A new analysis of the landmark SELECT trial, published in

Blog

-

GLP-1 has proven benefits outside of weight loss; healthy hums, healthy brain; off-the-shelf cell therapy fights breast cancer – Morning Medical Update

The Lancet , confirms that semaglutide reduces the risk of major cardiovascular events in people with obesity and preexisting heart disease — even in those without diabetes and… -

The symptom that puzzled doctors for millennia

There certainly are potential downsides. As a 2021 review of fever in the Covid-19 pandemic era put it: “blocking fever can be harmful because fever, along with other sickness symptoms, evolved as a defence against infection”.

Using…

Continue Reading

-

Teenager who rescued toddler from busy road praised by police

Molly ArmstrongBBC South Scotland

Police Scotland Dumfries and Galloway

Police Scotland Dumfries and GallowayNicholas was presented with a Local Police Commander Recognition Certificate for his actions A teenager has been praised by police after he rescued a lost toddler who was…

Continue Reading

-

Basel III risk-based capital ratios increase while leverage ratio and Net Stable Funding Ratio remain stable for large internationally active banks, latest Basel III monitoring exercise shows

- Basel III risk-based capital ratios increased in the second half of 2024.

- Banks’ leverage ratio and Net Stable Funding Ratio remain stable while Liquidity Coverage Ratio decreased.

- Dashboards offer new features to explore results.

Basel III risk-based capital ratios increased while leverage ratios and Net Stable Funding Ratios (NSFRs) remained stable for large internationally active banks in the second half of 2024, according to the latest Basel III monitoring exercise, published today.

The report, based on data as of 31 December 2024, sets out trends in current bank capital and liquidity ratios and the impact of the fully phased-in Basel III framework, including the December 2017 finalisation of the Basel III reforms and the January 2019 finalisation of the market risk framework. It covers both large internationally active banks (Group 1) and other smaller banks (Group 2). See note to editors for definitions.

The implementation of the final elements of the Basel III minimum requirements began on 1 January 2023. At the end of the second half of 2024, the average impact of the fully phased-in final Basel III framework on the Tier 1 minimum required capital (MRC) of Group 1 banks was +2.1%, compared with +1.8% at end-June 2024. Group 1 banks report no regulatory capital shortfall, compared with €0.9 billion at end-June 2024.

The monitoring exercise also collected bank data on Basel III liquidity requirements. The weighted average Liquidity Coverage Ratio (LCR) decreased compared with the previous reporting period to 134.8% for Group 1 banks. Three Group 1 banks reported an LCR below the minimum requirement of 100%.

The weighted average NSFR was stable at 123.7% for Group 1 banks. All banks reported an NSFR above the minimum requirement of 100%.

The report is accompanied by interactive Tableau dashboards, offering users an intuitive way to explore results. New features enhance usability, while expanded explanatory text provides deeper insights into topics such as risk-based capital and operational risk. For the first time, users can also download the underlying data directly from the dashboards.

Note to editors

Through a rigorous reporting process, the Basel Committee regularly reviews the implications of the Basel III standards for banks and has been publishing the results of such exercises since 2012.

The results shown for “current Basel III framework” reflect the current jurisdictional standards that apply to the reporting banks as of 31 December 2024, which reflect different degrees of implementation of the Basel III reforms. The Basel III implementation dashboard provides an overview of Basel III implementation status across jurisdictions. The results shown for “fully phased-in final Basel III framework (2028)” assume that the positions as of 31 December 2024 were subject to the full application of the Basel III standards. That is, they do not account for transitional arrangements set out in the Basel III framework, which expire on 1 January 2028. No assumptions were made about bank profitability or behavioural responses, such as changes in bank capital or balance sheet composition. For that reason, the results of the study may not be comparable with industry estimates.

Data are provided for 176 banks, including 116 large internationally active banks. These “Group 1” banks are defined as internationally active banks that have Tier 1 capital of more than €3 billion and include 29 institutions that have been designated as global systemically important banks (G-SIBs). The Basel Committee’s sample also includes 59 “Group 2” banks (ie banks that have Tier 1 capital of less than €3 billion or are not internationally active).

The values for the previous period may differ slightly from those published in the previous report. This is caused by data resubmissions for previous periods to improve the underlying data quality and enlarge the time series sample.

Continue Reading

-

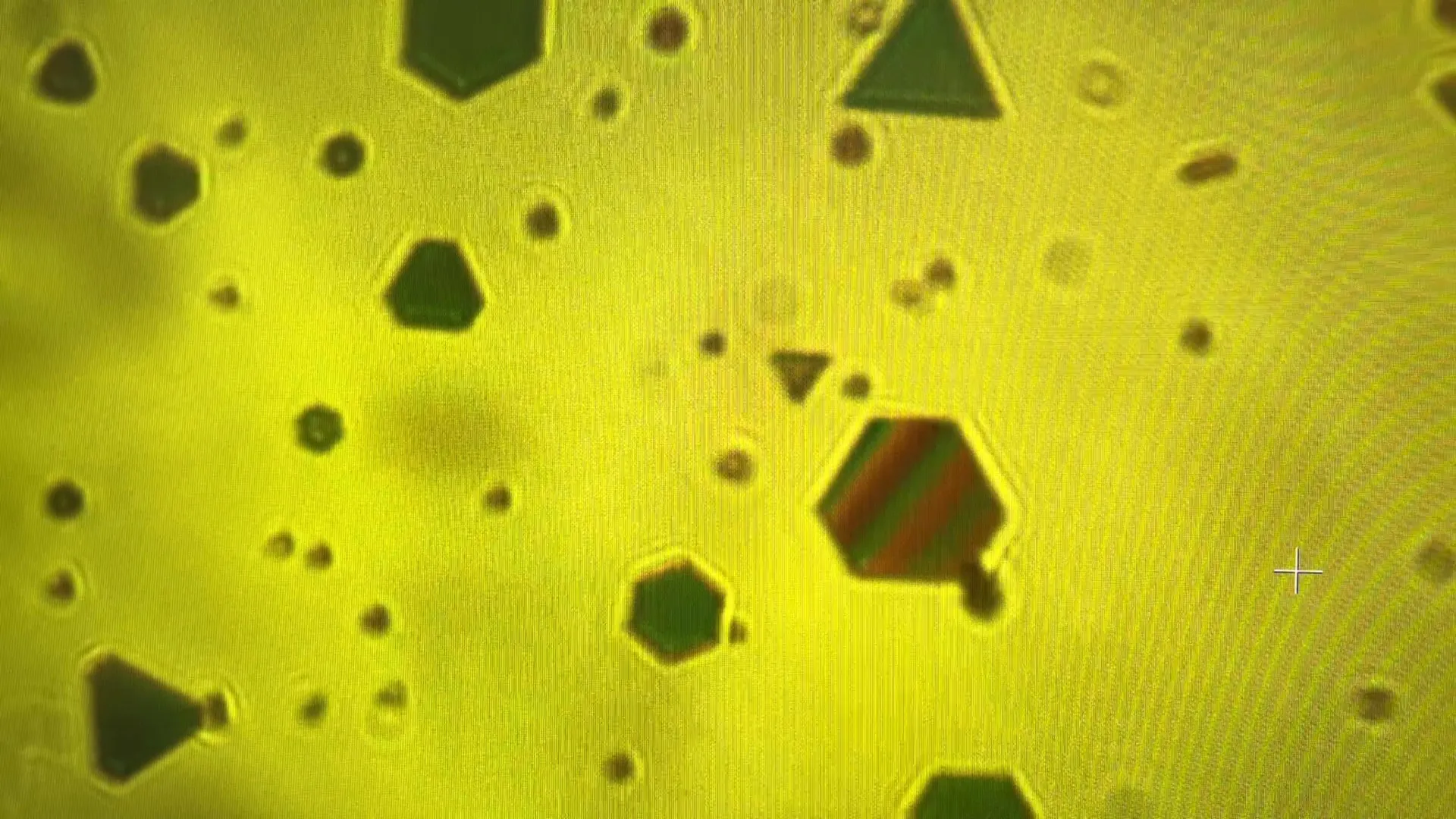

Gold flakes expose the secret forces binding our world together

When dust clings to a surface or a gecko walks across a ceiling, it happens thanks to what scientists call “nature’s invisible glue.” Researchers at Chalmers University of Technology in Sweden have developed a fast and simple way to observe these…

Continue Reading

-

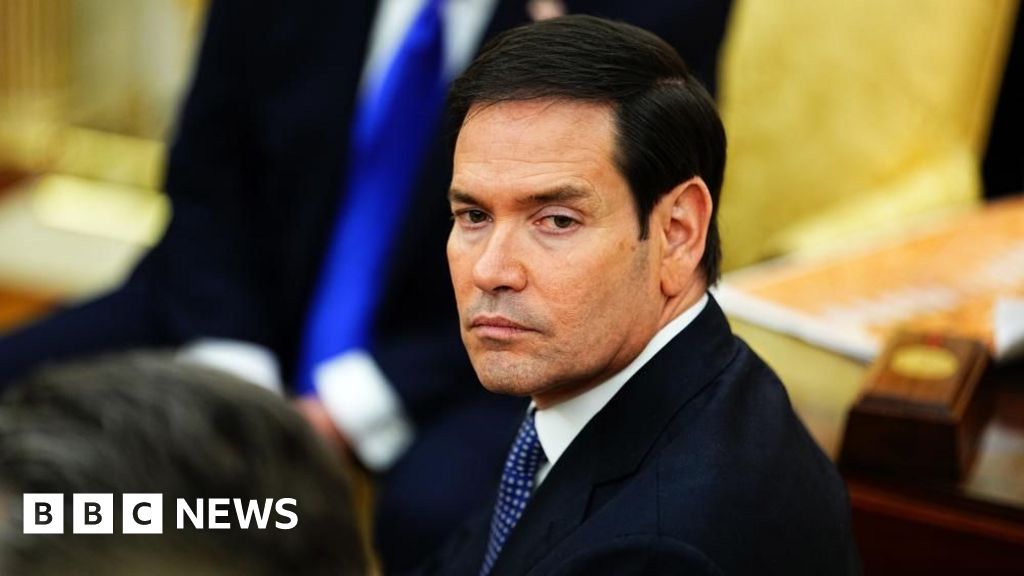

Rubio warns against West Bank annexation after Israel’s parliament advances move

The US Secretary of State has said that a move by Israel’s parliament towards annexation of the occupied West Bank would threaten Washington’s plan to end the conflict in Gaza.

“That’s not something we can be supportive of right now,” Marco Rubio…

Continue Reading

-

Alzheimer’s disrupts circadian rhythms of plaque-clearing brain cells – WashU Medicine

Visit the News Hub Mouse study shows how disease reprograms genes in specialized cells involved in amyloid removal

Getty Images

In a study published in Nature Neuroscience, researchers at WashU Medicine found in mice that amyloid…

Continue Reading

-

Unused labour potential in the EU: 11.7% in 2024 – News articles

In 2024, labour market slack in the EU accounted for 11.7% of the extended labour force, representing 26.7 million people aged 15 to 74 available for work but not participating in the labour market to their potential. This included unemployed and underemployed people, those seeking a job even though they are not immediately available to work and those immediately available to work but not seeking a job. With minor fluctuations, labour market slack in the EU has been decreasing over the decade, falling from 18.6% in 2015.

Among EU countries, Spain recorded the highest labour market slack in 2024 (19.3% of the extended labour force), followed by Finland (17.9%) and Sweden (17.8%)

In contrast, labour market slack was the lowest in Poland (5.0%), Malta (5.1%) and Slovenia and Hungary (both 6.3%).

Source dataset: lfsi_sla_a

Unemployment: the largest part of labour market slack

A detailed breakdown of labour market slack shows that 5.7% of the extended labour force was unemployed, 2.7% was available to work but not seeking employment, 2.4% of people were underemployed part-time workers and 0.9% were seeking employment but not immediately available to work.

Unemployed people made up most of the labour market slack in 23 EU countries, with the highest shares in Spain (10.9%), Greece (9.9%), Finland and Sweden (7.9% each).

However, there were some exceptions. In Ireland and the Netherlands, the majority of slack came from underemployed people working part-time (4.4% and 4.9%, respectively). In Czechia, the highest share was among people seeking work but not immediately available to start (3.1%), while in Italy, most were available to work but not seeking employment (7.3%).

Source dataset: lfsi_sla_a

Continue Reading

-

Tess Daly and Claudia Winkleman to leave Strictly Come Dancing at end of series

‘Lovely Bruce!’ Daly had been there from the startpublished at 10:19 BST

Emma Saunders

Culture reporter

Image caption, Daly and Forsyth, pictured for the 2014 Christmas special

Daly joined the show in the beginning, 2004, working…

Continue Reading