A number of economies in sub-Saharan Africa have seen

inflationary pressures wane in recent months amid currency

appreciation versus the US dollar. In turn, this is allowing

central banks to lower interest rates, helping business activity in

the region to expand solidly. PMI® data and the anecdotal evidence

provided by our survey respondents can help to illustrate the

impact of currency movements.

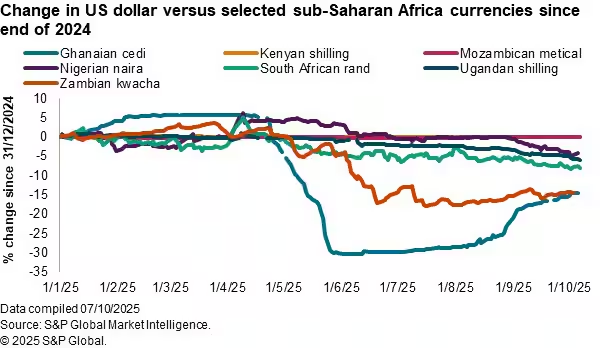

Range of currencies gain versus the US dollar in 2025

Of the seven economies in sub-Saharan Africa for which S&P

Global compile PMI surveys, five have seen currency appreciation

against the US dollar over the course of 2025 so far. While this to

some extent reflects the weakness of the dollar itself this year,

there have also been positive factors supporting local currencies,

including support from IMF programmes, fiscal consolidation and

tight monetary policy.

In particular, the Ghanaian cedi and Zambian kwacha have each

appreciated by 15% against the US dollar in 2025 so far, while the

South African rand and Nigerian naira have also seen gains.

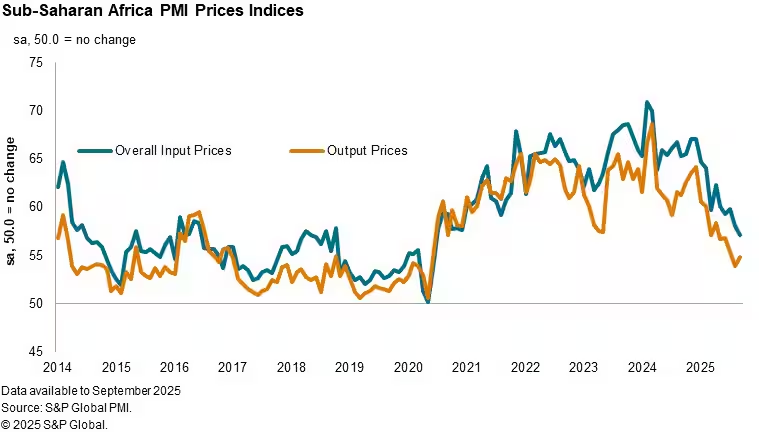

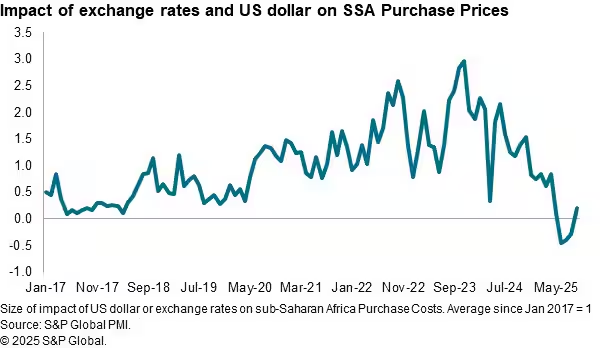

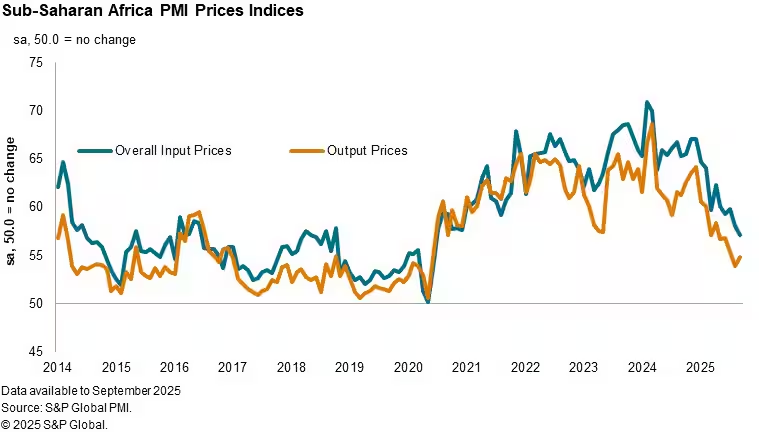

Currency appreciation has contributed to a sustained easing of

inflationary pressures in the sub-Saharan Africa business sector.

PMI data showed that overall input costs increased at the slowest

pace since the COVID-19 pandemic in September. While selling prices

rose at a slightly faster pace than in August, here too the pace of

inflation was among the weakest in the past five years.

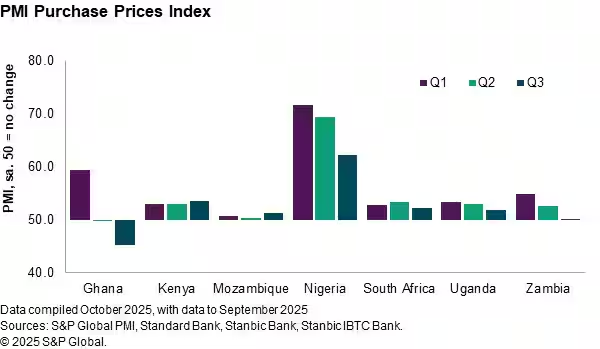

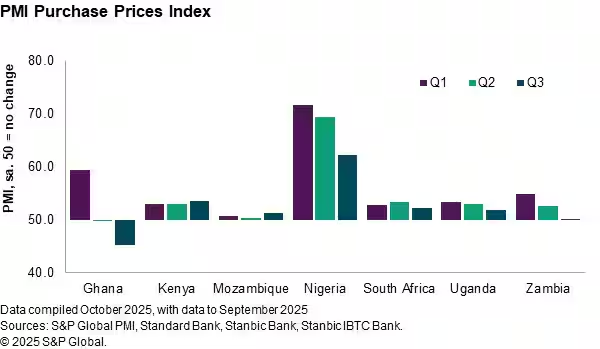

Country level PMI data show that most of the economies we cover

in sub-Saharan Africa have seen either a slowdown in inflation of

purchase costs or outright falls in prices over the course of 2025.

Those countries seeing the strongest currency appreciations against

the US dollar – Ghana and Zambia – have recorded periods of

decreasing purchase prices. Such price falls are rarely seen among

the sub-Saharan Africa PMIs, which normally suffer from marked

inflationary pressures. Even Nigeria, where purchase costs

continued to rise sharply during the third quarter, posted the

weakest pace of inflation since March 2020.

Survey comments highlight impact of currency gains

Anecdotal evidence from our PMI surveys can help us to see what

is driving the drop in price pressures in the region, with comments

from panellists highlighting the impact of currency appreciation on

purchase costs.

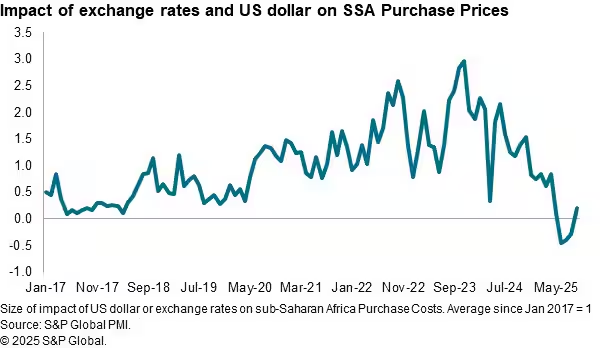

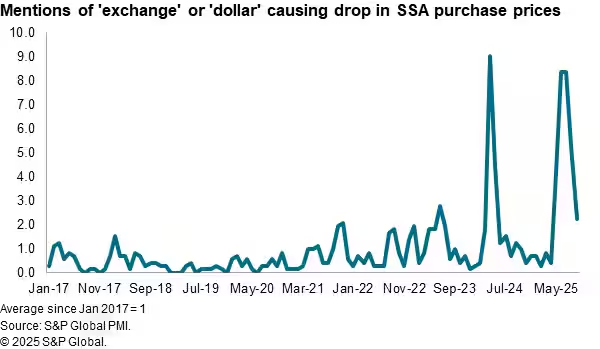

Normally we see any references to exchange rates or the dollar

being linked to rises in purchase prices as downward pressure on

local currencies feeds through to higher costs for imported items

and those priced in dollars. But between June and August this year

we recorded more mentions of these factors pushing down

prices rather than lifting them; the only time this has been the

case since we have had the full complement of seven sub-Saharan

Africa PMI surveys.

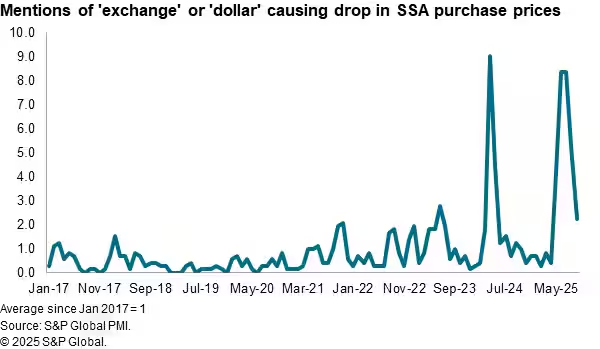

Similarly, recent months have seen above-average mentions of

either exchange rates or the dollar causing a drop in purchase

prices, to a degree second only to that seen in April 2024, when

firms in Kenya were responding to a substantial appreciation of the

shilling against the US dollar.

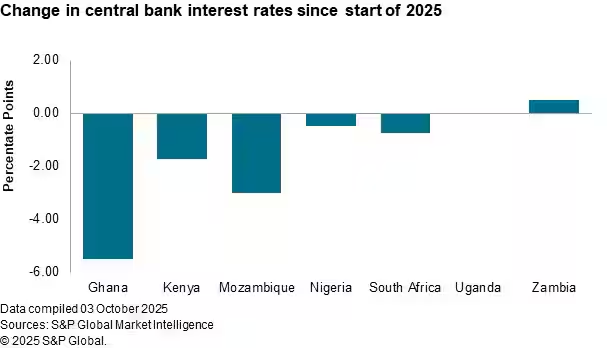

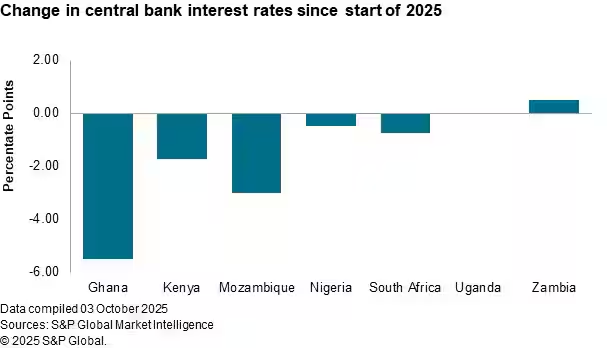

Central banks lower interest rates amid waning inflation

Easing inflationary pressures have enabled central banks across

much of the region to lower their interest rates over the course of

2025. Of the seven economies we cover, five have lower levels of

interest rates now than at the start of the year. Most notably is

Ghana, where the central bank has cut rates by 650 basis points in

the past two meetings. Interest rates in Uganda are at the same

level as they were at the start of 2025, while only Zambia has

posted an increase. Here though, S&P Global Market Intelligence

expects a cut of 50-100 basis points at the upcoming November

monetary policy committee meeting.

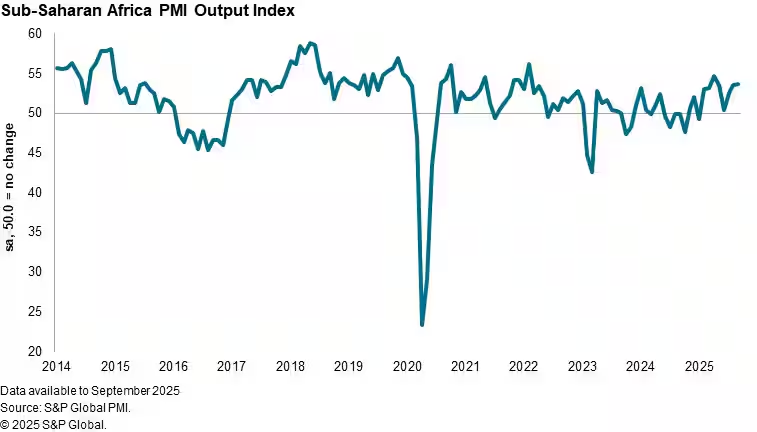

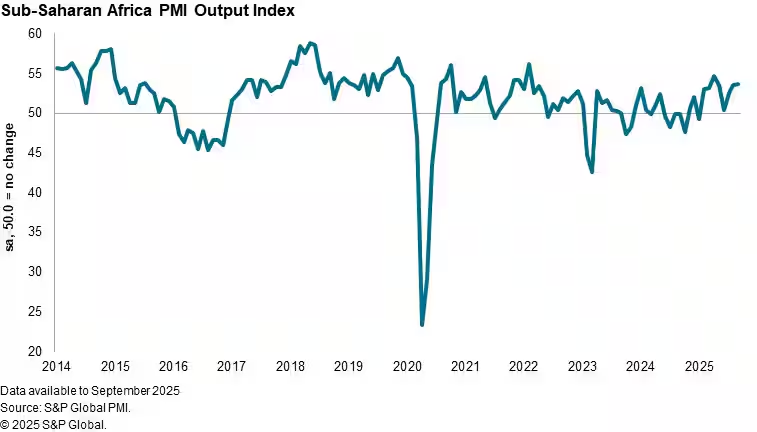

Output rises solidly at end of third quarter

The softening inflation environment has coincided with a period

of solid growth in the sub-Saharan Africa private sector. September

saw output increase at the fastest pace in five months in response

to higher inflows of new orders. Employment rose for the twelfth

month running, while firms increased their purchasing activity and

inventory holdings.

Most notably, the Stanbic Bank Zambia PMI signalled the fastest

rise in business activity since June 2023, while Stanbic Bank PMI

data for Kenya signalled a return to growth following mid-year

disruptions caused by protests. The only economy covered by PMI

data to see a drop in output during September was Ghana, but even

here new orders expanded and business confidence remained elevated,

meaning that we could potentially see renewed growth in the months

ahead.

Overall, the sub-Saharan Africa private sector enters the final

quarter of the year on a solid footing, in part at least due to the

currency gains seen over the course of 2025 so far.

Access the global PMI press releases.

Andrew Harker, Economics Director, S&P Global Market

Intelligence

Tel: +44 134 432 8196

andrew.harker@spglobal.com

© 2025, S&P Global. All rights reserved. Reproduction in

whole or in part without permission is prohibited.

Purchasing Managers’ Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

Learn more about PMI data

Request a demo

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.