June Lockhart, who starred in television shows such as Lassie and Lost In Space, has died at the age of 100.

The US actress died of natural causes at her home in Santa Monica, California, on Thursday, according to family spokesman…

June Lockhart, who starred in television shows such as Lassie and Lost In Space, has died at the age of 100.

The US actress died of natural causes at her home in Santa Monica, California, on Thursday, according to family spokesman…

Pakistan will take on China in the quarterfinals of the 3rd Asian Youth Games 2025 on October 26 at 1:30pm Pakistan time, following a strong 3-1 victory…

b Henry

0

1

1

0

0

1

0.00

c Latham

b Foulkes

c Latham

b Foulkes

2

4

2

0

0

9

50.00

b Foulkes

2

6

4

0

0

10

33.33

The vivo X300 series is off to a strong start – the two new models got mostly positive results in last week’s poll. There is still the question of the global launch time frame and pricing hanging over them – the official launch is set…

Former India captain Sunil Gavaskar was left fuming after finding out that two Australian women’s cricketers were harassed in Indore on the sidelines of the Women’s World Cup 2025 edition. According to a statement released by Cricket Australia,…

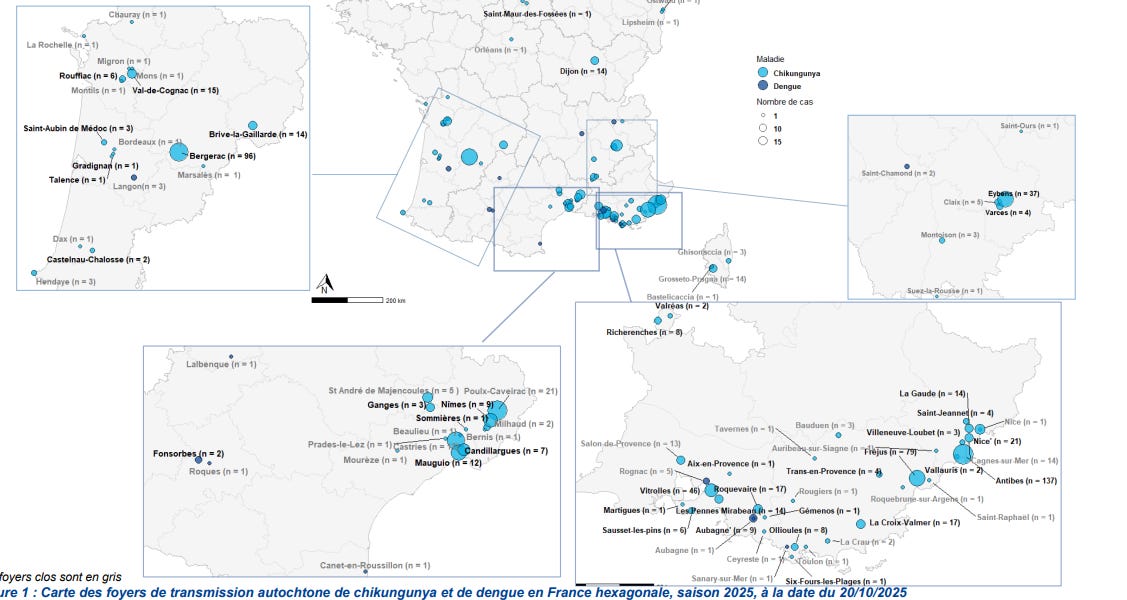

Sante publique France reports, as of October 20, 766 locally acquired chikungunya cases were reported in mainland France.

In addition, 29 local transmission of dengue fever have been reported this year.

91 outbreaks of indigenous vector-borne…

Investor sentiment around UP Fintech Holding (NasdaqGS:TIGR) has picked up after UBS and Jefferies each began covering the company with optimistic outlooks. The analysts highlighted the company’s foothold in expanding Hong Kong and Singapore wealth markets as well as its financial momentum.

See our latest analysis for UP Fintech Holding.

The upbeat analyst attention and momentum in Hong Kong and Singapore have helped fuel a stellar run for UP Fintech, with a 53.9% year-to-date share price return and a striking 1-year total shareholder return of 66.1%. Both the recent buzz and the longer-term track record, up 173% over three years, suggest that optimism around the company’s growth story is gaining traction among investors.

If fresh analyst optimism has you rethinking your watchlist, this could be the perfect moment to broaden your investing horizons and discover fast growing stocks with high insider ownership

But with shares already rallying this year and analyst targets suggesting more upside, the question is whether UP Fintech’s impressive growth is still underappreciated or if markets have already accounted for those future gains.

With the latest narrative valuing UP Fintech at $14.12, the gap versus the last close at $10.28 has caught attention. This fair value, calculated using a specific set of forward-looking earnings and margin assumptions, shapes the current debate around where the market might move next.

Strong growth in revenue, assets, and profitability; expansion into high-potential markets; and ongoing tech innovation position UP Fintech for durable, scalable, and diversified earnings.

Read the complete narrative.

Record margins, bold revenue forecasts, and a future earnings multiple are at the heart of this narrative. Want to see what assumptions drive this eye-catching target? The reasoning behind these numbers will surprise you.

Result: Fair Value of $14.12 (UNDERVALUED)

Have a read of the narrative in full and understand what’s behind the forecasts.

However, intensifying regulatory scrutiny and higher client acquisition costs in key markets could disrupt UP Fintech’s strong growth momentum and future profit forecasts.

Find out about the key risks to this UP Fintech Holding narrative.

If you think the numbers tell a different story or want to dig into the details yourself, you can craft your own take on UP Fintech in just a few minutes. Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding UP Fintech Holding.

Samsung has announced that it’s secured a partnership with Paris’s famed Centre Pompidou museum that will bring no less than 25 of the gallery’s most famous and revered masterpieces to Samsung’s online digital Art Store, enabling Samsung…

eInfochips, an Arrow Electronics company, and NXP Semiconductors recently announced a multi-year collaboration focusing on software distribution and customer services for NXP’s S32 microcontrollers, aiming to accelerate the development of software-defined vehicles.

This partnership highlights Arrow’s ongoing efforts to expand its value-added engineering and software support capabilities within the automotive and embedded systems sectors.

We’ll examine how Arrow’s expanded role in automotive software solutions with NXP could impact its outlook for recurring, higher-margin services growth.

These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump’s tariffs. Discover why before your portfolio feels the trade war pinch.

To be a shareholder in Arrow Electronics, you must believe that the company can successfully pivot toward higher-margin, recurring revenue streams as industrial, automotive, and connectivity trends drive demand for electronics content. While the recent eInfochips–NXP collaboration underscores Arrow’s ambitions in software and engineering services, it does not materially affect the immediate risk that automation and direct sourcing could weaken Arrow’s position in the traditional distribution business.

The most relevant recent announcement is Arrow’s appointment of an interim CEO in September 2025. This leadership change, closely following strategic partnerships, may impact Arrow’s agility in executing new service-focused initiatives as it aims for greater exposure to the software-defined automotive sector.

However, against this potential for a shift into higher-value offerings, investors should also recognize the risk if digital procurement trends accelerate and…

Read the full narrative on Arrow Electronics (it’s free!)

Arrow Electronics’ outlook suggests $35.2 billion in revenue and $734.1 million in earnings by 2028. This is based on an anticipated 7.3% annual revenue growth and a $266.9 million increase in earnings from the current $467.2 million.

Uncover how Arrow Electronics’ forecasts yield a $116.75 fair value, a 3% downside to its current price.

Two fair value estimates from the Simply Wall St Community both land at US$116.75, reflecting remarkably consistent expectations. Some see Arrow’s effort to expand recurring, engineering-related services as a turning point, but your experience could differ, explore alternative viewpoints to inform your decision.

Japan’s new HTV-X cargo spacecraft launched on its first-ever mission to the International Space Station on Saturday (Oct. 25).