Scientists say there is a “sweet spot” for mixing enjoyment and fear: not too tame and not too intense.

…

Blog

-

Why do we like haunted houses? The science behind why people pursue fear : Short Wave : NPR

-

ING to appoint Ida Lerner as chief financial officer

Amsterdam,

ING announced today that Ida Lerner will be appointed as chief financial officer (CFO) of ING. Until recently, Ida served as CFO at Norwegian bank DNB. She will succeed Tanate Phutrakul, who will step down from his position at ING’s annual general meeting in April 2026 as announced in July 2025.

Effective 1 April 2026, Ida will be appointed as member of the Management Board Banking. The Supervisory Board will propose to shareholders to appoint her as member of the Executive Board and as CFO of ING Group at the Annual General Meeting in April 2026.

Ida (Swedish/Norwegian) has been DNB’s CFO since 2021. She joined the bank in 2007. Before taking the position as CFO, she served as head of DNB for the Central & Eastern Europe, Middle East & Africa region based in London, chief of Customer Analysis in Northern Europe, Middle East & Africa and group executive vice president for Risk Management. Prior to joining DNB, she worked in various roles at HSBC and Nordea. Ida holds a Bachelor in Social Sciences, with an emphasis on economics from the University of Stockholm.

Steven van Rijswijk, CEO of ING, commented: “We are delighted to welcome Ida to ING’s executive team. Her experience as CFO at a large listed bank will be instrumental as we continue to execute our strategy and strengthen our position as a digital and sustainable bank. Ida’s deep knowledge of European banking will be a great addition to ING, and I look forward to working together to accelerate our strategic ambitions.”

Ida Lerner said: “I’m honoured to be joining ING at a time of growth, and with a clear ambition to become the best European bank. ING’s commitment to innovation, sustainability and customer empowerment aligns strongly with my values. Together with the Management Board Banking and our global teams, I’m excited to help steer ING’s financial strategy and support its purpose of empowering people to stay a step ahead in life and in business.”

The appointment of Ida has been approved by the European Central Bank.

Note for editors

More on investor information, go to the investor relations section on this site.

For news updates, go to the newsroom on this site or via X (@ING_news feed).

For ING photos such as board members, buildings, go to Flickr.

ING PROFILE

ING is a global financial institution with a strong European base, offering banking services through its operating company ING Bank. The purpose of ING Bank is: empowering people to stay a step ahead in life and in business. ING Bank’s more than 60,000 employees offer retail and wholesale banking services to customers in over 100 countries.

ING Group shares are listed on the exchanges of Amsterdam (INGA NA, INGA.AS), Brussels and on the New York Stock Exchange (ADRs: ING US, ING.N).

ING aims to put sustainability at the heart of what we do. Our policies and actions are assessed by independent research and ratings providers, which give updates on them annually. ING’s ESG rating by MSCI was reconfirmed by MSCI as ‘AA’ in August 2024 for the fifth year. As of December 2023, in Sustainalytics’ view, ING’s management of ESG material risk is ‘Strong’. Our current ESG Risk Rating, is 17.2 (Low Risk). ING Group shares are also included in major sustainability and ESG index products of leading providers. Here are some examples: Euronext, STOXX, Morningstar and FTSE Russell. Society is transitioning to a low-carbon economy. So are our clients, and so is ING. We finance a lot of sustainable activities, but we still finance more that’s not. Follow our progress on ing.com/climate.

Important legal information

Elements of this press release contain or may contain information about ING Groep N.V. and/ or ING Bank N.V. within the meaning of Article 7(1) to (4) of EU Regulation No 596/2014 (‘Market Abuse Regulation’).

ING Group’s annual accounts are prepared in accordance with International Financial Reporting Standards as adopted by the European Union (‘IFRS- EU’). In preparing the financial information in this document, except as described otherwise, the same accounting principles are applied as in the 2024 ING Group consolidated annual accounts. All figures in this document are unaudited. Small differences are possible in the tables due to rounding.

Certain of the statements contained herein are not historical facts, including, without limitation, certain statements made of future expectations and other forward-looking statements that are based on management’s current views and assumptions and involve known and unknown risks and uncertainties that could cause actual results, performance or events to differ materially from those expressed or implied in such statements. Actual results, performance or events may differ materially from those in such statements due to a number of factors, including, without limitation: (1) changes in general economic conditions and customer behaviour, in particular economic conditions in ING’s core markets, including changes affecting currency exchange rates and the regional and global economic impact of the invasion of Russia into Ukraine and related international response measures (2) changes affecting interest rate levels (3) any default of a major market participant and related market disruption (4) changes in performance of financial markets, including in Europe and developing markets (5) fiscal uncertainty in Europe and the United States (6) discontinuation of or changes in ‘benchmark’ indices (7) inflation and deflation in our principal markets (8) changes in conditions in the credit and capital markets generally, including changes in borrower and counterparty creditworthiness (9) failures of banks falling under the scope of state compensation schemes (10) non- compliance with or changes in laws and regulations, including those concerning financial services, financial economic crimes and tax laws, and the interpretation and application thereof (11) geopolitical risks, political instabilities and policies and actions of governmental and regulatory authorities, including in connection with the invasion of Russia into Ukraine and the related international response measures (12) legal and regulatory risks in certain countries with less developed legal and regulatory frameworks (13) prudential supervision and regulations, including in relation to stress tests and regulatory restrictions on dividends and distributions (also among members of the group) (14) ING’s ability to meet minimum capital and other prudential regulatory requirements (15) changes in regulation of US commodities and derivatives businesses of ING and its customers (16) application of bank recovery and resolution regimes, including write down and conversion powers in relation to our securities (17) outcome of current and future litigation, enforcement proceedings, investigations or other regulatory actions, including claims by customers or stakeholders who feel misled or treated unfairly, and other conduct issues (18) changes in tax laws and regulations and risks of non-compliance or investigation in connection with tax laws, including FATCA (19) operational and IT risks, such as system disruptions or failures, breaches of security, cyber-attacks, human error, changes in operational practices or inadequate controls including in respect of third parties with which we do business and including any risks as a result of incomplete, inaccurate, or otherwise flawed outputs from the algorithms and data sets utilized in artificial intelligence (20) risks and challenges related to cybercrime including the effects of cyberattacks and changes in legislation and regulation related to cybersecurity and data privacy, including such risks and challenges as a consequence of the use of emerging technologies, such as advanced forms of artificial intelligence and quantum computing (21) changes in general competitive factors, including ability to increase or maintain market share (22) inability to protect our intellectual property and infringement claims by third parties (23) inability of counterparties to meet financial obligations or ability to enforce rights against such counterparties (24) changes in credit ratings (25) business, operational, regulatory, reputation, transition and other risks and challenges in connection with climate change, diversity, equity and inclusion and other ESG-related matters, including data gathering and reporting and also including managing the conflicting laws and requirements of governments, regulators and authorities with respect to these topics (26) inability to attract and retain key personnel (27) future liabilities under defined benefit retirement plans (28) failure to manage business risks, including in connection with use of models, use of derivatives, or maintaining appropriate policies and guidelines (29) changes in capital and credit markets, including interbank funding, as well as customer deposits, which provide the liquidity and capital required to fund our operations, and (30) the other risks and uncertainties detailed in the most recent annual report of ING Groep N.V. (including the Risk Factors contained therein) and ING’s more recent disclosures, including press releases, which are available on www.ING.com.

This document may contain ESG-related material that has been prepared by ING on the basis of publicly available information, internally developed data and other third-party sources believed to be reliable. ING has not sought to independently verify information obtained from public and third-party sources and makes no representations or warranties as to accuracy, completeness, reasonableness or reliability of such information.

Materiality, as used in the context of ESG, is distinct from, and should not be confused with, such term as defined in the Market Abuse Regulation or as defined for Securities and Exchange Commission (‘SEC’) reporting purposes. Any issues identified as material for purposes of ESG in this document are therefore not necessarily material as defined in the Market Abuse Regulation or for SEC reporting purposes. In addition, there is currently no single, globally recognized set of accepted definitions in assessing whether activities are “green” or “sustainable.” Without limiting any of the statements contained herein, we make no representation or warranty as to whether any of our securities constitutes a green or sustainable security or conforms to present or future investor expectations or objectives for green or sustainable investing. For information on characteristics of a security, use of proceeds, a description of applicable project(s) and/or any other relevant information, please reference the offering documents for such security.This document may contain inactive textual addresses to internet websites operated by us and third parties. Reference to such websites is made for information purposes only, and information found at such websites is not incorporated by reference into this document. ING does not make any representation or warranty with respect to the accuracy or completeness of, or take any responsibility for, any information found at any websites operated by third parties. ING specifically disclaims any liability with respect to any information found at websites operated by third parties. ING cannot guarantee that websites operated by third parties remain available following the publication of this document, or that any information found at such websites will not change following the filing of this document. Many of those factors are beyond ING’s control.

Any forward-looking statements made by or on behalf of ING speak only as of the date they are made, and ING assumes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information or for any other reason.

This document does not constitute an offer to sell, or a solicitation of an offer to purchase, any securities in the United States or any other jurisdiction.

Continue Reading

-

Down Cemetery Road TV review — Emma Thompson plays a sharp-tongued detective in sprawling thriller

Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

It is reasonable to have expected more from Down Cemetery Road. Adapted from a novel by Mick Herron, author of the books…

Continue Reading

-

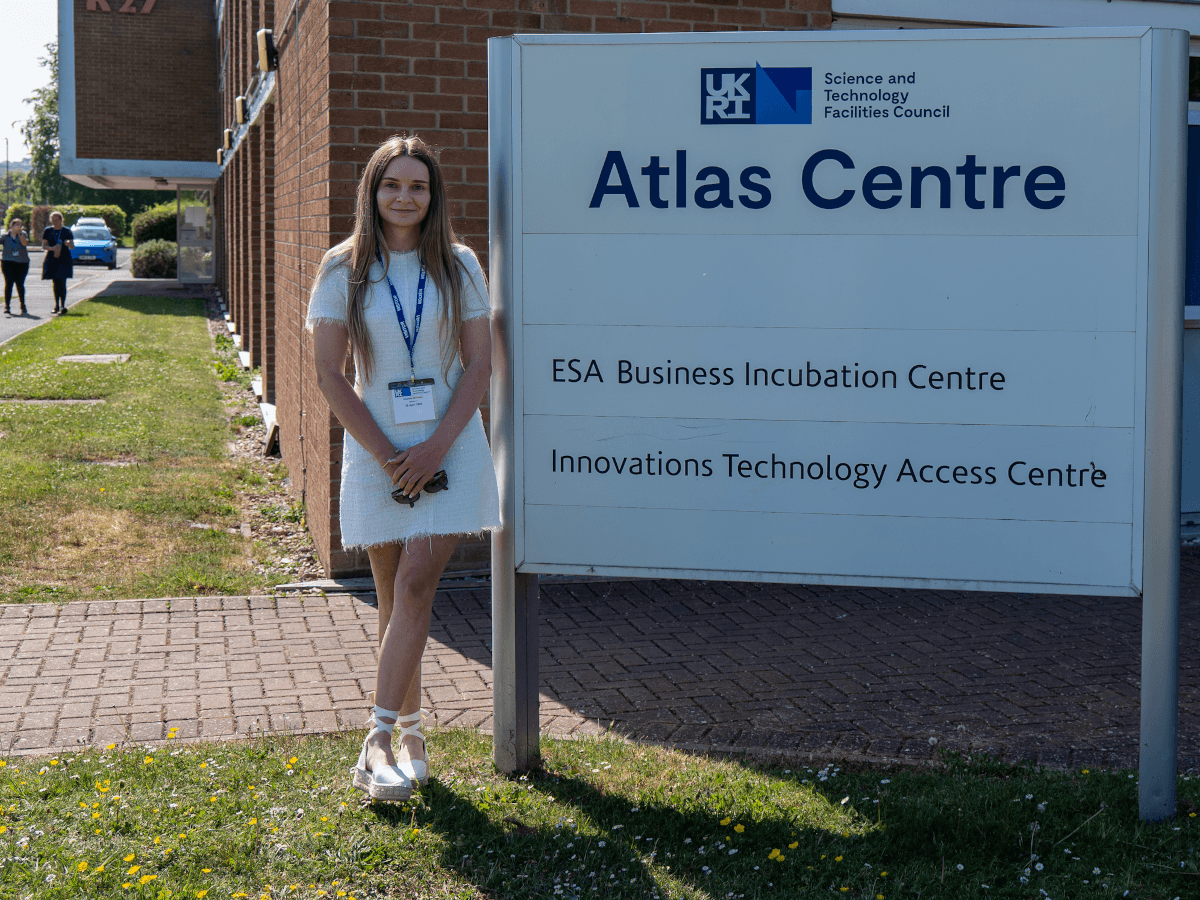

The deep-tech founder growing the thermoelectric materials sector

Chelsea Williams discusses how in deep-tech the important breakthroughs don’t just happen over night.

Growing up, Chelsea Williams, the co-founder and CTO of deep-tech thermoelectric materials start-up…

Continue Reading

-

Dead and Alive by Zadie Smith review – essays for an age of anxiety | Zadie Smith

Accepting a literary prize in Ohio last year, the novelist Zadie Smith described “feeling somewhat alienated from myself, experiencing myself as a posthumous entity”. Smith is only 50, but there is indeed something of the afterlife about the…

Continue Reading

-

Inside the All Blacks’ mindset for the Ireland Test » allblacks.com

Hooker Codie Taylor and lock Sam Darry may be at different ends of the All Blacks’ experience scale, but they share the understanding of what is involved in Sunday’s (NZT) Test in Chicago against Ireland.

Taylor, a veteran of…

Continue Reading

-

South Africa vs Japan – Debutant Zachary Porthen to start for Springboks at Twickenham

South Africa director of rugby Rassie Erasmus has named an experienced side for the Test against Japan in London on Nov. 1, but has included squad debutant Zachary Porthen in the starting XV.

Porthen, who got his maiden…

Continue Reading

-

A moment that changed me: I hated running – until I saw it through my daughter’s eyes | Running

As a teenager, I was very much a “don’t put me down for cardio” girl. At school I would volunteer to be the goalkeeper as it required the least amount of movement. When it came to sports day, if I couldn’t blag a sicknote, I’d…

Continue Reading

-

Nokia deploys future-ready network architecture to enhance Zayo’s leading IP network infrastructure

At Nokia, we create technology that helps the world act together.

As a B2B technology innovation leader, we are pioneering networks that sense, think and act by leveraging our work across mobile, fixed and cloud networks. In addition, we create value with intellectual property and long-term research, led by the award-winning Nokia Bell Labs, which is celebrating 100 years of innovation.

With truly open architectures that seamlessly integrate into any ecosystem, our high-performance networks create new opportunities for monetization and scale. Service providers, enterprises and partners worldwide trust Nokia to deliver secure, reliable and sustainable networks today – and work with us to create the digital services and applications of the future

';

Continue Reading

-

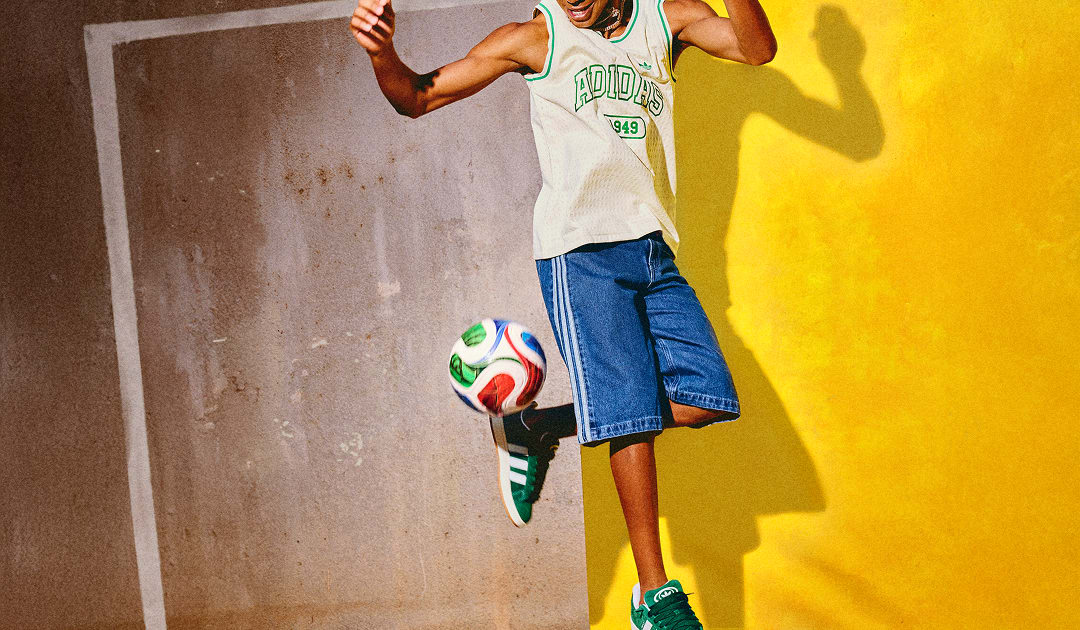

adidas brand momentum drives record revenues, strong third-quarter results, and upgrade of full-year 2025 outlook

Major developments Q3 2025:

- Brand adidas grows 12% currency-neutral, leading to record net sales of € 6.6 billion

- Broad-based double-digit growth across markets, divisions, categories, and channels

- Gross margin improves 0.5 percentage points to 51.8%, despite unfavorable effects from currencies and tariffs

- Operating profit up 23% to € 736 million

- Operating margin improves 1.8 percentage points to 11.1%

- Net income of € 485 million, as hyperinflation-related effects weigh on financial result

Major developments 9M 2025:

- Brand adidas grows 14%, with double-digit increases in all markets and channels

- Operating profit up 48% to € 1.9 billion, reflecting an operating margin of 10.1%

- Net income increases 52% to € 1.3 billion

Increased outlook for FY 2025:

- Double-digit currency-neutral revenue growth for adidas brand

- Company revenues to increase by around 9% (previously: high-single-digit increase)

- Operating profit to increase to around € 2.0 billion (previously: € 1.7 – € 1.8 billion)

adidas CEO Bjørn Gulden:

“I am extremely proud of what our teams achieved in the third quarter with actually record revenues. 12% growth for the adidas brand leading to total revenue of € 6.63 billion is the highest we have ever achieved as a company in a quarter. I am especially happy to see that our performance business is growing strongly across categories and in all regions.The environment is volatile with the tariff increases in the US and a lot of uncertainty among both retailers and consumers around the world, but our teams work hard, and our brand and our products resonate well with consumers.

Given the positive development in Q3, we have narrowed our top-line guidance and raised our full-year EBIT outlook from between € 1.7 billion and € 1.8 billion to around € 2.0 billion.

2025 is a success for us already. 14% growth for the adidas brand year-to-date and an EBIT margin above 10% is proof how strong our brand is. Being a global brand with a local mindset, empowering our markets to win their local consumers is the right strategy to be globally successful and is driving these strong results.

The focus is now on transitioning well into 2026, which will be another exciting sports year with the Winter Olympics right at the beginning, the biggest Football World Cup ever, and many more great events to look forward to.

adidas is a sports company that connects sports and street culture. We sell performance, comfort, and lifestyle. We see global demand for all these segments continue to grow. That is why we look positive into the future!”

Third-quarter results

adidas brand with 12% currency-neutral growth in Q3

In the third quarter of 2025, currency-neutral revenues for the adidas brand increased 12% versus the prior year, or more than € 700 million in absolute terms, reflecting its continued and broad-based momentum. Having completed the sale of the remaining Yeezy inventory at the end of last year, the company’s results for the third quarter of 2025 do not include any Yeezy revenues (2024: around € 200 million). Including Yeezy sales in the prior year, currency-neutral revenues increased 8%. In euro terms, revenues reached a record level of € 6,630 million (2024: € 6,438 million) in the quarter, despite the strengthening of the euro against several currencies, which led to an unfavorable translation impact of more than € 300 million.Double-digit increase in both footwear and apparel

Footwear revenues for the adidas brand grew 11% during the quarter on a currency-neutral basis. The broader and deeper product offering drove double-digit footwear growth in major sports categories, including Running, Football, Training, and Specialist Sports. Strong growth in Originals and Sportswear also contributed to the increase in footwear. Apparel sales grew 16% during the quarter as brand and product momentum continued to expand. Differentiated and locally relevant apparel collections fueled double-digit increases in Originals, Football, Running, Specialist Sports, and US Sports. Accessories grew 1% during the quarter.Double-digit growth in both Performance and Lifestyle

Performance revenues increased 17% on a currency-neutral basis during the third quarter, led by strong double-digit growth in Running and Football. Momentum in Running increased further with growth of more than 30%, driven by Adizero. The Adios Pro Evo 2 and Adios Pro 4 secured multiple marathon victories, including wins in Tokyo, Berlin, and Chicago, while the Prime X Evo concept shoe broke the six-hour barrier, setting a new world record for the 100 kilometers at the ‘Chasing 100’ project in Italy. Given these strong performance credentials, adidas continued to expand its successful Evo SL franchise, offering Adizero features at a compelling price point, and also recorded growth in everyday running franchises such as Supernova. In Football, growth was fueled by new season on-pitch kits and culturally inspired collections for the brand’s major clubs. The launch of a wide range of product for Liverpool FC, the brand’s latest addition to its unique portfolio of partners, was particularly successful across the globe. Updated packs for the F50 and Predator footwear franchises further drove excitement and growth. adidas players Ousmane Dembélé, Aitana Bonmatí, Gianluigi Donnarumma, Lamine Yamal, and Vicky López all having been awarded at the Ballon d’Or provided positive halo effects across the brand’s entire Football offering. Several other categories, including Training, Specialist Sports, US Sports, and Motorsport also contributed to the broad-based growth in Performance on the back of product innovation and newness that resonate strongly with consumers. Examples include the Dropset and Rapidmove footwear franchises for strength athletes, broader and deeper offerings for credibility sports such as American football, tennis, swimming, rugby, and field hockey, or the extensive merchandise collection in partnership with the Mercedes-AMG PETRONAS Formula 1 team.Lifestyle revenues for the adidas brand increased 10% on a currency-neutral basis in the third quarter, driven by double-digit growth in Originals. The popular Terrace franchises continued to see healthy demand backed by seasonal updates in colorways, materials, and new collaborations that cater to local consumer tastes. At the same time, the brand’s Low Profile offering continued to expand, with growth driven by updated looks for the Tokyo, Japan, and Taekwondo franchises, including animal-print and metallic iterations, as well as football- and ballet-inspired styles. After relaunching one of its most iconic franchises earlier this year, the brand also began to sequentially scale the Superstar, backed by a global campaign and market-led activations. In addition to evolving its classics footwear business, adidas continued to evolve its lifestyle running and lifestyle football offerings. Following successful activations, including the sought-after Pharrell Williams Adistar Jellyfish, the brand started to make silhouettes such as the Adistar Control, Goukana, and Megaride, as well as street-ready versions of the Predator and F50 more widely available. Building on the broad-based footwear momentum, Originals’ apparel offering continued to gain traction. The Firebird and Teamgeist collections see particularly strong demand, driven by their heritage and the use of differentiated materials such as knit and denim, as well as bold colors. Collaborations with Oasis, Wales Bonner, Edison Chen, Sporty & Rich, and collections created with several retail partners further supported growth in Originals. In Sportswear, increases were driven by growing demand for the brand’s commercial range, while innovative products such as the 3D-printed Climacool shoe and the revamped Z.N.E. apparel collection complemented the brand’s portfolio of sport-inspired lifestyle products.

Strong growth across all markets

In terms of regional performance during the third quarter, currency-neutral net sales for the adidas brand grew 12% in Europe, driven by double-digit growth in both wholesale and the brand’s direct-to-consumer (DTC) business. Revenues in Greater China (+10%), Emerging Markets (+13%), Latin America (+21%), and Japan/South Korea (+11%) were also up double-digits, with particularly strong increases in the company’s DTC channels in all regions. Revenues for the adidas brand in North America were up 8%, reflecting double-digit growth in both footwear and apparel, while accessories sales declined during the quarter.Double-digit growth across all channels

From a channel perspective, growth for the adidas brand was equally broad-based with double-digit increases in all channels. Strong sell-through rates in our retail partners’ stores and increased shelf space allocations continued to drive wholesale revenues, which increased 10% on a currency-neutral basis. Own retail revenues were up 13%, driven by strong like-for-like growth in the company’s global fleet of own stores and continued investments into retail doors. E‑commerce sales increased 15%, with a continued focus on full-price propositions and on top of more than 25% growth in the prior-year quarter. As a result, sales in the brand’s DTC business grew 14% in Q3.Gross margin improves 0.5 percentage points to 51.8%

The company’s gross margin increased 0.5 percentage points to 51.8% during the third quarter (2024: 51.3%). The positive development was mainly driven by lower product and freight costs, a better business mix, as well as continued strong sell-throughs, which more than offset the negative impacts from unfavorable currency fluctuations and higher US tariffs.Continued brand investments and overhead discipline

Other operating expenses decreased by 3% to € 2,740 million in the third quarter (2024: € 2,837 million). As a percentage of sales, other operating expenses decreased 2.7 percentage points to 41.3% (2024: 44.1%). Marketing and point-of-sales expenses were up 10% to € 798 million (2024: € 724 million) as brand investments remained a priority. Next to ‘You Got This,’ its overarching brand campaign, adidas executed several dedicated product campaigns. These featured growing franchises such as the Superstar and Evo SL and involved a multitude of market-led physical events to connect with local sport and streetwear culture. In addition, the increase in marketing expenses reflects new and extended partnerships. Recent brand partner signings include Liverpool FC, the future Audi Formula 1 team, Jeremiah Smith, Penn State, and Tennessee Athletics. As a percentage of sales, marketing and point-of-sale expenses were up 0.8 percentage points to 12.0% (2024: 11.2%). Operating overhead expenses decreased 8% to € 1,943 million (2024: € 2,114 million), as the company continued to invest into its sales and distribution capabilities while managing its overall cost base. As a percentage of sales, operating overhead expenses decreased 3.5 percentage points to 29.3% (2024: 32.8%), reflecting strong operating leverage.Operating profit growing to € 736 million reflects operating margin of 11.1% in Q3

The company’s operating profit increased by 23% to € 736 million in the third quarter (2024: € 598 million), reaching an operating margin of 11.1%, up 1.8 percentage points compared to the previous year (2024: 9.3%). Having completed the sale of the remaining Yeezy inventory at the end of last year, there was no Yeezy contribution to the company’s operating profit in the quarter (2024: around € 50 million).Net income from continuing operations increases to € 482 million

Net financial expenses amounted to € 86 million (2024: net financial income of € 4 million), with the development mainly driven by currency and hyperinflation-related effects. Financial expenses had fallen significantly in the prior-year quarter due to favorable currency and hyperinflation-related effects. In contrast, the company recorded a significant negative impact from currency and hyperinflation-related effects in Q3 this year and financial expenses increased accordingly. Against an income before taxes of € 650 million (2024: € 601 million), the company recorded income taxes of € 169 million (2024: € 133 million). The tax rate reached 25.9% (2024: 22.1%), reflecting timing effects related to the recognition of withholding taxes. As a result, net income from continuing operations increased by 3% to € 482 million (2024: € 469 million) and led to basic and diluted EPS from continuing operations of € 2.57 (2024: € 2.44).First nine months results

adidas brand revenues up 14% currency-neutral in the first nine months of the year

Currency-neutral revenues for the adidas brand increased 14% in the first nine months of 2025, or more than € 2.2 billion in absolute terms. Having completed the sale of the remaining Yeezy inventory at the end of last year, the company’s results for the first nine months of 2025 do not include any Yeezy revenues (2024: more than € 550 million). Including Yeezy sales in the prior year, currency-neutral revenues increased 10%. In euro terms, revenues were up 6% to € 18,735 million (2024: € 17,718 million), as currency developments had an unfavorable translation impact.Strong adidas brand momentum drives double-digit growth in footwear and apparel

Footwear revenues for the adidas brand increased 14% on a currency-neutral basis during the first nine months of the year, reflecting strong double-digit growth in Originals, Sportswear, Running, Training, Performance Basketball, and Specialist Sports. Apparel sales grew 14%, led by double-digit growth in Originals and Running, while Football, Training, Golf, Specialist Sports, and Sportswear also posted strong increases. Accessories grew 6% during the first nine months of the year.adidas brand with double-digit growth in all markets

In the first nine months of 2025, currency-neutral revenues for the adidas brand increased at double-digit rates in all markets. Europe grew 11%, North America was up 12%, and Greater China also increased 12%. In addition, Latin America (+24%), Emerging Markets (+17%), and Japan/South Korea (+14%) also recorded double-digit increases.adidas brand up double digits across all channels

From a channel perspective, the adidas brand also showed strong and broad-based growth in the first nine months of 2025. Wholesale revenues increased 14% on a currency-neutral basis and the DTC business grew 13%. Within DTC, own retail revenues were up 12% and e‑commerce sales increased 14%.Gross margin improves 0.8 percentage points to 51.9%

During the first nine months of the year, the company’s gross margin increased 0.8 percentage points to 51.9% (2024: 51.1%). The year-over-year increase of the adidas brand gross margin was even stronger. The positive development was mainly driven by lower product and freight costs, a better business mix, as well as continued strong sell-throughs, which more than offset unfavorable impacts from currencies and higher tariffs.Operating margin of 10.1% in the first nine months of 2025

Other operating expenses decreased by 1% to € 7,905 million (2024: € 7,953 million) in the first nine months of 2025. As a percentage of sales, other operating expenses decreased 2.7 percentage points to 42.2% (2024: 44.9%). Marketing and point-of-sale expenses were up 8% to € 2,255 million (2024: € 2,087 million). As a percentage of sales, marketing and point-of-sale expenses increased 0.3 percentage points to 12.0% (2024: 11.8%). Operating overhead expenses decreased 4% to € 5,650 million (2024: € 5,866 million). As a percentage of sales, operating overhead expenses decreased 2.9 percentage points to 30.2% (2024: 33.1%). As a result, the company’s operating profit increased 48% to € 1,892 million (2024: € 1,280 million), reflecting an operating margin of 10.1%, up 2.9 percentage points compared to the previous year (2024: 7.2%). Having completed the sale of the remaining Yeezy inventory at the end of last year, there was no Yeezy contribution to the company’s operating profit in the first nine months of 2025 (2024: around € 150 million). Net income from continuing operations increased by 52% to € 1,293 million (2024: € 851 million), while basic and diluted earnings per share from continuing operations increased to € 7.04 (2024: basic earnings per share from continuing operations of € 4.50; diluted earnings per share from continuing operations of € 4.49).Average operating working capital as a percentage of sales at 21.9%

Inventories increased 21% to € 5,471 million as at September 30, 2025 (2024: € 4,524 million) and were up 26% in currency-neutral terms. In addition to the support for the planned top-line growth, this development reflects the low comparison base in the prior year, earlier product purchases for World Cup-related products, as well as faster inbound deliveries. Current or future season products continue to account for the vast majority of the inventory position. Operating working capital was up 26% to € 6,179 million (2024: € 4,886 million) and average operating working capital as a percentage of sales increased 1.3 percentage points to 21.9% (2024: 20.6%).Healthy leverage ratio of 1.6x

Cash and cash equivalents amounted to € 1,030 million at September 30, 2025 (2024: € 1,781 million), reflecting the increased dividend payout in May and operating working capital investments in the first nine months of 2025. Adjusted net borrowings increased 14% to € 4,787 million at September 30, 2025 (2024: € 4,211 million), mainly due to the decline in cash and cash equivalents. The company’s ratio of adjusted net borrowings over EBITDA decreased to 1.6x (2024: 2.1x).Full-year outlook

Increased outlook with operating profit now expected to reach around € 2.0 billion

On October 21, adidas upgraded its full-year financial guidance. For the full year, the company continues to expect double-digit currency-neutral revenue growth for the adidas brand. Including Yeezy sales in the prior year (2024: around € 650 million), currency-neutral revenues are now expected to increase by around 9% (previously: increase at a high-single-digit rate). The company’s operating profit is now expected to increase to a level of around € 2.0 billion (previously: to reach a level of between € 1.7 billion and € 1.8 billion). The improved profitability outlook reflects continued brand momentum, the better-than-expected business performance, as well as the company’s successful efforts to partly mitigate the additional costs resulting from increased US tariffs.Continue Reading