- Qatar Held by Oman in Goalless Group A Opener beIN SPORTS

- How did Qatar and Saudi Arabia get home advantage and more rest than rivals in World Cup qualifiers? The Guardian

- ‘Big coach’ Queiroz can lead Oman to first World Cup, says Al-Ghassani

Blog

-

Qatar Held by Oman in Goalless Group A Opener – beIN SPORTS

-

Cristiano Ronaldo Admits He’d Rather Play Only for Portugal – beIN SPORTS

- Cristiano Ronaldo Admits He’d Rather Play Only for Portugal beIN SPORTS

- Cristiano Ronaldo admits he turned to Perplexity AI before Prestige Globe Award speech Moneycontrol

- Cristiano Ronaldo rules out retirement: “I still have a lot to give to…

Continue Reading

-

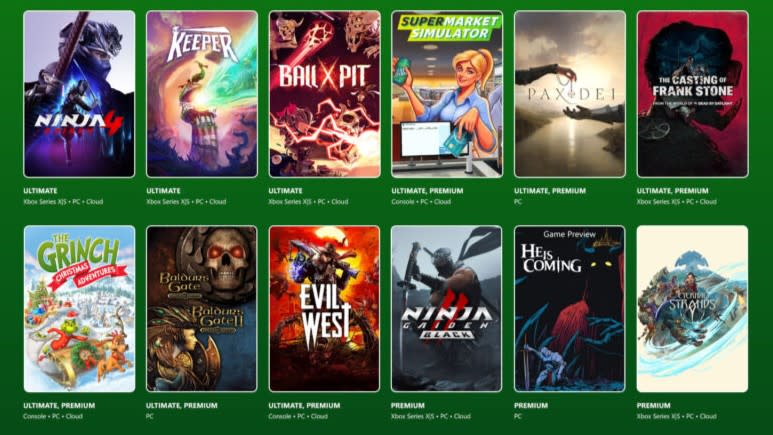

Xbox’s remaining Game Pass additions for October include Baldur’s Gate 1 and 2 and The Casting of Frank Stone

After cramming dozens more games into the service and announcing a 50 percent price increase for the Ultimate tier, Microsoft has revealed the rest of the Game Pass additions for October. They include some games that were previously confirmed to…

Continue Reading

-

Google’s virtual try-on adds shoes, expands internationally – Search Engine Land

- Google’s virtual try-on adds shoes, expands internationally Search Engine Land

- Our try on tool adds shoes and will expand to new countries The Keyword

- Google’s AI try-on imagines your feet in new shoes The Verge

- Google’s virtual try-on…

Continue Reading

-

PlayStation Abandons Call of Duty for Battlefield 6 in Move to Compete With Xbox

PlayStation has launched a new global marketing campaign with Battlefield 6. However, this has led some fans to speculate that Sony is moving away from Call of Duty BO7 to compete with Microsoft following their acquisition of CoD.

Sony Backs…

Continue Reading

-

Massive Prime Day Savings: The Beats Pill x Kim Kardashian Speaker Is 67% Off Today – PCMag

- Massive Prime Day Savings: The Beats Pill x Kim Kardashian Speaker Is 67% Off Today PCMag

- Want a Beats Pill Bluetooth speaker for almost half the price? It can be yours with this Prime Day deal Yahoo

- The Beats Pill x Kim Kardashian is less than…

Continue Reading

-

Gold surges past $4,000 amid strong safe haven demand

Gold (XAU/USD) marks another milestone on Wednesday, smashing through the $4,000 level for the first time as investors flock to the precious metal amid global economic and political uncertainty, coupled with a dovish Federal Reserve (Fed) outlook.

At the time of writing, XAU/USD is trading around $4,056, pushing deeper into uncharted territory with prices up more than 4% so far this week.

The latest leg higher comes despite a stronger US Dollar (USD) as political turmoil in France and Japan fuels safe haven demand, driving flows into both the Greenback and Gold. Meanwhile, the prolonged United States (US) government shutdown has added to market jitters, reinforcing demand for the yellow metal.

Persistent geopolitical risks, including the ongoing Russia-Ukraine war and tensions in the Middle East, along with concerns about global trade disruptions, have further bolstered Bullion’s safe-haven bid. Meanwhile, steady central bank buying and strong inflows into Gold-backed exchange-traded funds (ETFs) are helping to sustain the metal’s record-breaking rally.

Market movers: Fed Meeting Minutes take center stage as US shutdown stretches into second week

- Central banks worldwide are on track to buy 1,000 metric tons of Gold in 2025, marking a fourth consecutive year of hefty purchases as they diversify reserves away from US Dollar-denominated assets into Bullion, according to consultancy Metals Focus.

- The US government shutdown has entered its second week with no sign of resolution as Democrats refuse to provide the votes needed by the ruling Republican Senate to reopen federal agencies without a deal on extending expiring healthcare subsidies. The prolonged standoff is delaying key economic data, complicating the Fed’s policy outlook, while President Donald Trump’s threat of mass layoffs adds to economic uncertainty.

- The US Dollar Index (DXY), which tracks the value of the Greenback against a basket of six major currencies, extends gains for a third straight session, climbing to its highest level since August 5, hovering near 98.83 as political shake-ups in France and Japan prompt investors to rotate out of the Euro and Yen.

- US Treasury yields remain on the back foot across the curve as investors slightly increase bets on faster Fed easing in the months ahead, with 111 basis points (bps) of interest rate cuts priced in by December 2026, according to a Deutsche Bank report. The CME FedWatch Tool indicates markets are pricing a 94.6% chance that the Fed will lower rates by 25 bps at the October 29-30 FOMC meeting.

- In the absence of key economic releases, traders will focus on comments from Fed officials, with the release of the September Fed Meeting Minutes later on Wednesday, which is expected to provide more context behind the recent “risk-management” rate cut.

Technical analysis: XAU/USD rally stretches, but overbought signals flag risk of pullback

Gold’s buying momentum remains unabated with the metal extending its historic run even as signs of overextension emerge. From a technical standpoint, the rally appears stretched, with the monthly Relative Strength Index (RSI) climbing above 90 for the first time since the 1980s, underscoring the risk of near-term overheating.

On shorter time frames, momentum gauges are similarly elevated, with the 4-hour RSI holding near 76 in overbought territory. This suggests that while the underlying trend remains firmly bullish, the market may face increased odds of a pullback or a period of sideways consolidation as traders book profits and reassess positions.

Immediate support lies at the 9-period Simple Moving Average (SMA) around the $4,000 mark on the 4-hour chart, followed by the 21-period SMA, which should act as the next downside cushion if prices retreat. On the upside, resistance is anticipated at $4,050, followed by the $4,100 zone, where profit-taking could intensify.

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.

Continue Reading

-

Ring to launch AI features for recognizing people, finding lost dogs

Ring recently announced new features, including facial recognition technology designed to reduce the number of alerts.

The company says its Familiar Faces feature will recognize people the user knows and help limit push alerts triggered by routine…

Continue Reading

-

“Showed in England he’s a good captain”: Ex-WI skipper backs Shubman Gill’s appointment as India’s ODI captain

By Sahil Kohli

New Delhi [India], October 8 (ANI): Former West Indies captain Richie Richardson backed India’s newly-appointed ODI captain Shubman Gill’s promotion to the top post in ODIs and expressed that his seniors, Rohit Sharma and Virat…

Continue Reading

-

The Guest’s Eve Myles on why other mums find her frightening

Gareth Bull

Gareth BullEve Myles said her character in The Guest is “monstrous” Actress Eve Myles says people have been approaching her on the street to tell her they are frightened of her.

The Torchwood star, from Ystradgynlais in Powys, said parents at the…

Continue Reading