PUBLISHED

October 26, 2025

KARACHI:

…

Alphabet (NASDAQ:GOOGL) shares are up 51% over the past 12 months. But that’s nothing compared to many of the stocks in my quantum computing watchlist. Several of them are up more than 1,000%.

So, why am I talking about Alphabet and quantum computing?

Well, if you’ve been following this rather exciting sector you’ll know that Alphabet — the parent company of Google — is advancing its own quantum technologies, and it’s doing rather well.

Pure-play quantum computing stocks have been in vogue over the past 12 months, but they’re small companies, with relatively short pockets, and often no cash flow.

Alphabet on the other hand is a technology giant. Among other pros, it’s has a huge net cash position of over $50bn. I think its pockets are so deep that it could buy all of the pure-plays and have money left over.

Google’s recent demonstration of verifiable quantum advantage (doing something faster than a supercomputer) with its Willow chip and the Quantum Echoes algorithm is a milestone for quantum computing.

The experiment showed that complex simulations — such as molecular modelling — could be performed thousands of times faster than on the world’s fastest classical supercomputers.

From an investment perspective, this is important because it signals that quantum computing is moving from theory to practical application. In fact, Alphabet believes we will see real-world applications of quantum computing in the next five years.

Companies leading in this space are building a technological and competitive advantage that could one day open up opportunities in pharmaceuticals, materials science, and optimisation problems.

Early adoption could translate into faster innovation cycles and new revenue streams. For investors, breakthroughs like this highlight the potential of quantum technologies to reshape industries and generate long-term value.

For now, I don’t believe Google’s quantum computing achievements are really reflected in the share price. Which is strange because some of the pure-play quantum stocks are trading at ridiculous valuations.

However, if Alphabet continues to deliver these updates as we move towards a real-world application, I have no doubt that it will be reflected in the share price.

Personally, I believe Alphabet is among the best value mega-cap stocks. It’s often wrongly compared with communications peers when it’s really a technology giant.

Looking at the figure, the stock is currently trading around 26 times forward earnings. That’s broadly in line with the information technology sector average.

New research published in Scientific Reports has found that regular exercise paired with omega-3 supplementation can significantly enhance immune function and reduce the severity of chronic apical periodontitis, a type of inflammation that…

New research published in Scientific Reports has found that regular exercise paired with omega-3 supplementation can significantly enhance immune function and reduce the severity of chronic apical periodontitis, a type of inflammation that…

9.30pm, BBC Two

Daisy May Cooper is late meeting her brother Charlie – she’s been busy stocking up in a crystal shop, before they set off on a tour of the UK’s spookiest places. They start with a…

Nicola HaselerHertfordshire

BBC/Nicola Haseler

BBC/Nicola HaselerA pensioner who ploughed £40,000 into a fraudulent wine investment scheme has warned others not to fall for similar scams after three men were jailed.

Terry Fleming, 81, from Croxley Green, Hertfordshire, said he invested the money over two years believing he would make a profit, but eventually had to sell the bottles at a considerable loss.

Three men who stole at least £6m from 41 victims in the scheme were given prison terms to at St Albans Crown Court on Friday.

Mr Fleming said the scam “sounded believable” but the men only “cared about how much money they were going to make”.

Benjamin Cazaly, 43, of Coach House, Orpington, south-east London, was jailed for six and a half years; Dominic D’Sa, 46, of Oxford Avenue, Wimbledon, south-west London, for four and a half years; and Gregory Assemakis, 40, of Plaistow Grove, Bromley, south-east London, for three and a half years.

They had been found guilty of fraudulent trading in August.

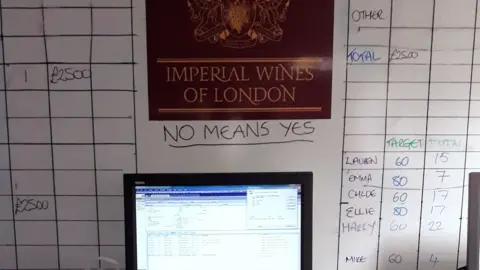

Cazaly founded Imperial Wines of London in 2008.

It claimed to be a family-run investment house with offices in Paris and Hong Kong.

In reality, it was a call centre in an office building in Groveland Court, London, which was raided by trading standards in November 2018.

An investigation by Hertfordshire Trading Standards found £37m passed through Imperial Wine & Spirits Merchants’ accounts during the 10 years it was trading.

Hertfordshire County Council

Hertfordshire County CouncilThe mantra “no means yes” was written on the wall, and they used films such as The Wolf of Wall Street to learn manipulation tricks.

Cold callers used fake names and followed scripts – found when the office was raided – to persuade pensioners to hand over their money.

Victims were sent glossy brochures that used logos from the Daily Telegraph and the Financial Times without permission.

Hertfordshire County Council said the jury was played a recording where a confused woman was asked for payment card details despite not knowing what a card was or who she banked with.

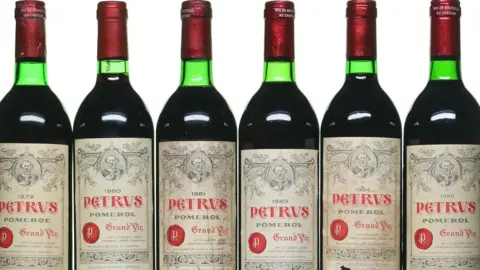

It said the long-running scam saw pensioners convinced to spend their life savings on wine investments which had vastly inflated prices.

Investors were told the company did not make money unless the wine was sold at a profit.

Mr Fleming said: “It sounded believable.

“It didn’t seem like you were paying a small price and getting a huge return, it would be an average purchase price and a reasonable profit selling price.”

But staff from Imperial Wines of London kept contacting him.

“They offered me better and better deals,” he said.

“Instead of just a slight profit, these were really good wines that were going to make a lot of money. I said ‘no, no, no’ and they kept coming back trying to sell me more and more wine.”

What Mr Fleming didn’t realise was that the bottles he was paying £2,000 for were only worth £400. In the end he had to sell them at a loss.

“They sold some of it for me at a loss but some of the wine just disappeared,” he said.

“I just gave up in the end. All they cared about was how much money they were going to make. “

Hertfordshire County Council

Hertfordshire County CouncilTrish Burls, from National Trading Standards, said: “Victims in this case lost thousands of pounds through a co-ordinated scam of lies, deceit and manipulation.

“The criminals exploited people’s passion and enthusiasm, preying on them to invest while stripping many of their life savings and causing significant emotional distress.”

Ajanta Hilton, executive member for community safety at Hertfordshire County Council, added: “The stories of those targeted with this investment scam are devastating.

“I’d like to thank them for their bravery in telling their stories so that these callous criminals could be brought to justice.”

Mr Fleming said he is speaking out to prevent other people from falling for similar scams.

“However smooth and nice they seem, they’re not,” he said.

“The nicer they seem, the worse they are.

“A lot of people I know didn’t cope, and it must have been terrible for them because their lives have been ruined.

Olivia Osby

Olivia OsbyLiam McCay was driving down Sunset Boulevard in Los Angeles with a friend from Ireland when it set in just how different…

MDCAT examinations, Dow Univeristy, Karachi Sindh October 26 2025 Photo: Our Correspondent

The Medical and Dental College Admission Test (MDCAT) 2025…

If you have been watching Bank of China’s stock, you are not alone. Whether you are considering buying in, holding, or wondering if it is time to lock in some profits, the last few years have given you plenty to think about. With share prices rising more than 23.8% in the past year and an outstanding 163.2% over the last five years, Bank of China has outperformed many expectations. Just this past week, shares nudged up another 2.6%, echoing a positive sentiment that has been building among investors.

Some of this optimism is tied to ongoing global financial shifts, where Chinese banks are seeing stronger capital inflows and a broad wave of strategic government support. Recent headlines highlight regulatory efforts aimed at reinforcing the stability of major banks, and Bank of China stands to benefit from both its size and its international footprint. These factors are changing how many investors perceive risk in the Chinese banking sector. They are also making those return numbers even more interesting.

With a value score of 5 out of a possible 6 checks for undervaluation, Bank of China already looks compelling compared to its peers. Next, let’s break down how that score came together using classic valuation approaches. As you will see, there may be an even more insightful way to look at the company’s worth.

Why Bank of China is lagging behind its peers

The Excess Returns valuation model measures how much return a company generates above the cost of its equity. This makes it a useful way to assess whether shareholders are getting a worthwhile reward for their investment risk. For Bank of China, this approach focuses on several key metrics drawn from forward-looking analyst expectations and historical performance.

Currently, Bank of China has a book value of HK$8.19 per share and a stable earnings per share (EPS) estimate of HK$0.75, based on a consensus of 14 analysts. The cost of equity is calculated at HK$0.78 per share, resulting in a modest excess return of HK$-0.02 per share. The company’s average return on equity is a solid 8.26%, with forecasts projecting a stable book value moving up to HK$9.11 per share, sourced from 11 analyst estimates.

Applying the Excess Returns model to these figures suggests an intrinsic value significantly higher than the current market price. The model estimates Bank of China’s stock to be approximately 53.8% undervalued. This result suggests the market may be underestimating the company’s capacity to generate returns on equity, especially relative to its peers and the industry average.

Bank Polska Kasa Opieki has recently seen a slight decrease in its consensus analyst price target, shifting from PLN 210.03 to PLN 207.78. This change comes as analysts weigh the bank’s robust historical revenue growth and stable asset quality, while also considering uncertainties brought on by evolving market conditions. Stay tuned to discover how you can continue monitoring key updates and shifts in the bank’s investment outlook.

Recent analyst activity reflects a reassessment of Bank Polska Kasa Opieki’s stock, factoring in both the company’s historical strengths and shifting market sentiment.

🐂 Bullish Takeaways

Analysts have previously rewarded Bank Polska Kasa Opieki for strong execution, consistent historical growth in revenue, and maintaining stable asset quality.

Positive mentions have often cited disciplined cost control and transparency, which support the bank’s resilient operating profile.

Some analysts acknowledge that while upside potential exists, much of it may be priced in at current valuation levels. This warrants a more balanced view going forward.

🐻 Bearish Takeaways

Oddo BHF downgraded Bank Polska Kasa Opieki to Neutral from Outperform on October 22, 0025, assigning a price target of PLN 200. This signals a more cautious stance on near-term upside.

The downgrade reflects elevated concerns about the bank’s valuation and the potential that recent market optimism may have already been factored into the share price.

Do your thoughts align with the Bull or Bear Analysts? Perhaps you think there’s more to the story. Head to the Simply Wall St Community to discover more perspectives or begin writing your own Narrative!

Bank Polska Kasa Opieki S.A. has announced a Special/Extraordinary Shareholders Meeting, which will take place on November 6, 2025, at 10:00 Central European Standard Time. The gathering is expected to address key strategic decisions for the bank’s future.

Analyst consensus price targets for Bank Polska Kasa Opieki have slightly declined, reflecting both steady performance fundamentals and increased market uncertainty.

Recent shifts in analyst outlooks, including a rating downgrade from Oddo BHF, highlight a cautious approach to the bank’s medium-term prospects amid valuation and market sentiment concerns.

The consensus analyst price target has decreased slightly from PLN 210.03 to PLN 207.78.

The discount rate has edged up marginally from 9.44% to 9.45%.

The revenue growth expectation has risen from 1.99% to 2.68%.

The net profit margin has decreased from 41.04% to 40.38%.

The future P/E ratio has declined modestly from 10.61x to 10.46x.