Reserve is in a rate-cutting cycle, while Trump’s fiscal policies are pushing longer-term yields higher through expectations of larger deficits and increased Treasury issuance. This mix of monetary easing and fiscal expansion is steepening the yield curve.

A key debate now is whether the steepening will be bearish or bullish:

Insights:

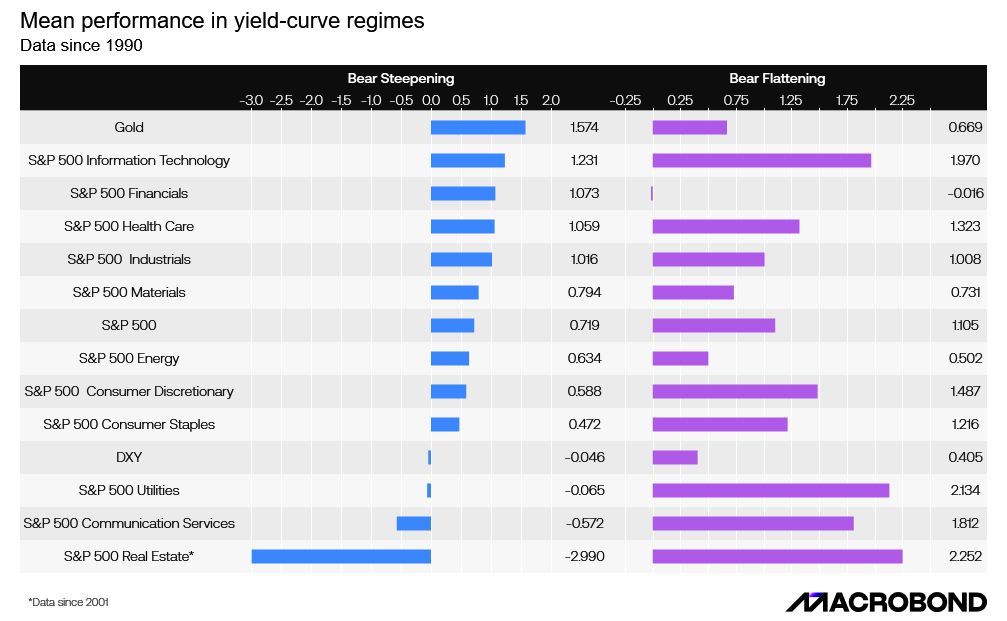

The direction this steepening takes will be crucial for market positioning, as equity valuations and fixed-income returns tend to react very differently under bear versus bull steepening regimes.

In this chart, you can see the historical performance of various equity sectors, fixed income, and gold across these different yield-curve environments.

Insights

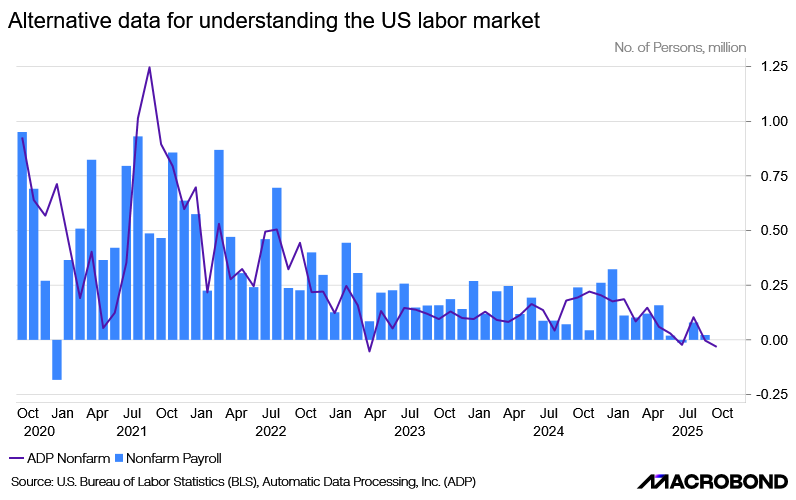

With the U.S. government shutdown halting operations at the Bureau of Labor Statistics (BLS), official labor market data — including the monthly Nonfarm Payrolls report — will not be released. This data blackout leaves policymakers and markets without one of their most important economic indicators. In the absence of BLS data, attention will turn to ADP’s private-sector employment report as a key alternative gauge of labor market momentum ahead of the Fed’s upcoming policy decisions.

Insights

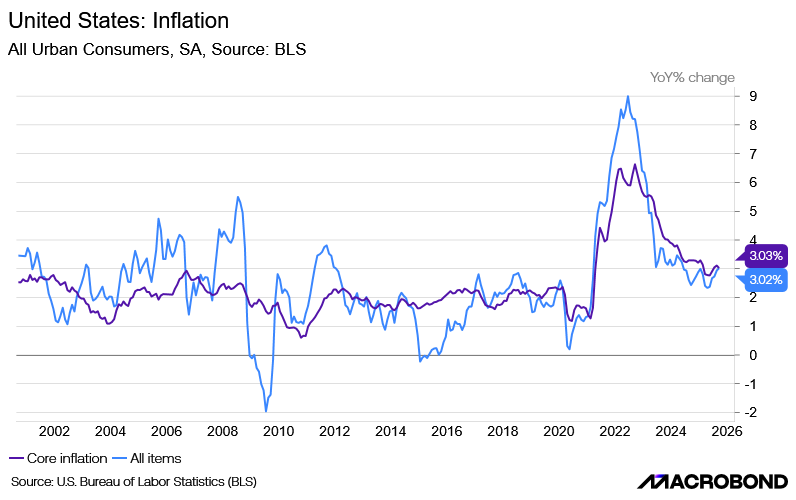

Last Friday, despite the ongoing government shutdown, markets received fresh economic data — the Consumer Price Index (CPI) for September.

The report showed that inflation remains stubbornly high at 3 percent, reinforcing concerns that price pressures are proving more persistent than the Federal Reserve had hoped.

This resilience in inflation is likely to weigh on the Fed’s upcoming policy discussions, as it complicates the path toward potential rate cuts and raises questions about how long restrictive monetary conditions will need to stay in place.

Robots can be programmed to do a variety of tasks, like packing boxes and even performing surgery. But each individual movement or task requires its own specific training process, which makes it hard for robots to adapt in real-world…

Subnautica 2 and PUBG publisher Krafton is positioning itself as an “AI-first company.”

The publisher said it would be “prioritizing AI as a central and primary means of problem-solving” and “fostering change in individuals and…

By sceditor on October 27, 2025 10:00 AM

HUNTINGTON BEACH, Calif. (October 27, 2025) – Players can save up to 90% on these and other Spike Chunsoft, Inc. titles from October 27 to November…

For the first time in seven years, Lily Allen is back with a new album. It’s intimate, raw and autofictional.

Last week, the “Smile” singer shared a 14-track breakup record, “West End Girl.” Amid her split with “Stranger Things”…