Sian FilcherEast Midlands

BBC

BBCA 22-year-old cancer patient has opened a respite lodge for teenagers and young adults going through treatment for the illness.

Continue Reading

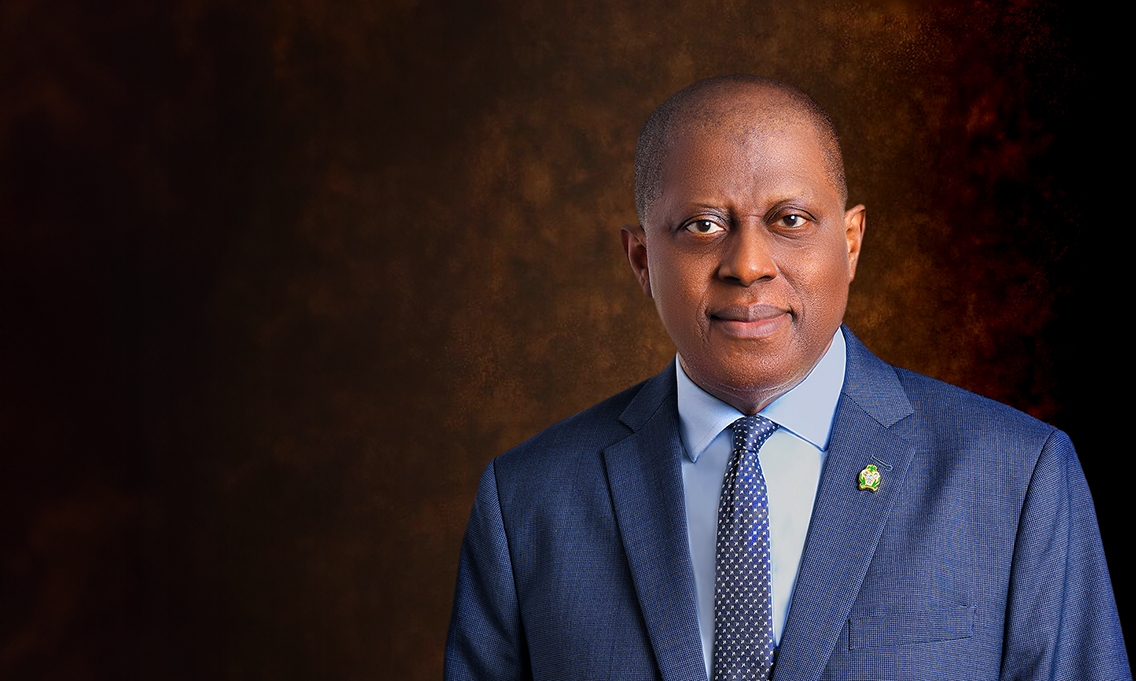

Banks that don’t meet recapitalisation target will downgrade their licences – Yemi Cardoso

This article was produced with the support of Central Bank of Nigeria

Cardoso made the clarification during a fireside chat on Friday, 10 October 2025, with Professor Helene Rey, Lord Bagri Professor of Economics at the Wheeler Institute of Business and Development, London Business School. The discussion, held in London with investors, academics, students and media representatives, came ahead of the IMF/World Bank Annual Meetings taking place from 13–18 October in Washington, DC.

Responding to a question from African Business, the CBN Governor said the recapitalisation exercise, which will conclude at the end of March 2026, is aimed at ensuring Nigeria maintains strong and resilient banks.

“With the banking recapitalisation, we left the door open in terms of the category of banking licence you decide to adopt,” Cardoso said. “If you feel that you cannot meet your capital requirement, you can downgrade your licence and move into another category of banks. You don’t need to merge if you don’t have to—but if you want to merge, go ahead.

I must emphasise that we have given all banks enough time to ensure they are able to meet the category of licence they want to hold. So we don’t see any cause for panic or disruption. Many of these anxieties may come from legacy issues—things that happened in the past that didn’t turn out well. We have given all banks different options. As these categories begin to emerge, you need to decide where your strengths lie and focus on that. You can’t be all things to all people.”

Earlier in the conversation, Cardoso clarified his comments on the CBN’s goal of achieving single-digit inflation, following the World Bank’s latest Africa’s Pulse report which described the target as unrealistic. The report projected that Nigeria, alongside Angola, Ethiopia, Ghana, Malawi, Sudan, Zambia, São Tomé and Príncipe, and Zimbabwe, will continue to record double-digit inflation throughout 2025.

“Sometimes one gets misquoted. I was clear that this is our goal in the medium term—that’s what I said,” he explained. “And you know why I said that? We have to challenge ourselves as Nigerians. We cannot be saying it’s alright to have double-digit inflation. We’ve got to keep pushing ourselves to get there.”

Cardoso also emphasised the need for better coordination between monetary and fiscal policy to sustain recent gains.

“This has been a challenge for Nigeria for years,” he said. “But the difference today is that the reforms that have taken place at the central bank are judged to be relatively successful, and people can feel the impact. That is encouraging the fiscal side to say, ‘Okay guys!’—and that’s a good thing.”

On the naira, Cardoso said that despite its earlier devaluation, the currency has now found its true value and become competitive under the market-determined, willing-buyer–willing-seller regime.

According to him, the market has responded positively to ongoing reforms, with the gap between the official and parallel market rates narrowing from about 50% to less than 2%. He added that there has been an accretion in reserves, a rise in foreign portfolio investments, and an improved ability of the CBN to meet domestic demand for foreign exchange.

“Nigerians are comfortable with the fact that even though the naira was devalued, it is now stable and there is predictability, allowing people to plan,” he concluded. “Without stability, we can’t have meaningful progress.”

Continue Reading

Écija: AI, external capital and expansion in Latin America

102.3 million in 2024, 37 offices and a £200 million target by 2030: Écija’s rise amid AI and investors

by mercedes galán

The legal sector is experiencing a moment of accelerated transformation, driven by digitalization, artificial intelligence and the entry of external capital in some firms. In this context, Hugo Écija, founder and chairman of Écija Abogados, sets out his model: business structure with separation between capital, management and service provision, intensive adoption of technology and an internal culture oriented towards continuous adaptation.

“I started my firm at 26, and today I am 53. I have dedicated more than half of my life to this project, which has been vital, with vision and always evolving,” recalls Écija, who founded his firm in Madrid in 1997.

ORIGIN

With the start of the new century, Écija decided to structure the firm as a limited company, separating capital, management and service provision, and focused on then-emerging areas such as audiovisual law and intellectual property. “Lawyers were at once owners, managers and those who contributed capital. Everything was mixed. I came from doing an MBA, from working in the U.S., and I asked myself: why did lawyers have to do everything?” he explains.

That business approach, unusual in Spanish legal practice in the late 1990s, made a difference. “Innovation is not only technological: law firms are companies that must adapt to the social, cultural and technological environment. Those that do not, die. And the speed of adaptation today is vital,” he comments.

ARTIFICIAL INTELLIGENCE

…

Continue Reading

4th ASEAN+3 Economic Cooperation and Financial Stability Forum (AMRO Forum) – ASEAN+3 Macroeconomic Research Office

The ASEAN+3 Economic Cooperation and Financial Stability Forum, or AMRO Forum, is a platform for regional and global exchange of knowledge and ideas on economic cooperation and financial stability.

In its fourth edition, AMRO will co-organize the forum with the Hong Kong Monetary Authority (HKMA) and Bank for International Settlements (BIS), with a common goal of achieving macroeconomic and financial resilience and stability for the region.

This year’s theme is Fragmentation to Resilience: Macro-financial Stability and Regional Integration in ASEAN+3. The ASEAN+3 region is faced with challenge of safeguarding financial stability and strengthening macro-financial resilience while sustaining long-term prosperity. Although ASEAN+3 has made substantial progress in economic and financial cooperation over recent decades, the current global transformation demands even higher degree of collective action to navigate the changing international order.

The forum will discuss the near-term risks and challenges to the region’s macro-financial stability and outlook, and present solutions and initiatives to promote its medium to long-term economic growth journey. There will be two sessions, comprising keynote speeches and panel discussions.

Join us online on November 25, 2025!

REGISTER NOW

Continue Reading

French biochemist shares ‘simple meal hack’ that can reduce blood sugar spikes by up to 70%

Published on: Oct 13, 2025 01:06 pm IST

Want steadier blood sugar? French biochemist Jessie Inchauspé shares why the order of foods on your plate matters more than you think.

Continue Reading

DNA repair secrets of naked mole-rats may guide new drug discovery

New research has demonstrated how tiny tweaks in a DNA-sensing enzyme may hold the key to the naked mole-rat’s extraordinary lifespan – offering insights that could one day inform therapies for aging and age-related diseases.