By Joe Sothcott & Robyn Walker

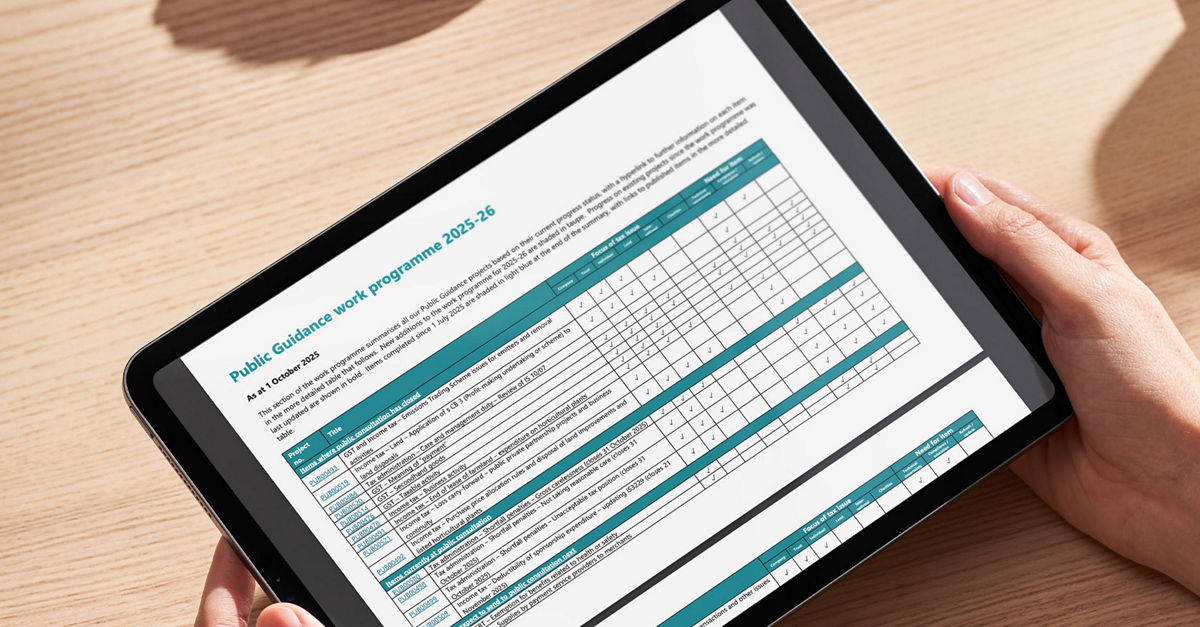

The Public Guidance Work Programme is a frequently overlooked yet invaluable publication produced by the Inland Revenue’s Tax Counsel Office. The Tax Counsel Office (TCO) is responsible for determining the Commissioner of Inland Revenue’s view on the tax laws and provides advice on tax technical matters, as well has having some oversight as to how tax laws are implemented within in the Inland Revenue.

The Work Programme tracks the status of priority interpretation items under development. With the latest update published on 1 October 2025 we take a look at what’s currently included, what’s missing, how it’s compiled, and what new items have been added.

What Is the Public Guidance Work Programme?

The Work Programme currently includes only items issued by the TCO, specifically:

- Interpretation statements – These set out the Commissioner’s view on how tax law applies to broader areas of tax. (Items finalised in year to September 2025: 22)

- Questions we’ve been asked (QWBAs) – Short-form guidance responding to specific, practical questions raised by taxpayers or advisors. (Items finalised in year to September 2025: 20)

While both are non-binding, they are considered authoritative and are widely relied upon by taxpayers and advisors.

The Work Programme does not include items produced by the Technical Standards team, such as:

- Standard practice statements (Items finalised in year to September 2025: 0)

- Operational statements (Items finalised in year to September 2025: 5)

- Commissioner’s statements (Items finalised in year to September 2025: 0)

- Kilometre rates for motor vehicle expenses (annually published)

- Determinations (Items finalised in year to September 2025: 17)

For example, the Draft Standard Practice Statement on Mutual Transactions of Associations (ED0265) is not listed in the Work Programme. Deloitte understands that, after public consultation over the draft guidance, the item is now on hold pending referral to Inland Revenue’s Policy team for a potential policy change.

Deloitte’s view is that all public guidance items, whether from the TCO Office or the Technical Standards team, should be published in a single consolidated work programme. This would improve transparency and make it easier to identify when items are on hold pending policy consideration.

How Is the Work Programme compiled?

The Work Programme includes:

- Consultation items—including those scheduled to begin consultation, currently under consultation, or where consultation has recently closed.

- Pre-consultation items in development or not yet started

- Items currently on hold

Transparency is the underlying principle of the Public Guidance Work Programme. TCO refreshes the Work Programme annually, and prior to each refresh, it invites public submissions on technical issues, gaps in existing guidance, and emerging areas of uncertainty. Submissions generally can be made via email or via an Inland Revenue form. Keep an eye out around mid-2026 for the next opportunity to contribute submissions for the Work Programme.

Once submissions are received, the TCO evaluates them based on:

- Importance of the issue

- Level of uncertainty or ambiguity

- Number of taxpayers affected

- Need to resolve existing issues

- Potential revenue implications

A draft Work Programme is then prepared and circulated to key stakeholders for feedback (including on relative priority) before the final version is published.

What’s new in the 2025–26 Work Programme?

The refreshed Work Programme includes a long list of new items:

- PUB00523: Income tax and GST – associated persons

- PUB00524: GST – B2B loyalty schemes

- PUB00525: GST – Compulsory zero-rating of land – update of IS 17/08

- PUB00526: GST – Concurrent land use

- PUB00527: GST – Financial services – custodian, supervisor and trustee fees

- PUB00528: GST – Financial services – planning fees – refresh of IS0052

- PUB00529: GST – Goods and services acquired for $10,000 or less

- PUB00530: GST – Types of unincorporated bodies

- PUB00531: Income tax – B2B loyalty schemes

- PUB00532: Income tax – deductions – financial planning fees – refresh of IS0044

- PUB00533: Income tax – Depreciation – low value assets

- PUB00534: Income tax – Intra-group dividends – s CD 27

- PUB00535: Income tax – Losses – business continuity and part year losses

- PUB00536: Income tax – NZ custodians’ ‘top-up’ amount of RWT

- PUB00537: Income tax – Retention money and performance bonds under construction contracts – update of QB 13/04

- PUB00538: Income tax – Schedular payments – withholding obligations under Sch 4, Part F

- PUB00539: Income tax – Share lending issues

- PUB00540: Income tax – Transferable development rights

- PUB00541: Income tax – Trusts – interest deductibility

- PUB00543: Income Ttax – FIFs – whether cost and CV methods can be used concurrently

- PUB00544: Income tax – When is a trustee a bare trustee

- PUB00545: GST – Fees of board members appointed by the Governor-General or Governor-General in Council

Some taxpayers may understandably have trepidations about a few of the items and whether they may open a pandora’s box where interpretation doesn’t match reality, in light of the open-loop gift cards debate that arose from the publication of QB 25/07: What is the income tax treatment of gift cards and products provided as trade rebates or promotions? Other items, such as guidance on often misunderstood areas, like how taxpayers can apply the 100% depreciation rate for low value assets under section EE 38, will be more welcome.

Want to suggest an Item?

We understand that raising issues for inclusion in the Work Programme can feel daunting—especially if there’s concern it might attract unwanted scrutiny. For those may feel uneasy about contact the TCO direct, Deloitte is always happy to raise issues on behalf of clients. If you have questions or would like to discuss a potential submission, please reach out to your usual Deloitte advisor.