🏀Saturday’s Schedule🏀

Top Storylines 👉📝

– Denver and Phoenix renew their rivalry

These teams have played three overtime games over their last 11 matchups. Nikola Jokić had one of the best performances in NBA history…

– Denver and Phoenix renew their rivalry

These teams have played three overtime games over their last 11 matchups. Nikola Jokić had one of the best performances in NBA history…

Scientists working in Wyoming’s badlands have uncovered two rare fossilized “mummies” of hoofed Edmontosaurus, a…

Dimeco (DIMC) delivered earnings growth of 6.7% per year over the last five years, with profits accelerating to a strong 36.1% gain in the latest twelve months. Net profit margin improved to 32.2% from 27.6% a year ago, signaling higher earnings quality and operational efficiency. Investors will note not only the company’s expanding profit margins, but also its attractive dividend, solid valuation, and consistently positive profit trajectory, with no major risks flagged in this period.

See our full analysis for Dimeco.

Next up, we’ll see how these headline results measure up against the widely held Simply Wall St narratives, spotlighting where the numbers match the market’s expectations and where they could spark new debates.

Curious how numbers become stories that shape markets? Explore Community Narratives

Dimeco trades at $41.25 per share while the DCF fair value stands at $93.21, meaning shares are currently 56% below what the discounted cash flow model suggests they could be worth.

Bulls point to this sizable gap as a key opportunity, highlighting that the company’s price-to-earnings ratio is just 6.8x versus the US banks industry average of 11.2x.

They argue that such a low multiple, combined with resilient profit margins of 32.2%, significantly supports the bullish case that Dimeco is undervalued both absolutely and relative to peers.

Critics may note limited risk disclosures, but value-focused investors see few red flags to challenge the upside implied by the fair value gap.

Net profit margin climbed to 32.2%, outshining the previous year’s 27.6% and indicating Dimeco is extracting higher profitability than typical industry rivals.

The prevailing market view underscores how this margin strength aligns with past earnings growth of 6.7% per year.

What is notable is that the most recent year’s 36.1% profit surge reinforces this operational quality, rather than marking a one-off spike.

Combined with limited downside risks and consistent profit trajectory, the margin trend makes bullish arguments more compelling for fundamentals-driven investors.

Dimeco’s price-to-earnings ratio of 6.8x sits well below both the peer group average of 9.5x and the sector’s 11.2x, solidifying its profile as a value stock within US banks.

The prevailing market view highlights that this relative discount, alongside a history of profit or revenue growth, draws in investors seeking income and upside potential.

Not only is the P/E ratio lower, but it comes with a track record of growing profits and an attractive dividend, helping it stand out from pure deep value plays that lack quality.

Any debate about slow long-term growth is less pressing when the company has consistently improved margins and payout, according to the financial data presented.

Fortuna Mining (TSX:FVI) shares edged slightly lower after the company reported a modest annual revenue dip, while net income saw a significant jump. Investors are considering how improved profitability might impact the stock’s valuation moving forward.

See our latest analysis for Fortuna Mining.

Fortuna Mining’s run this year has been impressive, with a year-to-date share price return of 73.44 percent and a 1-year total shareholder return of 61.90 percent. This demonstrates clear momentum, even after a short-term pullback. That kind of performance stands out, especially as investors consider recent earnings gains and the company’s improved profitability in the context of broader market trends.

If you’re keeping an eye out for stocks with breakout momentum or surging fundamentals, this is the perfect time to broaden your perspective and discover fast growing stocks with high insider ownership

With strong gains this year and analyst targets still above the current share price, some investors are questioning whether Fortuna Mining remains undervalued or if the market has already factored in future growth potential. Is this a real buying opportunity?

Fortuna Mining’s fair value, according to the most widely followed analyst narrative, comes in at CA$13.65 per share. This is well above the latest close at CA$11.43. This significant gap is catching the attention of investors looking for undervalued opportunities based on strong growth catalysts outlined below.

Expansion projects and exploration in West Africa and Latin America position Fortuna to boost production, access new revenue streams, and support long-term growth. Operational efficiencies, rising precious metals prices, and improved ESG performance collectively strengthen profitability, reduce risks, and enhance earnings stability.

Read the complete narrative.

Want to know why analysts think Fortuna Mining deserves a higher price? The real engine behind this narrative lies in aggressive profit growth and a transformative margin story, but the exact numbers will surprise you. Dig deeper to discover which financial assumptions are fueling this valuation gap.

Result: Fair Value of $13.65 (UNDERVALUED)

Have a read of the narrative in full and understand what’s behind the forecasts.

However, future growth depends heavily on successful project execution and cost management. Any setbacks could potentially jeopardize margins or delay production gains.

Find out about the key risks to this Fortuna Mining narrative.

While analysts see Fortuna Mining as significantly undervalued based on future growth estimates, our SWS DCF model comes to a different conclusion. It puts fair value at CA$9.56 per share, which is below the current price. This may indicate possible overvaluation if cash flow assumptions prove too optimistic. Which view will ultimately be right?

Venture Global (VG) shares have been on the move lately, catching the eye of investors curious about what is driving the change. The stock has dropped about 35% over the past month, drawing attention to recent shifts in sentiment.

See our latest analysis for Venture Global.

Looking beyond the past month’s 34.7% slide in share price, Venture Global’s momentum has been fading for most of 2024, with its year-to-date share price return down over 60%. While the latest moves may reflect shifting risk perceptions, it is part of a longer pattern where any short-term rallies have not built into sustained gains.

If you’re looking to widen your investing lens as market sentiment shifts, this could be the perfect moment to discover fast growing stocks with high insider ownership.

With shares trailing well below their analyst price targets and annual revenue still showing solid growth, the question now is whether Venture Global is trading at a steep discount or if future prospects are already reflected in the market.

Venture Global is trading at a price-to-earnings (P/E) ratio of 17.9x. This places it at a premium compared to the industry average and its own fair ratio estimate. With a last close price of $9.49, investors are currently paying more for each dollar of earnings than is typical for similar U.S. oil and gas companies.

The price-to-earnings ratio captures how much the market is willing to pay for a company’s profits. It is a widely used tool for gauging whether a stock is trading at a reasonable level given its current and future earnings. For Venture Global, this elevated multiple suggests high expectations for profit growth, despite modest near-term earnings estimates and industry headwinds.

Compared to the U.S. oil and gas industry average P/E of 12.8x, Venture Global appears significantly more expensive. Its ratio also exceeds the estimated fair price-to-earnings level of 14.3x. This valuation gap signals the market may be overpricing future prospects, especially given the company’s current growth and profit profile.

Explore the SWS fair ratio for Venture Global

Result: Price-to-Earnings of 17.9x (OVERVALUED)

However, rising revenue growth could falter if industry conditions worsen or if profit improvements do not keep pace with expectations.

Find out about the key risks to this Venture Global narrative.

While the price-to-earnings ratio presents Venture Global as expensive compared to its peers, the SWS DCF model offers a different perspective. According to our DCF model, shares are trading approximately 31.6% below their estimated fair value of $13.88. Could the market be missing long-term fundamentals?

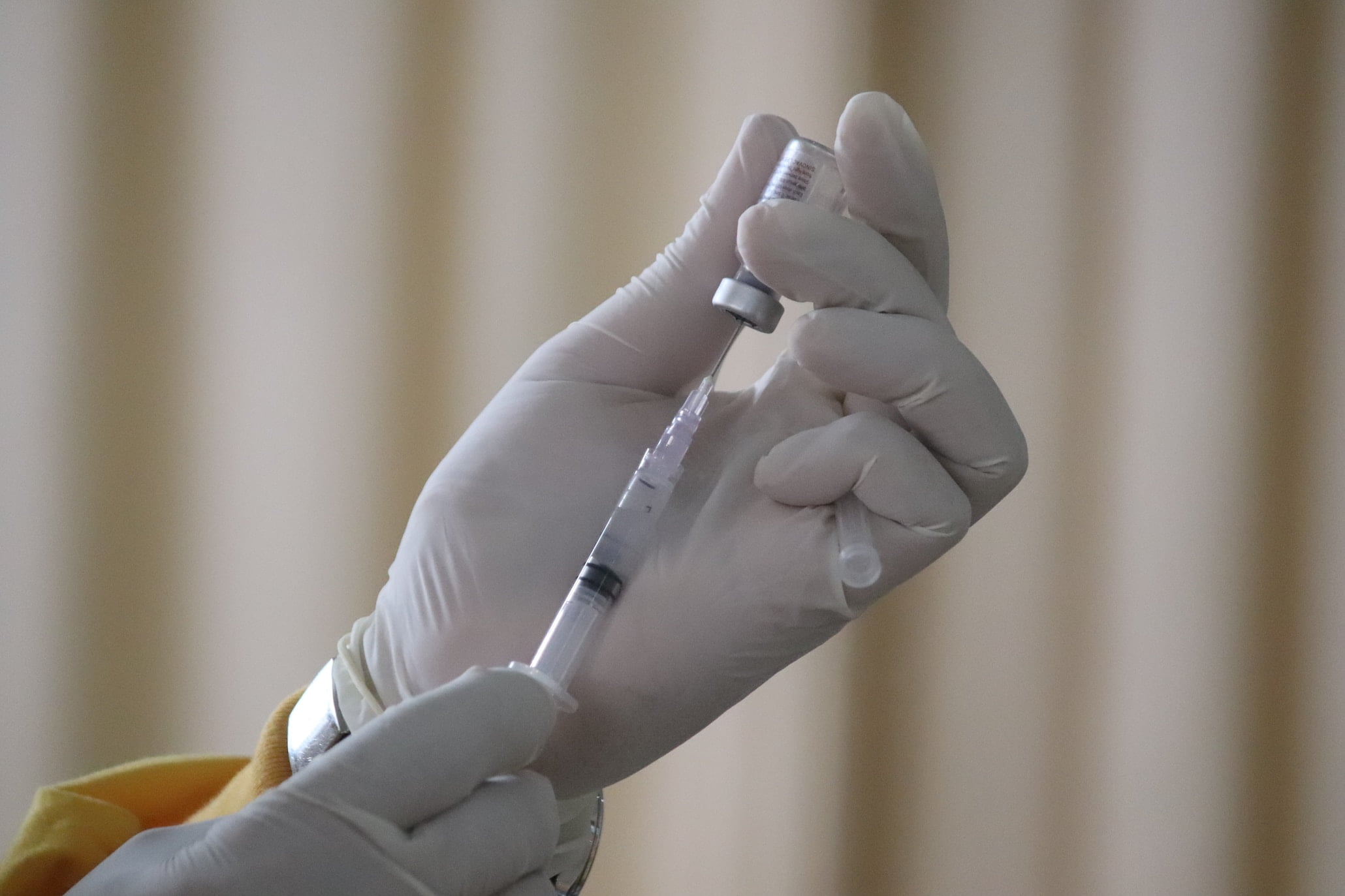

Zoster vaccination was associated with significantly reduced risks for all-cause mortality and major adverse cardiovascular events (MACE) among people living with HIV (PLWH), according to data from a real-world matched cohort presented at

Vertiv Holdings Co (NYSE:VRT) posted third-quarter earnings that outpaced expectations, prompting management to raise full-year guidance for both sales and earnings. The results highlight strong demand in digital infrastructure and AI-supported data centers.

See our latest analysis for Vertiv Holdings Co.

Vertiv’s momentum has been nothing short of remarkable. After topping expectations and lifting its forecast, shares have catapulted with a 31% gain in the past month alone, driving the 1-year total shareholder return to over 66%. With big data center contracts and fresh executive moves making headlines, investor enthusiasm continues to build as the company cements its leadership in AI-powered infrastructure.

If this surge in data center demand has you curious about new opportunities, it’s a great moment to discover See the full list for free.

Yet with shares already soaring and full-year guidance now higher, the big question for investors becomes this: Is Vertiv’s red-hot rally still leaving room for upside, or is the market already pricing in the next leg of growth?

Vertiv’s last close of $186.06 stands noticeably above the narrative’s fair value estimate of $173.11, revealing a premium in current market enthusiasm versus calculated future prospects.

Accelerating global demand for high-density, AI-driven data centers is driving robust growth in Vertiv’s sales pipeline and backlog. This is evidenced by recurring record order levels, backlog growth, and management’s raised organic sales growth guidance, which supports potentially higher future revenue.

Read the complete narrative.

Is this hot streak built to last? The most followed valuation hinges on a future profit windfall and a market-beating sales climb. But what exactly are the bold forecasts behind the scenes? Only the full narrative reveals the winning formula powering this price target.

Result: Fair Value of $173.11 (OVERVALUED)

Have a read of the narrative in full and understand what’s behind the forecasts.

However, persistent supply chain disruptions or a slowdown in AI data center build-outs could quickly test the strength of Vertiv’s growth outlook.

Find out about the key risks to this Vertiv Holdings Co narrative.

If you want to dive deeper or put your own spin on the story, you can build your own narrative from scratch in just a few minutes. Do it your way

A great starting point for your Vertiv Holdings Co research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.