Sanae Takaichi created history on Oct. 21, winning Japan’s parliamentary vote to become the country’s first women prime minister.

Philip Fong | Afp | Getty Images

Sanae Takaichi on Tuesday created history, winning Japan’s parliamentary vote to…

Sanae Takaichi created history on Oct. 21, winning Japan’s parliamentary vote to become the country’s first women prime minister.

Philip Fong | Afp | Getty Images

Sanae Takaichi on Tuesday created history, winning Japan’s parliamentary vote to…

Christopher Mahon is head of Dynamic Real Return in Multi-Asset Investing at Columbia Threadneedle Investments

At the Bank of England’s September meeting, the Monetary Policy Committee voted to continue with its policy of active QT, albeit in a reprofiled form. This was a disappointment.

As a reminder the BoE has been selling the bonds it accumulated during quantitative easing. Most other central banks are content to passively let their bonds mature.

Gilt sales have totalled £107bn so far. Investors say this has driven up borrowing costs and is pressuring public finances. Active QT may ultimately increase debt servicing costs by between £16-£60bn.

So, let’s take a look at the arguments for active QT. Spoiler — none pass the smell test today.

1) To shrink the balance sheet so ‘we can be ready next time’

The Bank calls this “increasing the headroom and flexibility” so that it can respond to a crisis in the future.

The BoE has so far shrunk its balance sheet by over £330bn. In nominal terms, this gives it room to do a Brexit-sized stimulus (£60bn), the original GFC-sized stimulus (£200bn) or, if counting in terms of BoE balance sheet-to-GDP, a pandemic-sized stimulus should it need.

Whether the Treasury would allow a repeat is another question. Cumulative losses of £133bn might give policymakers pause for thought.

The BoE argues it needs to go further. The headroom will naturally increase, as the bonds themselves mature. But why does it still need to use active QT to get there faster?

2) Because the BoE holdings have a particularly long maturity profile

The BoE has argued that because its bonds have a longer maturity profile than other central banks, it can’t rely on passive QT alone. And it’s true that if active QT was ruled out, the Bank’s balance sheet would shrink more slowly than other central banks.

But the BoE isn’t just matching other central banks’ QT pace, it’s going faster — about twice as fast as the Fed and the ECB. If matching the pace of other central banks was the reason, the BoE could recalibrate with fewer gilt sales.

3) The size of the balance sheet is an inflation risk

Selling gilts tightens monetary conditions and so could help control inflation. But does it work?

The theory is weakened by a maturity mismatch in the BoE QE programme. For instance, UK household borrowings tend to be unusually sensitive to short term rates (think 2-5-year fixed rate mortgages versus 30-year rates in America).

So, the transmission mechanism to the UK economy from the BoE buying a 30-year or 50-year gilt was weak and opaque. If one is using active QT to tighten policy, the same flaw applies in reverse. The transmission mechanism from selling a 30-year gilt is weak and opaque.

For real world evidence consider this: the BoE is running the most aggressive QT programme but comfortably has the G7’s highest inflation rate. This is hardly an advertisement for the inflation busting credentials of active QT.

4) To exit a QE programme in the least costly way

There are times when active QT is the most financially effective way to bring a QE programme to an end. Today is not one of them. To understand why, let’s recap how QE works.

Under QE, a central bank swaps bonds for interest-bearing bank reserves. This worked well in 2009 when rates were close to zero — and locking in a 3 per cent yield on a 30-year bond looked attractive.

As time went by, the trade became less attractive. By 2021, the BoE was buying gilts even when yield was down at 0.5 per cent. The “spread” between cash and gilts had become negligible.

Fast forward to today, with cash rates at 4 per cent, those trades are deeply underwater. Most of this is a sunk cost the country will never get back. But a small part is not. To distinguish the two, we must stop focusing on book cost and start thinking about the market value the Bank receives when it auctions off its gilt holdings.

Take the 0.5% 2061 gilt. Since the BoE first bought it, the price has fallen from £101 to £25. As such, it now yields just over 5 per cent. Will this gilt earn its keep when cash rates are 4 per cent? Probably, yes. But how about over the long term?

For a central bank with the ability to hold to maturity, what matters is whether the yield on the bonds is greater than the likely average of the cash rates it will pay on reserves. Roughly speaking, the expected cost of finance for the Bank to hold a 30- or 50-year gilt should be similar to the neutral (or equilibrium) rate.

The Fed’s dot plot shows the longer-term rates expected in the US. The Bank of England does not publish an equivalent, but their comments suggest UK neutral is near 3 per cent. A range of 2-4 per cent more than covers our bases.

When the BoE first mooted active gilt sales back in May 2022, gilts yielded less than 2 per cent. Active QT made perfect sense as the gilts paid less than the neutral rate.

But today gilts yield far more than any realistic neutral rate. To a central bank these are lowball prices. Taxpayers would probably thank them for cancelling further gilt sales.

5) To help your chancellor hit her golden rules

There is one taxpayer who might not thank the Bank for ending gilt sales: the chancellor.

This is because ongoing interest rate losses are treated differently from losses crystallised when they sell a bond in the government’s fiscal rules.

Gilt sales end up being a little bit helpful for those targets — even if it ends up hurting taxpayers in the long term.

The Bank itself — rightly — does not use this logic. Giving taxpayers a worse outcome to help the political needs of the Chancellor of the day would be a terrible reason to continue active QT.

Back in 2021, the House of Lords accused the Bank of showing QE “in a more positive light than the academic literature”. Today, the Bank appears to be underplaying the role of active QT on yields compared to independent research and has turned off the usual survey questions it could use to canvas alternative opinions from market participants. I’ve previously coined this behaviour “the incurious MPC”.

Implicit in the decision to scale back long end gilt sales is an admission that the previous approach was wrong. It’s an admission that there are trade-offs: speed of QT versus gilt yields and costs to taxpayers.

Being open about these trade-offs means changing the orthodoxy famously expressed by Sir Dave Ramsden, the Bank’s Deputy Governor for Markets and Banking, when he said that “decisions about the scale, pace and composition of QT were not and will not be affected by value-for-money considerations”. Likewise, the MPC is clear — it takes neither profit nor financial risk into account when making decisions around QE/ QT.

This Bank orthodoxy risks being seen as an ‘ivory tower’. Carefully assessing value-for-money (without political interference) would not undermine BoE independence, as the Bank claims. It would reinforce the BoE’s core mission of “promoting the good of the people of the UK”, which includes aiding long-term financial stability.

Failing to consider ‘financial risk’ has helped the Bank build a QE programme that has generated losses four times larger than the Fed’s, when scaled as a share of GDP. This is not helpful to the Bank’s mission of aiding long-term financial stability.

One tiny glimmer of hope? Calls to halt active QT are coming from ever-wider circles. And the Bank itself has had its first split vote on QT. Maybe — just maybe — their orthodoxy is creaking. It’s time for it to crack.

The author manages multi-asset portfolios some of which have benchmarks or allocations that include gilts. He is currently “neutral” on the allocation.

Charlotte Chess Center

Charlotte Chess CenterUS chess grandmaster and online commentator Daniel Naroditsky has died aged 29.

The popular chess player’s family announced…

At 42, Tong Liya has returned to a stage that once defined her dreams — this time, as a dancer.

After years of focusing on her acting career, she…

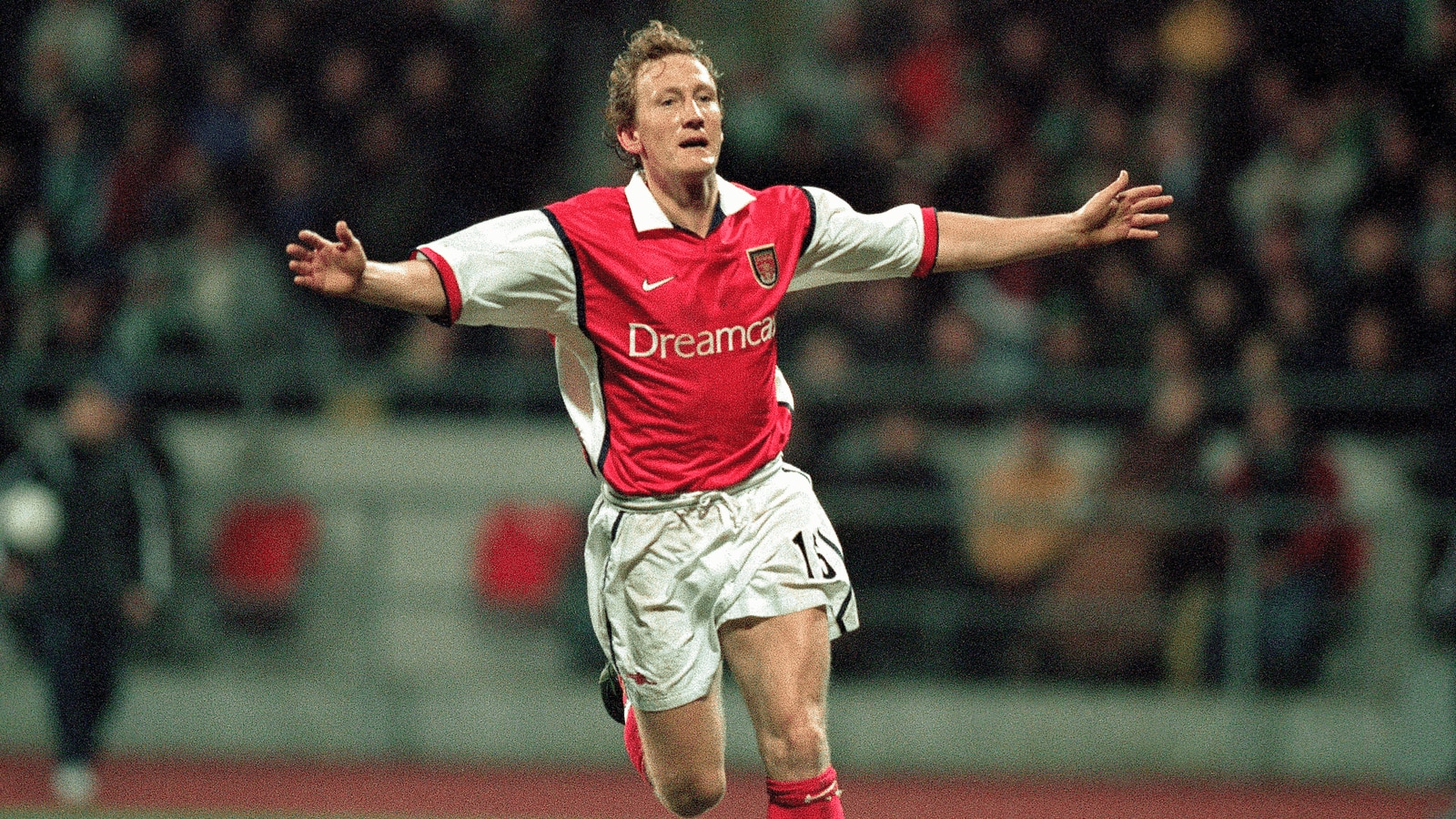

In his early seasons as an Arsenal player, Ray Parlour watched on as the Gunners competed in the 1991/92 European Cup and then won the UEFA Cup Winners’ Cup in 1993/94.

After making his Arsenal debut against Liverpool on January 29, 1992, Ray’s…

CLEVELAND, Ohio (Oct 21, 2025)—Menopause may take a toll on women physically and emotionally due to declining estrogen levels. For some, the use of hormone therapy has proven valuable in managing bothersome menopause symptoms. A new…

Hot on the heels of the rebirth of Joe Musashi and Sega’s Shinobi series, yet another famed ninja is back from the dead: Ryu Hayabusa returns with an all-new adventure in Ninja Gaiden 4, the first mainline…

With works by Karl-Heinz Adler, Tina Bara, Horst Bartnig, Nadja Buttendorf, Carlfriedrich Claus, Karl Clauss Dietel, Georg Eckelt, Antye Guenther, Su Yu Hsin, Margret Hoppe, Francis Hunger, knowbotiq, Irma Markulin, Helga Paris, A. R. Penck,…