A 29-year-old female diagnosed with RP presented to our emergency department with fever and dyspnea as her primary symptoms. She had a cuffless tracheostomy tube for 12 years due to SGS and TBM. Under the impression of pneumonia with impending…

Blog

-

Lawmakers grill minister over entertainers evading military service

Taipei, Oct. 22 (CNA) Lawmakers pressed Interior Minister Liu Shyh-fang (劉世芳) on Wednesday over a widening military service evasion case involving up to 120 people including actors and vocalists.

Liu told a meeting of the Legislative Yuan’s…

Continue Reading

-

The BBC wants to hear from 16 to 24-year-olds to help shape its future

The BBC is launching a bold new campaign of engagement with young people to listen to what matters to them and ensure that their needs are being met as plans for the BBC of the future are evolved.

UNBOXD is a youth-focused research drive that’s…

Continue Reading

-

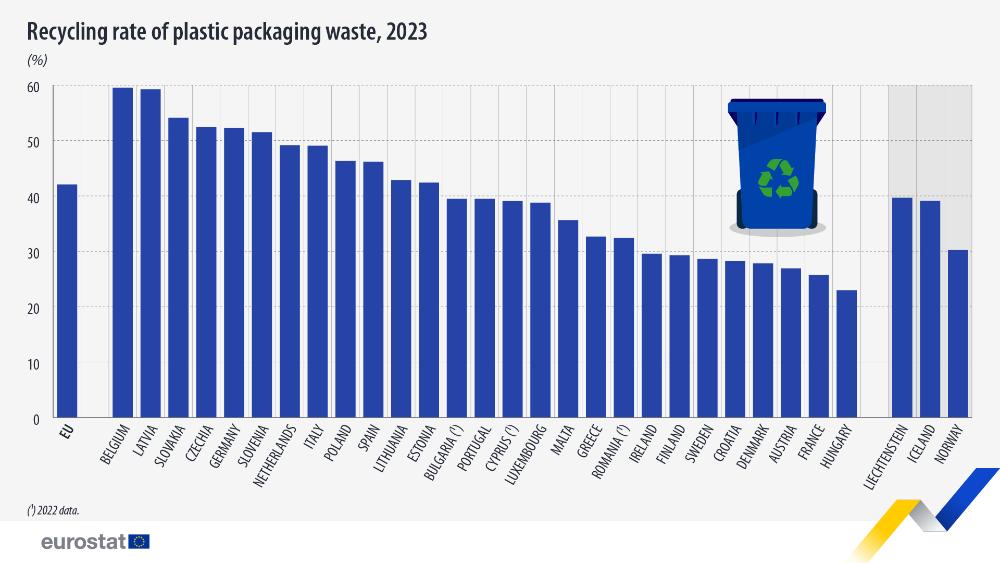

Plastic packaging waste in the EU: 35.3 kg per person – News articles

In 2023, 79.7 million tonnes of packaging waste were generated in the EU, or 177.8 kg per inhabitant. While this marks a reduction of 8.7 kg per capita compared with 2022, the figure remains 21.2 kg higher than in 2013.

Out of all the packaging waste generated, 40.4% was paper and cardboard, 19.8% was plastic, 18.8% glass, 15.8% wood, 4.9% metal and 0.2% other packaging.

An average of 35.3 kg of plastic packaging waste was generated in 2023 for each person living in the EU. Out of this, 14.8 kg were recycled. The amount of generated plastic waste decreased by 1.0 kg compared with 2022, while the amount of recycled plastic waste increased by 0.1 kg. Between 2013 and 2023, the amount of plastic packaging waste generated increased by 6.4 kg per capita, while the amount recycled increased by 3.8 kg.

Source dataset: env_waspac

This information comes from data on packaging waste published by Eurostat today. The article presents a handful of findings from the more detailed Statistics Explained article on packaging waste.

Increase in plastic packaging waste recycling

In 2023, the EU recycled 42.1% of all the generated plastic packaging waste, indicating an increase in the recycling rate compared with 2013 (38.2%).

Belgium recorded the highest recycling rate at 59.5%, followed by Latvia (59.2%) and Slovakia (54.1%).

In contrast, the lowest rates were recorded in Hungary (23.0%), France (25.7%) and Austria (26.9%).

Source dataset: env_waspac

Continue Reading

-

There’s an ancient version of planet Earth hidden all around us. Here’s how scientists found it

A team of geologists and Earth scientists have discovered what they believe to be traces of planet Earth, as it was when it first formed, lingering in ancient rocks.

There are various competing theories regarding the formation of Earth and the…

Continue Reading

-

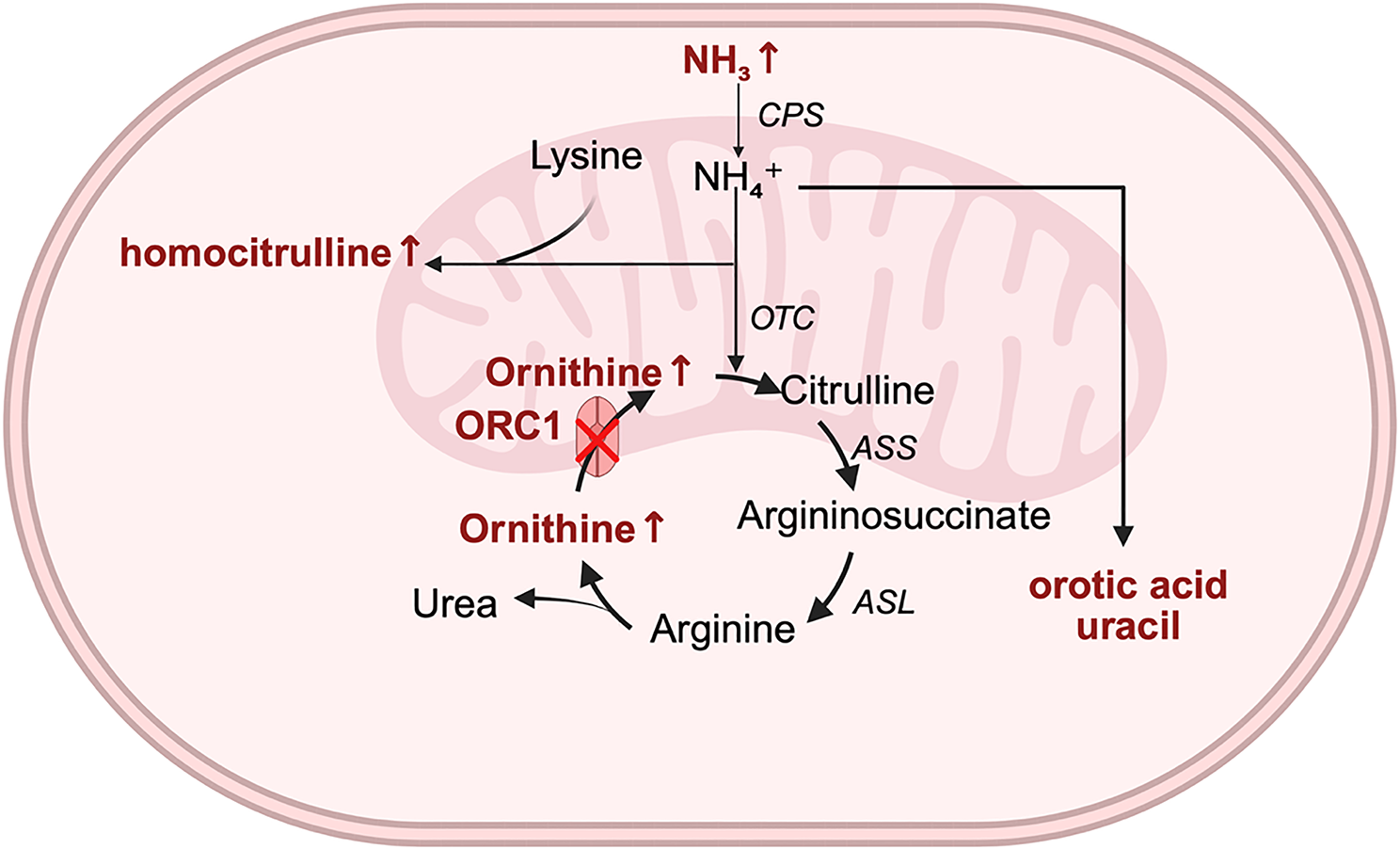

Liver transplantation can prevent the progression of neurological damage in hyperornithinemia-hyperammonemia-homocitrullinuria syndrome and maintain long-term metabolic stability — The largest single-center experience | Orphanet Journal of Rare Diseases

UCDs are rare inherited metabolic disorders, and HHH syndrome accounts for only 1-3.8% of the reported UCDs [12, 13]. The acute manifestations of HHH syndrome include encephalopathy, altered levels of consciousness, and seizures, with some…

Continue Reading

-

Simon Fawell comments on the Credit Suisse v SoftBank judgment in Law360 – Signature Litigation

- Simon Fawell comments on the Credit Suisse v SoftBank judgment in Law360 Signature Litigation

- The Lawyer and Law 360 quote James Hyne on our involvement in the landmark Greensill trial Charles Russell Speechlys

- ‘A Rare Case’: How Credit Suisse Missed Out In Greensill Trial Law360

- UBS Loses USD 440 Million UK Lawsuit Against SoftBank Over Greensill Collapse Hubbis

- Market Chatter: UBS Loses $440 Million Claim Against SoftBank in London Ruling 富途牛牛

Continue Reading

-

Non-insulated Microneedle Radiofrequency for the Treatment of Hydroqui

Introduction

Exogenous ochronosis (EO) is an acquired hyperpigmented disorder characterized by bluish-grey skin discoloration on the face, neck, back, or extensor surfaces of the extremities. EO demonstrates histopathological characteristics of…

Continue Reading

-

New China Platform Information Reporting Rules: Deadlines & Compliance

New China platform information reporting rules require internet companies to submit basic information and the identity and income details of their operators and employees. Before October 31, 2025, these companies must submit employee and operator income data for Q3 2025. Platform companies must immediately prepare to comply with these filing requirements to avoid significant financial penalties and operational suspensions.

Starting October 1, 2025, internet platform companies (“platform companies”) will be required to formally submit the identity and income information of their operators and employees to the tax authorities for the first time.

These obligations arise from the Provisions on the Submission of Tax-Related Information by Internet Platform Enterprises (the “Provisions”), issued by the State Council on June 20, 2025, which set out new tax-related reporting requirements for platform companies.

The deadline for the first round of quarterly reporting obligations by platform companies – covering operators’ and employees’ identity and income information – is October 31, 2025.

Find Business Support

To support the rollout of the new reporting regime, the State Taxation Administration (STA) released STA Announcement [2025] No. 15, which provides detailed implementation rules. The announcement specifies reporting obligations, technical requirements, and compliance timelines applicable to a wide range of digital platforms.

According to the General Office of the STA, as of October 15, 6,654 domestic and international platforms had already submitted the required basic information, which was due by July 20, 2025, for companies established before the Provisions’ implementation. In addition, over 4,100 platforms had already submitted tax-related information on their operators and employees, which must be submitted before October 31, covering over 60 percent of affected platforms. This group includes major platforms such as Pinduoduo, Ele.me, and Didi Chuxing.

On September 28, 2025, the STA, together with the Ministry of Industry and Information Technology (MIIT) and the Cyberspace Administration of China (CAC), issued a notice providing further guidance on implementing the Provisions. The notice clarified rules on administrative penalties, suspension of operations, and other related matters.

Explore vital economic, geographic, and regulatory insights for business investors, managers, or expats to navigate China’s business landscape. Our Online Business Guides offer explainer articles, news, useful tools, and videos from on-the-ground advisors who contribute to the Doing Business in China knowledge.

Start exploringTax-related reporting requirements for platform companies

Under the Provisions, internet platform enterprises are required to report certain tax-related information to their competent tax authorities. These obligations apply to e-commerce platform operators under the Electronic Commerce Law of the PRC, as well as other organizations that provide profit-making services such as online transaction venues, transaction matching, or information publication. Individuals providing services on these platforms in a personal capacity are considered “platform employees”.

Reporting requirements

Platform companies must submit information related to the identity and income of platform operators and employees. The types of information and documents that must be provided include at different timeframes, namely:

- Within 30 days from the implementation date of the Provisions (June 20, 2025) or within 30 days of commencing internet-based business operations, the following information must be reported:

- Platform domain name

- Business type

- Unified Social Credit Code and name of the relevant operating entity

- Within the month following the end of the quarter (October 31 for the third quarter of 2025), the following must be reported:

- The identity information of platform operators and employees

- The income information of platform operators and employees for the previous quarter

Note that companies are not required to submit income information on employees who provide delivery, transport, domestic, or other convenience services through the platforms if they are legally exempt from taxation or enjoy tax incentives. Additionally, companies are not required to resubmit tax-related information when handling withholding declarations, tax returns, and other tax-related matters for platform operators and employees.

Platforms are not required to report information on operators and employees prior to the implementation of the Provisions.

Foreign platform companies (such as Amazon) providing for-profit services in China must report tax-related information in accordance with regulations issued by the State Council tax authorities.

Required cooperation with tax authorities

When conducting tax inspections or identifying tax risks, tax authorities may request that platform companies and related parties provide supporting information, including:

- Contracts and orders of platform operators and employees

- Transaction details

- Financial account records

- Logistics and delivery information

Companies and related parties must provide this information truthfully and within the timeframe, manner, and scope requested by tax authorities.

Waiving of penalties and clarification of “serious circumstances”

The September 28 notice states that platform companies that commit certain tax reporting violations outlined in the Provisions will not be penalized if they correct the violations within the time limit set by the tax authorities.

These violations are:

- Failure to submit or provide tax-related information within the prescribed time limit;

- Concealing, falsely reporting, or omitting tax-related information, or causing the tax-related information to be untrue, inaccurate, or incomplete through the fault of the platform company; and

- Refusing to submit or provide tax-related information.

Under the Provisions, failure to rectify these violations within the prescribed timeframe may result in fines ranging from RMB 20,000 to RMB 100,000 (US$2,740 to US$13,700), or from RMB 100,000 to RMB 500,000 (US$13,700 to US$68,500 in “serious cases”. In serious cases, companies may also be ordered to suspend operations.

What constitutes a “serious case”

The September 28 notice also clarifies what constitutes a “serious case” under the Provisions. Specifically, a platform company will be considered to have committed a “serious case” and be subject to the higher penalty bracket if it fails to correct a violation within the timeframe ordered by the tax authorities, and any of the following conditions are met:

- Failing to submit or provide tax-related information, or omitting required tax-related information, for a cumulative total of two or more times within a single year;

- Concealing or falsely reporting tax-related information for a cumulative total of two or more times;

- Illegally guiding or assisting platform operators or employees to convert the nature of income or split income, through means such as mass registration, changing store unique identifiers, or other methods, resulting in tax-related information being submitted inaccurately, untruthfully, or incompletely;

- Forging or tampering with the tax-related information of platform operators or employees, or assisting platform operators or employees in forging or tampering with such information, resulting in tax-related information being submitted inaccurately, untruthfully, or incompletely;

- Refusing to submit or provide tax-related information in accordance with regulations through violence, threats, or public boycotts; and

- Other serious violations of Article 10 of the Provisions.

Suspension of operations

The notice clarifies that when, as may happen in serious cases, an internet platform is ordered to suspend operations, the competent tax authority is responsible for penalizing the platform for failing to submit tax-related information in accordance with the Provisions.

In such cases, the tax authorities may:

- Restrict the company’s issuance of invoices;

- Issue early warnings on the company’s acceptance of invoices; and

- Report penalties and request that relevant regulatory authorities take legal action.

If the platform rectifies its violations during the suspension period and actively mitigates any negative impacts, the tax authority that issued the suspension may, upon confirmation, coordinate with regulatory authorities to promptly lift the related punitive measures.

Key takeaways for platform companies

As the October 31 deadline approaches, platform companies should ensure they are fully prepared to submit the required identity and income information for their operators and employees in a timely, accurate, and complete manner. Companies that have not yet reported should immediately coordinate with local tax authorities to avoid delays or errors that could trigger penalties. Attention to the accuracy and completeness of submitted data is critical, as platform companies are responsible for verifying the information they provide, even though errors caused by operators or employees themselves are not penalized if proper verification measures were taken.

Find Business Support

Companies should make full use of the guidance and support provided by tax authorities, including training sessions, online tutorials, and secure reporting portals, to streamline submissions and ensure compliance with the Provisions. Understanding the scope of reporting obligations, including exemptions for certain employees who are legally exempt from taxation or enjoy incentives, is essential to avoid unnecessary duplication or misreporting.

Platform companies should take particular care to avoid prohibited practices outlined in the September 28 notice. According to the General Office of the STA, some platforms have been found to help employees register en masse as individual businesses in the platform’s location, attempting to convert personal labor income into business income to take advantage of preferential tax treatment and reduce or avoid tax payments. Other platforms or intermediaries have allegedly encouraged operators and employees to split income, register abroad, or change entity identifiers in order to conceal income and evade supervision, impeding normal tax procedures.

Related Reading

Overseas internet platforms that provide for-profit services to operators in China should also note that they are also required to report relevant tax information to Chinese tax authorities. Amazon, for example, issued a notice to sellers on October 13, 2025, announcing that it will begin quarterly reporting of Chinese sellers’ identity and income information to China’s tax authorities. The first submission, covering transactions from July to September 2025, is scheduled for completion by October 31.

Domestic operators who attempt to evade obligations through offshore registration or other means are subject to the same enforcement measures. The September 28 notice details the penalties for illegal practices by platform enterprises, emphasizing that compliance with these reporting requirements is a legal obligation and that violations will be rigorously enforced.

About Us

China Briefing is one of five regional Asia Briefing publications. It is supported by Dezan Shira & Associates, a pan-Asia, multi-disciplinary professional services firm that assists foreign investors throughout Asia, including through offices in Beijing, Tianjin, Dalian, Qingdao, Shanghai, Hangzhou, Ningbo, Suzhou, Guangzhou, Haikou, Zhongshan, Shenzhen, and Hong Kong in China. Dezan Shira & Associates also maintains offices or has alliance partners assisting foreign investors in Vietnam, Indonesia, Singapore, India, Malaysia, Mongolia, Dubai (UAE), Japan, South Korea, Nepal, The Philippines, Sri Lanka, Thailand, Italy, Germany, Bangladesh, Australia, United States, and United Kingdom and Ireland.

For a complimentary subscription to China Briefing’s content products, please click here. For support with establishing a business in China or for assistance in analyzing and entering markets, please contact the firm at china@dezshira.com or visit our website at www.dezshira.com.

Continue Reading

- Within 30 days from the implementation date of the Provisions (June 20, 2025) or within 30 days of commencing internet-based business operations, the following information must be reported: