Whether on the track or the street, at the club or the gym, the new KNWLS Nike collection embraces and enhances the female athlete’s every move.

The eight-piece collection from Nike and the venerable London-based label comprises a complete…

Whether on the track or the street, at the club or the gym, the new KNWLS Nike collection embraces and enhances the female athlete’s every move.

The eight-piece collection from Nike and the venerable London-based label comprises a complete…

Steve Jonesat Leeds Crown Court

West Yorkshire Police

West Yorkshire PoliceA provisional trial date has been set for two men accused of murdering peadophile singer Ian Watkins in prison.

The former Lostprophets…

Want to know if your staff are actually using that expensive AI bot you’ve splashed out on? Microsoft has your back with a feature that tracks adoption and usage of its Copilot AI suite.

The tool, called Benchmarks, will be rolled out to…

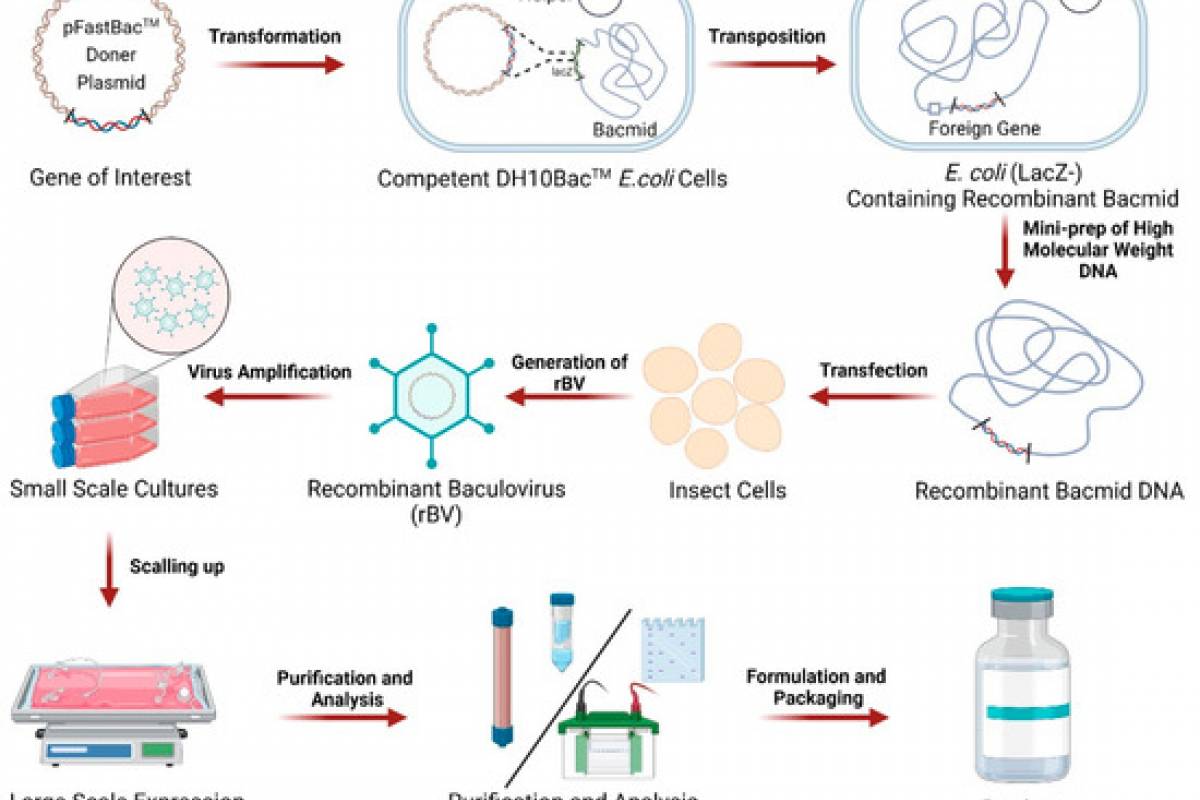

The world’s largest vaccine manufacturer, Serum Institute of India (SII) Pvt. Ltd., is enhancing its pandemic response preparedness by utilizing a baculovirus vaccine platform specifically designed to target H5N1 bird…

Badrov MB, Mak S, Floras JS. Cardiovascular autonomic disturbances in heart failure with preserved ejection fraction. Can J Cardiol. 2021;37:609–20.

Google Scholar

Jack CR, Bennett DA, Blennow K,…

Shortly after you finish celebrating the arrival of next year, a plague will rock up. Well, the full version of Pathologic 3, a game in which you play a doctor tasked with saving a town from a mysterious contagion will rock up….

Discover more Featured Stories like this in The Strad Playing Hub

It was a rainy afternoon in the city that gave birth to the atomic bomb when the Academy of St Martin in the Fields (ASMF) Chamber Ensemble took the stage. Presented…

New Global Witness research exposes glaring contradiction at the heart of forest finance, as Brazil prepares to launch flagship tropical forest fund at COP30

Financial institutions have made US$26 billion from financing deforesting companies since the Paris Agreement was signed in 2015 – averaging around $7 million every single day – according to a new report released by Global Witness today.

The investigation, based on data from Dutch research consultancy Profundo, reveals how some of the world’s biggest financial institutions – including Vanguard, JPMorgan Chase, BlackRock, BNP Paribas and HSBC – have reaped billions through investments, loans and issuance underwriting services provided to 50 companies accused of forest destruction around the world.

The findings represent the largest ever mapping of incomes related to deforestation, revealing the global financial system’s significant role in deforestation and the need for robust national rules to prevent deforesting businesses from receiving funds.

Overall, the analysis found:

All financial institutions named here were contacted by Global Witness. Their responses can be found in the main report.

Importantly, the $26 billion total includes only those incomes which represent each company’s deforestation-related activities. When considering all banking and investment services provided to these companies, across all of their lines of business, earnings climb to $104.7 billion.

Of the deforesting businesses across the six sectors analysed, the pulp and paper sector generated the highest income (48%) followed by palm oil (41%), then soya (4%), beef (3%), rubber (3%) and timber (1%).

The analysis cautions, however, that relative profits are not a direct reflection of a sector’s deforestation impact. For instance, beef production – though less capital-intensive than some of the sectors examined in this study, such as palm oil or pulp and paper – remains one of the world’s leading drivers of deforestation, even if meatpackers linked to deforestation appear to generate comparatively lower returns for financiers.

We are witnessing major banks bankroll a fire sale of the world’s rainforests. And they’re reaping obscene profits from the ashes.

Global Witness Forests Lead Alexandria Reid

Reid added: “Brazil has rightly grasped the vital need to turn the financial system from a threat into a lifeline for forests. But unless governments also act decisively to rein in this cash pipeline, initiatives like the TFFF will be fatally undermined by a deforestation economy that is not just surviving but thriving – precisely because it is so profitable.

“As long as tearing down forests remains more profitable than protecting them, the world will not meet its 2030 goal to halt deforestation, with catastrophic consequences for the climate.

“If world leaders want to change this, they must act now to shut down the profits fuelling this crisis.”

To calculate the figures, Global Witness and Profundo analysed hundreds of thousands of deals – worth a total of $184 billion over nearly 10 years – across six of the most damaging agri-commodity supply chains: cattle, soy, palm oil, rubber, paper and timber.

Nearly 4,000 financial institutions made a total income of $26 billion from financing deforesting companies from 2016 – 2024. This is more than double the UK’s entire climate finance expenditure between 2011 and 2021, and surpasses the 2024 GDPs of Madagascar and Namibia.

The findings come just weeks before COP30 in Brazil, where the host nation will launch the new Tropical Forests Forever Facility (TFFF) – a flagship fund that will invest a blend of public and private finance in global investments, using the returns to reward tropical forest nations who keep their forests standing.

If successful, the model could help close persistent finance gaps in forest conservation. But Global Witness warns that national governments seeking to support the initiative must regulate to stop harmful finance if they want to change the financial system from a threat to a lifeline to forests.

Despite most countries pledging to halt and reverse deforestation by 2030, forest destruction hit its highest level on record in 2024. Deforestation is the second largest driver of greenhouse gas emissions, after fossil fuels, yet weak regulation allows financial institutions worldwide to funnel money to destructive agribusinesses.

Notes to Editors:

Background:

Deforestation, which accounts for about 11% of carbon emissions, is expected to be a major topic at COP30, taking place this year in Belém, Brazil. In 2024, tropical primary forests were lost at about 18 football fields per minute – nearly doubling the 2023 rate – pushing the Amazon toward a potential irreversible ‘dieback’ tipping point.

More effort is required from national governments to meet their targets to end deforestation:

Overall, the finance sector remains largely unregulated in relation to deforestation, allowing banks and investors to back deforesting companies with little accountability.

Methodology

The analysis identified companies linked to deforestation and forest degradation by reviewing public reporting on firms listed in the Forests & Finance database, which tracks 279 high deforestation-risk companies across beef, palm oil, soya, pulp and paper, rubber and timber supply chains. Evidence was only considered credible if the company accused of deforestation had been given an opportunity to respond. This process resulted in a final list of 50 companies including major agribusiness firms — a full list of which can be found in the main report, along with any company responses.

Profundo then analysed the financing of these 50 companies across 343,903 financial deals, drawing on sources including Bloomberg, Refinitiv, IJGlobal, company filings and registries. The analysis covered credit-related income (from loans, revolving credit, and bond/share issuance underwriting since 2016) and investment-related income (from bond interest and share dividends up to May 2025). Where direct deal fee data was unavailable, standardised proxies were used.

To ensure figures only reflect earnings linked to deforestation, all income data was adjusted using Profundo’s “segment-adjustment” method. For example, if half a company’s revenue came from cattle ranching and half from chemical production, only 50% of its financing income was counted as deforestation related.

A PRS313 blood test could help predict if abnormal cells are likely to become breast cancerous or not.

A retrospective study utilizing the 313-SNP breast cancer polygenic risk score (PRS313) blood test has revealed that women…