1

McLaren

4

Qualifying 3, fastest lap 1:15.586

2

Ferrari

16

Qualifying 3,…

1

McLaren

4

Qualifying 3, fastest lap 1:15.586

2

Ferrari

16

Qualifying 3,…

In 2024, an estimated 40 million people were living with HIV. While 77 % were being treated, nine million were not. Despite progress, the HIV response faces growing challenges due to shifting funding and political uncertainty. The US, which…

Schrödinger announced it will release its third quarter 2025 financial results on November 5, 2025, followed by a live webcast and conference call for investors.

The company has attracted increasing industry attention as a pioneer in applying artificial intelligence to accelerate drug discovery and reshape biotechnology innovation.

We’ll explore how recognition of Schrödinger’s AI leadership amid growing sector focus may influence its long-term investment outlook.

Find companies with promising cash flow potential yet trading below their fair value.

To be a shareholder of Schrödinger, you need to believe the company’s AI-driven software can become essential to drug discovery, leading to scalable, recurring revenues and clinical milestones. The upcoming third quarter 2025 results announcement and investor call, while relevant for short-term sentiment, does not materially change the main near-term catalyst, new clinical data for SGR-1505, nor does it resolve the biggest risk of sluggish new client acquisition amid biotech sector headwinds.

The most closely related recent announcement is Schrödinger’s update on initial clinical results for SGR-1505, a MALT1 inhibitor, which showed early efficacy and received FDA Fast Track designation this June. This progress in the clinic positions SGR-1505 as a primary driver for milestone payments and licensing, supporting management’s focus on revenue growth from drug discovery and anchoring the short-term investment outlook.

However, investors should also be mindful that, in contrast to the excitement around new clinical milestones, ongoing challenges in expanding the customer base persist and…

Read the full narrative on Schrödinger (it’s free!)

Schrödinger’s narrative projects $396.6 million revenue and $34.8 million earnings by 2028. This requires 18.6% yearly revenue growth and a $216.1 million increase in earnings from the current level of -$181.3 million.

Uncover how Schrödinger’s forecasts yield a $27.30 fair value, a 21% upside to its current price.

Six independent valuations from the Simply Wall St Community place fair value for Schrödinger between US$27.00 and US$43.20 per share. While some see upside, many remain focused on the risk that slow new client acquisition could constrain long-term revenue growth and influence market sentiment ahead of earnings; explore the range of outlooks shaping this debate.

Explore 6 other fair value estimates on Schrödinger – why the stock might be worth as much as 92% more than the current price!

Advances in transport and communication technologies in the 1980s and 1990s allowed the proliferation of global value chains that spurred the East Asian growth miracle (Baldwin 2016, Williamson and O’Rourke 2017). Recent decades have seen a new wave of disruptive technologies like robots, AI and digital platforms. Yet, this period has coincided with a deceleration in East Asian productivity (‘total factor productivity’) growth.

While this productivity slowdown has been global, it is far from uniform. In OECD economies, the top-performing firms – often referred to as the ‘global frontier’ – have maintained rapid productivity growth. The overall slowdown in OECD economies comes from a growing gap between these leaders and the rest (Blanchenay et al. 2017, Criscuolo et al. 2017). What remains less understood is how these dynamics play out in emerging economies.

Why has this productivity slowdown in East Asia come at a time of rapid technological progress? To address this question, in De Nicola et al. (2025) we use newly harmonised firm-level data from national statistical agencies across five major East Asian economies.

First, in East Asia, around three quarters of aggregate productivity growth has been due to increases within existing firms. Very little is contributed to productivity growth by the reallocation of market share across firms or from firm entry and exit. In fact, the market share of the national frontier firms – the 10% most productive firms in a sector – is declining. Resources appear to be trapped in less-productive firms that should shrink or exit, which could enable more-productive firms to scale up.

Second, productivity growth within the national frontier firms has been slower than among less productive firms. Frontier firms account for a large share of output and employment and around half of all within-firm productivity growth, so their stagnation weighs heavily on overall productivity.

While slower growth relative to less productive firms may reflect desirable domestic convergence, productivity gaps between East Asia’s frontier firms and the global frontier are widening in digital-intensive sectors — such as electronics, IT services, and pharmaceuticals. Between 2005 and 2015, global frontier firms in digital manufacturing boosted productivity by 76%. In contrast, national frontier firms in Indonesia, Malaysia, the Philippines, and Viet Nam achieved only a 34% increase over the same period (refer to Figure 1).

One reason for the underperformance of leading firms in East Asia is the uneven adoption of advanced technology. The gap in technology use between firms in East Asia and Pacific (EAP) and the world’s most sophisticated firms has widened, much more so than the gap between the average EAP firms and their global counterparts. The diffusion of accessible technologies like mobile internet is almost universal, whereas big differences persist for sophisticated technologies that drive frontier firm growth.

Figure 1 The national frontier in EAP countries is falling behind the global frontier, especially in digital sectors

The relative stagnation of East Asia’s top firms may be because they lack adequate competition incentives and the relevant capabilities, such as high-quality skills and infrastructure.

Barriers to competition in both goods and services markets stifle the incentive for the top firms to innovate. Firms that are close to the frontier innovate to stay ahead of their competitors, whereas laggard firms are discouraged and innovate less (Aghion et al. 2021). For example, Chinese import competition has been found to increase the innovation of leading firms but to depress it among nonleading firms in several countries (Cusolito et al. 2021, Iacovone 2012).

Although tariffs on goods are relatively low in East Asia, non-tariff measures in manufacturing and restrictions on services limit competition. For instance, in sectors dominated by state-owned enterprises (SOEs), frontier firm productivity growth is significantly lower than in other sectors.

Policy reforms that increase exposure to competition can be powerful tools to accelerate productivity growth. For example, liberalisation of services markets following Viet Nam’s WTO accession in 2007 are associated with 5% faster productivity growth of frontier firms in these same services sectors and over 10% in downstream manufacturing firms that use these services (see Figure 2).

Figure 2 Opening services to competition in Viet Nam increased productivity in these services sectors as well as in downstream manufacturing sectors that use services inputs

Productivity growth and adoption of sophisticated technologies require a broad range of skills and high-quality digital infrastructure. Yet basic skills remain limited. In several East Asian economies, more than half of 10-year-olds are unable to read an age-appropriate passage. Management quality remains a challenge, with the best-managed firms in the region especially far behind the best-managed firms globally. Meanwhile, access to high-speed fibre broadband – critical for cloud-based tools and AI – is uneven across and within countries.

Improving skills is key. Reforms are needed to fix the foundation of basic skills on which more-advanced skills can be built. Equipping workers with the skills that complement new technologies and enhancing the abilities of managers are crucial to accelerating productivity (Arias et al. 2025). Increased investment in new technologies is correlated with higher firm productivity in Viet Nam, but only for firms with a sufficiently skilled workforce (see Figure 3).

Figure 3 Productivity gains from technology adoption accrue to firms with more-skilled workers

Boosting productivity at the frontier requires a package of mutually reinforcing reforms: enhancing competition by liberalising services and reducing non-tariff barriers; building skills, from foundational literacy to advanced technical and managerial capabilities; and expanding digital infrastructure, thus ensuring access to high-speed internet and cloud services.

Synchronizing reforms can help exploit the synergies between enhanced human capital, infrastructure, and competition. For example, both openness to foreign competition and access to fibre broadband for firms in the Philippines increased technology adoption, but their combined impact was more than double. Similarly, widening access to higher education in China increased productivity, especially for foreign-owned firms. Also, trade liberalization in Indonesia led to productivity-enhancing increases in foreign direct investment, especially for firms with more-skilled workforces.

The relative stagnation of East Asia’s frontier firms is a challenge for long-term growth. In a world of accelerating technological change, maintaining competitiveness requires more than broad access to digital infrastructure. It requires ensuring that the most productive firms can innovate, expand, and adopt cutting-edge technologies. Our findings call for coordinated reforms – in skills, infrastructure, and competition – that can unleash the potential of East Asian firms and ensure they keep pace with the best in the world.

Authors’ note: The opinions expressed in this column are entirely those of the authors. They do not necessarily represent the views of the International Bank for Reconstruction and Development/World Bank and its affiliated organisations, or those of the Executive Directors of the World Bank or the governments they represent.

Arias, O, D Fukuzawa, D Le and A Mattoo (2025), “Future jobs: AI, robots, and jobs in developing countries”, VoxEU.org, 30 August.

Aghion, P, C Antonin, and S Bunel (202a), The Power of Creative Destruction: Economic Upheaval and the Wealth of Nations, Harvard University Press.

Baldwin, R (2016), The Great Convergence: Information Technology and the New Globalization, Harvard University Press.

Blanchenay, P, C Criscuolo, and G Berlingieri (2017), “Great Divergences: The growing dispersion of wages and productivity in OECD countries”, VoxEU.org, 15 May.

Cusolito, A P, A Garcia-Marin, and W F Maloney (2021), “Proximity to the frontier, markups, and the response of innovation to foreign competition”, VoxEU.org, 4 November.

Criscuolo, C, P Gal, and D Andrews (2017), “The best vs the rest: The global productivity slowdown hides an increasing performance gap across firms”, VoxEU.org, 27 March.

De Nicola, F, A Mattoo, and J Timmis (2025), Firm Foundations of Growth: Productivity and Technology in East Asia and Pacific, East Asia and Pacific Development Studies, World Bank.

Iacovone, L (2012), “The Better You Are, The Stronger It Makes You: Evidence on the Asymmetric Impact of Liberalization”, Journal of Development Economics 99(2): 474–85

Williamson, J G and K O’Rourke (2017), “The spread of modern manufacturing to the poor periphery”, VoxEU.org, 3 April.

RM of 21st century pop icons BTS premiered a new global digital feature as part of its ongoing collaboration with Samsung Electronics and his continuing role as global ambassador for Samsung Art TVs. The short film, released…

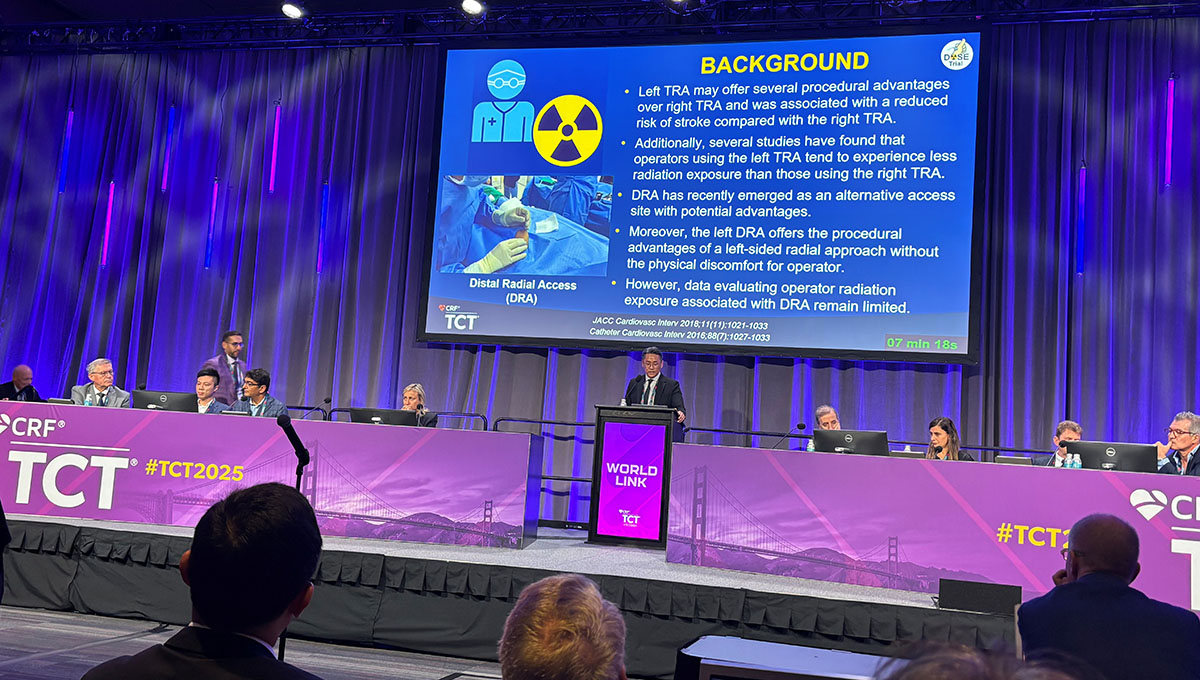

SAN FRANCISCO, CA—Operators are exposed to equal amounts of radiation during coronary procedures whether they use left distal radial access (DRA) or right transradial access (TRA), according to new data from the randomized, multicenter DOSE trial.

Yongcheol Kim, MD, PhD (Yongin Severance Hospital, Republic of Korea), who presented the data during the TCT WorldLink Forum today, said left DRA “has recently emerged as an alternative access site” that, among other things, offers operators less physical discomfort. It also involves less subclavian tortuosity plus catheter techniques that are more akin to the transfemoral approach.

Unfortunately, as in the group’s previous DRAMI trial comparing access routes in STEMI patients, the hoped-for radiation benefits with left DRA did not pan out.

James Goldstein, MD (Millennium Cardiology, Royal Oak, MI), the discussant following Kim’s presentation, summed up the data by saying: “I love it when trials make sense.” In DOSE, “the manner in which the left and right wrists were ultimately positioned [was] pretty much the same spot on the groin, so there’s no a priori reason to think there would be much difference in radiation exposure based on the position and the access,” he commented.

Led by Oh-Hyun Lee, MD, and Ji Woong Roh, MD, PhD (both from Yongin Severance Hospital), the study, which was simultaneously published in JACC: Cardiovascular Interventions, is the first large, randomized trial to evaluate the potential for left DRA to limit how much radiation operators receive during these procedures.

Prior studies had suggested that “operators using the left TRA tend to experience less radiation exposure than those using the right TRA,” according to Kim.

“Coronary angiography and PCI are essential procedures in the diagnosis and treatment of coronary artery disease, often performed thousands of times over an interventional cardiologist’s career,” the researchers note in their paper, adding that the radiation exposure to operators that accompanies such cases can, over a lifetime, pose substantial health risks.

The DOSE Trial

The DOSE investigators randomized 1,010 patients scheduled to undergo coronary procedures by either left DRA or right TRA at three centers in the Republic of Korea. They used a set of three real-time dosimeters to measure radiation exposure for five experienced operators at the left wrist, as well as at the left side of the head outside the lead cap and the left chest pocket of the lead vest. All wore the same radiation protection gear, including lead skirt and vests, thyroid collars, leaded glasses, leaded caps, and shields mounted on the table and ceiling.

With left DRA, patients’ left hands were positioned in the same place as where the left femoral artery puncture site would be, whereas with right TRA, patients’ right arms were positioned close to the right side of their bodies.

The left DRA group had a lower proportion of male patients and was more likely to undergo ultrasound-guided puncture. PCI, done in a quarter of the participants, trended higher with left DRA but didn’t reach statistical significance. All other baseline characteristics were similar in the two groups.

However, radiation levels were similar at each location no matter which access route was used.

Median Radiation Exposure (μSv) to Operators by Access Route

|

|

Left DRA |

Right TRA |

P Value |

|

Left Wrist |

4.76 |

5.20 |

0.342 |

|

Head |

2.00 |

1.83 |

0.416 |

|

Chest |

1.28 |

1.07 |

0.199 |

There were no advantages to either approach for the secondary endpoints of access-site crossover, fluoroscopy time, procedure time, and contrast volume, and no differences across patient subgroups.

Overall, though, the study reassures “that radiation hazard should not be considered a limiting factor for the adoption of left DRA in routine clinical practice,” the researchers conclude.

Goldstein added that both access routes were “successful, with equivalent levels of procedural performance,” however.

Going forward, as radiation protective gear grows more sophisticated and more widely used, these issues may have less relevance, he suggested. The benefits of the newer products go beyond lower exposure to radiation. Also important, Goldstein said, is “getting the lead off and avoiding the orthopedic complications” associated with traditional protective clothing.

![What you get with Google AI Pro and AI Ultra [October 2025]](https://afnnews.qaasid.com/wp-content/uploads/2025/10/1761433330_Google-One-AI-plans.jpg)

At I/O 2025, Google One AI Premium (and Gemini Advanced) became “Google AI Pro,” while a higher, more expensive tier was introduced with “Google AI Ultra.”

Updated 10/25

AI Pro is simply a…

– Denver and Phoenix renew their rivalry

These teams have played three overtime games over their last 11 matchups. Nikola Jokić had one of the best performances in NBA history…