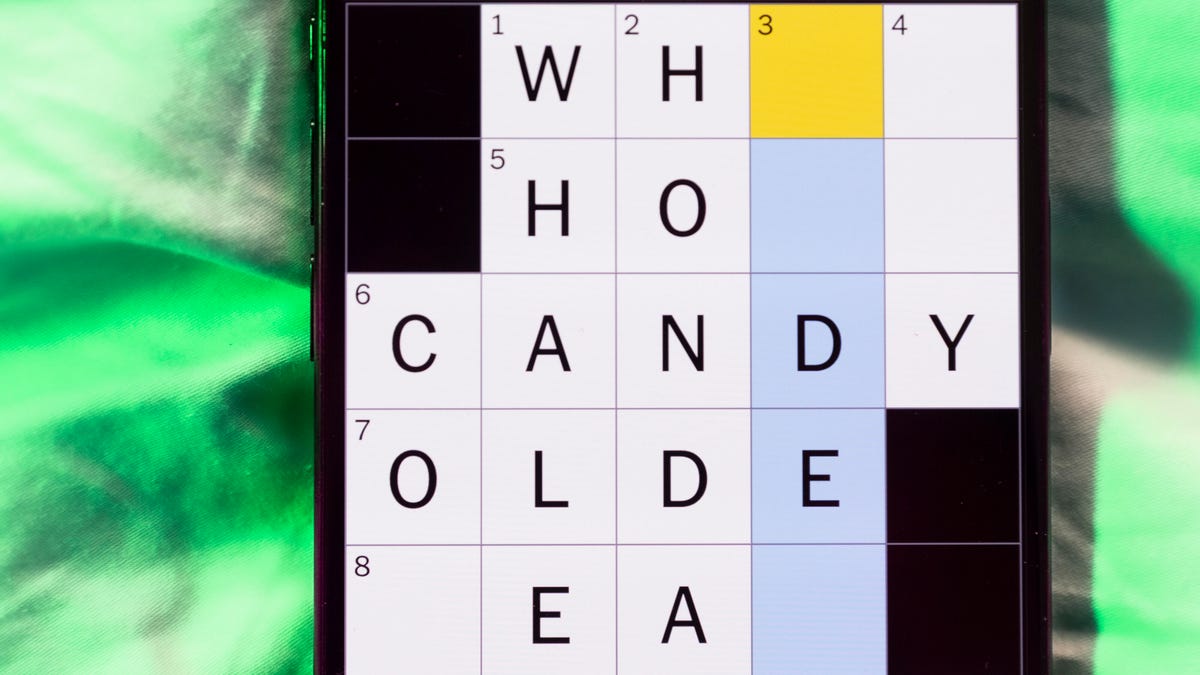

Looking for the most recent Mini Crossword answer? Click here for today’s Mini Crossword hints, as well as our daily answers and hints for The New York Times Wordle, Strands, Connections and Connections: Sports Edition puzzles.

Need some help…

Looking for the most recent Mini Crossword answer? Click here for today’s Mini Crossword hints, as well as our daily answers and hints for The New York Times Wordle, Strands, Connections and Connections: Sports Edition puzzles.

Need some help…

Traders are now squarely focused on Wednesday’s FOMC rate decision and accompanying statement. While a quarter-point cut to a 3.75%–4.00% target range is fully priced in, market reaction will hinge on forward guidance and Chair Powell’s tone in the post-meeting press conference.

With job growth slowing and inflation moderating, the Fed is under pressure to support labor conditions without reigniting price risks. The central bank’s challenge is compounded by limited data visibility, as the shutdown has delayed key labor and spending reports.

If the Fed signals additional cuts are likely, that would increase downside pressure on the dollar. Conversely, any effort to downplay further easing could offer near-term support to the index.

Bond markets echoed this sentiment shift. The benchmark 10-year yield retreated below 4% to close near 3.966%, while shorter maturities showed similar declines.

With the Fed now weighing labor market deterioration more heavily than inflation risks, fixed income traders are positioning for a slower policy path through year-end. This cautious tone limited dollar upside, even as international rate expectations trended lower.

Rivian Automotive (RIVN) shares have seen some volatility recently, catching the attention of investors watching the electric vehicle sector. The company has delivered mixed short-term returns; however, its longer-term performance tells a different story.

See our latest analysis for Rivian Automotive.

After a choppy stretch this year, Rivian’s share price has recently lost momentum, sliding 16.7% over the past month. However, when you take a step back, the one-year total shareholder return is an impressive 24.2%, even after accounting for big swings since last year’s lows.

If you’re curious what else is out there in electric vehicles and autos, now’s the perfect time to check out See the full list for free.

But with Rivian’s shares now trading below analyst targets after a period of turbulence, the key question remains: is this a genuine buying opportunity, or has the market already factored in all the future growth?

Rivian’s most widely followed narrative currently places its fair value at $14.48, which is about 10% above the last close of $12.98. This disconnect between the share price and narrative fair value sharpens focus on key drivers supporting this bullish view.

Vertical integration in technology, especially in autonomy, battery, and software, combined with growing software and services revenue (including licensing via partnerships like with Volkswagen) is expected to open new high-margin revenue streams and diversify earnings. This could potentially strengthen EBITDA and net margins over time.

Read the complete narrative.

Want to know why high-tech partnerships and vertical integration are central to Rivian’s future? There’s a set of bold assumptions powering this target valuation, including game-changing revenue projections and margin shifts few expect. Curious about what the consensus is betting on beneath the surface? Unpack the narrative to see what’s driving the models and which financial levers matter most.

Result: Fair Value of $14.48 (UNDERVALUED)

Have a read of the narrative in full and understand what’s behind the forecasts.

However, persistent cash burn and policy changes, such as tariff shifts or tax credit reductions, could quickly undermine these optimistic forecasts for Rivian’s future.

Find out about the key risks to this Rivian Automotive narrative.

Looking at Rivian through the lens of price-to-sales, things appear less optimistic. The company’s ratio stands at 3.1x, which is quite a bit higher than both the US Auto industry average of 1.3x and the peer average of 1.5x. Even our fair ratio estimate is just 1.4x, suggesting the market is paying a premium. Does this premium signal belief in future breakthroughs or simply extra valuation risk?

First Capital (FCAP) delivered impressive earnings growth of 25.1% over the last year, building on a five-year annualized growth rate of 4.9%. Net profit margins reached 31.2%, up from 28.7%, highlighting strong operational efficiency and high-quality earnings. The balance of risks and rewards currently leans positive, supported by ongoing profit growth and an attractive dividend.

See our full analysis for First Capital.

Next up, we will see how these results compare with the market’s prevailing narratives and whether the numbers reinforce or challenge the dominant stories about FCAP.

Curious how numbers become stories that shape markets? Explore Community Narratives

Net profit margins advanced to 31.2%, up from 28.7% last year. This signals a tangible step up in operational efficiency for First Capital and offers investors increased confidence in the company’s core profitability.

Strong earnings quality and margin growth provide reassurance around the bank’s ability to sustain reliable profits.

This margin expansion supports the view that community banks like FCAP offer a safe and reliable source of yield, especially when larger institutions face greater volatility.

With margins climbing higher, the underlying quality of FCAP’s earnings now sits in rare territory among regional banks.

FCAP trades at a Price-To-Earnings (P/E) ratio of 9.8x, noticeably under the US Banks industry average of 11.2x and the peer group’s 10.8x. This positions its shares as attractively valued within its sector.

Shares changing hands at a discount highlight a compelling mismatch between FCAP’s recent profit gains and the lower market valuation being assigned.

Investors who focus on value strategies may find FCAP especially interesting, given its below-industry-average P/E alongside high and rising net profit margins.

Despite ongoing operational improvements, the gap between its current share price of $42.92 and DCF fair value of $72.33 suggests room for re-rating if positive trends continue.

The latest filing noted no material risks, leaving the positive balance of risks and rewards unchanged since the last update.

Market watchers point to the current environment with solid profit growth, an attractive dividend, and no flagged risks, favoring a steady outlook for the stock.

Investors are likely to focus now on whether these supportive conditions can be maintained, as stability often attracts long-term capital to regional banks like FCAP.

The absence of new concerns removes a common hurdle, giving recent positive fundamentals more room to influence sentiment and valuation.

( October 26, 2025, 03:00 GMT | Official Statement) — MLex Summary: South Korean auto-parts maker Kapec Valeo has been fined 410 million won ($285,000) by the country’s competition regulator for technology misappropriation, in violation of the Subcontracting Act. The Korea Fair Trade Commission said the company used an improved design proposal from its subcontractor without consent, incorporated it into its own design drawings and shared it with rival suppliers. The subcontractor had originally modified the design while producing a prototype to address qualify defects in the company’s earlier design. The KFTC also said that Kapec Valeo, a joint venture between Korea Powertrain and French automotive supplier Valeo Bayen, requested 198 technical documents from six subcontractors without issuing the required written statements outlining the purpose and ownership of the requested data, as mandated under the law. The regulator said the case marks the first case where an engineering change request was recognized as a protected technical material, noting that the technical data cannot be used or shared without explicit consent. The statement, in Korean, is attached….

MLex identifies risk to business wherever it emerges, with specialist reporters across the globe providing exclusive news and deep-dive analysis on the proposals, probes, enforcement actions and rulings that matter to your organization and clients, now and in the longer term.

Know what others in the room don’t, with features including:

Experience MLex today with a 14-day free trial.

Hong Kong University of Science and Technology (HKUST) start-up Stellerus Technology aims to be the world’s first provider of satellite-enabled three-dimensional wind data to help wind power, transport and insurance firms boost revenues, cut costs and manage risks, according to its founders.

Stellerus, founded in 2023 by the university’s academics, would leverage China’s cost competitiveness in satellite manufacturing to make global 3D wind data collection economically viable, said Su Hui, the chairwoman and co-founder.

3D wind data – wind direction and speed and their changes with altitude – is crucial for improving weather forecasting, especially severe climate events.

“After I came to Hong Kong, I realised the technology for implementing such a project in mainland China was quite developed and the cost would be much lower than overseas,” Su said. “In the US, such a satellite could cost US$100 million to build, compared with 20 million yuan [US$2.8 million] in China.”

Su, a hydraulic expert, joined the HKUST’s department of civil and environmental engineering in 2022 as chair professor. She was formerly a principal scientist and weather programme manager at the Jet Propulsion Laboratory at Nasa.

Apple’s striking Cosmic Orange iPhone 17 Pro and iPhone 17 Pro Max models, launched as this year’s standout “Hero” colour, are reportedly developing an unexpected pinkish tint. Social media platforms such as X and Reddit have been flooded…

Visitors view artworks at the 12th Artweeks Istanbul in Istanbul, Türkiye, Oct. 25, 2025. The 12th edition of Artweeks Istanbul was held in Türkiye’s largest city Istanbul from Oct. 15 to 26. Hundreds of artworks were on display to the public…