As a market that has shown steady growth for years, 4X games thrive on its core principles: eXplore, eXpand, eXploit, and eXterminate.

The result is one of the most demanding genres to build, yet also one of the most rewarding: long-term…

As a market that has shown steady growth for years, 4X games thrive on its core principles: eXplore, eXpand, eXploit, and eXterminate.

The result is one of the most demanding genres to build, yet also one of the most rewarding: long-term…

If you are eyeing CME Group stock and wondering whether now is the right time to buy, hold, or maybe wait on the sidelines, you are not alone. Over the past few years, CME has treated its long-term shareholders to a remarkable journey, boasting a 100.4% return over the past five years. Even zooming in, the ride has stayed exciting, with a 15.1% return so far this year and 22.6% over the last twelve months. Some investors might notice the dip of 1.3% in the past week, raising questions about whether new developments such as the company’s plan to launch sports contracts by the end of the year are already baked into the price or are hinting at shifting risk perceptions in the market.

Of course, price action is only half the story. Analysts have recently adjusted their expectations; UBS even trimmed its price target slightly, despite raising estimates, reflecting a bit more caution about future outlook. Meanwhile, CME’s latest venture into sports contracts could open fresh revenue streams, especially as it wades deeper into prediction markets alongside big names in the industry. With competitors watching closely and industry partnerships evolving, the question is not just whether CME Group’s stock can keep climbing, but whether its current valuation really stacks up against its prospects.

When we run CME Group through our 6-factor valuation check, it scores a 1 out of 6 for being undervalued, so not a screaming bargain at first glance. But before jumping to conclusions, let’s break down what those valuation measures really mean and see if there is a more insightful way to judge what CME is worth in today’s market.

CME Group scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

The Excess Returns valuation approach examines how well a company generates returns above its cost of equity. Instead of focusing simply on earnings or cash flows, it measures the value created over and above what shareholders expect as a return for their capital. For CME Group, recent analyst estimates suggest its book value stands at $77.13 per share, while its expected stable earnings per share are $12.28, based on a weighted average of future Return on Equity projections from eight analysts.

With a cost of equity set at $6.41 per share, CME achieves an excess return of $5.87 per share. This translates to an impressive average Return on Equity of 15.56%. The model also references a stable book value projection of $78.88 per share, built from assessments by five different analysts. These figures together inform a valuation model designed to capture the company’s ability to unlock value well into the future, rather than reflecting just short-term profits.

Yuki Tsunoda has hit out at Liam Lawson for “always doing something on purpose” after complaining of being blocked by the Racing Bulls driver in Qualifying for the United States Grand Prix.

Tsunoda and Lawson have been involved in a number of…

The world of botany is usually pretty good at following certain rules. It was previously thought that because the Fibonacci sequence is present in the structure of so many extant plant species, it must have evolved in some of the earliest…

Best viewing under moonless skies from 1 a.m. to dawn

Each October, Earth passes through the inbound debris stream of Halley’s Comet, producing the annual Orionid Meteor Shower. The outbound portion of this same debris trail…

FRISCO, Texas — Donovan Ezeiruaku never went more than two games last year at Boston College without a sack. He is six games into his Dallas Cowboys career, and the second-round defensive end is still looking for his first sack as a…

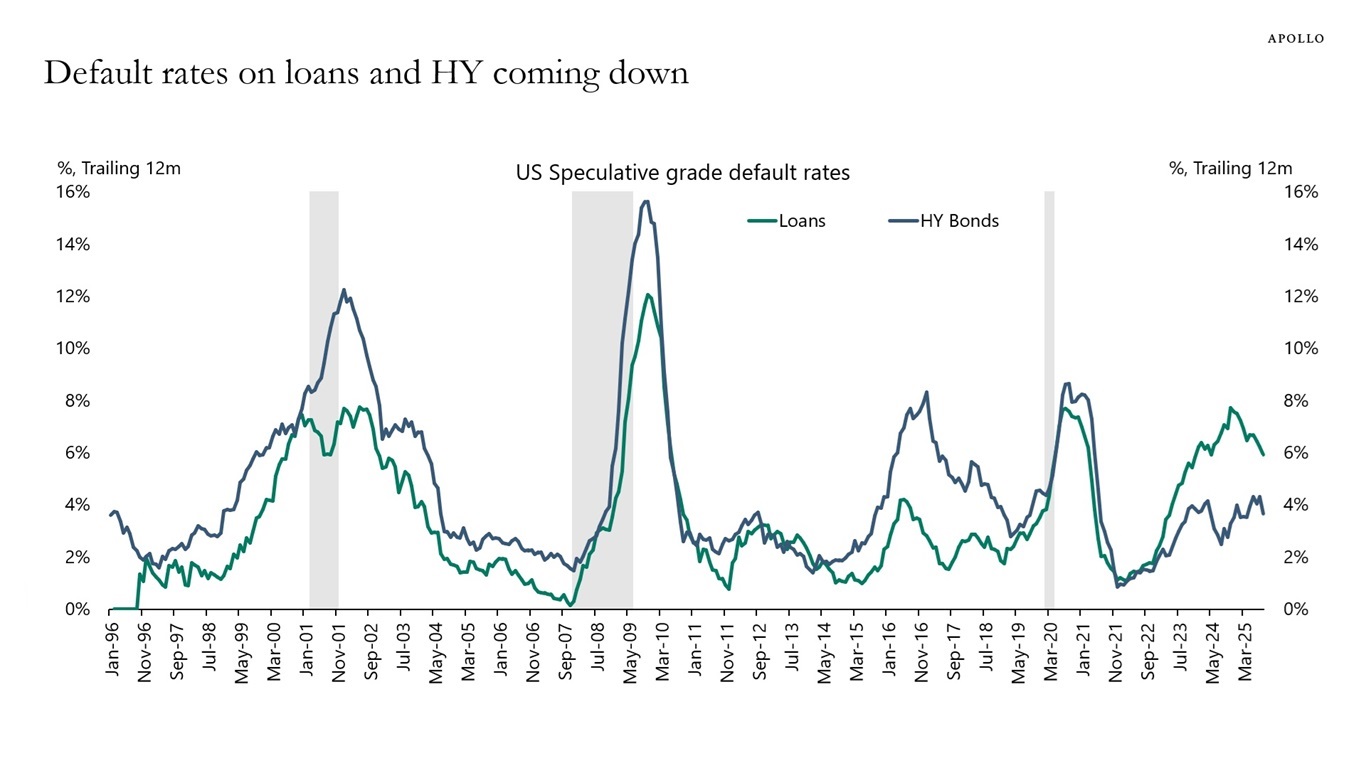

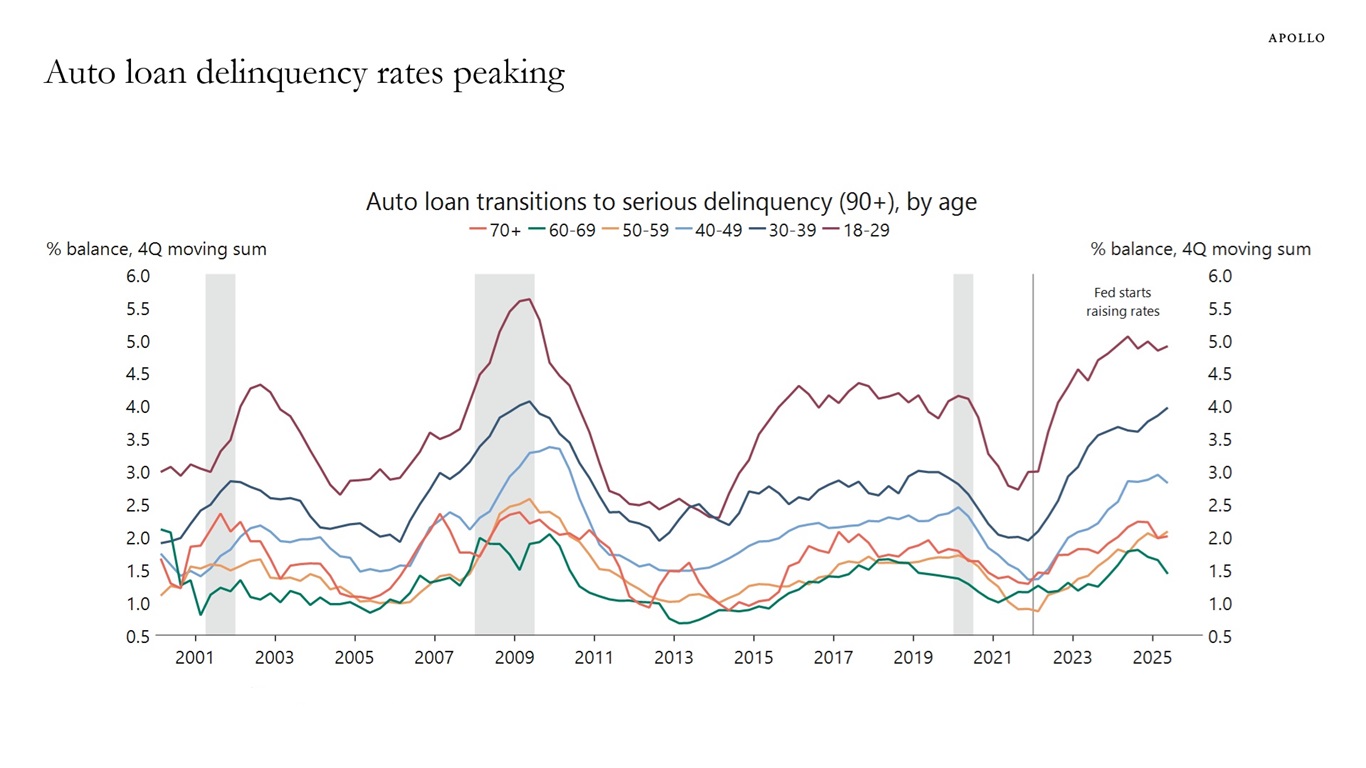

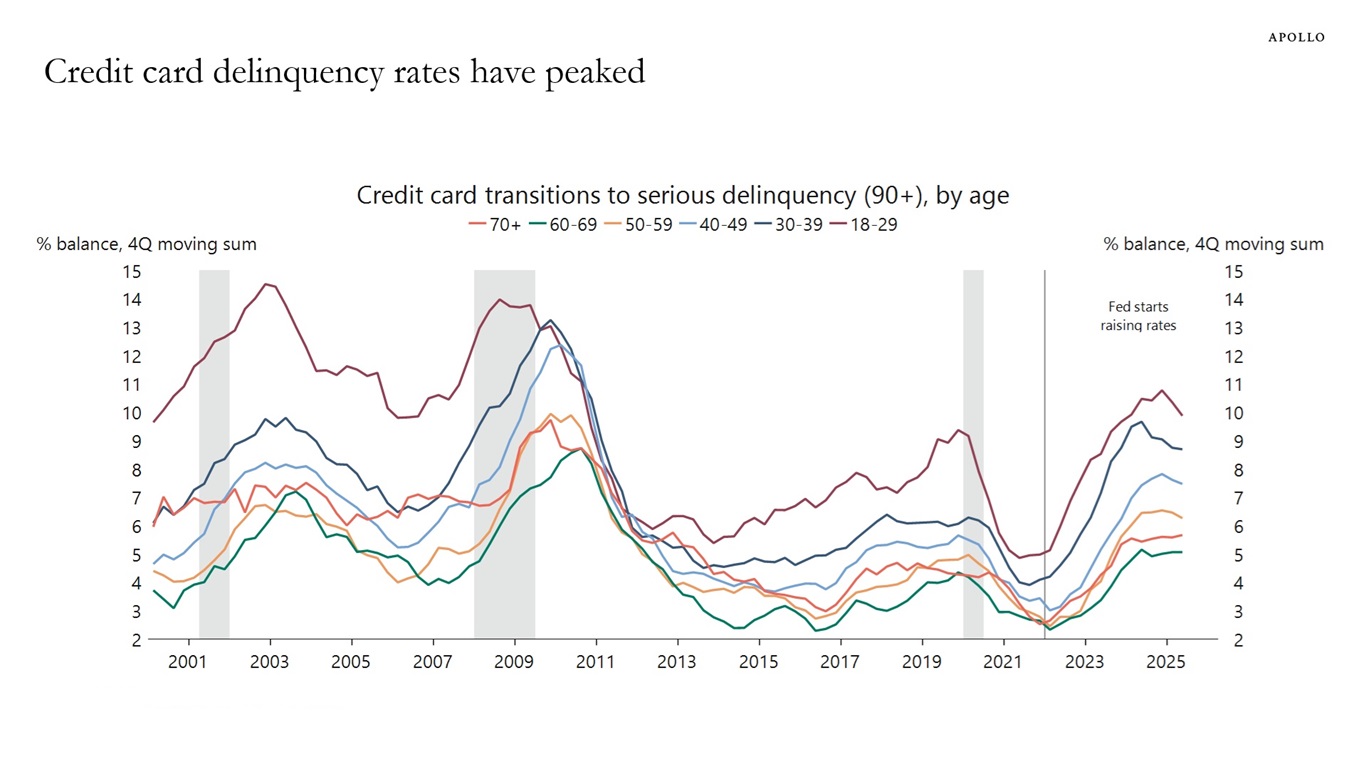

Contrary to widespread fears about the economic outlook, key credit indicators are turning more bullish. Default rates for high yield debt and loans have peaked, along with delinquency rates for auto loans and credit cards, see charts below.

Three factors explain why corporate default and consumer delinquency rates are moving lower:

1) Uncertainty related to the trade war is significantly lower than its peak during Liberation Day.

2) The ongoing AI boom is boosting the buildout of data centers and related energy infrastructure. Simultaneously, higher stock prices are supporting consumer spending.

3) Investors are increasingly recognizing that we are in the early stages of an industrial renaissance across sectors like aerospace, defense, manufacturing, biotech and technology/automation.

In summary, while the trade war remains a mild drag on growth, its impact is being more than offset by the tailwinds from the AI boom and the industrial renaissance. Consequently, there is a growing upside risk that economic growth will reaccelerate over the coming quarters.

Download high-res charts

This presentation may not be distributed, transmitted or otherwise communicated to others in whole or in part without the express consent of Apollo Global Management, Inc. (together with its subsidiaries, “Apollo”).

Apollo makes no representation or warranty, expressed or implied, with respect to the accuracy, reasonableness, or completeness of any of the statements made during this presentation, including, but not limited to, statements obtained from third parties. Opinions, estimates and projections constitute the current judgment of the speaker as of the date indicated. They do not necessarily reflect the views and opinions of Apollo and are subject to change at any time without notice. Apollo does not have any responsibility to update this presentation to account for such changes. There can be no assurance that any trends discussed during this presentation will continue.

Statements made throughout this presentation are not intended to provide, and should not be relied upon for, accounting, legal or tax advice and do not constitute an investment recommendation or investment advice. Investors should make an independent investigation of the information discussed during this presentation, including consulting their tax, legal, accounting or other advisors about such information. Apollo does not act for you and is not responsible for providing you with the protections afforded to its clients. This presentation does not constitute an offer to sell, or the solicitation of an offer to buy, any security, product or service, including interest in any investment product or fund or account managed or advised by Apollo.

Certain statements made throughout this presentation may be “forward-looking” in nature. Due to various risks and uncertainties, actual events or results may differ materially from those reflected or contemplated in such forward-looking information. As such, undue reliance should not be placed on such statements. Forward-looking statements may be identified by the use of terminology including, but not limited to, “may”, “will”, “should”, “expect”, “anticipate”, “target”, “project”, “estimate”, “intend”, “continue” or “believe” or the negatives thereof or other variations thereon or comparable terminology.

Max Verstappen secured pole position for the United States Grand Prix, backing up his lights-to-flag victory in the Sprint, despite a timing error from Red Bull denying him a second timed effort in Q3.

The four-time World Champion set a 1m…

RAWALPINDI, Pakistan (AP) — World test champion South Africa will be heavily relying on its fit-again spinner Keshav Maharaj to level the two-test series against Pakistan as yet another dry pitch is…