The Royal Ballet has long offered headphones with audio descriptions so that visually impaired members of the audience can follow the action on stage. Now the entire audience will hear such descriptions, within a groundbreaking work that explores…

Blog

-

Gout Flares After Stroke Rise in First Week

Gout flares affect one in twenty stroke patients within a week, often the paretic limb, unveiling undiagnosed hyperuricemia.

Study Overview

This single-center cohort combined with a systematic review and meta-analysis evaluated the incidence,…

Continue Reading

-

Border clashes erupt between Pakistan and Afghanistan—again – The Economist

- Border clashes erupt between Pakistan and Afghanistan—again The Economist

- Security forces repel attack along Balochistan border, 15-20 Afghan Taliban killed: ISPR Dawn

- Afghan Taliban and Pakistan agree short truce after deadly clashes BBC

- The…

Continue Reading

-

Australia vs Bangladesh LIVE: Women's Cricket World Cup 2025 score, radio, highlights & updates – BBC

- Australia vs Bangladesh LIVE: Women’s Cricket World Cup 2025 score, radio, highlights & updates BBC

- Can Bangladesh spring a surprise on heavyweights Australia? ESPNcricinfo

- Australia vs Bangladesh LIVE streaming info: Where to watch AUS-W vs…

Continue Reading

-

China blames US for global panic over rare earths controls – Reuters

- China blames US for global panic over rare earths controls Reuters

- Rare earths tensions rise as US and China trade barbs Dawn

- China accuses U.S. of deliberately causing panic over rare earth controls, says it is open to talks CNBC

- China’s new…

Continue Reading

-

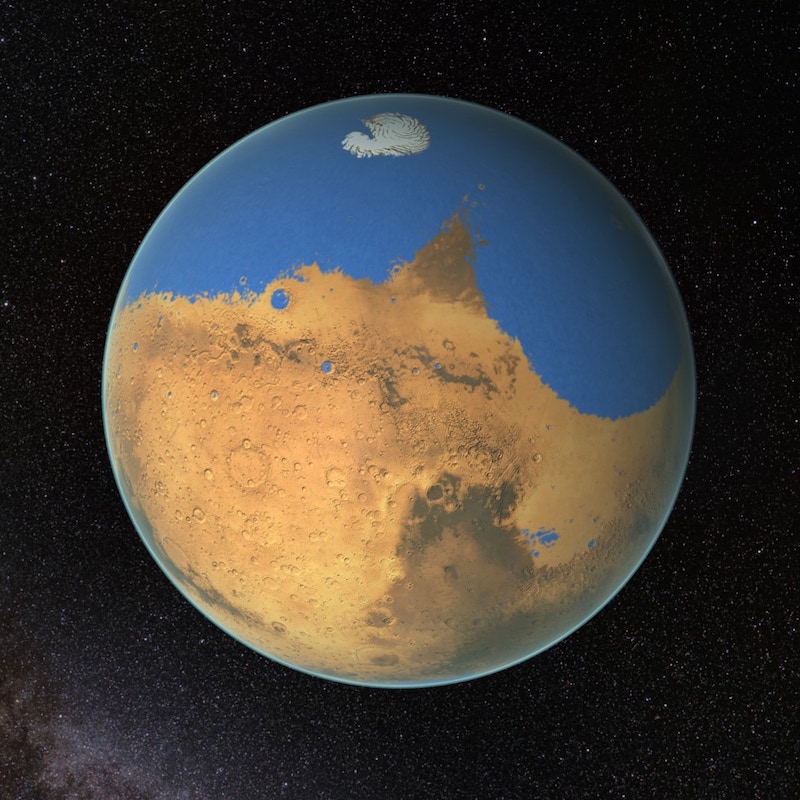

New evidence for ocean on Mars found in ancient rivers

View larger. | Artist’s concept of what an ancient ocean on Mars might have looked like. A new study shows evidence for rivers that once emptied into the ocean, creating backwater zones and inverted river ridges much like those on Earth. Image… Continue Reading

-

Pakistan, Australia agree to enhance bilateral cooperation – RADIO PAKISTAN

- Pakistan, Australia agree to enhance bilateral cooperation RADIO PAKISTAN

- PM Shehbaz meets outgoing Australian High Commissioner Neil Hawkins The Nation (Pakistan )

- PM lauds Australia’s constructive role in global peace efforts Daily Times

- PM…

Continue Reading

-

Just a moment…

Just a moment… This request seems a bit unusual, so we need to confirm that you’re human. Please press and hold the button until it turns completely green. Thank you for your cooperation!

Continue Reading

-

Non-financial misconduct: how the FCA’s new rules could impact acquisitions in financial services

The FCA’s latest proposals on non-financial misconduct (NFM) will add an additional factor to corporate transactions in the financial services sector. With new rules extending the regulatory spotlight to a wider range of firms, acquirers should consider NFM risks and policies as part of their due diligence processes. This development is set to influence risk assessment and post-completion integration, making NFM compliance a concern for buyers and sellers alike.On 2 July 2025, the Financial Conduct Authority (FCA) published Consultation Paper CP 25/18, outlining new rule changes and proposals to tackle NFM in the financial services industry. NFM refers to the type of serious misconduct described in the new rules and covers behaviour such as bullying, violence and sexual harassment which do not involve financial wrongdoing but can breach regulatory standards and seriously undermine workplace culture. The publication follows concerns being raised by the regulator about NFM behaviours going unchallenged in certain pockets of the industry.

Previously, only banks were subject to wider scope rules. The new final rules extend the scope of the Code of Conduct (COCON) sourcebook and align the rules more closely between banks and non-banks, so that COCON now applies the conduct rules to staff of all FSMA firms holding a Part 4A permission (eg insurers, consumer credit lenders, asset managers etc) when they are performing tasks for their regulated employer, irrespective of whether or not those tasks are part of the firm’s regulated activities (SMCR financial activities).

The revised rules have also been adjusted to align more closely with employment law and in particular the definition of ‘harassment’ as set out in the Equality Act 2010.

The rule changes will come into force on 1 September 2026 and will not apply retrospectively.

Proposals for consultation include:

- COCON – The FCA’s proposed amendment to the rules on NFM in COCON. In addition, the FCA will consider providing additional guidance in COCON on how NFM can be a breach of the COCON rules with examples of scenarios illustrating the boundary between work and private life, when conduct is outside of a firm’s SMCR financial activities and when NFM may be out of scope in a non-bank.

- Fit and Proper test for Employees and Senior Personnel (FIT) – The FCA proposes including explanatory material on how various types of conduct, including NFM, are relevant to fitness and propriety and form part of the FIT section of the FCA Handbook, including the relevancy of similarly serious behaviour in a person’s private or personal life.

What does this mean?

- Risk and exposure – The extension of NFM rules means that regulatory risk in relation to workplace conduct will be relevant to a much wider range of transactions. Failure to comply and subsequently address any issues of non-compliance relating to NFM could expose a regulated firm and, as a consequence, a buyer to possible regulatory scrutiny and reputational damage.

- Due diligence – Buyers considering the acquisition of a financial services business should now assess whether the target has effective policies and procedures in place to address NFM, including checking staff awareness and training. If such policies are absent post-September 2026, it would be advisable to recommend their introduction post-completion and to align the target’s compliance, HR and governance (eg board) with the buyer’s on NFM going forward to ensure regulatory compliance.

- Integration and governance – Firms should ensure that NFM compliance is integrated into any target’s policies, systems, board reporting and senior management attestations. This will help demonstrate ongoing commitment to regulatory standards and mitigate future risks of both employment claims and regulatory scrutiny, as well as ensuring that a safe workplace culture is being promoted.

- Communication to staff – Although the COCON rule change does not come into effect until next year, firms are reminded of their duty under section 64B of the Financial Services and Markets Act 2000 to notify staff about the conduct rules and take all reasonable steps to make sure they understand how they apply to them. Firms are expected to keep these requirements under review and will need to update internal conduct documents and training materials to properly reflect the new rules and guidance.

What’s next?

The consultation closed on 10 September 2025. The FCA is currently reviewing feedback and is expected to set out its final regulatory approach before the end of the year.

Continue Reading

-

Check out Williams, Racing Bulls, McLaren, Haas and Aston Martin’s special liveries for the 2025 United States Grand Prix

Williams, Racing Bulls, McLaren, Haas and Aston Martin have all shown off special liveries that will adorn their cars at the 2025 United States Grand Prix.

At Williams, the team will pay homage to their 2002 livery, marking the year that title…

Continue Reading