Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

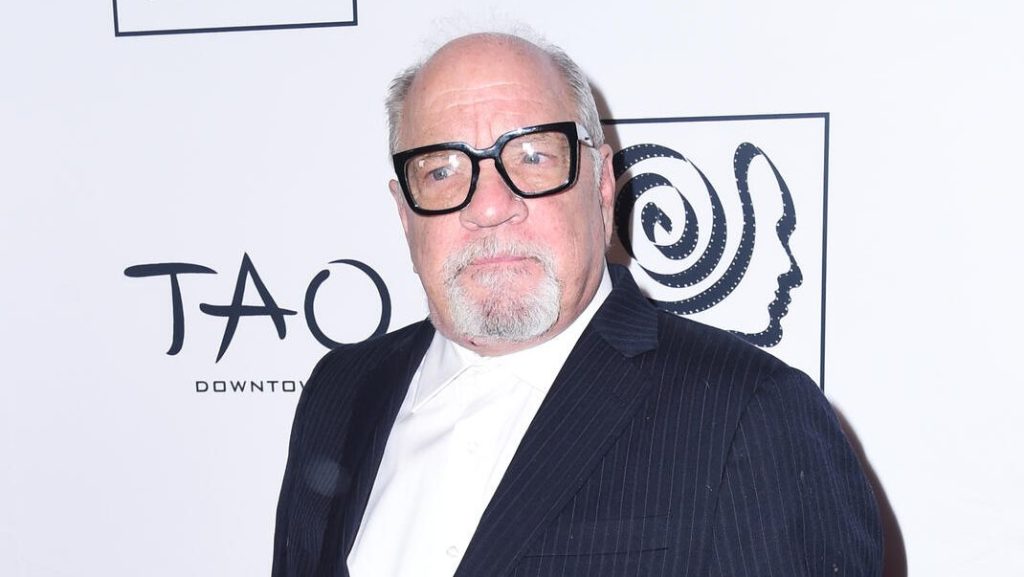

JPMorgan Chase has asked a US court to end its obligation to pay legal fees for Charlie Javice and another executive convicted of defrauding the bank, an unusual legacy of its purchase of Frank, their failed fintech start-up.

In a filing on Friday, JPMorgan alleged “clear abuse” by Javice and Olivier Amar for the “unreasonable” sums of money claimed for their legal defences, which total about $115mn, of which $60.1mn was advanced to Javice and $55.2mn to Amar.

JPMorgan noted Javice engaged five law firms for her defence, a legal team the bank said had remained in place after her conviction in March for defrauding the bank. One law firm representing Amar received advanced fees and expenses totalling $53.9mn, JPMorgan claimed.

Javice was sentenced to seven years in prison last month, and ordered to pay restitution to JPMorgan of $288mn, including legal fees, and forfeit an additional $22mn. Amar was separately convicted of fraud but has yet to be sentenced. Javice has asked the court to reduce the restitution award, a move objected to by JPMorgan and the Department of Justice.

But JPMorgan has also been obliged to cover Javice and Amar’s legal fees as part of the agreement to sell their student finance company, Frank, to the bank in 2021.

JPMorgan wrote in its filing that “the fees and expenses to fund Javice’s criminal defence have far exceeded any reasonable amount for defence of the entire case” and she was unnecessarily continuing “to utilise all five law firms in connection with post-conviction proceedings”.

Representatives for Javice and Amar did not immediately respond to requests for comment.

While the amounts involved are minor for JPMorgan — the company generated more than $1bn a week in profits in 2024 — the spat is a reminder of the bank’s ill-fated purchase.

JPMorgan bought Javice’s company for $175mn but soon discovered the business had only a small fraction of the 4mn users that she had claimed.

The bank claimed Javice and her co-founder Olivier Amar had hired a data scientist to create millions of fabricated users at the time of the company’s sale process.