Harry Kane helped fire England to the 2026 FIFA World Cup finals after a 5-0 win against Latvia on a night Thomas Tuchel was teased by fans.

Captain Kane returned from injury to score twice in the first-half amid a remarkable start to the season,…

Harry Kane helped fire England to the 2026 FIFA World Cup finals after a 5-0 win against Latvia on a night Thomas Tuchel was teased by fans.

Captain Kane returned from injury to score twice in the first-half amid a remarkable start to the season,…

Apple released the third public beta of iOS 26.1 on Tuesday, about a month after the company released iOS 26, which introduced Liquid Glass, call screening and more to your device. The iOS 26.1 beta brings a few new settings to developers’ and…

Born in Palermo, Sicily, Giorgio Rizzo spent his childhood curious about the natural world. “I have always been fascinated by nature and how plants and animals can adapt and survive in extreme environments,” he says….

TORONTO, October 14, 2025 – Thomson Reuters (Nasdaq/TSX: TRI), a global content and technology company, today announced a new wave of AI-powered innovations that extend the momentum of CoCounsel Legal. The latest enhancements are headlined by the beta launch of Deep Research on Practical Law expanding the organization’s agentic capabilities and deeper integration with trusted Thomson Reuters content.

In addition, deep product integration between CoCounsel and HighQ has launched, and regional expansion of CoCounsel in French, German and Japanese will be available to customers in October.

Deep Research on Practical Law, currently in beta with select customers, is a significant advancement toward the comprehensive, trusted, and seamless CoCounsel Legal research solution of the future. Deep Research on Practical Law plans the research steps, retrieves the most relevant guidance and templates from Practical Law, and presents clear, supported conclusions. It adapts as follow-up questions are asked, enabling deeper, more nuanced analysis.

This streamlined approach saves time, reduces friction, and builds confidence in the resulting work product. As the leading resource for legal know-how content, Deep Research in Practical Law complements Westlaw’s primary-law expertise and supports the evolving needs of legal professionals. Deep Research on Practical Law will be available in the U.S. in the first half of 2026. CoCounsel Deep Research on both Westlaw and Practical Law will be available in the UK in the same timeframe.

“In this dynamic legal environment, continuous innovation is a necessity, and Thomson Reuters is investing more than $200 million a year organically in AI to develop cutting-edge solutions for our customers,” said Raghu Ramanathan, president, Legal Professionals, Thomson Reuters. “Innovative advancements like Deep Research in Practical Law and key CoCounsel integrations empower legal professionals with professional-grade AI to not only navigate this transformative era, but to thrive in it.”

CoCounsel’s generative AI capabilities are now integrated into Thomson Reuters HighQ. With more than 1 million users, HighQ is a secure, collaboration and workflow automation platform trusted by law firms, corporations, government agencies and their clients to work seamlessly on legal services. Through CoCounsel’s advanced AI capabilities, HighQ brings generative AI directly into the collaborative workflow between enterprises, allowing legal teams to provide differentiated, AI-powered services that enhance client experiences, improve operational efficiency and create a competitive advantage.

HighQ Document Insights powered by CoCounsel’s document review and summarize capabilities allows HighQ users to understand documents faster, gain critical insights, and pinpoint and extract information at the point of need.

Users can seamlessly access CoCounsel Drafting to review a document, edit, redline it against a playbook and more. This additional integration allows users to leverage their documents in HighQ and eliminate versioning risks and manual uploads, saving significant time on drafting and review tasks.

Self-Service Q&A delivers a new AI-powered chat experience within modernized HighQ dashboards that allows users to ask natural language questions to curated document sets and receive summarized, highly relevant answers in minutes, transforming static repositories into dynamic knowledge hubs.

CoCounsel is expanding its footprint internationally adding new languages including French, German, Spanish, Portuguese and Japanese. The professional-grade legal AI assistant will be available in France, Benelux/Brussels, Luxembourg and Quebec (French), Germany, Austria and Switzerland (German), Brazil (Portuguese), Argentina (Spanish), and Japan (Japanese) to meet the needs of legal professionals in those regions. CoCounsel is also available in the U.S., UK, Canada, New Zealand, Hong Kong, Southeast Asia and United Arab Emirates.

Additional functionality has been released across multiple legal solutions and is highlighted via the CoCounsel Monthly Insider for October on the Thomson Reuters Innovation Blog.

In the UK, Thomson Reuters will showcase these innovations to customers at Legal Geek in London from Oct. 15-16. According to Thomson Reuters Future of Professionals research, UK legal professionals predict that AI will enable lawyers to save 3 hours per week which translates to an average of over £12,000 in annual value per lawyer based on our comprehensive study. This leads to over £2billion in estimated annual impact across the UK legal industry.

Thomson Reuters customers will get a preview at the Association of Corporate Counsel Annual Meeting from Oct. 19-22, 2025, as well as Corporates and Legal Professionals Synergy 2025 Conference held in Orlando, Fla. from Nov. 9-12, 2025.

Thomson Reuters (Nasdaq/TSX: TRI) informs the way forward by bringing together the trusted content and technology that people and organizations need to make the right decisions. The company serves professionals across legal, tax, accounting, compliance, government, and media. Its products combine highly specialized software and insights to empower professionals with the data, intelligence, and solutions needed to make informed decisions, and to help institutions in their pursuit of justice, truth, and transparency. Reuters, part of Thomson Reuters, is a world leading provider of trusted journalism and news. For more information, visit tr.com.

Jeff McCoy

+1.763.326.4421

jeffrey.mccoy@tr.com

This article first appeared on GuruFocus.

Intel (INTC, Financials) is making another push into the artificial intelligence chip market with its upcoming data center GPU, code-named Crescent Island, which customers will begin testing in the…

Simple Life is getting smarter.

What’s happening: The London-based behavioral coaching company secured a $35M Series B led by actor Kevin Hart’s HartBeat Ventures to advance AI-powered plans.

Lean machine. Counting 800K…

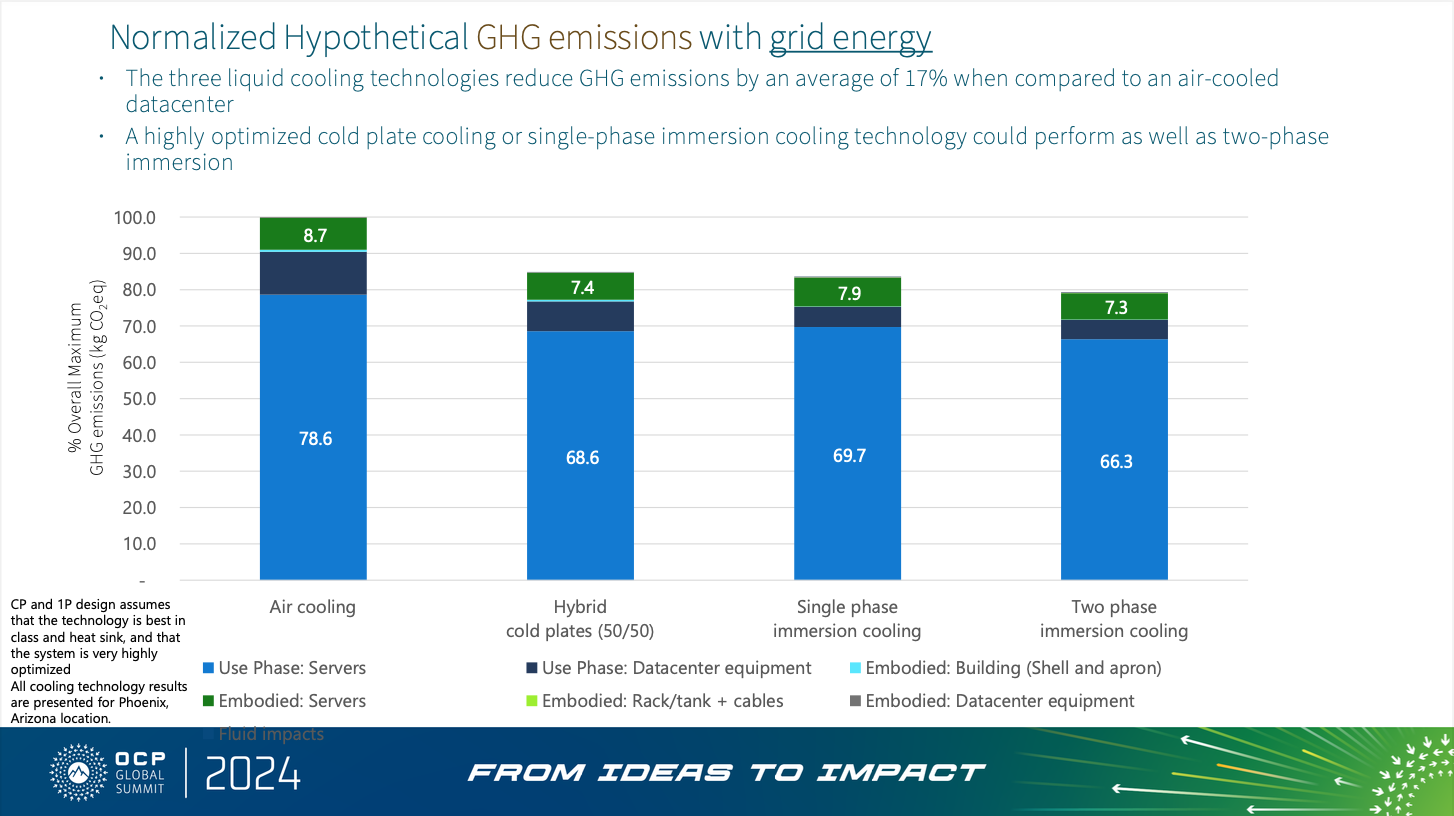

The data centers, server hardware, and global network infrastructure that underpin Meta’s operations are a critical focus to address the environmental impact of our operations. As we develop and deploy the compute capacity and storage racks used in data centers, we are focused on our goal to reach net zero emissions across our value chain in 2030. To do this, we prioritize interventions to reduce emissions associated with this hardware, including collaborating with hardware suppliers to reduce upstream emissions.

Design for Sustainability is a set of guidelines, developed and proposed by Meta, to aid hardware designers in reducing the environmental impact of IT racks. This considers various factors such as energy efficiency and the selection, reduction, circularity, and end-of-life disposal of materials used in hardware. Sustainable hardware design requires collaboration between hardware designers, engineers, and sustainability experts to create hardware that meets performance requirements while limiting environmental impact.

In this guide, we specifically focus on the design of racks that power our data centers and offer alternatives for various components (e.g., mechanicals, cooling, compute, storage and cabling) that can help rack designers make sustainable choices early in the product’s lifecycle.

To reach our net zero goal, we are primarily focused on reducing our Scope 3 (or value chain) emissions from physical sources like data center construction and our IT hardware (compute, storage and cooling equipment) and network fiber infrastructure.

While the energy efficiency of the hardware itself deployed in our data centers helps reduce energy consumption, we have to also consider IT hardware emissions associated with the manufacturing and delivery of equipment to Meta, as well as the end-of-life disposal, recycling, or resale of this hardware.

Our methods for controlling and reducing Scope 3 emissions generally involve optimizing material selection, choosing and developing lower carbon alternatives in design, and helping to reduce the upstream emissions of our suppliers.

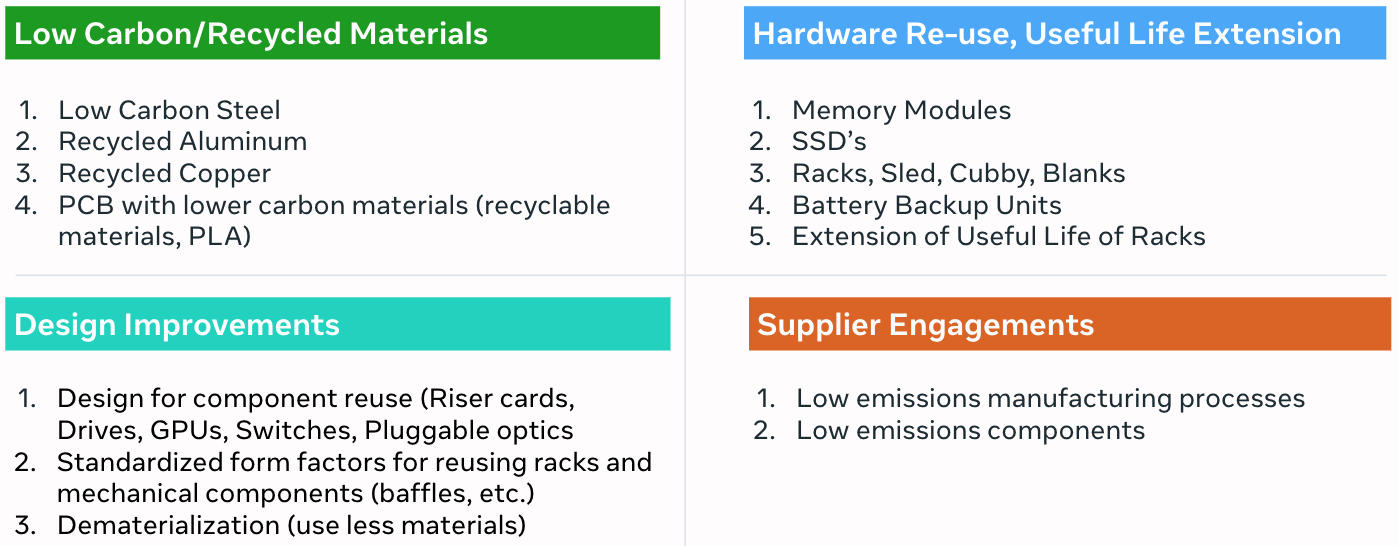

For internal teams focused on hardware, this involves:

These actions to reduce Scope 3 emissions from our IT hardware also have the additional benefit of reducing the amount of electronic waste (e-waste) generated from our data centers.

There are many different rack designs deployed within Meta’s data centers to support different workloads and infrastructure needs, mainly:

While there are differences in architecture across these different rack types, most of these racks apply general hardware design principles and contain active and passive components from a similar group of suppliers. As such, the same design principles for sustainability apply across these varied rack types.

Within each rack, there are five main categories of components that are targeted for emissions reductions:

The emissions breakdown for a generic compute rack is shown below.

We focus on four main categories to address emissions associated with these hardware components:

We will cover a few of the levers listed above in detail below.

Modular Design which allows older rack components to be re-used in newer racks. Open Rack designs (ORv2 & ORv3) form the bulk of high volume racks that exist in our data centers.

Here are some key aspects of the ORv3 modular rack design:

These design principles should continue to be followed in successive generations of racks. With the expansion of AI workloads, new specialized racks for compute, storage, power and cooling are being developed that are challenging designers to adopt the most modular design principles.

Retrofitting existing rack designs for new uses/high density is a cost-effective and sustainable approach to meet evolving data center needs. This strategy can help reduce e-waste, lower costs, and accelerate deployment times. Benefits of re-use/retrofitting include:

There are several challenges when considering re-using or retrofitting racks:

Overall, the benefits of retrofitting existing racks are substantial and should be examined in every new rack design.

Steel is a significant portion of a rack and chassis and substituting traditional steel with green steel can reduce emissions. Green steel is typically produced using electric arc furnaces (EAF) instead of traditional basic oxygen furnaces (BOF), allowing for the use of clean and renewable electricity and a higher quantity of recycled content. This approach significantly reduces carbon emissions associated with steel production. Meta collaborates with suppliers who offer green steel produced with 100% clean and renewable energy.

While steel is a significant component of rack and chassis, aluminum and copper are extensively used in heat sinks and wiring. Recycling steel, aluminum, and copper saves significant energy needed to produce hardware from raw materials.

As part of our commitment to sustainability, we now require all racks/chassis to contain a minimum of 20% recycled steel. Additionally, all heat sinks must be manufactured entirely from recycled aluminum or copper. These mandates are an important step in our ongoing sustainability journey.

Several of our steel suppliers, such as Tata Steel, provide recycled steel. Product design teams may ask their original design manufacturer (ODM) partners to make sure that recycled steel is included in the steel vendor(s) selected by Meta’s ODM partners. Similarly, there are many vendors that are providing recycled aluminum and copper products.

Extending the useful life of racks, servers, memory, and SSDs helps Meta reduce the number of hardware equipment that needs to be ordered. This has helped achieve significant reductions in both emissions and costs.

A key requirement for extending useful life of hardware is the reliability of the hardware component or rack. Benchmarking reliability is an important element to determine whether hardware life extensions are feasible and for how long. Additional consideration needs to be given to the fact that spares and vendor support may have diminishing availability. Also, extending hardware life also comes with the risk of increased equipment failure, so a clear strategy to deal with the higher incidence of potential failure should be put in place.

Dematerialization and removal of unnecessary hardware components can lead to a significant reduction in the use of raw materials, water, and/or energy. This entails reducing the use of raw materials such as steel on racks or removing unnecessary components on server motherboards while maintaining the design constraints established for the rack and its components.

Dematerialization also involves consolidating multiple racks into fewer, more efficient ones, reducing their overall physical footprint.

Extra components on hardware boards are included for several reasons:

In addition, changes in requirements over time can also lead to extra components. While it is very difficult to modify systems in production, it is important to make sure that each hardware design optimizes for components that will be populated.

Examples of extra components on hardware boards include:

In addition to hardware boards, excess components may also be present in other parts of the rack. Removing excess components can lead to lowering the emissions footprint of a circuit board or rack.

Productionizing new technologies can help Meta significantly reduce emissions. Memory and SSD/HDD are typically the single largest source of embodied carbon emissions in a server rack. New technologies can help Meta reduce emissions and costs while providing a substantially higher power-normalized performance.

Examples of such technologies include:

Teams can explore additional approaches to reduce emissions associated with memory/SSD/HDD which include:

Meta engages with suppliers to reduce emissions through its net zero supplier engagement program. This program is designed to set GHG reduction targets with selected suppliers to help achieve our net zero target. Key aspects of the program include:

The Clean Energy Procurement Academy (CEPA), launched in 2023 (with Meta and other corporations), helps suppliers — especially in the Asia-Pacific region — learn how to procure renewable energy via region-specific curricula.

The Design for Sustainability principles outlined in this guide represent an important step forward in Meta’s goal to achieve net zero emissions in 2030. By integrating innovative design strategies such as modularity, reuse, retrofitting, and dematerialization, alongside the adoption of greener materials and extended hardware lifecycles, Meta can significantly reduce the carbon footprint of its data center infrastructure. These approaches not only lower emissions but also drive cost savings, e-waste reductions, and operational efficiency, reinforcing sustainability as a core business value.

Collaboration across hardware designers, engineers, suppliers, and sustainability experts is essential to realize these goals. The ongoing engagement with suppliers further amplifies the impact by addressing emissions across our entire value chain. As Meta continues to evolve its rack designs and operational frameworks, the focus on sustainability will remain paramount, ensuring that future infrastructure innovations support both environmental responsibility and business performance.

Ultimately, the success of these efforts will be measured by tangible emissions reductions, extended useful life of server hardware, and the widespread adoption of low carbon technologies and materials.

Advanced labor cesarean birth raises future preterm birth risk | Image Credit: © Michael – © Michael – stock.adobe.com.

Scarring in the wound linked to increased preterm birth risk in future pregnancies is 8 times more likely in women with…

YouTube is updating the look of the video player to be “cleaner and more immersive” beginning this week. “This includes updated controls and new icons to make the viewing experience more visually satisfying while obscuring less content,”

By Joseph Adinolfi

The revival of the U.S.-China trade war has ended a streak of summer calm that had brought about the lowest volatility since January 2020

The stock market’s “fear gauge” is back above its long-term average.

After one of the quietest summers for the stock market in years, Wall Street’s fear gauge has once again shot higher as investors fret that a trade standoff between the U.S. and China could escalate further.

The Cboe Volatility Index VIX, better known as the VIX, or Wall Street’s “fear gauge,” traded as high as 22.76 on Tuesday, its highest intraday level since May 23, when it traded as high as 25.53, according to Dow Jones Market Data. By the time the market closed, the VIX had moved well off its earlier highs. The index ended the day above 20, a level with some significance.

Since the VIX’s inception in the early 1990s, its long-term average sits just below 20. As a result, investors tend to see this level as the line in the sand between a relatively calm market, and one that is starting to look a bit more panicked.

The level of the VIX is based on trading activity in options contracts tied to the S&P 500 SPX that are due to expire in roughly one month. It is seen as a proxy for how worried traders are about the possibility that stocks could be due for a nosedive. After all, volatility tends to rise more quickly when the market is falling.

A summer lull

Looking back, there were signs that investors were beginning to feel a bit too complacent.

Stocks trundled higher all summer with few interruptions. This placid trading ultimately sent the three-month realized volatility for the S&P 500 to its lowest level since January 2020 last week, according to FactSet data and MarketWatch calculations.

Realized volatility is a calculation that measures how volatile a given index or asset has been in the recent past. The VIX, which measures implied volatility, attempts to gauge how volatile investors expect markets will be in the immediate future.

For a while, the VIX trended lower alongside realized volatility for the S&P 500. But around Labor Day, the two started to diverge.

This could mean a couple of different things, according to portfolio managers who spoke with MarketWatch. The first is that investors increasingly preferred to bet on further upside in the stock market using call options instead of actual shares. Call options on the S&P 500 will deliver a payoff if the index rises above a predetermined level before a given time, which is known as the expiration date.

It might also mean that some traders were scooping up put options, which act like a form of portfolio insurance. Wary of myriad risks that could upset the apple cart following a record-setting rebound earlier in the year, some investors may have preferred to hedge their downside risk, while holding on to their stocks, so as not to miss out on any further gains.

Signs that the market might be bracing for some upcoming turbulence first started to emerge in late September. Between Sept. 29 and Oct. 3, the S&P 500 and the VIX rose simultaneously for five straight sessions. That hadn’t happened since at least 1996, according to an analysis from Carson Group’s Ryan Detrick.

Seeing both the VIX and S&P 500 trend higher hinted that the market’s streak of calm might soon be coming to an end, said Michael Kramer, portfolio manager at Mott Capital Management.

“The tinder was there for something like Friday to occur,” said Mike Thompson, co-portfolio manager at Little Harbor Advisors.

“You just needed that spark to trigger it,” Mott Capital’s Kramer said.

While the U.S.-China trade tensions remain far from settled, Thompson and his brother, Matt Thompson, also a co-portfolio manager at Little Harbor Advisors, are keeping an eye out for any indication that a bigger burst of volatility might lie ahead.

Investors have largely blamed the selloff for the revival of trade tensions between the U.S. and China. On Friday, President Donald Trump threatened 100% tariffs on all Chinese goods imported into the U.S. in retaliation for Beijing stepping up export controls on rare earth metals.

Then on Tuesday, Beijing sanctioned U.S. subsidiaries of a South Korean shipping firm, sparking a global stock-market selloff that had largely reversed by the time the closing bell rang out on Wall Street.

But according to the Thompson brothers, the U.S.-China tariff dance has started to feel a little too familiar for it to be a real cause for concern. Investors appear to be catching on to the pattern of escalation, followed immediately by de-escalation, as each side vies for maximum leverage.

A more plausible threat to market calm, in their view, would be the ructions in the credit market. On Tuesday, JPMorgan Chase & Co. (JPM) Chief Executive Jamie Dimon warned about the potential for more credit problems after the bank lost money on a loan to bankrupt subprime auto lender Tricolor. Trouble in the space could get worse after a long period where conditions in the credit market were relatively favorable.

On Friday, BlackRock (BLK) and other institutional investors asked for their money back from Point Bonita Capital, a fund managed by the investment bank Jefferies (JEF), after the bankruptcy of auto parts supplier First Brands Group saddled the fund with big losses.

“We’re keeping an eye out for whether there is another shoe to drop,” Matt Thompson said.

U.S. stocks were on track to finish mostly higher on Tuesday, until Trump dropped a Truth Social post accusing China of a “Economically Hostile Act” for refusing to purchase soybeans from American farmers. That caused the S&P 500 to finish 0.2% lower, while the Nasdaq Composite COMP ended down 0.8%. Of the three major U.S. indexes, only the Dow Jones Industrial Average DJIA managed to finish higher. Meanwhile, the Russell 2000 RUT, an index of small-cap stocks, quietly notched another record closing high.

-Joseph Adinolfi

This content was created by MarketWatch, which is operated by Dow Jones & Co. MarketWatch is published independently from Dow Jones Newswires and The Wall Street Journal.

(END) Dow Jones Newswires

10-14-25 1642ET

Copyright (c) 2025 Dow Jones & Company, Inc.