BBC One premiered the long-awaited The Celebrity Traitors, and the game didn’t wait too long to start.

Claudia Winkleman greeted the celebrity players at a graveyard where each grave had the name of a contestant.

“We’re starting as we mean…

BBC One premiered the long-awaited The Celebrity Traitors, and the game didn’t wait too long to start.

Claudia Winkleman greeted the celebrity players at a graveyard where each grave had the name of a contestant.

“We’re starting as we mean…

Marwan Ateya © Backpagepix

Wednesday’s 2026 Fifa World Cup qualifying in Africa saw Egypt punch their ticket to the global showpiece, while Ghana can all but begin planning a trip to North America next year after an emphatic triumph over the…

A major new study presented at United European Gastroenterology (UEG) Week 2025 reveals that both sugar-sweetened beverages (SSBs) and low- or non-sugar-sweetened beverages (LNSSBs) are significantly associated with an increased risk of metabolic…

Maya Le Tissier scored a first-half penalty as Manchester United launched their maiden Champions League campaign with a 1-0 win over Valerenga.

Skipper Le Tissier struck after 31 minutes as United saw off the Norwegians in their first match of the…

Nikhil InamdarBBC News, Mumbai

Getty Images

Getty ImagesIndia’s ravenous appetite for stock market investing has sparked a fundraising gold rush in Asia’s third largest economy, with its booming initial public offerings (IPO) market undeterred by trade tariffs or global uncertainties.

Major companies – from global co-working firm WeWork India and South Korean conglomerate LG Electronics’ India arm to financial services giant Tata Capital – have raised record-setting amounts of money just this week, offering their shares to investors through IPOs.

Unlike the secondary markets, where investors buy and sell existing stocks of companies, IPOs are used by privately held firms to sell their shares to investors for the first time, and debut on the public markets.

Some 79 companies raked in $11.5bn (£8.58bn) in the first nine months of 2025, while a string of other issues in the final three months of the year is expected to bring in another $10-11bn, pushing India’s IPO market to more than $20bn this year, according to investment bank Kotak Mahindra Capital Company. And this is not counting the fundraising done by India’s small and medium-sized enterprises.

Companies operating in a wide range of sectors including new-age tech firms, e-commerce majors, retail, infrastructure and healthcare players are tapping the IPO market.

“This has given Indian investors the breadth [of investment opportunities] that’s not seen in other countries,” V Jayasankar, managing director at Kotak Mahindra Capital Company, told the BBC.

“Apart from institutional money, systematic investment plans [or fixed monthly contributions] by mom-and-pop investors in mutual funds has kept flows into IPOs robust,” Mr Jayasankar said.

Getty Images

Getty ImagesBesides high demand for new investment opportunities, the market is on fire also because India’s growth over the past decade has birthed a strong pipeline of companies across diverse industries that have reached a certain scale and maturity, according to Abhinav Bharti, head of India equity capital markets at US investment banking giant JP Morgan.

“This is just the start of the trend, and we should see India to be a regular $20bn IPO market on an ongoing basis, if not higher,” Mr Bharti said on the company’s YouTube channel.

But while this wave of new share offerings signals a maturing of India’s investing landscape, the euphoria also demands caution, experts say.

“There’s a lot of exuberance. Investors need to be selective and study the financials of the companies they choose. They must not invest blindly,” says Kranthi Bathini of WealthMills Securities.

The IPO frenzy has hit a fever pitch even as Indian stock markets overall have delivered lacklustre returns to investors.

India’s benchmark Nifty-50 index of its largest and most liquid companies has clocked barely 6% this year, while returns from indices tracking small and mid-sized firms are negative.

Besides concerns about worsening global geopolitics and US President Donald Trump’s 50% tariffs on India, expensive share valuations have worried analysts.

But ironically, this could be contributing to the high interest in debuting companies.

“Investors currently see IPOs as a better place to make returns because of the chance of a 15-20% pop in the stock price on listing,” said Mr Jayasankar.

However estimates suggest that half of the IPOs that have debuted this year are trading below their listing price. Kotak’s own analysis shows that only 43 of the 79 companies that listed this year have given positive returns.

Mr Jayasankar says this could partly be because they were mis-priced (sold expensive) or because the overall market sentiment is low.

Also, the majority of the companies hitting the markets in the first nine months were smaller firms, which tend to be more volatile.

“The last quarter of the year tends to be skewed towards larger or better-quality companies hitting the market,” Mr Jayasankar said.

Getty Images

Getty ImagesWhile Indians have been lapping up new issues, there has been a distinct lack of interest in these IPOs from foreign investors, who’ve sold over $20bn in Indian equities this year.

“Global investors are in wait-and-watch mode,” said Mr Bathini. “India has gone from being the most favoured nation to the least favoured nation for them in a matter of months, because of tariffs and other uncertainties.”

Their lack of participation in the IPO market reflects an overall reduction in portfolio funds to India, he said.

This, if anything, is an obvious signal that domestic mom-and-pop investors are getting swayed by euphoria rather than fundamentals.

“There is an entire industry working to first build and then maintain this mood,” writes economics commentator Vivek Kaul in a piece for Mumbai Mirror newspaper. This includes investment bankers, analysts at stock brokerages and fund managers, he says.

The frenzy is fun, says Mr Kaul, and a game of perceptions and hype, but “not for turning a modest investment into lasting financial security”.

But Indian investors do not appear to be in a mood to listen.

With companies such as Walmart-backed PhonePe, India’s largest mobile telecoms giant Jio and unicorns [tech start-ups valued at over $1bn] such as Groww and Meesho hitting the markets in the coming months, India’s IPO party is likely to continue, at least for some more time.

Follow BBC News India on Instagram, YouTube, X and Facebook.

Samsung’s 65-inch Frame Pro TV is around $1,797.99 ($402 off) — a new all-time low — at Amazon and Best Buy during Amazon’s Prime Big Deal Days. The 75-inch model is around $2,197.99 ($1,400 off) at Amazon and Best Buy, which is also its…

Follow ZDNET: Add us as a preferred source on Google.

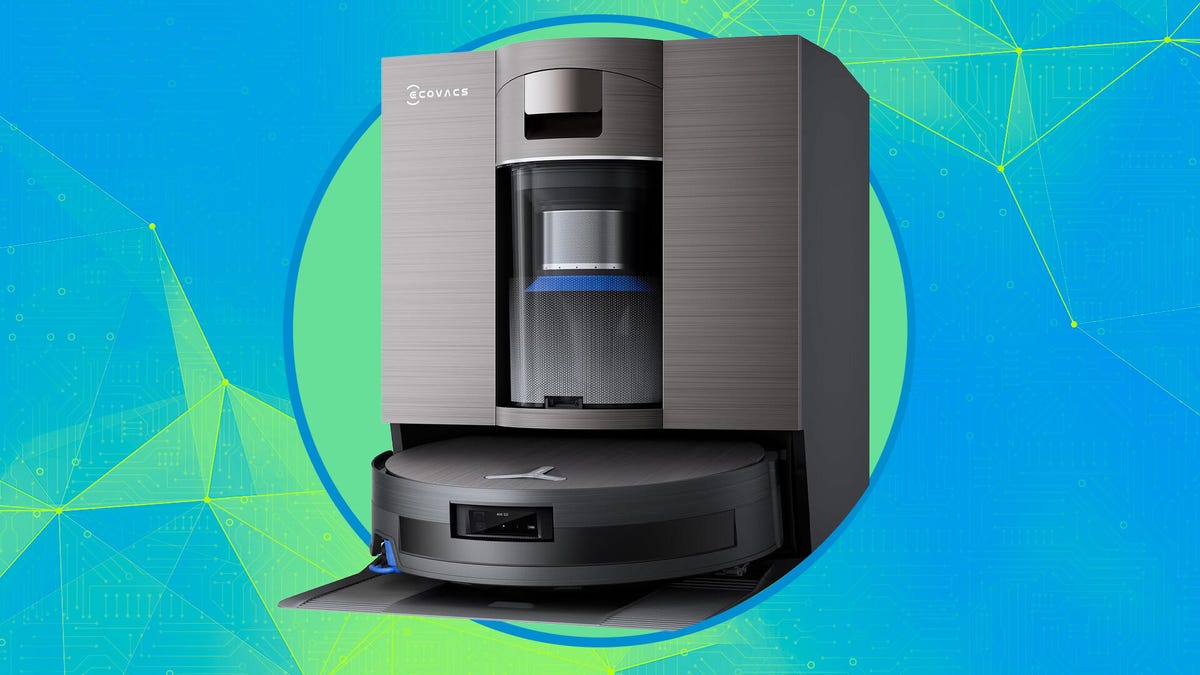

I’ve tested dozens of robot vacuums, and it’s rare that I stick with only one. Yet I’ve been using the Ecovacs Deebot X11 OmniCyclone for over a month, and I’m in love….

In 1982, the Museum of Modern Art staged the first-ever major retrospective dedicated to the work of Louise Bourgeois. She was 70 years old. The overdue exhibition was intended to solidify Bourgeois’s…

Pharmacists are being stretched thin by competing job demands, as pharmacy chains prioritize prescription speed and volume over diabetes care support, a new CCS survey finds.

Between 2010 and 2021, nearly one-third of all retail pharmacies in…