Blog

-

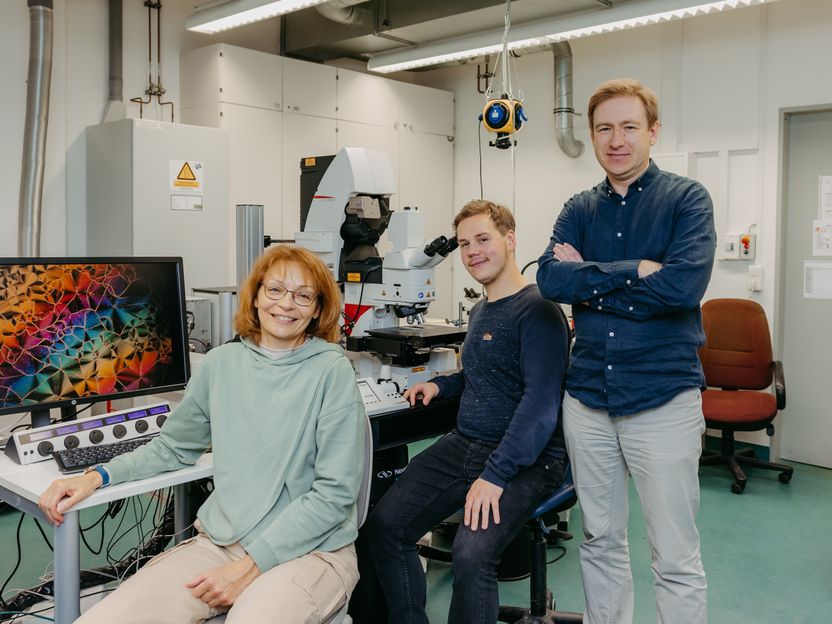

Researchers at the University of Magdeburg discover new class of materials

Physicists at Otto von Guericke University Magdeburg have developed a new class of materials: so-called multiferroic liquids. These materials combine ferromagnetic and ferroelectric properties in a liquid state for the first…

Continue Reading

-

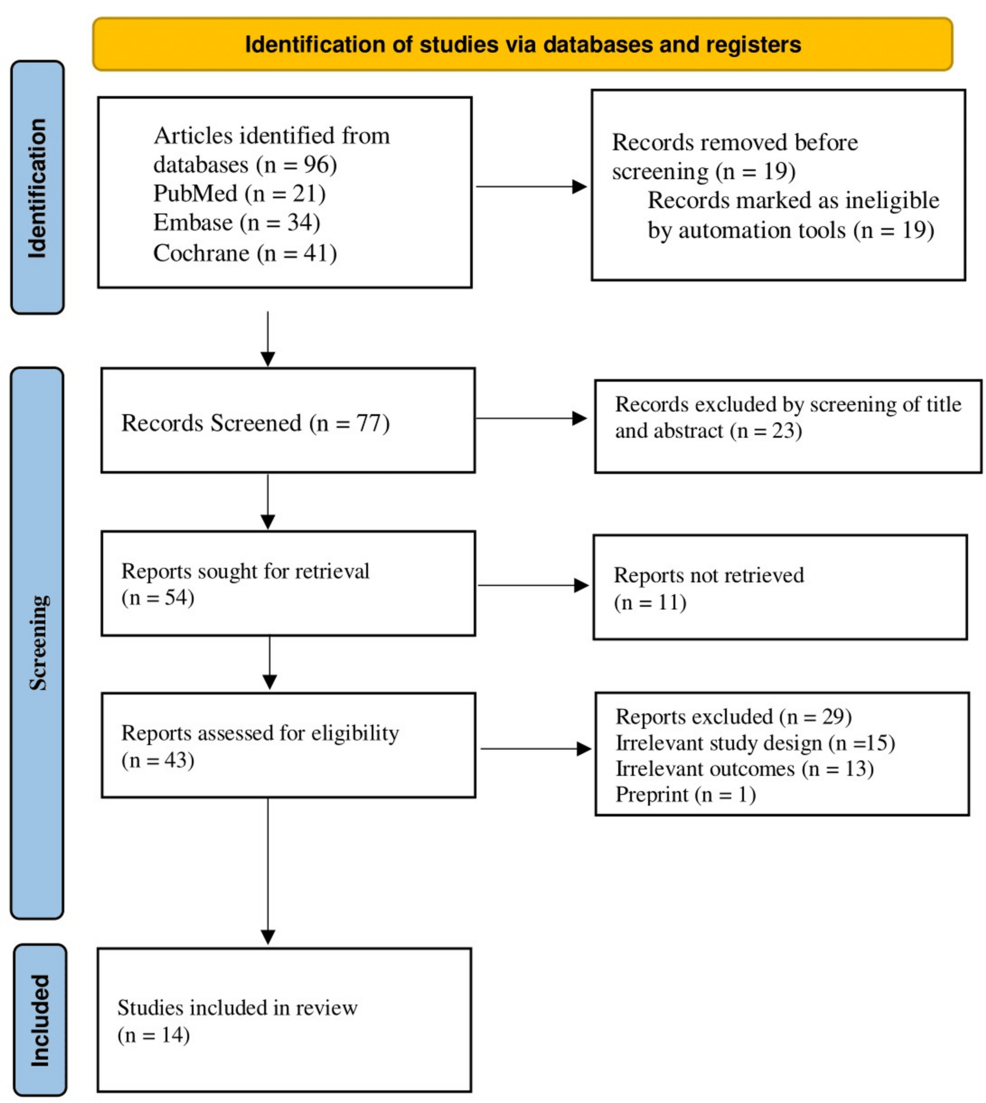

Limited Effectiveness of Neo-Adjuvant Chemo-Radiotherapy in Stage II a

Introduction

Mucinous adenocarcinoma of the rectum is characterized by a high mucin content and represents 10–20% of all rectal cancers. This distinct histopathological subtype is associated with unique clinicopathological features such as…

Continue Reading

-

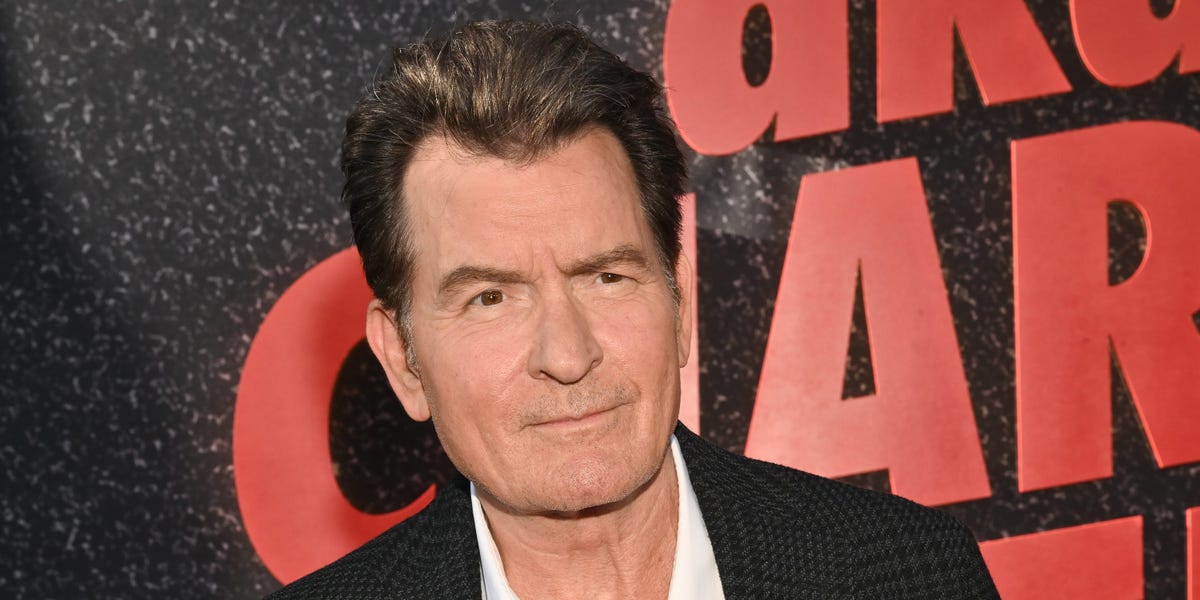

Charlie Sheen Says Hiding Having HIV Was Harder Than Living With It

Charlie Sheen says the weight of hiding his HIV diagnosis took a greater toll on him than managing the condition itself.

On Thursday’s episode of “In Depth with Graham Bensinger,” the actor spoke about his new memoir…

Continue Reading

-

Comparative Analysis of Paraspinal Muscle Fat Infiltration and Clinica

Introduction

Transforaminal lumbar interbody fusion (TLIF) has traditionally been a standard approach in lumbar fusion surgeries. However, the development of minimally invasive spinal techniques has positioned Minimally Invasive Transforaminal…

Continue Reading

-

Palmar Forensics uses CLEAR for vendor fraud protection

Why Thomson Reuters Risk & Fraud Solutions?

After a comprehensive process evaluating alternative solutions, Palmar Forensics selected Thomson Reuters CLEAR as the backbone of its investigative and vendor credentialing workflows for several reasons.

The first was comprehensiveness and navigability; full reports are thorough yet easier to navigate than alternatives. Their prior tool generated 200 to 300-page reports with lots of noise; CLEAR’s reports contain less irrelevant information, are structured, and searchable. As Joseph Palmar, CEO of Palmar Forensics puts it, “CLEAR is more effective and efficient. The CLEAR report is still 60 or 70 pages long, but it’s simple to navigate. It’s just so much easier to find out what you need to know. And it’s complete and accurate — it’s so comprehensive.”

CLEAR’s algorithms and logic were also praised. Particularly the strong relationship and ownership discovery that uncovers shell or sister companies and bid-rigging; targeted modules like CLEAR Risk Inform, CLEAR ID Confirm, and seamless alerts for continuous monitoring. These features gave CLEAR a competitive advantage.

Lastly, Palmar called out the credibility of Thomson Reuters and CLEAR within the industry, making it easy for him to trust.

“The Thomson Reuters CLEAR solution is the gold standard of fraud investigations. Law enforcement and the federal government both use it. I’ve lost count of how many meetings I’ve walked into where we’ve mentioned that we use CLEAR and they instantly realize we know what we’re talking about,” he says.

The value of CLEAR

Since 2012, Palmar Forensics has been using CLEAR — which provides comprehensive, up-to-date information from public records, sanctions databases, and media coverage. It also performs ID validation through CLEAR ID Confirm and subject-risk analytics through CLEAR Risk Inform.

When onboarding new vendors, Palmar Forensics uses CLEAR as the backbone of its proprietary vendor credentialing tool, VETTED®, to verify that the suppliers its clients want to work with are legitimate and independent businesses — and that their officers and or directors are “clean.” CLEAR does so by researching areas such as current and previous addresses, business relationships, criminal records, and creditworthiness. Then, they can be onboarded with greater certainty.

“We make sure clients are dealing with reputable organizations that aren’t shell companies, that aren’t linked to other similar businesses for bid-rigging purposes, and that the company’s officers aren’t criminals or have a nefarious history. In our world, that’s not an unusual situation — it’s an everyday occurrence,” says Palmar.

Uncovering hidden insights

If clients have suspicions about an existing vendor, Palmar Forensics uses CLEAR as part of an automated tool called VETTED to do a deeper dive to check for undisclosed relationships with other organizations, criminal links or backgrounds, or any lawsuits, liens or judgements. In one recent example, an investigation into a list of vendors provided by a client uncovered a conflict of interest in the awarding of contracts — several “separate” vendors were owned by the same people. In another example, one company owner was unaware that their business partner of 20 years had been charged with assault with a deadly weapon.

“Using Thomson Reuters Risk & Fraud Solutions as the backbone of VETTED gives us insights we wouldn’t otherwise have, so clients can understand who they’re doing business with,” explains Palmar. “CLEAR allows us to identify whether there’s anything in a company or individual’s background that’s fraudulent or in any way problematic. We have a suite of tools that we use, but the backbone of everything is CLEAR from Thomson Reuters.”

CLEAR alerts are incredibly useful, according to Palmar. By setting up alerts on certain entities and officers, it is notified about any potential reputational or financial hit to its clients, after the initial onboarding verification process. For Palmar Forensics, this continuous monitoring adds another important layer to the solution’s capabilities.

When considering the value of CLEAR, Palmar says decision-makers need to think beyond strict return on investment (ROI) metrics. That’s because vendor fraud does not usually happen at volume. But when it does occur, the damage can be incalculable. So, while only a small fraction of vendors commit fraud or have criminal associations, organizations must do everything they can to root them out. CLEAR enables them to do that — and that’s where its true value lies.

He cites the example of a charitable foundation where seven of its 500 vendors — accounting for 1% of its vendor base — stole $3 million over the course of five years. In addition to the direct financial loss, this raised the risk that donors would no longer donate money to that organization. Similarly, in the health care sector, if fraud is uncovered in the Medicaid or Medicare space, companies may find their government funding is suspended or withheld, which could have significant implications for business continuity beyond the loss itself.

“You need to spend money to prevent fraudulent expenditures and protect your reputation,” Palmar says. “If you have a massive fraud, your stock price may be affected but there may be even bigger problems to deal with. You can’t measure reputational harm, but one mistake can destroy the reputation you’ve worked so hard to develop.”

“To my mind, it’s better to do the preemptive work to protect the organization. At least if you’ve done your checks, that’s something you can say to the media, or to the board, as opposed to saying no, we didn’t do that because there was no ROI for doing so.”

Continue Reading

-

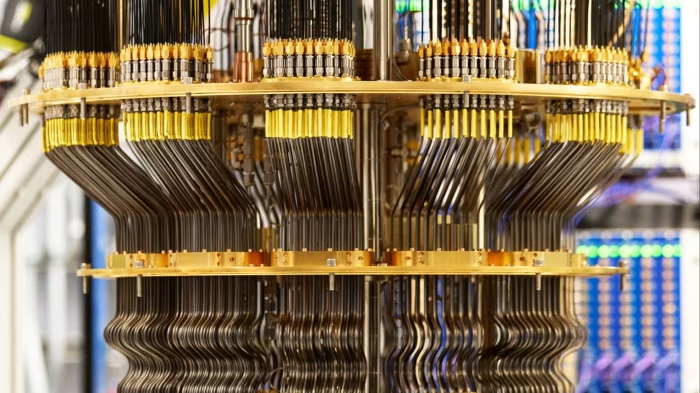

Quantum technology is coming to the real world

Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

The writer is senior vice-president for research, labs, technology and society at Google-Alphabet

Quantum computing able to harness the subatomic world may seem like a distant prospect to some people. This misapprehension persists despite recent research breakthroughs, many built on the foundational research of 2025 Nobel laureates John Clarke, Michel Devoret, and John Martinis. But quantum computers are already being used for scientific research and real-world applications appear likely to emerge in the near future, even before we get to the goal of large-scale, error-corrected computing systems.

Estimates of how long it will be before we can use quantum computing in ways that will affect most people’s lives vary from a few years to decades. Rather than a single light-switch moment when we shift all at once from not having a quantum computer to having one, it’s more likely that we will follow a more gradual quantum continuum as the systems increasingly become useful.

A helpful way to think about this stage of quantum development is something akin to artificial intelligence in 2010, when neural networks were on the cusp of becoming useful but before advances like protein structure predictor AlphaFold or generative AI chatbots.

Quantum technology holds the promise of solving difficult problems, helping us to learn the structure of quantum systems, from molecules to magnets to black holes.

Similar to early neural networks, quantum computing is already proving useful as a platform for research and experimentation. For example, researchers such as Misha Lukin at Harvard have used them to uncover new phenomena like many-body quantum scars, which reveal order embedded within quantum chaos.

We are also starting to see the potential for real-world applications with quantum advantage (ie problems that quantum computing can solve that are beyond the reach of classical supercomputers), which can advance areas like drug discovery and material science.

We are making progress on quantum computing itself: Google’s quantum processor ran in minutes a benchmark algorithm that would take today’s fastest supercomputers 10 septillion years (a period of time that vastly exceeds the age of the universe). More significant was the demonstration of “below threshold” error correction — a long-standing challenge in the field. Last week, we published the first algorithm with verifiable quantum advantage on hardware and in proof-of-principle experiments with the University of California, Berkeley, found it could be used to understand molecular structure when combined with a common chemistry technique.

Researchers and mathematicians have highlighted at least 70 algorithms — from mathematics and data science to simulation and machine learning — that could allow quantum computers to solve problems much faster than classical ones in a wide range of useful areas. One that has captured public attention since its discovery in the 1990s is Shor’s algorithm, which is expected to be capable of cracking much of the encryption used by today’s most advanced communications systems and digital networks.

While not imminent, here too we are closer than public perception might acknowledge. This year there was a 20-fold decrease in the estimated size of the quantum computer needed to run Shor’s algorithm and crack the widely used RSA-2048 encryption. This shortened timeline underscores the importance of migrating to new, post-quantum cryptography standards, such as those released by the US National Institute of Standards and Technology last year.

Within five years we are likely to start to see real-world applications become possible, even before we get to a large-scale error corrected quantum computer. In order to be prepared to capitalise on these developments, different sectors have the opportunity to lay the groundwork now.

For governments, that might look like investments in quantum infrastructure such as cryogenic cooling systems, specialised electronics and quantum-ready networks. For businesses, it may be determining how the technology might be useful to their respective industries, for example accurate simulation of molecules in the creation of batteries for electric carmakers, or fusion power for the energy industry.

Individuals should consider how quantum might influence their own careers. We’ll need more specialised engineers (including electrical, mechanical, systems and software engineers), technicians, and applications developers. For anyone thinking about the jobs of the future, these are the fields that could be areas of potential opportunity.

Continue Reading

-

deals, dollars, deposits and Donald

Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Europe’s investment banks were already fighting an uphill battle to catch up with their Wall Street rivals, which dwarf them in both size and valuation terms. The return of Donald Trump to the White House has created a medley of additional challenges, laid bare in quarterly earnings this week.

The first problem: deals. In the US, Trump’s deregulatory agenda has encouraged a flurry of mergers and new listings at home. Yet his unpredictable foreign policy is eliciting caution abroad. So while takeovers of US companies jumped 25 per cent in the first nine months of this year to $1.4tn, according to LSEG data, European deals were up just 11 per cent to $554bn. Similarly, new listings in the US have raised more than twice as much as IPOs in Europe, according to Dealogic.

The result is that the high-margin fees that banks mint from corporate activity are harder to come by. Lars Machenil, chief financial officer at BNP Paribas, told analysts that European companies are in “wait and see” mode.

Despite this, BNP’s US business is growing at a similar rate to Wall Street rivals, Machenil claims. But then comes the second — less intentional — impact of Trump: the dollar. Even after a recent rebound, the currency’s value against major trade partners is down almost 9 per cent year to date. That means European banks’ US earnings are no longer worth as much once translated into their own currency.

At BNP, foreign exchange moves were a big reason it missed third-quarter revenue forecasts. For Deutsche Bank, currency movements were the difference between expanding its loan book and shrinking it. At UBS, the particularly sharp rally in the Swiss franc earlier in the year unfavourably pumped up the bank’s leverage ratios, making its balance sheet more tricky to manage.

The other D making some European bankers jealous: deposits. Between geopolitical uncertainty, White House efforts to encourage US investment, and higher interest rates, large companies are moving more of their cash to US accounts. Deposits in Bank of America’s global banking unit, for example, jumped 15 per cent year on year in the third quarter, while JPMorgan’s rose 12 per cent. At Deutsche Bank, in contrast, corporate deposits fell, despite enthusiastic talk of a wave of defence-related investment in the continent.

That’s inconvenient because, as Crisil Coalition Greenwich has highlighted, these sorts of corporate deposits boost the US banks several times over: they earn interest on the deposits themselves, make further money from cash management and payments businesses, and gain sticky funding for other parts of the group.

An optimistic take on this would be that maybe Europe’s banks aren’t as far behind Wall Street as they look: strip out some currency and other drags and both sides are growing at similar rates. Europeans will benefit proportionally more if the local deal pipeline unclogs. Even then, though Americans will rule the roost. Closing that gap is yet another D: doubtful.

nicholas.megaw@ft.com

Continue Reading

-

Inside Cadogan’s Reinvention of London’s Sloane Street as a Global Retail Destination

For almost 250 years, Sloane Street has been a cultural and commercial anchor at the heart of Chelsea, London. Property manager, investor and developer Cadogan, which operates across Chelsea’s Duke of York Square, Sloane Street, Pavilion Road…

Continue Reading

-

‘One contestant makes wool vulvas!’ Tom Daley on his knockout knitting show – and arguing with Traitors producers | Television

In The Game of Wool, Channel 4’s quest to find Britain’s best knitter, you can’t take your eyes off Tom Daley’s outfits. One of his goals for the series, he says, is that “what I was wearing would get progressively more interesting”,…

Continue Reading