ABOARD AIR FORCE ONE (AP) — President Donald Trump headed for Asia for the first time this term, a trip where he is expected to work on investment deals and peace efforts before meeting face-to-face with…

Blog

-

Relive the Commodore 64’s glory days with a slimmer, blacked-out remake

The Commodore 64 is back in black, sort of. Retro Games and Plaion Replai released a limited edition redesign of the best-selling computer, called THEC64 – Black Edition. Like its name suggests, the console is a modernized version of the classic…

Continue Reading

-

Isak ruled out of Liverpool squad; Salah returns to lineup

LONDON — Liverpool striker Alexander Isak is not part of the matchday squad for Saturday’s clash against

Continue Reading

-

Nothing Phone (3a) Lite pops up on Geekbench with key specs, European price and sale date surfaces

The Nothing Phone (3a) series consists of two smartphones – Nothing Phone (3a) and Nothing Phone (3a) Pro. Last week, we heard that these smartphones would be joined by the Nothing Phone (3a) Lite by the end of 2025, and now a French…

Continue Reading

-

Lando Norris leads Lewis Hamilton and George Russell in final practice

Lando Norris topped the final practice session ahead of the Mexico City Grand Prix, the McLaren driver more than three-tenths clear of Ferrari’s Lewis Hamilton as Mercedes’ George Russell completed the top three.

Norris posted his 1m 16.633s with…

Continue Reading

-

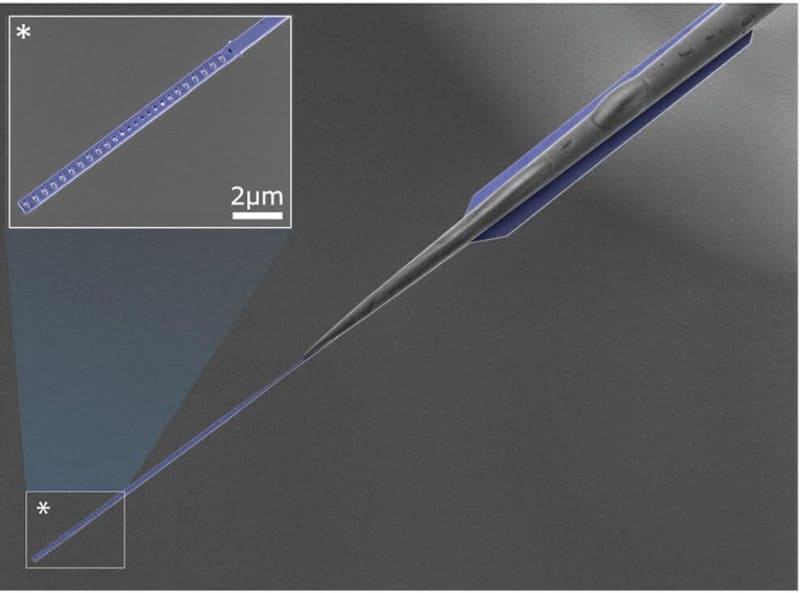

Scientists built a microscopic ‘ocean’ on a silicon chip to study quantum waves

For more than 50 years, scientists have dreamed of seeing the hidden patterns that govern the motion of nonlinear waves—the unpredictable ripples that shape tsunamis, tides, and turbulent flows. Now, a team from the University of Queensland has…

Continue Reading

-

The Bull Case for Meta Platforms (META) Could Change Following AI Layoffs and Infrastructure Shift

-

In the past week, Meta Platforms announced the layoff of about 600 employees from its artificial intelligence and Superintelligence divisions, following CEO Mark Zuckerberg’s push to accelerate AI development after mixed results from recent language model releases.

-

At the same time, Meta is moving forward with major investments in new data centers and infrastructure partnerships, highlighting a clear shift from its earlier focus on the metaverse to artificial intelligence as its central area for growth and efficiency.

-

We’ll examine how Meta’s simultaneous workforce restructuring and expansion of AI infrastructure could reshape its investment narrative heading into earnings season.

AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part – they are all under $10b in market cap – there’s still time to get in early.

To own Meta Platforms, you have to believe its pivot to AI will drive sustained growth in advertising and new revenue streams, while keeping expenses and margin pressure in check. The recent layoffs in Meta’s AI and Superintelligence divisions may streamline decision-making, but do not appear material to the company’s biggest near-term catalyst, successful AI-driven ad monetization, nor to the most important risk, which remains escalating capital expenditure outpacing revenue growth.

Among the latest announcements, Meta’s joint venture with Blue Owl Capital to fund the $27 billion Hyperion data center stands out. This move reinforces Meta’s commitment to AI infrastructure and may help fuel future engagement and advertising gains, tying directly into the company’s main catalyst: enhanced AI-enabled ad performance.

By contrast, what investors should not overlook is how much Meta’s rising data center and AI spending could start to …

Read the full narrative on Meta Platforms (it’s free!)

Meta Platforms’ outlook anticipates $275.9 billion in revenue and $92.1 billion in earnings by 2028. This is based on an expected annual revenue growth rate of 15.6% and a $20.6 billion increase in earnings from the current $71.5 billion.

Uncover how Meta Platforms’ forecasts yield a $863.20 fair value, a 17% upside to its current price.

META Community Fair Values as at Oct 2025 Fair value estimates from 100 Simply Wall St Community members range from US$538 to over US$1,100 per share. Many are closely watching whether Meta’s surge in AI and data center investment translates into sustainable profit growth or places further pressure on cash flows.

Continue Reading

-

-

Shriya Satam wins silver in MMA; Bhoomika Nehate bags 200m bronze

Shriya Satam (MMA) secured a silver while Bhoomika Nehate (200m) finished third in their respective events as India added two medals to their tally at the Asian Youth Games 2025 in Manama, Bahrain on Saturday.

India’s two medals from Saturday…

Continue Reading

-

How Investors May Respond To Arm Holdings (ARM) Expanding AI Chiplet Partnerships in Data Center Infrastructure

-

Astera Labs recently announced a collaboration with Arm Total Design to integrate its Intelligent Connectivity Platform with Arm Neoverse Compute Subsystems, aiming to streamline custom AI infrastructure chiplet solutions for clients seeking multi-protocol connectivity.

-

This move highlights Arm Holdings’ expanding influence across the AI hardware supply chain, signaling growing adoption of its technologies in custom architectures beyond traditional markets.

-

We’ll explore how Arm’s new partnerships in AI data center hardware may impact the company’s long-term investment case and market positioning.

Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

To be a shareholder in Arm Holdings, you need conviction that Arm’s ongoing expansion into AI infrastructure and custom chip solutions can successfully offset potential saturation in its core smartphone markets. The recent Astera Labs collaboration strengthens Arm’s industry partnerships but does not materially change the near-term focus on ramping AI data center design wins as the main catalyst, nor does it resolve the execution risks tied to diversification and rising R&D expenses.

Among recent announcements, the partnership with Astera Labs is the most relevant because it boosts Arm’s ability to embed its Neoverse Compute Subsystems in next-generation AI hardware. This underscores Arm’s growing footprint in custom architectures, directly tying into the current catalyst of gaining AI data center share, even as execution risk, particularly in new, complex verticals, remains front of mind for investors.

Yet, it’s worth contrasting that expanded opportunity with the ongoing risk that major customers could…

Read the full narrative on Arm Holdings (it’s free!)

Arm Holdings’ narrative projects $7.4 billion revenue and $2.3 billion earnings by 2028. This requires 21.5% yearly revenue growth and a $1.6 billion earnings increase from $699 million currently.

Uncover how Arm Holdings’ forecasts yield a $155.61 fair value, a 9% downside to its current price.

ARM Community Fair Values as at Oct 2025 Compared to the consensus, the most optimistic analysts see Arm’s data center share soaring and forecast US$8.6 billion in revenues by 2028. They expect Arm’s industry partnerships and AI momentum could drive revenue and margin acceleration, though emerging competition and rising R&D costs suggest these bullish assumptions might face more volatility. As you weigh your own view, keep in mind just how wide the range of possible futures for Arm could be.

Continue Reading

-

-

TotalEnergies ready to restart $20bn Mozambique LNG project

Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

TotalEnergies is close to restarting one of Africa’s biggest energy projects four years after it was halted by a terrorist attack, with the French group and its partners judging that it is safe to proceed.

The $20bn plan for a liquefied natural gas project in Mozambique has been on hold since 2021 when a deadly attack by Islamist militants in the Cabo Delgado province where the project is located prompted TotalEnergies to activate a contractual get-out, known as force majeure.

On Saturday, Total said that the consortium behind the project had “taken the decision to lift the Force Majeure” and that it had informed the Mozambican government.

The decision is a key step towards resuming a project that has been touted as potentially transformative for Mozambique’s economy. Also backed by Japanese energy company Mitsui, the project will have a maximum capacity of up to 43mn tons of LNG per year.

Mozambique’s government must approve updates to the budget for the project, known as MozambiqueLNG, before it is relaunched, Total added.

MozambiqueLNG has been backed with loans from countries including the US government and is strategically important project for Total, as it seeks to increase its production of LNG.

Following the 2021 attack, Mozambique’s military collaborated with Rwandan forces to restore order to the province, including protecting the Afungi Peninsula where the Total-led project and a $30bn development led by US oil company ExxonMobil are based.

Lifting of force majeure is a positive development for Exxon’s planned project. Last month the company’s chief executive Darren Woods sought reassurances from Mozambican president Daniel Chapo about security of the region.

TotalEnergies move to lift force majeure is a signal that concerns over the safety of employees and the security of the project have eased.

Despite the potential economic benefits of MozambiqueLNG, it has been dogged by controversy, including allegations of human rights abuses by Mozambican soldiers protecting the project.

This year, the FT reported that the UK government was seeking legal advice over how to pull out of its $1.15bn backing for the project, while it has also commissioned a human rights review of the development.

Continue Reading