Scientists from the Massachusetts Institute of Technology and international collaborators have identified what appears to be preserved material from Earth’s ancient precursor, dating back approximately 4.5 billion years. The groundbreaking…

Blog

-

October 18, 2025 – Matches, How to Watch Before AEW WrestleDream

Before AEW WrestleDream goes live at 8 p.m. ET/7 p.m. CT tonight, Saturday, October 18, LIVE on HBO Max PPV from Chaifetz Arena in St. Louis, Missouri, it’s time for the one-hour AEW Tailgate Brawl, LIVE at 7 p.m. ET/6 p.m. CT on TNT and…

Continue Reading

-

Expert Discusses Early Safety and Tolerability Findings for VMT-α-NET in Neuroendocrine Tumors | ESMO 2025

Q: Could you walk us through the key safety and tolerability findings from the dose-finding cohorts (1 and 2)? Were there any dose-limiting toxicities, and how manageable were they in this patient population?

Thor Halfdanarson, MD: Absolutely. So, in terms of the safety profile, there were relatively few grade 3 toxicities, and overall, the drug is very well tolerated. There were no new safety signals. Obviously, as always, we get concerned about kidney function and bone marrow involvement by the radioligand, but we didn’t really see any of that.

In terms of renal function, creatinine—the indicator of renal function—was stable in patients following treatment. There were no obvious kidney signals. Therefore, for kidney toxicity, same thing with the bone marrow and the blood counts—everything seemed to hold up really nicely.

So, nothing unexpected. As we’ve seen with other alpha particle therapies, there is more hair loss, but typically mild in patients undergoing latitude 12 alpha, VMT alpha NET, and it’s similar with other radioligand therapies testing alpha. There is a little bit of nausea, mostly mild, but in terms of other organ toxicities, not a whole lot.

Q: Do you have data on the pharmacokinetics, tumor uptake, normal organ distribution, and clearance of ^212Pb-VMT-α-NET? How consistent was tumor targeting across patients?

Halfdanarson: We have limited information on that yet. We did collect those data in a subset of the patients enrolled, but we haven’t looked at it in a systematic way yet, so we are not reporting that at ESMO. That’s definitely to be reported later.

What we do know is that a subset of the patients had tumors that did not uniformly light up on somatostatin receptor imaging and were included in the trial because the inclusion criteria didn’t require uniform expression—and they seemed to derive benefit as well. So, in terms of pharmacokinetics and more advanced dosimetry data, that’s yet to come.

Q: Based on the safety and preliminary efficacy, what is the recommended phase 2 dose (or dose expansion dose) you intend to move forward with? What factors drove that decision?

Halfdanarson: We are not yet at a point with the recommended phase 2 dose. We are up to 5 millicurie in the largest expansion cohort, and then there is one cohort above that with 6 millicurie, which I believe has eight patients on it. We have not yet reported in full in terms of efficacy and toxicity. So, I would suspect that it falls somewhere between five and six, depending on what the third and highest dose cohort shows.

Continue Reading

-

The last few months have been devastating for LLM dreams

First slowly, and then all at once, dreams of LLMs bringing us to the cusp of AGI have fallen apart. The last few months have been devastating:

• June, 2025: the Apple reasoning paper confirmed that even with “reasoning”, LLMs still can’t…

Continue Reading

-

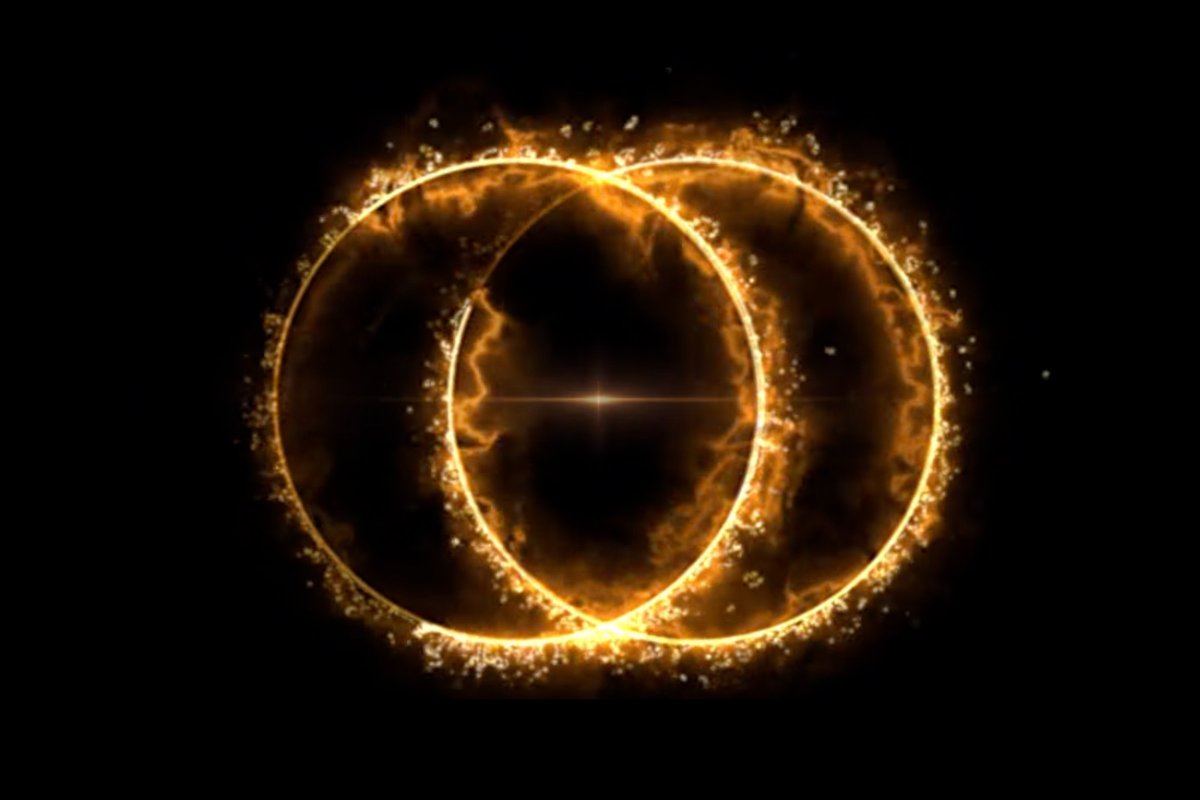

Astronomers Astonished By Twin Cosmic Rings That Dwarf Entire Galaxies

Looming billions of light years away, astronomers have spotted an enormous double-ring structure — itself hundreds of thousands of light years across — that glows spectacularly in radio wavelengths. And, tantalizingly, they can’t fully…

Continue Reading

-

Researchers Image The Toxic Molecules That Drive Parkinson’s Disease For The First Time

Scientists have imaged and quantified the toxic protein molecules that are thought to drive Parkinson’s disease for the first time. The finding will help researchers understand how this neurodegenerative disease begins at the molecular level.

Continue Reading

While shareholders of XP (NASDAQ:XP) are in the red over the last five years, underlying earnings have actually grown

Generally speaking long term investing is the way to go. But no-one is immune from buying too high. To wit, the XP Inc. (NASDAQ:XP) share price managed to fall 62% over five long years. That is extremely sub-optimal, to say the least. More recently, the share price has dropped a further 17% in a month.

The recent uptick of 4.7% could be a positive sign of things to come, so let’s take a look at historical fundamentals.

AI is about to change healthcare. These 20 stocks are working on everything from early diagnostics to drug discovery. The best part – they are all under $10bn in marketcap – there is still time to get in early.

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

During the unfortunate half decade during which the share price slipped, XP actually saw its earnings per share (EPS) improve by 26% per year. So it doesn’t seem like EPS is a great guide to understanding how the market is valuing the stock. Alternatively, growth expectations may have been unreasonable in the past.

Because of the sharp contrast between the EPS growth rate and the share price growth, we’re inclined to look to other metrics to understand the changing market sentiment around the stock.

We note that the dividend has remained healthy, so that wouldn’t really explain the share price drop. While it’s not completely obvious why the share price is down, a closer look at the company’s history might help explain it.

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

XP is a well known stock, with plenty of analyst coverage, suggesting some visibility into future growth. Given we have quite a good number of analyst forecasts, it might be well worth checking out this free chart depicting consensus estimates.

It is important to consider the total shareholder return, as well as the share price return, for any given stock. Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. It’s fair to say that the TSR gives a more complete picture for stocks that pay a dividend. We note that for XP the TSR over the last 5 years was -58%, which is better than the share price return mentioned above. The dividends paid by the company have thusly boosted the total shareholder return.

Continue Reading

1,800-year-old ancient dragon kiln unearthed in east China

A well-preserved dragon kiln…