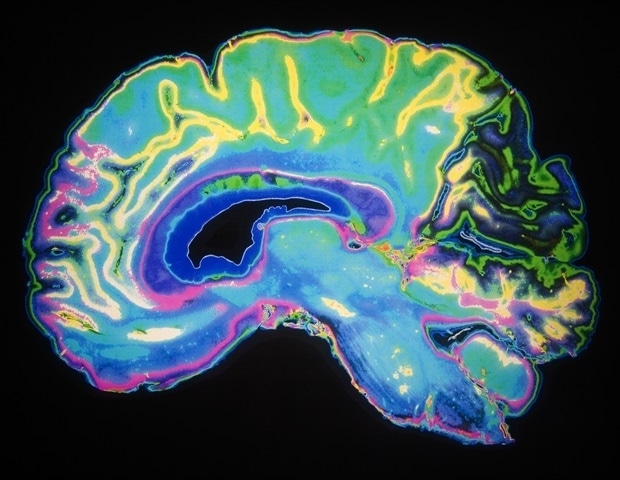

As information zings from cell to cell inside the brain, bursts of electricity spur its transmission. At Cold Spring Harbor Laboratory (CSHL), scientists have turned their attention to the tiny pores that let charged ions enter a…

Blog

-

This talented 12-year-old set a world record while balancing on his bike

Meet Jordi Sala Hernandez, a 12-year-old trials biking titan from Girona, Spain.

He holds the record for the most car roofs traversed on a bicycle performing a wheelie in one minute!

This means Jordi had to hop across 10 cars that were parked…

Continue Reading

-

Just a moment…

Just a moment… This request seems a bit unusual, so we need to confirm that you’re human. Please press and hold the button until it turns completely green. Thank you for your cooperation!

Continue Reading

-

Marvel Rivals Version 20251030 Patch Notes _Marvel Rivals

Greetings, Rivals!

We’re thrilled to announce the upcoming patch drops on October 30th, 2025, at 09:00:00 (UTC)! This update will be deployed seamlessly, with no server downtime required! Simply log in after the update and…Continue Reading

-

Oldest 3D Burrow Systems Found in Hubei’s Shibantan

A research team from the Nanjing Institute of Geology and Palaeontology of the Chinese Academy of Sciences (NIGPAS) has made progress in studying the Shibantan Biota in Yichang, Hubei Province, uncovering the oldest known complex…

Continue Reading

-

Federal Reserve cuts key interest rate for the second time this year

The Federal Reserve on Wednesday cut its benchmark interest rate by a quarter-point for the second time this year, a move that could bring financial relief to consumers and businesses — but also carries risk as inflation ticks up.

In its statement accompanying the rate-cut announcement, the central bank said that although economic activity has been expanding, jobs growth had slowed while inflation had increased.

Fed Chair Jerome Powell is scheduled to discuss the decision at a 2:30 p.m. ET press conference.

The central bank’s action is designed to reduce the cost of borrowing throughout the economy. A lower rate tends to have immediate effects on auto loans and credit cards. Mortgage rates are not directly tied to the Fed’s benchmark rate, but they can move in parallel.

It comes as the U.S. economy grapples with a slowing labor market and stubborn price growth.

Several major companies have announced thousands of job cuts this year while many government workers remain furloughed due to the shutdown. Price growth in September ticked up to its highest point since January, according to federal data.

Despite all of that uncertainty, stock markets have rocketed to record highs, fueled in large part by an artificial intelligence investment boom. Chipmaker Nvidia on Wednesday became the first company to be valued at $5 trillion on the stock market.

What happens next in the economy is anyone’s guess. The Fed’s next rate decision is scheduled for Dec. 10.

Typically, in times of a labor market slowdown the Fed lowers rates to spur economic activity. During times of rising inflation, the Fed often hikes rates to put a lid on rising prices.

With data simultaneously showing a weakening employment picture and a stubborn price growth, the Fed faces a dilemma.

“There is no risk-free path for policy as we navigate the tension between our employment and inflation goals,” Powell said earlier this month. He made similar remarks when the Fed cut rates for the first time this year, in September.

Lower interest rates can sometimes worsen inflation by increasing overall economic activity.

Last week, the Bureau of Labor Statistics reported that the annual inflation rate for consumer prices had climbed from 2.9% to 3% in September — well above the Fed’s 2% target. The Fed’s view of the economy remains impaired by a lack of other data, which is paused due to the government shutdown. One of those measures, the personal consumption expenditures index (PCE), is the Fed’s preferred inflation gauge. The August PCE report, published prior to the shutdown, also showed a reading north of the 2% goal.

Many economists attribute a significant portion of ongoing price pressures to President Donald Trump’s tariffs.

“The tariffs are the biggest tax increase since the late 1960s,” said Luke Tilley, chief economist at Wilmington Trust financial group.

Meanwhile, jobs data suggests the U.S. is experiencing one of the weakest labor markets of the 21st century. The unemployment rate, at 4.3% as of August, is relatively low on a historical basis. But it is taking those without jobs an average of nearly six months to land a new position, as hiring rates have collapsed to levels last seen in the years following the 2008 global financial crisis. The government shutdown, now on the verge of its fourth week, has complicated matters by preventing the Bureau of Labor Statistics from releasing more current economic data.

Without fresh numbers, “the Fed’s task is further complicated,” BNP Paribas economists wrote in a note on Tuesday. There are few private-sector sources of data and none can fully replicate the official government data. For instance, payroll processor ADP released its employment survey, which pointed to a significant decline in private employment in August and September. But that data only covers about 20% of the private labor force and does not count federal, state or local government employment.

Part of the problem is that economic growth appears to be powering ahead thanks in great part to investments in artificial intelligence.

Estimates of gross domestic product, the standard measure of economic growth, have soared to nearly 4%. Major stock market indexes, meanwhile, continue to set new records — also largely as a result of AI investments, fueling concerns about a bubble. The mere expectation that the Fed will further lower interest rates has also historically led to support for stock prices. Stocks were moderately higher after the announcement Wednesday.

“Something’s gotta give,” Fed governor Christopher Waller said on Oct. 16. Waller, a Trump nominee who is a finalist to succeed Powell as chair, has a permanent vote on the Fed’s rate-setting committee. “Either economic growth softens to match a soft labor market, or the labor market rebounds to match stronger economic growth,” he added.

But even Waller, who in the summer called on the Fed to lower rates as soon as possible, urged caution: “We need to move with care when adjusting the policy rate to ensure we don’t make a mistake that will be costly to correct.”

Other analysts believe that the tension between elevated inflation and weakening labor data is easing — though for reasons that do not bode well for the broader economy. In a note published Monday, Neil Dutta, head of economics at Renaissance Macro research group, said that as jobs growth continues to falter, price pressures will, too, as households grow more cautious about spending.

“Labor market slack continues to build and there is reason to expect inflation to cool as a result,” Dutta wrote.

Continue Reading

-

Fruit flies illuminate the role of Alzheimer’s disease risk genes

Scientists have identified hundreds of genes that may increase the risk of developing Alzheimer’s disease but the roles these genes play in the brain are poorly understood. This lack of understanding poses a barrier to developing…

Continue Reading

-

Statement Regarding Reinvestment of Principal Payments from Treasury Securities and Agency Securities

Statement Regarding Reinvestment of Principal Payments from Treasury Securities and Agency Securities

On October 29, 2025, the Federal Open Market Committee (FOMC) provided additional information regarding plans for its securities holdings. Beginning in December, the Open Market Trading Desk (the Desk) at the Federal Reserve Bank of New York will roll over at auction all principal payments from the Federal Reserve’s holdings of Treasury securities and will reinvest all principal payments from the Federal Reserve’s holdings of agency securities into Treasury bills through secondary market purchases.

Rollovers of principal payments from maturing Treasury securities will continue to be reinvested in new Treasury securities being issued on the maturity date. Rollovers will continue to be accomplished by placing non-competitive bids at Treasury auctions; the bids will be allocated across the securities being issued on each auction date in proportion to their announced offering amounts.

The Desk plans to distribute the monthly secondary market purchase amount across two Treasury bill sectors. The approximate amount of purchases in each sector over the monthly purchase period will be determined by sector weights. These sector weights will be based on the 12-month average of the par amount of Treasury bills outstanding in each sector relative to the total amount outstanding across the two sectors, initially measured at the end of September 2025. Further details on the sectors are provided in the Purchases FAQs linked below. The monthly amount of secondary market Treasury reinvestment purchases into Treasury bills will be announced on or around the ninth business day of each month alongside a tentative schedule of purchase operations expected to take place over the monthly period. The Desk plans to release the first schedule of purchase operations on December 11, 2025.

Additional information on Treasury reinvestment purchases can be found in the following locations:

FAQs: Treasury Reinvestments – Rollovers »

FAQs: Treasury Reinvestments – Purchases »Continue Reading

-

Keep Your Home Safe During Holiday Travels With Up to 60% Off Blink Outdoor 4 Cams

With the holidays coming up, many of us will be on the road, visiting with friends and family. Whether you’re away for one day or one week, it’s important to keep your home protected. Getting a home security camera is a great way to make sure…

Continue Reading