The China National Medical Products Administration (NMPA) has approved Shingrix (GSK”s Recombinant Zoster Vaccine or RZV) for the prevention of shingles (herpes zoster) in adults aged 18 years and…

The China National Medical Products Administration (NMPA) has approved Shingrix (GSK”s Recombinant Zoster Vaccine or RZV) for the prevention of shingles (herpes zoster) in adults aged 18 years and…

Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Awasi Mendoza, Argentina; Awasi…

Stay informed with free updates

Simply sign up to the Automobiles myFT Digest — delivered directly to your inbox.

Chinese carmaker Geely wants to sell 100,000 cars a year in the UK and would consider local production as it aims to take on Tesla and BYD in Europe’s second-largest market for electric vehicles.

The UK has become a battleground for European expansion by Chinese carmakers because of strong EV sales and the absence of import tariffs.

“Currently the UK market is more open and a friend for Chinese brands,” Michael Yang, the head of Geely Auto UK, told the Financial Times.

Geely would aim to launch 10 electric and plug-in hybrid models over the next three years and sell about 100,000 cars a year in the UK, he said in an interview. This would give it a market share of around 5 per cent in the country. BYD and Tesla have a share of around 2 per cent each this year.

“In the future, if we find that local production has more of an advantage, why not do that? We are open about that,” he added, saying the company planned to hire about 300 workers in the UK.

Geely Auto is a Hong Kong-listed unit of privately held Geely Holding, one of the world’s biggest auto groups, with stakes in Volvo Cars, Polestar, Lotus, London black-cab maker LEVC and Aston Martin.

The first Geely car to be sold in the UK will be the all-electric EX5 sport utility vehicle, a rival to Tesla’s flagship Model Y, with a starting price of £31,990.

The UK government has been courting Chinese carmakers to produce in the country. But it has had little success so far because of the high cost of energy and labour compared with other locations such as Turkey, Hungary and Spain, which have managed to attract Chinese groups to build European production hubs.

The UK is aiming to produce 1.3mn vehicles a year by 2035, almost double the 755,000 units the Society of Motor Manufacturers and Traders expects to be made this year.

Hitting the target will require new manufacturing. Chinese brands have become a focus as established groups grapple with various problems.

Nissan, which owns the largest UK plant, is downsizing its global operations because of financial difficulties. Jaguar Land Rover’s production had to be halted for more than a month following a cyber attack, which caused vehicle output in the UK to fall 36 per cent in September, according to the SMMT.

Meanwhile, the UK has become BYD’s biggest market outside China with sales increasing nearly 10-fold in a year, according to the latest data.

Chery, another Chinese carmaker, which sells the Chery, Omoda and Jaecoo brands, accounted for nearly 4 per cent of new car sales last month, compared with 0.4 per cent just a year earlier.

When asked whether Geely would consider using existing LEVC and Lotus manufacturing facilities for new UK production, Yang said: “It all depends, but hopefully we can use the existing plant. It’s easier.”

Lotus said earlier this year that it would pull out of manufacturing in the UK. This decision was later reversed but it has been talking with other carmakers about building models at its plant in Hethel in eastern England.

Yang also said that the various Geely brands would not cannibalise each other since they all target different customers.

“Volvo and Polestar, they are more like premium brands and Lotus is a performance car,” he said. “LEVC in the UK is for the iconic taxi, so Geely is focusing more on the mainstream.”

Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

When Creedence Clearwater Revival…

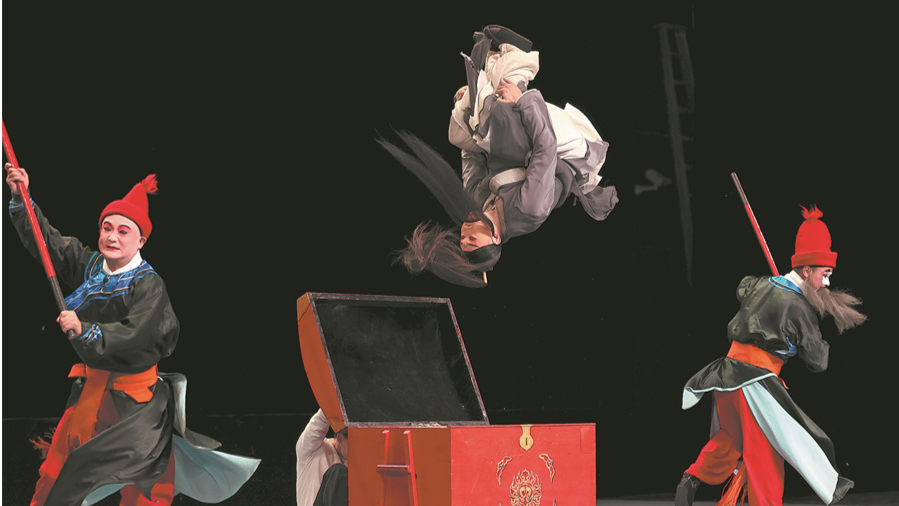

Wuju Opera is finding new and young audiences through global tours and innovative use of technologies.

In Jinhua,…

Researchers at Trinity College Dublin have uncovered what they call a “universal thermal performance curve” (UTPC), a pattern that appears to apply to every living species on Earth. This curve describes how organisms respond to changes in…

ATLANTA — No double overtime, not many tense moments or subsequent buckets of sweat, and no problem against a Hawks’ team missing three starters. That summarized the night for the defending champions.

By comparison to its first two games of…

Victoria’s Secret (VSCO) shares have seen movement recently, prompting investors to review the retailer’s performance and outlook. The company’s stock is up 59% over the past 3 months, which reflects renewed interest among market watchers.

See our latest analysis for Victoria’s Secret.

After a bumpy start this year, Victoria’s Secret has staged an impressive comeback, with a 26% one-month share price return and momentum building as renewed industry optimism takes hold. While the year-to-date share price is still lower, long-term shareholders have captured a 16.9% total return over the past year.

If you’re intrigued by how turnarounds like this can create opportunities, it might be time to broaden your search and discover fast growing stocks with high insider ownership

With the stock’s recent surge but analyst targets lagging behind, the question is whether Victoria’s Secret remains undervalued, or if the current price already factors in all the anticipated future growth.

The most widely followed narrative puts Victoria’s Secret’s fair value well below its last close price, signaling a potential disconnect between analyst models and recent market enthusiasm.

The analysts have a consensus price target of $22.7 for Victoria’s Secret based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $27.0, and the most bearish reporting a price target of just $17.0.

Read the complete narrative.

Curious what kind of growth projections and future profit assumptions drive this punchy valuation? The key takeaway is that most analyst forecasts are based on slow revenue growth, thinning margins, and a higher-than-normal profit multiple. Which number is the real linchpin? The full narrative reveals the bold assumptions behind the current fair value.

Result: Fair Value of $22.70 (OVERVALUED)

Have a read of the narrative in full and understand what’s behind the forecasts.

However, persistent tariff pressures or a sustained slowdown in mall traffic could quickly undermine the optimistic case for Victoria’s Secret’s recovery.

Find out about the key risks to this Victoria’s Secret narrative.

While analyst models suggest Victoria’s Secret is overvalued versus consensus estimates, our SWS DCF model points in a different direction. Based on projected future cash flows, the stock currently trades 21.6% below its fair value, which suggests potential upside. Which perspective will the market ultimately reward?