Using data from the RadioAstron satellite, astronomers have produced a radio image of two supermassive black holes at the center of the distant quasar OJ 287, where the secondary black hole is in a 12-year orbit around the primary.

This…

Using data from the RadioAstron satellite, astronomers have produced a radio image of two supermassive black holes at the center of the distant quasar OJ 287, where the secondary black hole is in a 12-year orbit around the primary.

This…

Gold price rises during the North American session on Friday amid an escalation of the trade war between the US and China. This, the US government shutdown and expectation for further easing by the Federal Reserve (Fed) keep the yellow metal bid. XAU/USD trades at $3,997, up 0.60%, at the time of writing.

Risk aversion is the name of the game after US President Donald Trump warned of possible fresh duties on China, as the latter threatens to impose export controls on rare earths. Trump added that there is no reason to meet with China’s President Xi Jinping in two weeks in South Korea as planned.

On Thursday, the yellow metal posted losses of 1.59% as traders booked profits, along with the ceasefire between Israel and Gaza.

The US government shutdown extends to the tenth straight day and the chances of a reopening in the near term remain far.

Data-wise, the University of Michigan (UoM) revealed that Consumer Sentiment was steady in October, as households appear to shrug off the partial shutdown of the government.

Next week, the US economic docket is expected to release the Consumer Price Index (CPI) for September. Nevertheless, the US Bureau of Labor Statistics (BLS) revealed that it will be announced on Friday at 8:30 AM ET.

Gold’s technical picture remains bullish, though a daily close above $4,000 could cement the case for higher prices next week, with the all-time high sitting at $4,059. Otherwise, XAU/USD could be poised for a pullback, with sellers’ eyes on the October 1 high turned support at $3,895. A breach of the latter will expose the 20-day Simple Moving Average (SMA) at $3,818.

From a momentum standpoint, the Relative Strength Index (RSI) shows that buyers remain in charge, despite being overbought above 70 . However, the strong upward trend suggests that higher readings above the 80 level to seen as an overextended trend up.

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.

Phoebe Robinson could see the potential appeal of being with a 72-year-old man. Not really, but kind of.

It was a casual semi-joke she made to a friend months ago when her schedule was chaotic between traveling, moving to a new apartment, writing…

As the lights went out around Marina Bay, Atlassian Williams Racing once again showed the grit that has defined our season. With the team fighting through the field in Singapore, Lia Block securing her maiden F1 Academy victory, and James Vowles…

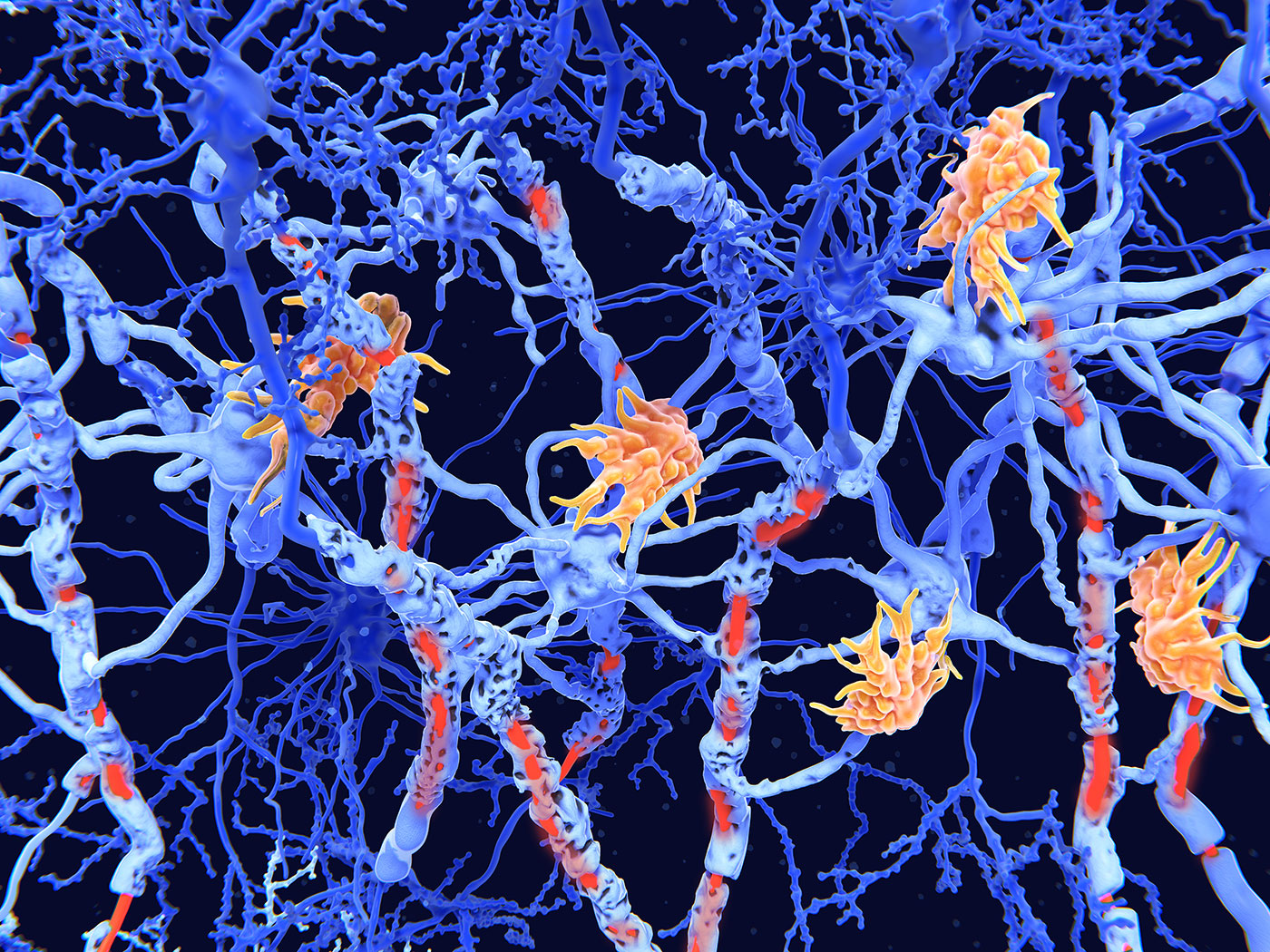

Scientists using “disease in a dish” technology to study multiple sclerosis (MS) identified an unusual type of brain cell that they say may play a vital role in…

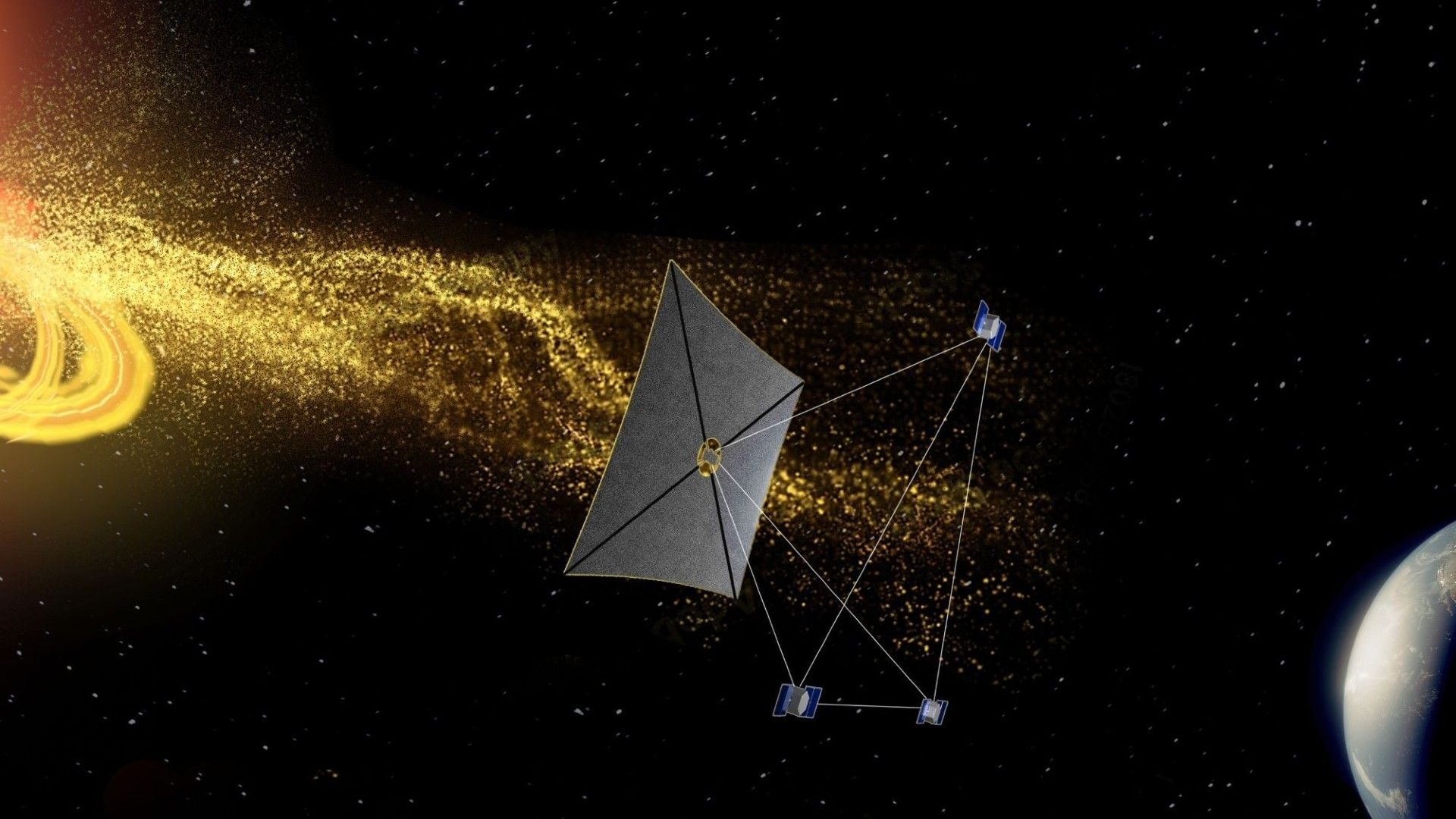

A fleet of sentinel spacecraft, including one with a huge solar sail, could watch out for sneaky “space tornadoes” posing a threat to Earth during solar storms, a new study suggests.

The proposal says that four deep-space spacecraft, collectively…

Macroeconomic factors could also support EM stocks. The US Fed is forecast to cut rates further, creating room for further monetary easing and stronger growth across a number of emerging markets, Trivedi writes.

And the US dollar “will likely stay on the back foot” relative to emerging markets currencies amid a softening US labor market and a potential increase in investment flows into EM stocks and bonds as investors diversify away from the dollar. A weakening dollar can boost flows into EM stocks as investors look for higher returns outside the US.

Which Stock Markets Are Forecast to Grow?

Within Asian markets, Goldman Sachs Research sees investment opportunities in Chinese and Korean equities.

In Korea, 70% of stocks trade below book value (the implied value of a stock based on the company’s assets minus its liabilities). Ongoing reforms to the way companies are governed in Korea could also drive up the country’s equity prices, as could Chinese efforts to address disorderly price cutting and excessive competition among producers.

Meanwhile, Saudi Arabian equities could benefit from the potential easing of limits on foreign ownership of listed companies, which Goldman Sachs Research estimates could unlock passive inflows up to $10 billion to the Saudi markets.

“On balance, this should be supportive of Saudi equities—which have lagged EM in the year to date—and fits with our regional diversification theme,” Trivedi writes.

On the other hand, Indian equities have lagged other emerging markets this year. High valuations, higher-than-expected tariffs, and challenges for the software sector from the increased price of US H1B visas suggest that a broad recovery might not be imminent.

Beyond Asia, the team anticipates continued gains from South African stocks as rising gold prices help mining companies and inexpensive domestic sectors could benefit from a potential growth recovery and lower borrowing costs.

Why are emerging currencies strengthening against the US dollar?

Emerging market currencies outperformed their peers from major developed economies in September, and Goldman Sachs Research anticipates that this outperformance could continue.

There are three key factors supporting the appreciation of EM currencies relative to their DM peers. Firstly, high levels of carry (when investors borrow currency in a country with lower interest rates in order to invest somewhere with higher rates) are contributing to the attractiveness of emerging markets currencies relative to other major currencies.

Secondly, the team notes that the US dollar has been acting more like a cyclical currency lately—one which appreciates as the economy grows and declines when the economy is under pressure—particularly when a shock emanates from the US.

As a result, EM currencies are likely to weaken less significantly against the dollar in the event of changes to risk sentiment or downward revisions to growth expectations in the US.

And finally, the strong performance of EM equities is also likely to have played a role in the appreciation of EM currencies relative to their developed market peers.

The team has found that there is a relationship between the performance of EM currencies and relative equity returns. In short, “the best environment for EM foreign exchange is when both the MSCI EM and S&P indices are going up and MSCI EM is outperforming,” Trivedi writes.

This article is being provided for educational purposes only. The information contained in this article does not constitute a recommendation from any Goldman Sachs entity to the recipient, and Goldman Sachs is not providing any financial, economic, legal, investment, accounting, or tax advice through this article or to its recipient. Neither Goldman Sachs nor any of its affiliates makes any representation or warranty, express or implied, as to the accuracy or completeness of the statements or any information contained in this article and any liability therefore (including in respect of direct, indirect, or consequential loss or damage) is expressly disclaimed.

There is, allegedly, a commonly held belief among landscape architects familiar with New York City: for Calvert Vaux and Frederick Law Olmsted, the designers of both Central Park and Prospect Park, the former was merely practice for the latter.

President Donald Trump has threatened to pull out of an expected meeting with President Xi Jinping of China after Beijing tightened its rules for exports of rare earths.

In a post on social media, Trump said he now saw “no reason” to meet with President Xi later this month, accusing China of “becoming very hostile” and trying to hold the world “captive”.

He also threatened a “massive” increase in tariffs on Chinese goods, raising fears about further escalation of trade tensions between the two economic giants.

Financial markets dropped in the wake of the remarks, with the S&P 500 down 1.8% in mid-afternoon trade in New York.

The last time Beijing tightened export controls – after Trump raised tariffs on Chinese goods early this year – there was an outcry from many US firms reliant on the materials . Carmaker Ford even had to temporarily pause production.

In addition to tightening rules for rare earth exports, China has opened a monopoly investigation into the US tech firm Qualcomm that could stall its acquisition of another chipmaker.

Although Qualcomm is based in the US, a significant portion of its business is concentrated in China.

Beijing has also said it will charge new port fees to ships with ties to the US, including those owned or operated by US firms.

“Some very strange things are happening in China!” Trump wrote in a post on social media on Friday. “They are becoming very hostile.”

The US and China have been in a fragile trade détente since May, when the two sides agreed to drop triple-digit tariffs on each others’ goods that had nearly stopped trade between the two countries.

Officials have held a series of talks since then on matters including TikTok, agricultural purchases, and the trade of advanced technology like semiconductors and rare earths supplied by China, which are key components in cars, smartphones and many other items.

The two sides were expected to meet again this month at a summit in South Korea.

China expert Jonathan Czin, a fellow at the Brookings Institution, said Xi’s recent actions were a bid to shape the upcoming talks, noting that the recent rare earths directive does not go into effect immediately.

“He’s looking for ways to seize the initiative,” he said. “The Trump administration is having to play a game of whack-a-mole and deal with these issues as they come up.”

He added that he did not think China was worried about US retaliation in response.

“What China took away from the Liberation Day tariffs and the cycle of escalation followed by de-escalation is that the Chinese side had a higher pain threshold,” he said. “From their perspective, the Trump administration blinked.”

In prior rounds of trade talks, China has pushed for looser US restrictions on semiconductors. It is also interested in securing more stable tariff policies that would make it easier for its businesses to sell into the US.

Xi has previously used as leverage his country’s dominance of production of rare earths, critical minerals and other materials.

But the export rules unveiled this week target overseas defence manufacturers, making them particularly serious, said Gracelin Baskaran, director of the critical minerals security program at Washington-based Center for Strategic and International Studies.

“Nothing makes America move like targeting our defence industry,” she said. “The US is going to have to negotiate because we have limited options, and in an era of rising geopolitical tension and potential conflict, we need to build our industrial defence base.”

While a Trump-Xi meeting now looks unlikely, she said it was not necessarily completely off the table. Ms Baskaran said there’s still time and room for talks. China’s new rules don’t take effect until December.

“Negotiations are likely imminent,” she said. “Who does them and where they happen will be determined with time.”

Ask Cathy Loughead the most punk thing she’s ever done, and she doesn’t miss a beat: “I went on stage with my neck broken in two places. I couldn’t bounce around, so I blinged the brace up instead. That was a great gig.”

Loughead is part…