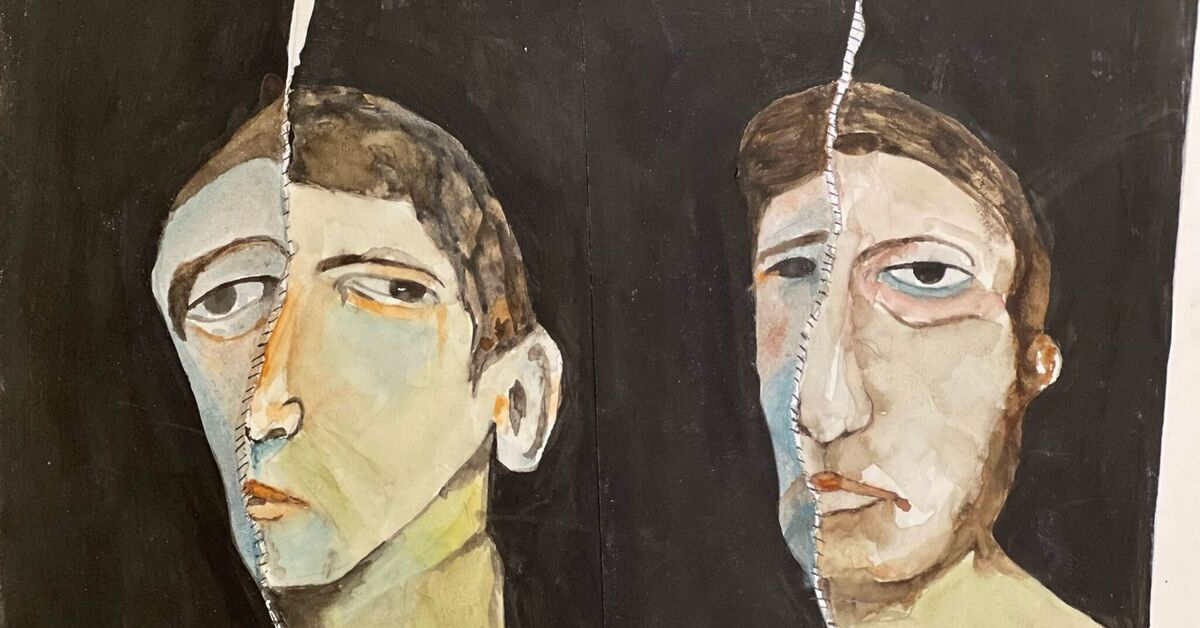

Even before starting a tour of Gaza Biennale — The Istanbul Pavilion, its curator warned that this is no ordinary biennial. Indeed, it is quite the opposite.

“The biennial is one of the most colonial inventions in contemporary art,” said…

Even before starting a tour of Gaza Biennale — The Istanbul Pavilion, its curator warned that this is no ordinary biennial. Indeed, it is quite the opposite.

“The biennial is one of the most colonial inventions in contemporary art,” said…

Ontario to stop running advertisement featuring voice of US President Ronald Reagan saying that trade tariffs were a bad idea.

Published On 25 Oct 2025

The Canadian province of Ontario has…

Alice CullinaneWest Midlands

Darby Hutchby

Darby HutchbyWhen Darby Hutchby was studying visual communication at university in 2017, artificial intelligence (AI) was a…

An exhibition by an artist widely regarded as one of Britain’s greatest landscape painters opens later in Liverpool.

For the next four months, the Walker Art Gallery will feature the work of JMW Turner and his enduring impact on later generations.

Continue Reading

This request seems a bit unusual, so we need to confirm that you’re human. Please press and hold the button until it turns completely green. Thank you for your cooperation!

Enova International (ENVA) delivered a 62.4% gain in earnings for the past year, rebounding from an annual decline of 12% over the previous five years. Net profit margins climbed to 20.7%, improving from last year’s 15.4%, and revenue is projected to surge 39.6% per year, outpacing the broader US market’s 10% forecast. With high-quality earnings, accelerating profits, and earnings projected to rise another 13.9% annually, investors are taking stock of Enova’s momentum. The share price of $124.70 currently trades above the estimated fair value of $71.01.

See our full analysis for Enova International.

Next, we will see how this performance compares with the broader narratives that investors and analysts are discussing. Sometimes the numbers shake things up, and sometimes they settle the debate.

See what the community is saying about Enova International

Analysts estimate profit margins will contract from 18.8% now to just 7.5% in three years, even as revenue is expected to grow by 60.7% per year through the same period.

According to the analysts’ consensus view, Enova’s technology-driven risk controls and digital platform have supported high margins so far.

However, they debate whether volume gains can continue to offset anticipated pressures from rising regulatory scrutiny, competitive threats, and changing consumer preferences.

This margin squeeze could test the bullish thesis that the company’s underwriting edge and online-only business model will protect profitability over time.

Relatively high current net profit margins of 20.7% remain above last year’s 15.4%, but analysts expect that industry pressures and evolving regulation could challenge Enova’s ability to sustain these levels moving forward.

The consensus narrative flags Enova’s use of advanced AI and real-time analytics for credit risk, enabling rapid adaptation and supporting lower default rates as a key strategic advantage.

Analysts’ consensus view points to the company’s growing share in small business lending, where segment diversification and digital scaling are delivering record origination and consistent credit performance.

This strengthens the argument that Enova can outpace traditional lenders, especially as more customers prefer the speed and convenience of digital-only offerings.

However, expansion into these segments may also bring increased competition from both banks and fintechs, making ongoing technology investment crucial to protecting margins.

Enova’s 10.6x Price-to-Earnings ratio is well below its peer average of 19.8x, though shares at $124.70 currently trade substantially above DCF fair value of $71.01, exposing a 75% premium to fair value and a 7% discount to the analyst price target of $133.63.

Analysts’ consensus view notes this market premium reflects both recent growth outperformance and optimism that digital efficiency and scaling can drive upside.

Yet the valuation gap to fair value remains a watch item, especially as growth normalizes and the company faces sector headwinds not fully captured in current sentiment.

Bulls may argue that Enova’s faster-than-market growth track and tech edge justify the multiple, while skeptics cite margin forecasts and calls for caution on future returns.

With a share price exceeding calculated intrinsic value but remaining below the analyst target, the next stage of the story turns on whether the company can deliver on both its technology edge and profit forecasts to close the valuation gap. See how the bull and bear cases stack up in the community’s narrative for Enova: 📊 Read the full Enova International Consensus Narrative.

Eleanor LawsonWest Midlands

Lee Allen

Lee AllenWith budget cuts, libraries closing and a report showing

Carles Reina, GTM manager at Eleven Labs, shared why he invested in AI company.

Eleven Labs

The angel investor who backed a billion-dollar AI startup when it was still in its infancy said he decided to invest in the company after just 30 minutes of meeting one of its founders.

Carles Reina first decided to invest in AI voice startup Eleven Labs in 2022, when he was a venture partner at pre-seed fund Concept Ventures.

Co-founded in 2022 by Mati Staniszewski and Piotr Dąbkowski, Eleven Labs specializes in advanced text-to-speech and voice cloning technology. In its January Series C funding round earlier this year, the company raised $180 million at a valuation of $3.3 billion.

Then in September, the company announced it was letting employees sell shares at a $6.6 billion valuation.

However, before Eleven Labs even had a concrete product, Reina, who was working at Palantir Technologies at the time, decided to take a chance on the firm after meeting Staniszewski.

“I met Mati when he was still at Palantir,” Reina told CNBC Make It in an interview. “We started talking, and within 30 minutes of the first conversation, I told him, ‘How much money do you want?’”

Reina explained that before the launch of ChatGPT, voice AI hadn’t garnered much attention because big tech companies like Google, Amazon, and Microsoft all had text-to-speech products, but they hadn’t really taken off.

“With ElevenLabs no one was looking at voice AI, literally no one wanted to give [them] money. No VCs wanted to actually back ElevenLabs, back in the early days on the pre-seed round. So those are the type of industries that I really like, so that I can get in before everyone else,” he said.

Reina has made 74 angel investments over the past eight years, including Revolut, Volumetric, Elroy Air, and Speckle. He now works for Eleven Labs as a go-to-market manager.

He said he always tries to identify industries that other investors are not paying attention to: “I’ve done [invested in] mostly AI before it was sexy. I’ve done robotics before it was sexy as well.”

Reina specializes in investing in pre-seed companies — those with an idea, but often without a fully developed product. This means identifying key traits in founders that indicate a startup will succeed.

“If there is a product, fantastic, but if there is no product, absolutely fine for me … I love founders that are very technical. They’re super sharp, very smart, literally trying to build a global company from day one,” Reina explained.

He said he “invests based on thesis,” so if a founder is very technical, they’ll have a deeper understanding of the product and the market they’re selling to.

Reina said he saw these traits in Staniszewksi, which convinced him to back ElevenLabs despite the voice AI market being very small at the time.

“No one wants to talk to AI voices if they sound robotic. That’s fundamentally the biggest problem that there was right… so when I spoke with Mati, he talked about both elements, and he had not been in the market,” Reina said.

“It was really interesting to see he was thinking about the problems of the entire ecosystem before even actually having any product or before even actually talking to any real potential customer.”

Staniszewski had a background in mathematics with a first-class honors degree from Imperial College London. His vision and technical expertise sold Reina, and ElevenLabs became one of the few startups that he decided to back “literally within less than an hour.”

Now, Eleven Labs is planning a global expansion, including building new hubs in Paris, Singapore, Brazil and Mexico, as well as getting the company ready for IPO within the next five years, Staniszewski told CNBC in July.

ABOARD AIR FORCE ONE: US President Donald Trump left on Friday for Asia and high-stakes trade talks with Chinese counterpart Xi Jinping – adding that he would also like to meet North Korean leader Kim Jong Un on his…