On September 11, Pakistan and Saudi Arabia signed a historic defence pact in the presence of Prime Minister Muhammad Shehbaz Sharif amd COAS Field Marshal Asim Munir. What was a narrative initially concocted during the Pahalgam incident,…

Blog

-

Qnity and SK hynix Sign Long-Term CMP Pad Supply Agreement

About Qnity

Qnity, DuPont’s Electronics business, is a premier technology solutions provider across the semiconductor value chain, empowering AI, high performance computing, and advanced connectivity. From groundbreaking solutions for semiconductor chip manufacturing, to enabling high-speed transmission within complex electronic systems, our high-performance materials and integration expertise make tomorrow’s technologies possible. More information about the company, its businesses and solutions can be found at www.qnityelectronics.com. Investors can access the initial Form 10 filing and amendments for Qnity on its investor website.Qnity™, the Qnity Node Logo, and all products, unless otherwise noted, denoted with ™ or ® are trademarks, trade names or registered trademarks of affiliates of Qnity Electronics, Inc.

About DuPont

DuPont (NYSE: DD) is a global innovation leader with technology-based materials and solutions that help transform industries and everyday life. Our employees apply diverse science and expertise to help customers advance their best ideas and deliver essential innovations in key markets, including electronics, transportation, construction, water, healthcare, and worker safety. More information about the company, its businesses, and solutions can be found at www.dupont.com. Investors can access information included on the Investor Relations section of the website at investors.dupont.com.DuPont™, the DuPont Oval Logo, and all trademarks and service marks denoted with ™, ℠ or ® are owned by affiliates of DuPont de Nemours, Inc. unless otherwise noted.

* On January 15, 2025, DuPont de Nemours, Inc. (“DuPont”) announced it is targeting November 1, 2025 to complete the intended separation of its Electronics business (the “Intended Electronics Separation”) by way of a spin-off transaction, thereby creating Qnity Electronics, Inc., a new independent, publicly traded electronics company. The Intended Electronics Separation will not require a shareholder vote and is subject to satisfaction of customary conditions, including final approval by DuPont’s Board of Directors, receipt of tax opinion from counsel, the completion and effectiveness of a Form 10 registration statement with the U.S. Securities and Exchange Commission, applicable regulatory approvals and satisfactory completion of financing.

Cautionary Statement Regarding Forward-Looking Statements

This release contains forward-looking statements. Forward-looking statements use words such as “plans”, “expects”, “will”, “would”, “anticipates”, “believes”, “intends”, “seeks”, “projects”, “efforts”, “estimates”, “potential”, “continue”, “intend”, “may”, “could”, “should” and similar expressions, among others, as well as other words or expressions referencing future events, conditions or circumstances. Statements that describe or relate to DuPont’s or Qnity’s plans, goals, intentions, strategies, DuPont’s or Qnity’s expectations regarding the Spin-Off, and statements that do not relate to historical or current fact, are examples of forward-looking statements. Forward-looking statements are based on our current beliefs, expectations and assumptions, which may not prove to be accurate, and involve a number of known and unknown risks and uncertainties, many of which are out of DuPont’s and Qnity’s control. Forward-looking statements are not guarantees of future performance, and there are a number of important factors that could cause actual outcomes and results to differ materially from the results contemplated by such forward-looking statements. Additional information concerning these and other factors can be found in DuPont’s and Qnity’s filings with the U.S. Securities and Exchange Commission, including DuPont’s most recent annual report on Form 10-K, most recent quarterly report on Form 10-Q and current reports on Form 8-K and Qnity’s registration statement on Form 10. Any forward-looking statement speaks only as of the date on which it is made. Neither DuPont nor Qnity undertake any obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by applicable law.

Continue Reading

-

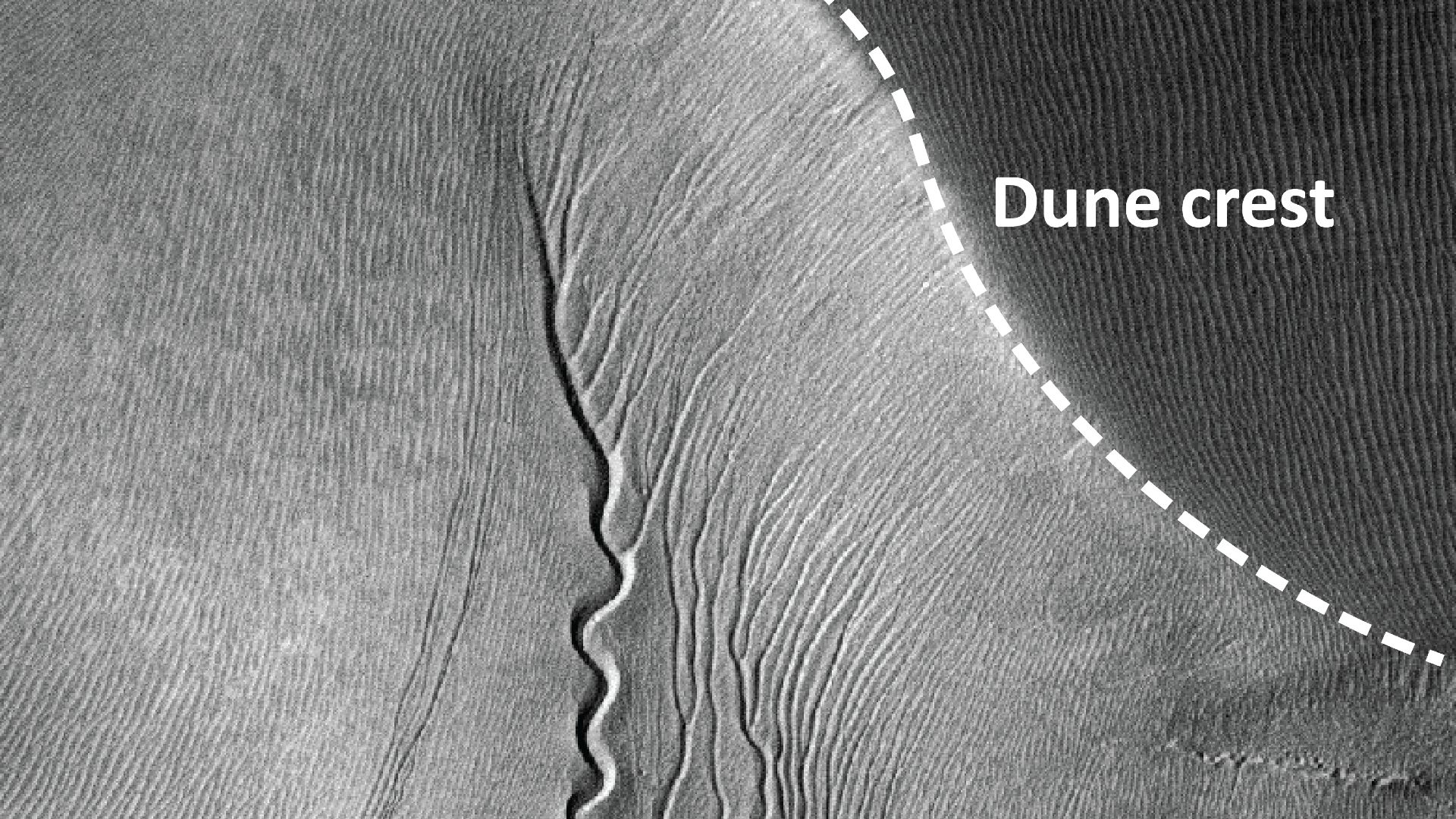

Dry ice may burrow through Mars like sandworms in ‘Dune’

Blocks of carbon dioxide ice appear to carve mysterious gullies on Mars as they melt along dunes and blast away sand — a process that looks eerily like the burrowing of fictional sandworms in the movie “Dune.”

Planetary scientists have long…

Continue Reading

-

Just a moment…

Just a moment… This request seems a bit unusual, so we need to confirm that you’re human. Please press and hold the button until it turns completely green. Thank you for your cooperation!

Continue Reading

-

Just a moment…

Just a moment… This request seems a bit unusual, so we need to confirm that you’re human. Please press and hold the button until it turns completely green. Thank you for your cooperation!

Continue Reading

-

Diving in with Nachum Ulanovsky

They erected safari-style tents for shade and strung hammocks between poles. Supplies were scheduled to arrive every three or four days. They set up a generator to cook meals and power their equipment and hired a crew of locals to…

Continue Reading

-

Cybersecurity firm F5 sinks 12% after disclosing nation-state hack

Pavlo Gonchar | SOPA Images | Lightrocket | Getty Images

U.S. cybersecurity company F5 fell 12% on Thursday after disclosing a system breach in which a “highly sophisticated nation-state threat actor” gained long-term access to some systems.

F5 shares were pacing for the worst day since April 27, 2022, when the stock fell 12.8%.

The company disclosed the breach in a Securities and Exchange Commission filing on Wednesday and said the hack affected its BIG-IP product development environment. F5 said the attacker infiltrated files containing some source code and information on “undisclosed vulnerabilities” in BIG-IP.

The breach was later attributed to state-backed hackers from China, Bloomberg reported, citing people familiar with the matter.

F5, which was made aware of the attack in August, said they have not seen evidence of any new unauthorized activity.

“We have no knowledge of undisclosed critical or remote code vulnerabilities, and we are not aware of active exploitation of any undisclosed F5 vulnerabilities,” F5 said in a statement.

The cybersecurity giant told customers that hackers were in the network for at least 12 months and that the breach used a malware called Brickstorm, according to Bloomberg.

F5 would not confirm the information.

Brickstorm is attributed to a suspected China-nexus threat dubbed UNC5221, Google Threat Intelligence Group said in a blog post. The malware is used for maintaining “long-term stealthy access” and can remain undetected in victim systems for an average of 393 days, according to Mandiant.

The attack prompted an emergency directive from the Cybersecurity and Infrastructure Security Agency on Wednesday, telling all agencies using F5 software or products to apply the latest update.

“The alarming ease with which these vulnerabilities can be exploited by malicious actors demands immediate and decisive action from all federal agencies,” CISA Acting Director Madhu Gottumukkala said. “These same risks extend to any organization using this technology, potentially leading to a catastrophic compromise of critical information systems.”

The UK’s National Cyber Security Centre also issued guidance for the F5 attack, advising customers to install security updates and continue monitoring for threats.

Continue Reading

-

Springboks and All Blacks reignite traditional tours

In the tour’s maiden year, South Africa will host New Zealand in August and September 2026. The All Blacks kick off the tour against the DHL Stormers in Cape Town on Friday, 7 August and take on the…

Continue Reading

-

Trump threatens ‘to go in and kill’ Hamas in Gaza over internal clashes | Donald Trump News

Statement appears to signal about-face from US president, who previously backed Hamas’s crackdown on Gaza gangs.

Published On 16 Oct 2025

United States President Donald Trump has threatened…

Continue Reading

-

US regional bank shares sink on credit worries after fraud disclosures

Stay informed with free updates

Simply sign up to the US banks myFT Digest — delivered directly to your inbox.

Shares in US regional banks fell on Thursday after two lenders disclosed that they were exposed to alleged fraud by borrowers, raising broader concerns about the health of bank loan portfolios.

The disclosures by Western Alliance Bank and Zions Bank follow the recent failures by car parts maker First Brands and auto lender Tricolor, which have left credit investors nursing losses and are under scrutiny from the US Department of Justice.

The KBW regional banking index, which comprises 50 smaller banks, fell more than 5.8 per cent on Thursday, on course for its lowest closing level since June. Shares in Zions had dropped 12 per cent and Western Alliance was down by more than 10 per cent. The two are members of the KBW bank index, which comprises 24 of the country’s leading lenders and was 3.3 per cent lower.

“When credit risk is rising, you just sell off the entire group and you get answers to your questions later,” said Timur Braziler, mid-cap bank analyst at Wells Fargo.

The drop in regional bank stocks helped prompt a move in the wider US stock market, with financials dragging the S&P 500 0.9 per cent lower.

In response to these regional bank worries — as well as the escalation in trade tensions between China and the US — the two-year Treasury yield sank to its lowest level since September 2022. The two-year yield, which moves with interest rate expectations, fell by as much as 0.09 percentage points to a low of 3.41 per cent.

“There was no single obvious catalysing incident [for the two-year move]. There are a variety of different factors that are interrelated that prompted it,” said Jonathan Hill, head of US inflation market strategy at Barclays.

“Part of it has to do with some weakness in regional banks, part of it has to do with trade tensions between the US and China, and part of it has to do with worries about stress in the funding market,” he said.

Utah-based Zions Bank — which has about $89bn in assets — on Wednesday said in regulatory filings that it would take a $60mn provision after it had “identified what it believes to be apparent misrepresentations and contractual default” on “two related commercial and industrial loans” affiliated with two borrowers.

The bank also said it had found “other irregularities with respect to the loans and collateral” and that it had commenced a lawsuit in California against the borrowers.

Separately, Western Alliance disclosed in regulatory filings on Thursday that it had initiated a lawsuit alleging fraud by a borrower “in failing to provide collateral loans in first position, among other claims”.

It is seeking to recover approximately $100mn, according to analysts at Citi.

The bank said on Thursday that it had “evaluated the existing collateral” and believed it covered the obligation. It also said it had “a limited guarantee and full guarantee from two ultra-high net worth individuals under certain circumstances, such as fraud”.

Western Alliance, which has about $87bn in assets, said that its “total criticised assets” — loans that show early signs of weakness — were “lower than they were on June 30, 2025” and affirmed its existing guidance and outlook for the year.

Analysts at Jefferies said the stock market reaction was “overdone” given the exposures of Western Alliance and Zions Bank represented 1.6 per cent and 1.1 per cent of their tangible common equity, respectively.

Shares in Banc of California fell by 8 per cent. The lender, with total assets of $34bn, has minimal exposure to the borrowers in question, according to a review of court documents by Jefferies analysts. They estimate that it will not incur any losses on this due to its senior position in the credit facility.

“The whole industry is being painted by the same brush,” said Catherine Mealor, head of small and mid-cap bank research coverage at KBW. “We are going to have pockets of credit stress as we move into this normalisation period. And so how does that impact the overall multiple that we put on the group?”

While Wall Street banks’ third-quarter results have shown resilient credit quality overall, the collapses of First Brands and Tricolor have raised concerns about lending standards.

“Historically fraud has been very idiosyncratic, very one off,” Braziler said. “And what if we are getting into an environment where more of these nefarious characters bubbled up to the top and fraud becomes a larger part of the conversation? I think that’s really the question at heart here and what investors are trying to figure out.”

Shares in Jefferies, which has exposure to First Brands, were down by more than 9 per cent on Thursday.

Western Alliance declined to comment beyond their filing. Zions did not immediately respond to a request for comment.

Continue Reading