Main Takeaway

Budget 2027 maintains a fiscally prudent stance with no

broad personal income tax rate cuts, while enhancing

targeted supports for households, business investment

incentives, housing supply and climate action.

The below provides a brief overview of the more relevant

changes that may be of interest to corporate entities followed

by a table providing a general overview of the more significant

tax changes brought in by Budget 2027, across all taxes.

Corporate Tax, Research and Development

(R&D) and Capital Markets

Measures aimed at the corporate sector strategically

reinforce Ireland’s reputation as an innovative base, providing

enhanced incentives for research and supporting capital

market participation for indigenous enterprises.

Impact on Corporate Taxpayers

A central component of the budget’s innovation strategy is

the substantial enhancement of the R&D tax credit. The rate

is being increased from 30% to 35%. This enhancement

provides significant encouragement for both multinational

corporations (MNCs) and indigenous companies to base their

high-value innovation activities in Ireland.

Furthermore, the measure includes vital liquidity and

compliance improvements for smaller claimants.The first-year

payment minimum threshold is being raised from €75,000

to €87,500. This adjustment directly enhances cash flow for

Small and Medium Enterprises (SMEs) engaged in R&D,

accelerating their access to state funding.

Implications for Investors and Investment

Funds

In the financial services sector, stability and technical clarity

are prioritised. The exit tax rate applied to payments made

from Irish funds and equivalent offshore funds to Irish

individual investors has been reduced from 41% to 38%. This

adjustment aims to improve retail participation in investment

funds, as it enhances net returns for non-resident and

domestic investors.

Combined with the unchanged 9% value-added tax (VAT) on

property-related services, Ireland’s fund ecosystem retains

competitive cost structures.

In support of capital markets, a new market cap exemption

threshold of €1 billion is introduced for Irish SMEs and startups

trading on regulated markets. For companies falling below

this threshold, the standard 1% stamp duty charge paid on

share transactions will no longer apply. The SME marketcap

threshold stamp duty exemption is aimed at attracting

increased equity financing for growth companies listed on

regulated markets, bolstering liquidity and investor appetite.

Entrepreneurial Incentives and Capital

Gains

To stimulate entrepreneurial activity and reward risk-takers,

the Capital Gains Tax (CGT) Revised Entrepreneur Relief has

been significantly strengthened. The overall lifetime limit on

gains eligible for the reduced 10% CGT rate is increased

from €1 million to €1.5 million. This 50% increase applies to

qualifying disposals made on or after 1 January 2026. This

policy signals a strong commitment to supporting successful

founders and incentivises them to reinvest their capital within

the Irish economy, thereby promoting further start-up creation

and economic dynamism.

In support of capital markets, a new market cap exemption

threshold of €1 billion is introduced for Irish SMEs and startups

trading on regulated markets. For companies falling below

this threshold, the standard 1% stamp duty charge paid on

share transactions will no longer apply.

This measure is positioned as essential for enhancing the

growth prospects of homegrown businesses, particularly

those seeking to secure funding or scale internationally. The

Key Employee Engagement Programme (KEEP) has also been

extended until the end of 2028.

Conclusion

Although from a personal income tax perspective Budget

2027 has a much more targeted and measured approach

to what we’ve seen in previous years, the enhancements

to R&D incentives, fund taxation and SME reliefs should

hopefully lower effective tax burdens for corporates and

investors, foster greater deal activity in growth sectors

and prop up Ireland’s positioning as a tax-efficient hub for

innovation finance.

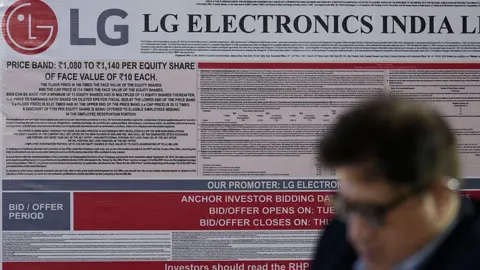

The below table provides a brief summary of the pertinent

tax changes brought in by Budget 2027. We now wait for

the publication of Finance Bill 2026, to see exactly how

these measures will be implemented.

| Tax Area | Measure | Key Change/Rate | Effective Date (or Period) | Potential Impact / Client Action |

| Corporate & SME Tax | Directly or indirectly, individually or in aggregate | Treated as if itself on the Entity List | Same restrictions as parent entity apply | Same restrictions as parent entity apply |

|---|---|---|---|---|

| Unlisted foreign entity owned ≥ 50% by MEU List party | Directly or indirectly, individually or in aggregate |

Treated as if itself is an MEU | Same restrictions as parent MEU entity apply |

|

| Unlisted foreign entity owned ≥ 50% by an SDN* | Directly or indirectly, individually or in aggregate |

Treated as if itself an SDN* | Same restrictions as the SDN owner | |

| Financial Services | Exit Tax (Investment Funds) | Reduced rate on fund payments to individuals | 41% to 38% | Aims to encourage greater retail participation by Irish individuals in domestic investment funds. |

| SME/Start-up Stamp Duty Exemption | New Market Cap Threshold in respect of shares traded on regulated markets. | Up to €1 billion (Exemption applies) | Supports capital market liquidity and growth for indigenous SMEs and start-ups. | |

| Indirect Taxes (VAT & Excise) | VAT on Hospitality/Hairdressing | Reduced rate introduced | 13.5% to 9% (from 1 July 2026) | Significant support for the services sector, aiding more than 150,000 jobs facing cost pressures. |

| VAT on Gas and Electricity | Reduced rate extension | 9% extended until 31 Dec 2030 | Provides long-term certainty and relief on essential energy costs for households and businesses. | |

| Carbon Tax (Auto-Fuels) | Increased rate per tonne of CO2 | €63.50 to €71.00 (from 8 Oct 2025) | Immediate increase in the cost of petrol and diesel; future cost increases for home heating fuels (May 2026). | |

| Tobacco Excise Duty | Increase per packet of 20 cigarettes | +50 cent (from 7 Oct 2025) | Will push the cost of a popular packet of 20 cigarettes towards €19. | |

| Housing Supply & Development | VAT on New Apartments | Reduced sales rate | 13.5% to 9% | Direct reduction in construction costs, intended to lower the final price of new apartment units. |

| Derelict Property Tax (DPT) | New tax to replace Derelict Sites Levy | Rate not < 7%=”” of=”” market=”” value=”” (implementation=”” /> | Allows Revenue to enforce a minimum 7% annual charge on the market value of vacant land. | |

| Employment & Global Mobility | SARP Minimum Income Threshold | Increased threshold | €125,000 (from 2026) | Requires review of all current/planned expatriate assignments; employees below €125k will cease to qualify for the relief. |

| Foreign Earnings Deduction (FED) | Increased maximum relief; Scope widened | €50,000 (from 2026) and now includes Philippines & Turkey | Improves competitiveness for deploying employees to/from expanded market list (Philippines, Turkey). | |

| Company Car BIK Relief (€10k OMV reduction) | Relief Tapering Schedule | €10,000 (2026); €5,000 (2027); €2,500 (2028); Abolished (2029) | Requires immediate review of corporate fleet policies due to rapid BIK relief withdrawal starting in 2027. | |

| Personal Tax (Income & USC) | USC 2% Rate Band Ceiling | Increased by €1,318 (to €28,700) | 1 January 2026 | Provides marginal tax relief for middle-income earners; protects minimum wage earners from moving into the top USC rate band. |

| Rent Tax Credit | Extended (Value remains €1,000 p.a.) | Extended to end of 2028 | Confirms continued cost-of-living support for eligible tenants for three additional years. | |

| Mortgage Interest Relief | Extended (reduced value in final year) | Extended for 2 years (2025 and 2026) | Provides temporary support for homeowners but note the relief value diminishes in 2026. |