Federica Brignone hasn’t set any finish line to her 2026 season. There isn’t one because she doesn’t want to set one for herself in the season leading up to Milano Cortina 2026 and the chance to compete in the Olympic Winter Games on home…

Blog

-

It’s Qwen’s world and we get to live in it, on CAISI’s report, & GPT-OSS update

Before getting into the latest artifacts, there are a couple of pieces of crucial open ecosystem we have to cover.

First, the Center for AI Standards and Innovation (CAISI) released a report that observed the ecosystem and evaluated DeepSeek 3.1…

Continue Reading

-

Stem Cell Textbooks Challenged by “Immortal” Flatworm – SciTechDaily

- Stem Cell Textbooks Challenged by “Immortal” Flatworm SciTechDaily

- Flatworm Stem Cells Regenerate Through Contactless Communication the-scientist.com

- This Tiny Worm May Be the Key to Human Limb Regeneration VICE

- Flatworms defy stem cell…

Continue Reading

-

US court orders spyware company NSO to stop targeting WhatsApp, reduces damages

89By Raphael Satter WASHINGTON (Reuters) -A U.S. court has ordered Israel’s NSO Group to stop targeting Meta Platforms’ WhatsApp messaging service, a development the spyware company warned could put it out of business. In a 25-page ruling handed down Friday, U.S. District Court Judge Phyllis Hamilton imposed a permanent injunction on NSO Group’s efforts to break into WhatsApp, one of the world’s most widely used communications platforms. Hamilton also handed NSO a significant break on the damages awarded in a recently concluded jury trial, reducing the punitive damages it owes Meta from about $167 million to $4 million. The injunction is likely to pose a challenge to NSO, which has for years been accused of facilitating human rights abuses through its flagship hacking tool, Pegasus. Pegasus takes advantage of weaknesses in commonly deployed pieces of software to power its surveillance, making WhatsApp one of its bigger targets. NSO has previously argued that an injunction preventing it from going after WhatsApp “would put NSO’s entire enterprise at risk” and “force NSO out of business,” according to the judgment. Meta executives celebrated the decision. “Today’s ruling bans spyware maker NSO from ever targeting WhatsApp and our global users again,” WhatsApp chief Will Cathcart said on X. “We applaud this decision that comes after six years of litigation to hold NSO accountable for targeting members of civil society.” NSO, which has long insisted its products fight serious crime and terrorism, said it welcomed the 97% reduction in punitive damages and said that the injunction did not apply to NSO’s customers, “who will continue using the company’s technology to help protect public safety.” The company said it would review the decision and “determine its next steps accordingly.” The company was recently purchased by a group led by Hollywood producer Robert Simonds, according to a report earlier this month in tech publication TechCrunch. Simonds did not immediately return an email. (Reporting by Raphael SatterEditing by Marguerita Choy)

(The article has been published through a syndicated feed. Except for the headline, the content has been published verbatim. Liability lies with original publisher.)

Continue Reading

-

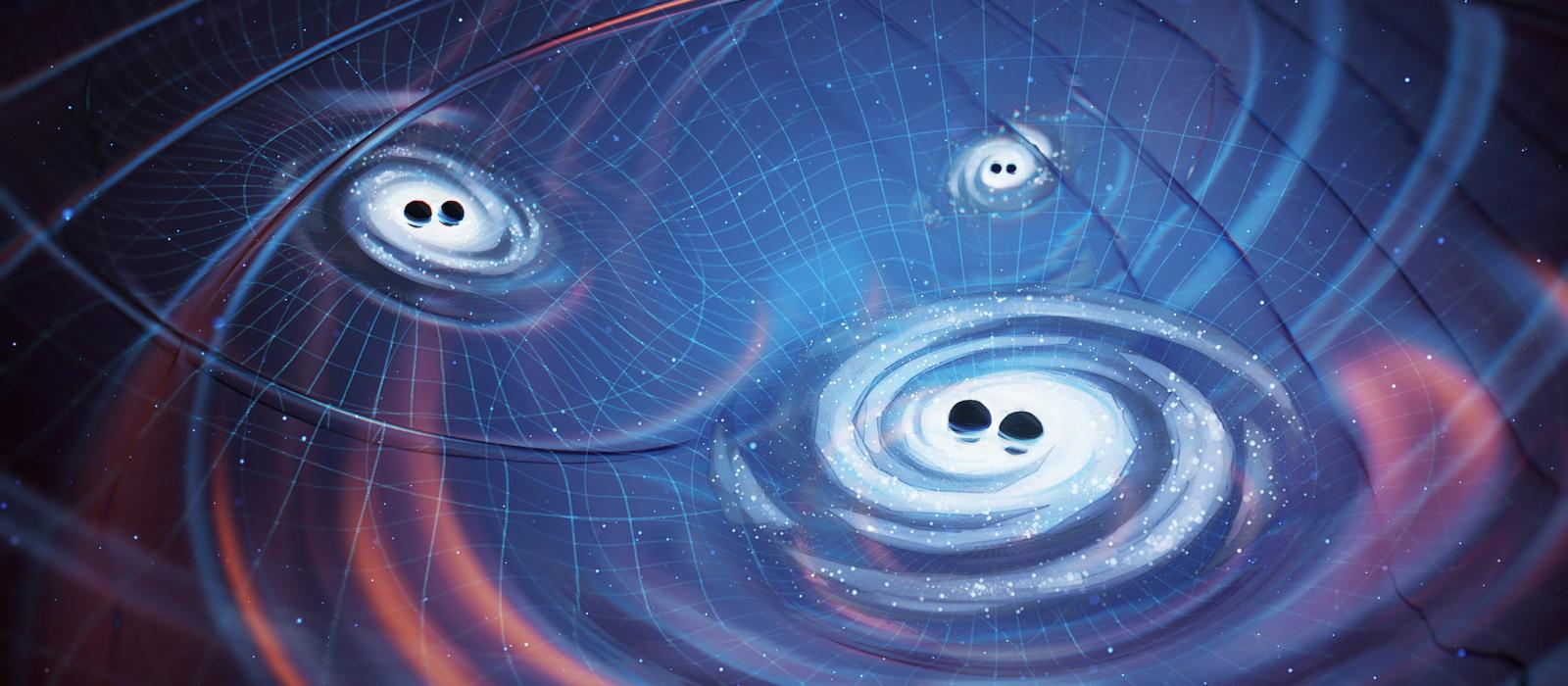

Listening For Gravitational Waves In The Rhythm of Pulsars

At the dawn of time, so the theory goes, the cosmos underwent a flash of rapid expansion. Almost instantly the visible Universe grew from a volume smaller than a proton to a spherical region nearly two meters across. It’s a moment known…

Continue Reading

-

Fake Door Marking Exposed: Polio Campaign in Bhag Reduced to Mere Formality – https://www.dailyindependent.com.pk

Fake Door Marking Exposed: Polio Campaign in Bhag Reduced to Mere Formality – https://www.dailyindependent.com.pk

Continue Reading

-

Evaluating Valuation After FDA Breakthrough Therapy Designation for BPL-003

Atai Life Sciences (NasdaqGM:ATAI) and its partner Beckley Psytech just received Breakthrough Therapy designation from the FDA for BPL-003, their investigational nasal spray for treatment-resistant depression. This recognition accelerates the path to potential approval and highlights excitement about new mental health therapies.

See our latest analysis for Atai Life Sciences.

Atai’s FDA breakthrough news supercharged momentum that was already building. The share price has spiked 303% year-to-date, and the 1-year total shareholder return is an eye-popping 404%. With fresh capital raised through a $130 million equity offering and continued sector-wide interest in psychedelic medicines, investors are clearly betting on both near-term catalysts and the company’s longer-term potential.

If regulatory milestones like this have you curious about other breakthrough opportunities, this is a great time to explore the latest See the full list for free..

With Atai’s massive rally, strong analyst buy ratings, and a price target well above current levels, investors are now asking whether the stock remains undervalued or if recent gains have already priced in the next stage of growth.

Atai Life Sciences trades at a price-to-book ratio of 9.6x, placing it well above the typical level in the pharmaceutical industry and raising questions about how much growth is being priced in at $6.45 per share.

The price-to-book ratio compares a company’s market value to its book value, providing a sense of how much investors are willing to pay for each dollar of assets. In pharmaceuticals, where early-stage R&D companies are often years from profitability, elevated price-to-book multiples can reflect either strong future expectations or indicate market exuberance.

While Atai’s ratio trails the peer group average of 11.3x, it remains much higher than the broader US Pharmaceuticals industry average of 2.4x. This suggests investors have high expectations, but maintaining this premium may be challenging without substantial revenue growth or positive earnings developments to support this year’s performance.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Book of 9.6x (OVERVALUED)

However, weak profitability and the potential for slower revenue growth could quickly cool investor enthusiasm if expectations get ahead of fundamentals.

Find out about the key risks to this Atai Life Sciences narrative.

If you have your own perspective or want to dive deeper, you can examine the numbers and construct your own take in just a few minutes, or Do it your way.

Continue Reading

-

Comet C/2025 R2 SWAN with messier 16 and Messier 17 – 17 Oct. 2025.

The beautiful comet C/2025 R2 SWAN is putting a wonderful show out there, thanks to the deep-sky friends it is meeting.

Comet C/2025 R2 SWAN with Messier 16 and Messier 17. 17 Oct. 2025.

The image above comes from the average of five,…

Continue Reading

-

Looking at the Narrative for Spotify as Analyst Sentiment and Growth Drivers Shift

Spotify Technology’s consensus analyst price target has edged down slightly, from $747.78 to $746.42. This signals a minor revision in how experts value the stock. This subtle shift comes as analysts weigh encouraging signs of revenue growth and new product initiatives, while also considering ongoing concerns around risk and market expectations. Read on to see how you can keep track of these evolving perspectives and stay informed on Spotify’s investment outlook.

Analysts have issued a variety of recent notes on Spotify Technology, reflecting both optimism and caution regarding the company’s near- and medium-term prospects. Their commentary provides insights into the factors driving updates to price targets, ratings, and overall investor sentiment.

🐂 Bullish Takeaways

-

Several firms, including JPMorgan, Guggenheim, Canaccord, and BNP Paribas Exane, have expressed a constructive outlook, highlighting robust subscriber and user growth, improving engagement and conversion, and ongoing international price increases.

-

JPMorgan raised its price target on Spotify to $805 from $740, citing updates to its model for international price hikes and projecting 14% year-over-year revenue growth through 2026. The firm also flagged potential upside if a U.S. price increase is implemented.

-

Guggenheim lifted its price target to $850 from $800 as it expects further price increases, particularly in large markets, to fuel upward revisions to revenue and profits.

-

Canaccord continues to view near-term share pullbacks as buying opportunities, basing its bullish stance on improving engagement, steady subscriber growth, pricing power, and a renewed focus on the ads business. The firm maintains a Buy rating with an $850 price target.

-

BNP Paribas Exane initiated coverage with an Outperform rating and a $900 price target, marking one of the highest targets among peers.

-

Other firms such as Wells Fargo and KeyBanc maintain Overweight ratings, indicating ongoing belief in Spotify’s pricing power and margin expansion potential, despite recent stock volatility.

-

Key drivers rewarded by analysts include execution on product momentum, strategic price increases, differentiation versus peers, and transparent communication of growth targets.

🐻 Bearish Takeaways

-

Caution has emerged among firms such as Goldman Sachs and Citi, who either downgraded their ratings or highlighted risks in their research.

-

Goldman Sachs downgraded Spotify to Neutral from Buy, even as it modestly raised its price target to $770 from $765. The firm sees a balanced risk/reward profile, suggesting much of Spotify’s forward growth may already be priced into the shares, particularly ahead of the Q3 earnings report. Goldman nonetheless expects solid mid-teens annual revenue growth over the next four years.

-

Citi increased its price target to $750 from $715 but maintained a Neutral rating, citing concerns that consensus estimates may underestimate the growing wholesale cost of music.

-

Phillip Securities upgraded the stock to Neutral from Reduce, but noted that near-term expectations are being tempered by increased investments and operating costs.

-

Analysts in this group tend to cite concerns over valuation, the extent to which future upside is already reflected in the share price, rising costs, and the impact of recent investment cycles as factors warranting a more cautious outlook.

Continue Reading

-

-

Pakistan vaccinates girls against HPV, cervical cancers

Pakistan vaccinates girls against HPV, cervical cancers | The Jerusalem Post Continue Reading