This article first appeared on GuruFocus.

Following the October 11 market correction, risk-off sentiment swept across global crypto markets. Yet, within days, the Trump family’s digital-asset ecosystem including the WLFI platform, the USD1 stablecoin, and American Bitcoin (ABTC) delivered substantial gains. Independent estimates suggest roughly $1.3 billion in new wealth creation, pushing the family’s total net worth to around $7.7 billion. Supporters hail the momentum as a sign of market recovery, while critics warn of regulatory capture and conflicts of interest. The convergence of policy and capital has become a defining feature of this new policy-driven market.

Policy-Capital Feedback Loop:

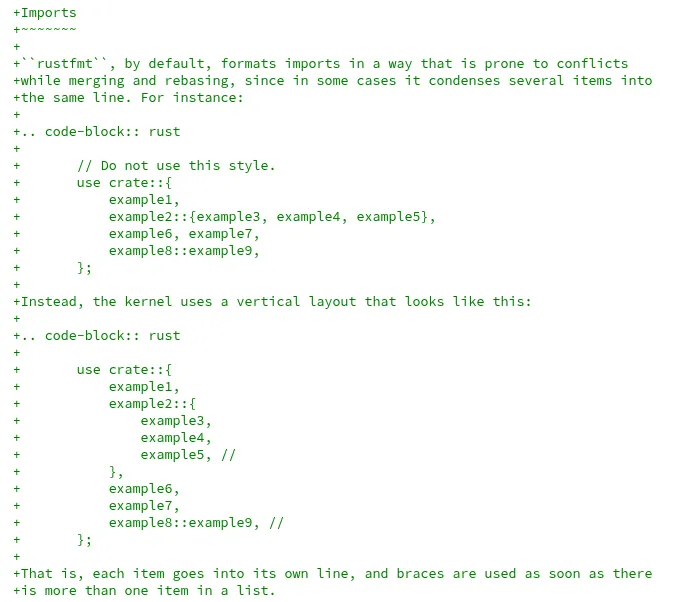

Since Donald Trump’s inauguration, regulatory posture has softened and pending litigation settlements have accelerated. Liquidity has flowed back into crypto markets, lifting correlated assets tied to the Trump ecosystem.

Two Primary Growth Engines:

-

WLFI: Governance-token unlock and institutional accumulation.

-

USD1: After the federal compliance framework (Genius Act) took effect, the reserve-based model began generating significant interest income and network expansion.

Industrial Backbone:American Bitcoin (ABTC) went public via merger and Nasdaq listing, seeing sharp intraday volatility and rapid valuation gains.

Core Controversy:The boundary between regulator and regulated remains blurred. The role of offshore capital introduces national-security and governance-integrity concerns.

-

Jan 2025: SEC leadership reshuffle ? enforcement pivot.

-

Mar Aug 2025: ABTC formed and completed merger with a listed entity.

-

Jul 2025: Federal Stablecoin Framework (Genius Act) signed into law.

-

Aug 2025: Alt5 Sigma announces $1.5 billion allocation to WLFI.

-

Sept 1 2025: WLFI lists publicly ? peak valuation ? $7 billion.

-

Sept 3 2025: ABTC debuts on Nasdaq ? intraday valuation ? $13.2 billion.

-

WLFI Governance Token: Market debut and institutional buying boosted capitalization and liquidity.

-

USD1 Stablecoin: Interest income from reserve assets and ecosystem integration magnified cashflow.

-

ABTC Equity Holdings: Public-market repricing increased book value.

Across multiple independent reports, the Trump family’s paper and realized gains for Q3 2025 are estimated around $1.3 billion, with aggregate net worth now near $7.7 billion, including unrealized holdings.

-

Policy Reversal: Mid-term politics and regulatory realignment could drive valuation retracement.

-

Governance & Ethics: Potential conflicts of interest and offshore funding influence demand greater audit transparency.

-

Market Volatility: Post-October 11 secondary sell-offs suggest liquidity recovery remains incomplete.

This case illustrates how policy markets precede fundamentals.Investors should watch for early signals of capital rotation such as:

-

Rising political donations ? policy commitments ? fast-track implementation ? market inflows. Asset selection should focus on sustainable cashflow, audited transparency, policy resilience, and liquidity management.

Amid heightened volatility, some investors have shifted from price speculation toward cashflow anchoring.NB HASH, a global digital-income platform established in 2019, offers a regulated and automated pathway for generating daily returns through transparent digital-asset contracts positioning itself as a potential cashflow buffer during high-volatility cycles.

Highlights:

-

Stable distribution: Daily settlements with real-time dashboard visibility.

-

Low entry threshold: Starting from $20, suited for varying risk profiles.

-

Flexible compounding: Withdraw anytime or auto-reinvest for long-term growth.

-

Free Fund Experience: Trial program allows users to validate mechanisms at zero cost.

Use Cases: education funding, retirement supplements, or household secondary cashflow.More information is available at nbhash.cominfo@nbhash.com