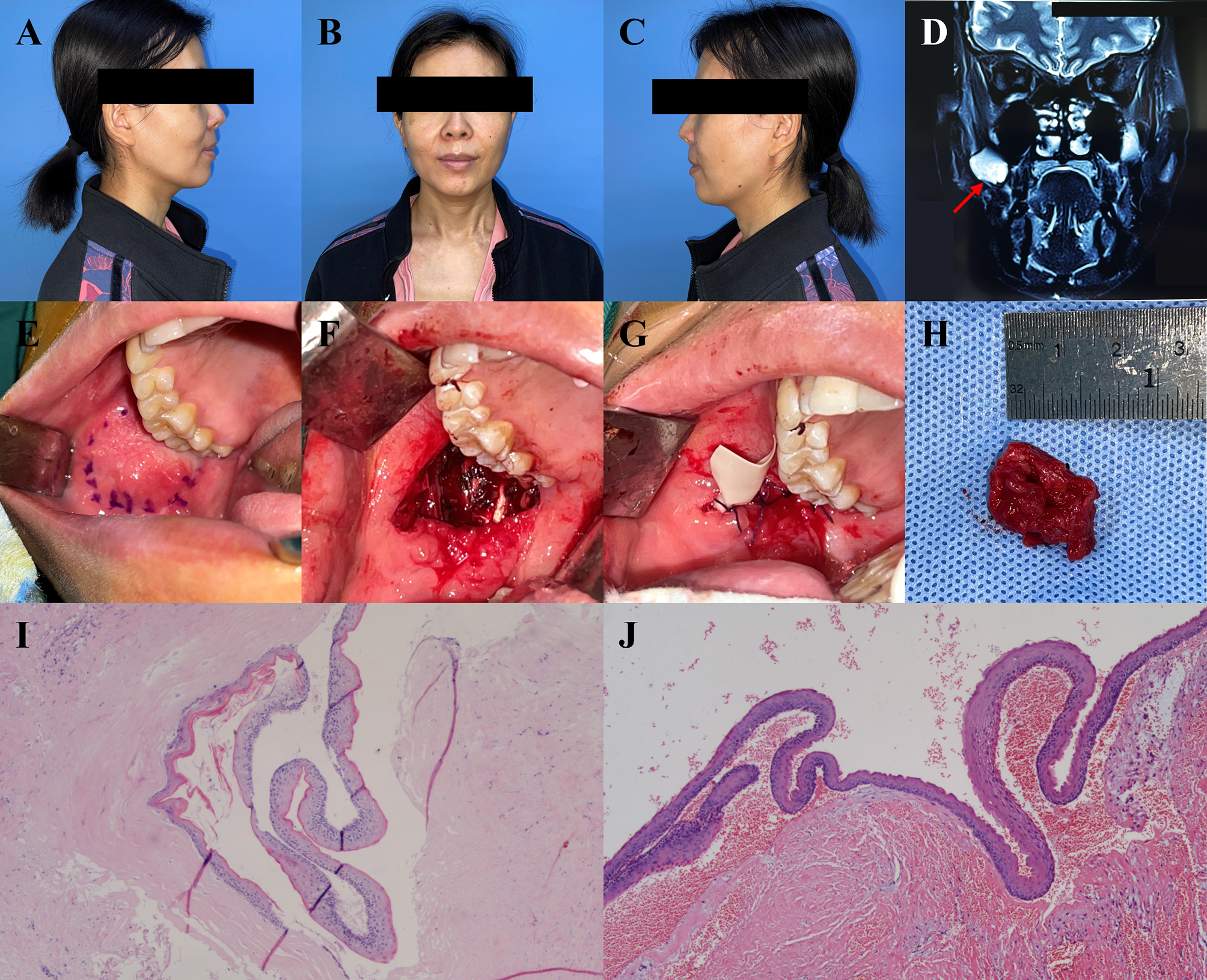

POKC is a particular type of OKC. Investigating the origin of POKC is critical, and its origin may potentially be deduced based on that of OKC. The most common theory suggests that OKCs arise from remnants of the dental lamina, which maintain…

Blog

-

How tiny drones inspired by bats could save lives in dark and stormy conditions

WORCESTER, Mass. — Don’t be fooled by the fog machine, spooky lights and fake bats: the robotics lab at Worcester Polytechnic Institute lab isn’t hosting a Halloween party.

Instead, it’s a testing ground for tiny drones that can be deployed in search and rescue missions even in dark, smoky or stormy conditions.

“We all know that when there’s an earthquake or a tsunami, the first thing that goes down is power lines. A lot of times, it’s at night, and you’re not going to wait until the next morning to go and rescue survivors,” said Nitin Sanket, assistant professor of robotics engineering. “So we started looking at nature. Is there a creature in the world which can actually do this?”

Sanket and his students found their answer in bats and the winged mammal’s highly sophisticated ability to echolocate, or navigate via reflected sound. With a National Science Foundation grant, they’re developing small, inexpensive and energy-efficient aerial robots that can be flown where and when current drones can’t operate.

Last month, emergency workers in Pakistan used drones to find people stranded on rooftops by massive floods. In August, a rescue team used a drone to find a California man who got trapped for two days behind a waterfall. And in July, drones helped find a stable route to three mine workers who spent more than 60 hours trapped underground in Canada.

But while drones are becoming more common in search and rescue, Sanket and researchers elsewhere want to move beyond the manually operated individual robots being used today. A key next step is developing aerial robots that can be deployed in swarms and make their own decisions about where to search, said Ryan Williams, an associate professor at Virginia Tech.

“That type of deployment — autonomous drones — that is effectively nil,” he said.

Williams tackled that problem with a recent project that involved programming drones to choose search trajectories in coordination with human searchers. Among other things, his team used historical data from thousands of missing person cases to create a model predicting how someone would behave if lost in the woods.

“And then we used that model to better localize our drones, to search in locations with higher chances of finding someone,” he said.

At WPI, Sanket’s project addresses other limitations of current drones, including their size and perception capabilities.

“Current robots are big, bulky, expensive and cannot work in all sorts of scenarios,” he said.

By contrast, his drone fits in the palm of his hand, is made mostly from inexpensive hobby-grade materials and can operate in the dark. A small ultrasonic sensor, not unlike those used in automatic faucets in public restrooms, mimics bat behavior, sending out a pulse of high-frequency sound and using the echo to detect obstacles in its path.

During a recent demonstration, a student used a remote control to launch the drone in a brightly lit room and then again after turning off all but a faintly glowing red light. As it approached a clear, Plexiglas wall, the drone repeatedly halted and backed away, even with the lights off and with fog and fake snow swirling through the air.

“Currently, search and rescue robots are mainly operational in broad daylight,” Sanket said. “The problem is that search and rescues are dull, dangerous and dirty jobs that happen a lot of times in darkness.”

But development didn’t go completely smoothly. The researchers realized that the noise of the bat robot’s propellers interfered with the ultrasound, requiring 3D printed shells to minimize the interference. They also used artificial intelligence to teach the drone how to filter and interpret sound signals.

Still, there’s a long way to go to match bats, which can contract and compress their muscles to listen only to certain echoes and can detect something as small as a human hair from several meters away.

“Bats are amazing,” Sanket said. “We are nowhere close to what nature has achieved. But the goal is that one day in the future, we will be there and these will be useful for deployment in the wild.”

Continue Reading

-

Qatar’s PM blames Palestinians for ceasefire violation after attack on Israeli soldier – Dawn

- Qatar’s PM blames Palestinians for ceasefire violation after attack on Israeli soldier Dawn

- Qatar PM: Palestinian party violated ceasefire, Doha is pushing Hamas to acknowledge need to disarm The Times of Israel

- FO condemns Israel for violating…

Continue Reading

-

BYD profit falls 33% as Chinese EV maker doubles down on overseas markets

Stay informed with free updates

Simply sign up to the Electric vehicles myFT Digest — delivered directly to your inbox.

BYD’s profits declined 33 per cent in the third quarter, highlighting the urgency of the Chinese electric vehicle maker’s overseas push following Beijing’s campaign against aggressive competition in the domestic sector.

BYD has become the world’s largest and fastest-growing producer of EVs and the chief global rival to Elon Musk’s Tesla. But the third-quarter results show a continued slowdown for the group after a period of breakneck growth.

The Shenzhen-based group on Thursday reported net income of Rmb7.8bn ($1.1bn), compared with Rmb11.6bn from the same period last year. The result fell short of analysts’ expectation of Rmb9.6bn, but was an improvement from Rmb6.36bn in the second quarter.

The company’s stock hit a record high in May after it made breakthrough announcements on battery charging and driverless technology, but second-quarter earnings came in lower than expected, hit by Beijing’s crackdown on aggressive discounting and supplier payment practices. Share have fallen more than 30 per cent from the May peak.

BYD remains the dominant EV force at home, selling about 30 per cent of new EVs so far this year, but it faces intensifying competition from local rivals such as Geely.

These pressures have forced BYD to double down on plans to rapidly expand sales abroad. Along with factories in Brazil, Hungary, Indonesia, Thailand, Turkey and Uzbekistan, it is constructing a fleet of eight purpose-built vessels to ship its cars.

Still, analysts expect BYD to announce further technological breakthroughs in the coming months, including an EV powered by a semi-solid-state battery. The technology, in which the battery’s electrolyte is a gel-like material rather than liquid, promises to increase energy density.

BYD is also testing “gigacasting”, a manufacturing process pioneered by Tesla in which vehicles are pressed with 9,000 tonnes of pressure to cast the underbody. The company said the process would remove the need to install 72 components and make vehicles lighter.

Analysts said they expected a design revamp in 2026, as Chinese consumers have grown weary of the brand’s signature “dragon face” design, which has been in use for seven years.

“This is a more fundamental cause of BYD’s challenges this year,” said Feng Xiao, co-head of China industrial research at CLSA. “BYD is redesigning the look of its cars.”

Revenue for the July to September quarter came in at Rmb195bn, down 3 per cent from the previous corresponding period and below the Rmb216bn forecast by analysts.

Gross margin was 17.6 per cent, up from 16.27 per cent in the previous quarter but still off the 21.89 per cent reported in the third quarter last year. The margin improvement reflects a higher share of premium models in the company’s product mix, including from overseas markets.

BYD’s exports in the first nine months of the year rose 14 per cent to 705,000 cars, according to data from Automobility, a Shanghai-based consultancy, putting it on track to achieve its forecast of 800,000 to 1mn overseas deliveries this year.

The group, which has forecast total sales of 4.6mn this year, has a long-term annual sales target of 10mn cars, with half coming from outside China.

China overtook Japan in 2023 as the world’s biggest car exporter following a boom in shipments of traditional cars with internal combustion engines to developing countries.

But the export mix is shifting, with battery-only and plug-in hybrid vehicles accounting for 35 per cent of shipments so far this year, up from about 20 per cent in 2023 and 2024.

BYD is the biggest driver of this change, capturing about 40 per cent of China’s total EV exports.

Continue Reading

-

Lankum announce new single, Specials cover ‘Ghost Town’ – Rough Trade Records

Watch the Leonn Ward directed video here

12” vinyl single out in January

LISTEN / WATCH

Rough Trade Records are excited to announce a new stand-alone single by Lankum. Originally created for an Oona Doherty dance show ‘Specky…

Continue Reading

-

Android XR Smart Glasses: What to Look Out For in 2026

Android XR (powered by Google, Samsung and Qualcomm) has proved its worth within extended reality as a pivotal driving force. With Samsung Galaxy XR’s release in October receiving critical acclaim, few…

Continue Reading

-

BorgWarner Battery System to Power HOLON’s Autonomous Shuttle

- First autonomous vehicle equipped with BorgWarner battery technology

- Marks first contract BorgWarner has secured with HOLON, a company of the BENTELER Group

- Battery system features the latest generation cell chemistry and benchmark-setting energy density

Auburn Hills, Michigan, October 30, 2025 – BorgWarner, a global product leader in delivering innovative and sustainable mobility solutions, has secured a contract to supply its battery system to the all-new HOLON urban, a 15-person, Level 4 autonomous, fully electric shuttle. The contract marks BorgWarner’s first supply of battery technology for autonomous vehicles produced in North America.

BorgWarner will supply its lithium nickel manganese cobalt oxide (NMC) 5AKM 157 cylindrical cell (CYC) battery system for the HOLON urban. Each vehicle will feature two battery packs, each equipped with an integrated, replaceable contactor box and a multi-pack controller. The 57 kWh battery packs incorporate a modular design with cylindrical NMC cells, which offer the latest generation cell chemistry and benchmark-setting energy density. Additionally, BorgWarner’s NMC battery system is protected by a robust stainless steel battery case and uses a compact, active liquid cooling system.

“BorgWarner has extensive experience with smart and integrated battery management systems and excels in energy density, scalability and robust safety certifications – all key components to this exciting new application,” said Henk Vanthournout, Vice President of BorgWarner Inc. and President and General Manager, Battery and Charging Systems. “Working with an innovator like HOLON is a great fit for our team. They aim to provide safe, sustainable and inclusive transportation solutions, aligning with our overall sustainability strategy and vision to create a clean, energy-efficient world.”

BorgWarner leveraged their battery pack know-how to design a pack that fits the customer’s space and performance needs of the HOLON urban. The pack features the latest BorgWarner-developed software and proven multi-pack controller, which meets cybersecurity and functional safety requirements.

Flavio Friesen, VP Engineering at HOLON confirms: “BorgWarner is a strong fit for HOLON: their battery platform combines benchmark energy density with robust safety, cybersecurity, and serviceability. The modular, liquid-cooled two-pack system integrates perfectly with our shuttle’s packaging and uptime requirements, supporting not only our North American rollout, but also the demands in Europe and the Middle East regions.”

BorgWarner’s battery system is Buy America compliant and satisfies the Foreign Entity of Concern (FEOC) restriction, further supporting its contract with HOLON. Manufacturing is scheduled to start in Q2 2027 in Seneca, South Carolina.

Continue Reading

-

Nanopores, hummingbirds and pies at the Timp Lab

What if we could trace the origins of disease back to just four letters — the DNA base — and even correct them at the molecular level?

Genomic research is entering a new era, driven by rapid advancements in sequencing…

Continue Reading

-

How fortified dairy can help close the nutrient gap in children’s diets

As governments tighten regulations on childhood obesity and parents seek healthier, non-HFSS choices, the importance of early nutrition has never been clearer. Antoine Hours, general manager at Yoplait UK, discusses how fortified dairy products…

Continue Reading

-

Baxter Reports Third-Quarter 2025 Results

PDFDEERFIELD, Ill. –

Baxter International Inc. (NYSE:BAX), a global medtech leader, today reported results for the third quarter of 2025.

“I joined Baxter because it’s a global healthcare leader – an iconic brand with an essential portfolio that touches more than 350 million patients every year,” said Andrew Hider, president and CEO. “In my first weeks, I’ve seen firsthand the passion and expertise that are at the heart of this company. I’ve been working side-by-side with our teams to understand what drives performance, as well as our challenges and opportunities ahead. Following this work, we have already taken decisive steps, including the launch of a new enterprise-wide continuous improvement system to sharpen execution and strengthen future results. There is clearly work ahead of us, but I’m energized by the team’s commitment, motivated by our potential, and confident we’ve begun taking the right steps to build a future of growth and enhanced performance.”

Third-Quarter 2025 Companywide Financial Results

Note that continuing operations exclude Baxter’s Kidney Care business, which was acquired by Carlyle in January 2025, and is reported as discontinued operations.

- Worldwide sales from continuing operations in the third quarter totaled approximately $2.84 billion, increasing 5% on a reported basis and 2% on an operational basis.

- U.S. sales from continuing operations in the third quarter totaled approximately $1.54 billion, increasing 3% on a reported basis and declining 1% on an operational basis.

- International sales from continuing operations in the third quarter totaled approximately $1.29 billion, increasing 8% on a reported basis and 5% on an operational basis.

- On a U.S. GAAP basis, net income (loss) from continuing operations totaled ($51) million, or ($0.10) per diluted share in the third quarter.

- On an adjusted basis, net income from continuing operations in the third quarter was $0.69 per diluted share, increasing 41% over the prior year.

Please see the attached schedules accompanying this press release for additional details on sales performance in the quarter, including breakouts by Baxter’s segments.

Third-Quarter 2025 Segment Results

- Medical Products & Therapies sales for the third quarter totaled approximately $1.33 billion, declining 1% on both a reported and operational basis. Performance in the quarter reflected reduced sales within the Infusion Therapies & Technologies division driven by lower infusion pump sales and softness in IV solutions, which the company believes is due to continuing post-Hurricane Helene fluid conservation efforts. This decline was partially offset by continued strong global demand for Advanced Surgery products.

- Healthcare Systems & Technologies sales for the third quarter totaled approximately $773 million, an increase of 3% on a reported basis and 2% on an operational basis. Performance in the quarter reflected continued demand for Care & Connectivity Solutions products. Growth in the Front Line Care division reflected sequential improvement across both U.S. and international markets.

- Pharmaceuticals sales for the third quarter totaled approximately $632 million, an increase of 7% on a reported basis and 7% on an operational basis. Performance in the quarter reflected continued strength in Drug Compounding and Injectables & Anesthesia products, which benefitted from increased volumes in select international markets and steady contributions from the Injectables portfolio.

Recent Highlights4

Baxter continues to advance key strategic priorities in pursuit of its Mission to Save and Sustain Lives. Among recent highlights, the company:

- Launched the Welch Allyn Connex 360 Vital Signs Monitor, its next generation patient monitoring device and the latest innovation in Baxter’s connected monitoring portfolio. Connex 360 offers an advanced connectivity and security platform, customizable configurations based on a hospital’s clinical routines, and upgrade capabilities that set the stage for future functionality and enhancements.

- Announced it was awarded a Gold Level Resiliency Badge from the Healthcare Industry Resilience Collaborative (HIRC) in the categories of IV Solutions, Nutrition Solutions and Premix Drugs, becoming the first manufacturer to earn this distinction across these categories.

- Highlighted the actions that supported an expedited recovery following the impact of Hurricane Helene at its North Cove, N.C. site, and how it is further strengthening resiliency across its supply chain.

2025 Financial Outlook

For full-year 2025: Baxter now expects sales growth from continuing operations of 4% to 5% on a reported basis. On an operational basis, Baxter now expects sales growth of 1% to 2%. The company now expects adjusted earnings from continuing operations, before special items, of $2.35 to $2.40 per diluted share.

For fourth-quarter 2025: The company expects sales growth from continuing operations of approximately 2% on a reported basis and a decline of approximately 2% on an operational basis. The company expects adjusted earnings from continuing operations, before special items, of $0.52 to $0.57 per diluted share.

A webcast of Baxter’s third-quarter 2025 conference call for investors can be accessed live from a link in the Investor Relations section of the company’s website at www.baxter.com beginning at 7:30 a.m. CDT on October 30, 2025. Please see www.baxter.com for more information regarding this and future investor events and webcasts.

Upcoming Webcasted Investor Events (to be made available on www.baxter.com)

- Jefferies Global Healthcare Conference at 7 a.m. CST, November 18, 2025

- Evercore Healthcare Conference at 9:50 a.m. CST, December 2, 2025

About Baxter

At Baxter, we are everywhere healthcare happens – and everywhere it is going, with essential solutions in the hospital, physician’s office and other sites of care. For nearly a century, our customers have counted on us as a vital and trusted partner. And every day, millions of patients and healthcare providers rely on our unmatched portfolio of connected solutions, medical devices, and advanced injectable technologies. Approximately 38,000 Baxter team members live our enduring Mission: to Save and Sustain Lives. Together, we are redefining how care is delivered to make a greater impact today, tomorrow, and beyond. To learn more, visit www.baxter.com and follow us on X, LinkedIn and Facebook.

Non-GAAP Financial Measures

Non-GAAP financial measures may enhance an understanding of the company’s operations and may facilitate an analysis of those operations, particularly in evaluating performance from one period to another. Management believes that non-GAAP financial measures, when used in conjunction with the results presented in accordance with U.S. GAAP and the company’s reconciliations to corresponding U.S. GAAP financial measures (which are included in the tables accompanying this release), may enhance an investor’s overall understanding of the company’s past financial performance and prospects for the future. Management uses these non-GAAP measures internally in financial planning, to monitor business unit performance, and, in some cases, for purposes of determining incentive compensation. This information should be considered in addition to, and not as substitutes for, information prepared in accordance with U.S. GAAP.

Operational sales growth is a non-GAAP measure that excludes the impact of the Kidney Care MSA not reflected in reportable segments, reflects the previously announced exit of IV solutions in China in the Medical Products & Therapies reportable segment, and is calculated on a constant currency basis, as if foreign currency exchange rates had remained constant between the prior and current periods.

Other non-GAAP financial measures included in this release and the accompanying tables (including within the tables that provide the company’s detailed reconciliations to the corresponding U.S. GAAP financial measures) are: adjusted gross margin, adjusted selling, general, and administrative expenses, adjusted research and development expenses, adjusted other operating income, net, adjusted operating income, adjusted other income (expense), net, adjusted income (loss) from continuing operations before income taxes, adjusted income tax expense (benefit), adjusted income (loss) from continuing operations, adjusted income (loss) from discontinued operations, adjusted net income (loss), adjusted net income (loss) attributable to Baxter stockholders, adjusted diluted earnings per share from continuing operations, adjusted diluted earnings per share from discontinued operations and adjusted diluted earnings per share. Those non-GAAP financial measures exclude the impact of special items. For the quarters and nine-month periods ended September 30, 2025 and 2024, special items for one or more periods included intangible asset amortization, business optimization charges, acquisition and integration costs, separation-related costs, expenses related to European medical devices regulation, certain legal matters, a goodwill impairment, investment impairments, product-related reserves, the gain on the sale of the Kidney Care business, Hurricane Helene costs, and certain tax matters. These items are excluded because they are highly variable or unusual and of a size that may substantially impact the company’s reported operations for a period. Additionally, intangible asset amortization is excluded as a special item to facilitate an evaluation of current and past operating performance and is consistent with how management and the company’s Board of Directors assess performance.

This release and the accompanying tables also include free cash flow, a non-GAAP financial measure that Baxter defines as operating cash flow less capital expenditures. Free cash flow is used by management and the company’s Board of Directors to evaluate the cash generated from Baxter’s operating activities each period after deducting its capital spending.

This release also includes forecasts of certain of the aforementioned non-GAAP measures on a forward-looking basis as part of the company’s financial outlook for upcoming periods. Baxter calculates forward-looking non-GAAP financial measures based on forecasts that omit certain amounts that would be included in GAAP financial measures. For instance, forward-looking operational sales growth represents the company’s targeted future sales growth excluding sales to Vantive under the Kidney Care MSA not reflected in reportable segments, reflects the previously announced exit of IV solutions in China in the Medical Products & Therapies reportable segment, and assumes foreign currency exchange rates remain constant in future periods. Additionally, forward-looking adjusted diluted EPS guidance excludes potential charges or gains that would be reflected as non-GAAP adjustments to earnings. Baxter provides forward-looking operational sales growth guidance and adjusted diluted EPS guidance because it believes that these measures provide useful information for the reasons noted above. Baxter has not provided reconciliations of forward-looking adjusted EPS guidance to forward-looking GAAP EPS guidance because the company is unable to predict with reasonable certainty the impact of legal proceedings, future business optimization actions, separation-related costs, integration-related costs, asset impairments and unusual gains and losses, and the related amounts are unavailable without unreasonable efforts (as specified in the exception provided by Item 10(e)(1)(i)(B) of Regulation S-K). In addition, Baxter believes that such reconciliations would imply a degree of precision and certainty that could be confusing to investors. Such items could have a substantial impact on GAAP measures of financial performance.

Forward-Looking Statements

This release includes forward-looking statements concerning the company’s financial results (including the outlook for fourth-quarter and full-year 2025) and operational, business development and regulatory activities. These forward-looking statements are based on assumptions about many important factors, including the following, which could cause actual results to differ materially from those in the forward-looking statements: the company’s ability to achieve the intended benefits of its recent strategic actions, including the sale of the Kidney Care business, business strategy and development activities (including the acquisition Hill-Rom Holdings, Inc. and completion of related integration activities) and cost saving initiatives, or of future long-term financial improvement goals; the impact of global economic conditions (including, among other things, changes in tariffs, taxation, trade policies and treaties, sanctions, embargos, export control restrictions, the potential for a recession, supply chain disruptions, inflation levels and interest rates, financial market volatility, banking crises, the war in Ukraine, the conflict in the Middle East and other geopolitical events, and the potential for escalation of these and other conflicts, the related economic sanctions being imposed globally in response to the conflicts and potential trade wars, global public health crises, pandemics and epidemics, or the anticipation of any of the foregoing, on the company’s operations and on the company’s employees, customers, suppliers, and foreign governments in countries in which the company operates and the company’s ability to identify actions to mitigate the impact of those conditions (or to realize the anticipated benefits of any such mitigating actions); demand and market acceptance risks for, and competitive pressures (including pricing) related to, new and existing products and services (including customer response to recent Novum IQ Large Volume Pump (Novum LVP) field actions and the related voluntary ship and installation hold, which may include additional returns or exchanges), challenges and reputational risks associated with converting customers to new or alternative products and challenges with accurately predicting changing customer preferences and future expenditures and inventory levels (including with respect to the impact of the Novum LVP ship and installation hold and what the company believes to be continuing fluid conservation practices) and with being able to monetize new and existing products and services, the impact of those products and services on quality and patient safety concerns, and the need for ongoing training and support for the company’s products and services; product development risks, including satisfactory clinical performance and obtaining and maintaining required regulatory approvals (including as a result of evolving regulatory requirements or the withdrawal or resubmission of any pending applications), the ability to manufacture at appropriate scale, and the general unpredictability associated with the product development cycle (which may result in monetary penalties owed to the company’s suppliers in the event the company does not place orders at levels contemplated in its contractual arrangements); future actions of, or failures to act or delays in acting by the U.S. Food and Drug Administration, the European Medicines Agency, or any other regulatory body or government authority (including the U.S. Securities and Exchange Commission, Department of Justice, Health Canada or the Attorney General of any state), or any product quality or patient safety issues (including those related to the company’s infusion pump category) that could delay, limit or suspend product development, manufacturing, or sale or otherwise lead to product recalls (either voluntary or required by governmental authorities), adverse regulatory site inspection reports, voluntary or official action indicated classifications, labeling changes, launch delays, warning letters, import bans, refusal of a government to grant or the government withdrawal of approvals, clearances, licenses or other marketing authorizations, denial of import certifications, sanctions, seizures, injunctions (including to halt manufacture or distribution), monetary sanctions, criminal or civil liabilities or litigation; the continuity, availability, and pricing of acceptable raw materials and component parts, the company’s ability to pass some or all of any increased costs to its customers through price increases or otherwise, and the related continuity of the company’s manufacturing, sterilization, supply and distribution and those of the company’s suppliers; failure to accurately forecast or achieve the company’s short- and long-term financial performance and goals, market and category growth rates, growth rates for the company’s segments, customer demand and related impacts on the company’s liquidity (including with respect to increased inventory levels); the company’s ability to execute on its capital allocation plans, including the company’s debt repayment plans, the timing and amount of any dividends, share repurchases and divestiture proceeds; future downgrades to the company’s credit ratings or ratings outlooks, or withdrawals by rating agencies from rating the company and its indebtedness, and the related impact on the company’s funding costs and liquidity; the company’s ability to finance and develop new products or services, or enhancements thereto, on commercially acceptable terms or at all; actions by tax authorities in connection with ongoing tax audits (including with respect to transfer pricing matters and the potential issuance of one or more Notice of Proposed Adjustments), the outcome of pending or future litigation (including as a result of customer or supplier disputes) and the sufficiency of any related reserves; fluctuations in foreign exchange and interest rates; the impact of any accounting estimates and assumptions, including with respect to goodwill, intangible assets, or other long-lived asset impairments on the company’s operating results; failures with respect to the company’s quality, compliance or ethics programs; our ability to attract, develop, retain and engage key employees, including as a result of organizational or other corporate changes and strategic initiatives, and the occurrence of labor disruptions resulting from labor disagreements under bargaining agreements or national trade union agreements, disputes with works councils or otherwise); inability to create additional production capacity in a timely manner or the occurrence of other manufacturing, sterilization, or supply difficulties, including as a result of natural disaster or severe weather event (such as Hurricane Helene), war, terrorism, global public health crises and epidemics/pandemics, regulatory actions, or otherwise; future actions of third parties, including third-party payors and the company’s customers and distributors (including group purchasing organizations and integrated delivery networks); breaches and breakdowns affecting the company’s information technology systems or protected information, including by cyber-attack, data leakage, unauthorized access or theft, or failures of or vulnerabilities in the company’s information technology systems or products; the company’s ability to effectively develop, integrate or deploy artificial intelligence, machine learning and other emerging technologies into the company’s products, services and operations in a manner that is compliant with existing and emerging regulations and consistent with evolving customer preferences; the impact of physical effects of climate change, severe storms (including Hurricane Helene) and storm-related events; changes to legislation and regulation and other governmental pressures in the United States and globally, including the cost of compliance and potential penalties for purported noncompliance thereof, including new or amended laws, rules and regulations as well as the impact of healthcare reform and its implementation, suspension, repeal, replacement, amendment, modification and other similar actions undertaken by the United States or foreign governments, including with respect to pricing, reimbursement, taxation (including taxation of income, whether with respect to current or future tax reform) and rebate policies; the company’s ability to meet evolving and varied corporate responsibility expectations of the company’s stakeholders, including compliance with emerging and potentially contradictory global sustainability regulations; the ability to protect or enforce the company’s patents or other proprietary rights (including trademarks, copyrights, trade secrets, and know-how) or where the patents of third parties prevent or restrict the company’s manufacture, sale, or use of affected products or technology; and other factors discussed in Baxter’s most recent filings on Form 10-K and Form 10-Q and other SEC filings, all of which are available on Baxter’s website. Baxter does not undertake to update its forward-looking statements unless otherwise required by the federal securities laws.

Baxter, Connex 360, Novum IQ and Welch Allyn are trademarks of Baxter International Inc.

1 Sales growth on an operational basis and adjusted diluted EPS are non-GAAP financial measures. See the “Non-GAAP Financial Measures” section below for information about the non-GAAP financial measures included in this release and see the accompanying tables to this press release for reconciliations of those non-GAAP measures to the corresponding U.S. GAAP measures.

2 Operational sales growth excludes the impact of the Kidney Care manufacturing and supply agreement (MSA) not reflected in reportable segments, reflects the previously announced exit of IV solutions in China in the Medical Products & Therapies reportable segment, and is calculated at constant currency rates.

3 Generally Accepted Accounting Principles

4 See links to original press releases for additional information.

Continue Reading