Sean CoughlanRoyal correspondent

Millie Pilkington/ King’s Foundation

Millie Pilkington/ King’s FoundationKing Charles says he wants to inspire a “sense of determination” to protect the…

Sean CoughlanRoyal correspondent

Millie Pilkington/ King’s Foundation

Millie Pilkington/ King’s FoundationKing Charles says he wants to inspire a “sense of determination” to protect the…

It’s safe to say the Nintendo Switch 2 is the game console to get this year, and if you already got your hands on one, you’ve probably loaded it up with all your old Switch games and new Switch 2 games. If you haven’t thought about adding more…

Fresh from launching his first Apple playlist earlier this year, King Charles is now fronting a new doc feature on Amazon Prime Video.

“Finding Harmony: A King’s Vision,” set for release globally in early 2026, will chronicle what…

Neal won the fight via knockout, the first man to stop the Brazilian via strikes, and Luque was diagnosed with a subdural hematoma — a bleed on the brain — that instantly put his career in jeopardy. Luque was medically suspended for a year…

By Campbell Rose, Greg Mitchell & Anna Roche

In September 2025 Inland Revenue published Interpretation Statement 25/19 Whether an off-market share cancellation is made in lieu of the payment of a dividend (IS 25/19), which finalised the draft interpretation statement (IS) issued for public consultation earlier this year and replaces previous guidance from 1999.

As we discussed in our May 2025 Tax Alert article the draft IS was, generally, welcome updated guidance on whether a share cancellation is in lieu of a dividend. However, it was not without some potential fish-hooks, which were raised with officials as part of the consultation process. We summarise below how some of those submissions fared.

Some suggestions raised in submissions included that:

The finalised IS 25/19 included the usual minor ‘tidy ups’ and clarifications that arise through the consultation process, as well as some notable changes, including:

Areas not updated in IS 25/19

Inland Revenue did not address all of the key concerns that were raised in submissions.

IS 29/15 does not acknowledge that non pro-rata buy-backs generally should not be considered to be in lieu of a dividend (other than in rare circumstances). This point is of fundamental importance to investment companies, as their business model is often to redeem or cancel the shares of some shareholders while contemporaneously issuing new equity to other shareholders. A clear statement providing guidance in this context would have been a welcome addition to provide certainty; instead it appears that the tax implications will need to be firmly grounded in the commercial drivers specific to the business model and particular redemption(s)/re-issuance(s).

Inland Revenue did not consider there was scope to apply a purposive approach to interpreting the “all or nothing” nature of the tainting language in the in lieu of dividend rule, based on the legislation as drafted and its intended scope. This issue has been referred to policy officials for further consideration.

“Dividend avoidance/integrity” is currently, and we expect will continue to be, a key focus area for Inland Revenue. It represents an area of avoidance-related investigation where Inland Revenue’s enquiries can be assumed to commence from a sceptical starting point – and potentially in scenarios where the statutory time bar may not apply.

Accordingly, in defending a share cancellation as being genuine, it will be critical to retain objective evidence that compellingly supports the commercial reasons underpinning the cancellation. This needs to then be appropriately weighted with the other statutory factors in section CD 22(7) of the Income Tax Act 2007 to support a position that none of the amount paid is in lieu of a dividend.

As IS 25/19 has been updated to include reference to “inexplicable accumulation of earnings”, “examin[ing] the source of (…) funds” for “objective evidence that they represent genuine surplus capital and not simply accumulated profits”. In the context of examples the analysis also uses new terminology of dividends being “effectively deferred”, and “utilis[ing] a bank account of accumulated profits”.

It is therefore imperative that companies tread carefully in this area, given heightened Inland Revenue scrutiny of the capital/revenue (dividend) boundary. As we noted in our May 2025 article, obtaining appropriate specialist tax advice and achieving valuable certainty through a binding ruling before undertaking a share cancellation, warrant serious consideration.

If you have any questions on IS 25/19 or the tax implications more generally of share cancellations, please contact your usual Deloitte advisor.

Having retired from T20Is, white-ball spearhead Mitchell Starc is aiming to end his decade-long drought in the BBL

Mitchell Starc is aiming to end his 11-year Big Bash…

By Joe Sothcott & Robyn Walker

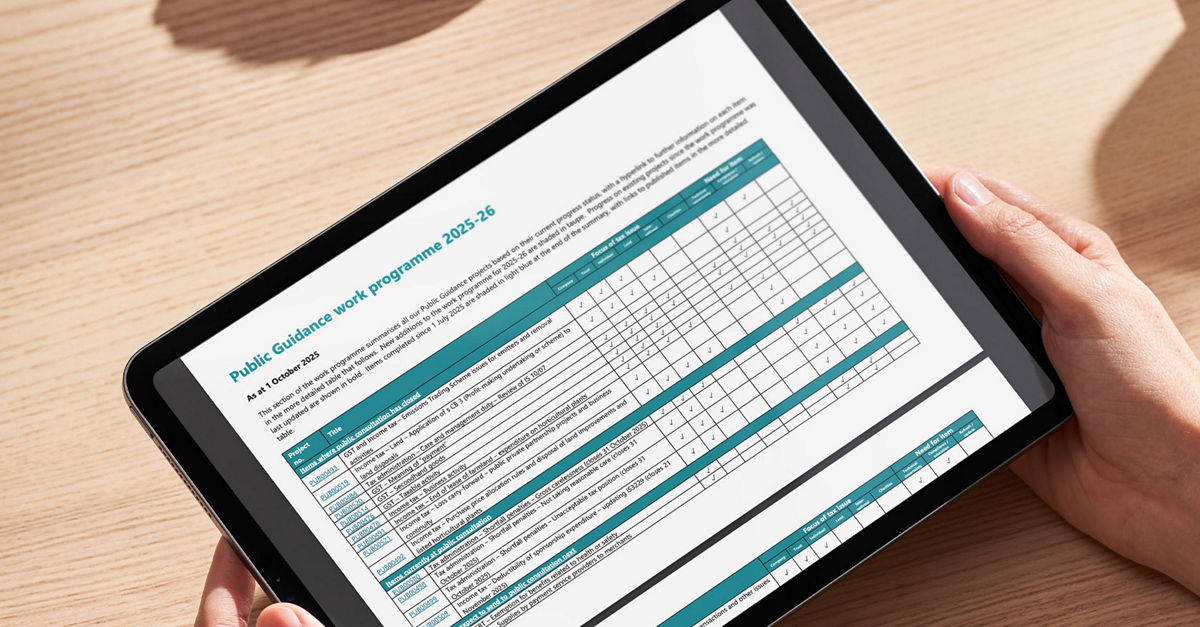

The Public Guidance Work Programme is a frequently overlooked yet invaluable publication produced by the Inland Revenue’s Tax Counsel Office. The Tax Counsel Office (TCO) is responsible for determining the Commissioner of Inland Revenue’s view on the tax laws and provides advice on tax technical matters, as well has having some oversight as to how tax laws are implemented within in the Inland Revenue.

The Work Programme tracks the status of priority interpretation items under development. With the latest update published on 1 October 2025 we take a look at what’s currently included, what’s missing, how it’s compiled, and what new items have been added.

What Is the Public Guidance Work Programme?

The Work Programme currently includes only items issued by the TCO, specifically:

While both are non-binding, they are considered authoritative and are widely relied upon by taxpayers and advisors.

The Work Programme does not include items produced by the Technical Standards team, such as:

For example, the Draft Standard Practice Statement on Mutual Transactions of Associations (ED0265) is not listed in the Work Programme. Deloitte understands that, after public consultation over the draft guidance, the item is now on hold pending referral to Inland Revenue’s Policy team for a potential policy change.

Deloitte’s view is that all public guidance items, whether from the TCO Office or the Technical Standards team, should be published in a single consolidated work programme. This would improve transparency and make it easier to identify when items are on hold pending policy consideration.

How Is the Work Programme compiled?

The Work Programme includes:

Transparency is the underlying principle of the Public Guidance Work Programme. TCO refreshes the Work Programme annually, and prior to each refresh, it invites public submissions on technical issues, gaps in existing guidance, and emerging areas of uncertainty. Submissions generally can be made via email or via an Inland Revenue form. Keep an eye out around mid-2026 for the next opportunity to contribute submissions for the Work Programme.

Once submissions are received, the TCO evaluates them based on:

A draft Work Programme is then prepared and circulated to key stakeholders for feedback (including on relative priority) before the final version is published.

What’s new in the 2025–26 Work Programme?

The refreshed Work Programme includes a long list of new items:

Some taxpayers may understandably have trepidations about a few of the items and whether they may open a pandora’s box where interpretation doesn’t match reality, in light of the open-loop gift cards debate that arose from the publication of QB 25/07: What is the income tax treatment of gift cards and products provided as trade rebates or promotions? Other items, such as guidance on often misunderstood areas, like how taxpayers can apply the 100% depreciation rate for low value assets under section EE 38, will be more welcome.

Want to suggest an Item?

We understand that raising issues for inclusion in the Work Programme can feel daunting—especially if there’s concern it might attract unwanted scrutiny. For those may feel uneasy about contact the TCO direct, Deloitte is always happy to raise issues on behalf of clients. If you have questions or would like to discuss a potential submission, please reach out to your usual Deloitte advisor.

By Amy Sexton & Robyn Walker

The prospect of a significant sum of money lying dormant and unclaimed will motivate many to search the Inland Revenue’s unclaimed money database, especially when media coverage draws attention to its existence. The recent Taxation (Annual Rates for 2025–26, Compliance Simplification, and Remedial Measures) Bill (the Bill) proposes changes aimed at simplifying the management of unclaimed money by Inland Revenue, with the intention of making it easier for rightful owners to make claims.

Unclaimed money are funds held by an individual or organisation (such as bank, solicitor, utility company, life insurer, employer, other business) where the rightful owner cannot be located. After a specified period of time passes without contact, these funds are classified as “unclaimed” and transferred to an administrator. The required time period varies depending on the type of funds involved.

While Inland Revenue is widely recognised for administering unclaimed money, not all categories of unclaimed funds fall under its responsibility, a raft of options are outlined on The Treasury website.

Additional information

Currently the Unclaimed Money Act 1971 puts the following obligations on holders of unclaimed money:

a. the source, and history of the accrual, of the amount

b. the identity and whereabouts of the owner

c. the source of the owner’s entitlement to payment of the money.

Under the Bill. when transferring unclaimed money, holders will be required to provide Inland Revenue with more detailed information to assist in identifying the rightful owner. The new legislation will read as follows:

a. the source, and history of the accrual, of the amount

i. the full name, date of birth, and tax file number of the owner

ii. the address and contact details of the owner

b. the whereabouts of the owner

c. the source of the owner’s entitlement to payment of the money

d. where applicable, the number of the account where the money is held, the date the account was opened, and the date of the owner’s last interaction with the account.

It is important to note that under both the current and proposed legislation, the information needs to be in the “possession or control” and “readily available” to the holder. With more data points being required upfront there will be a need for businesses dealing with unclaimed money to give thought to whether new systems and processes are required to efficiently extract information, particularly if it is spread across different information sources.

20 year time bar

In 2021 a 25 year time bar was introduced for unclaimed money administered by Inland Revenue. The proposal is to reduce this time bar to 20 years (which is still a very long time!). If money remains unclaimed after the time bar, it will be removed from the unclaimed money list and transferred to the Crown.

Currently, claimants often face challenges in proving ownership of unclaimed money, leading to considerable correspondence with Inland Revenue. These proposed changes are intended to streamline the process for all parties involved. For context, in the 2023/24 year Inland Revenue received 23,000 claims for unclaimed money but approved only 4,300 claims, amounting to $36.5m, with over $0.5b remaining unclaimed.

These proposed changes are scheduled to take effect from 1 April 2026.

If you believe you may have a claim to unclaimed money and are unsure how to establish ownership, please contact your usual Deloitte advisor for assistance.

By Young Jin Kim & Bart de Gouw

It is widely accepted that cross-border related-party debt can be used by multinational enterprises (MNEs) to shift profits out of a country. In the New Zealand context this led to the introduction of the Restricted Transfer Pricing (RTP) rules and the requirement to disclose inbound cross-border intercompany loans with a value of more than NZD10M to Inland Revenue in the BEPS Disclosure Form (this disclosure requirement has since been amended effective from the 2025 income year with taxpayers just required to hold a copy of the necessary information).

In recent years, the International Revenue Strategy (IRS) team at Inland Revenue has observed considerable behavioural change by foreign-owned MNEs with the introduction of additional equity and/or reducing related-party debt financing. This behavioural change has been attributed to the introduction of the RTP rules and a greater focus on financing by the Inland Revenue (via targeted campaigns, risk reviews and audits).

The past five years has seen a highly volatile interest rate environment, with historic lows in the Official Cash Rate in the 2020 and 2021 years, a rapid increase in 2022 and 2023, and a declining rate since the middle of 2024. This level of volatility has meant that taxpayers should have been regularly reviewing intercompany financing arrangements to ensure that the behaviour of the parties to the loans, the terms and conditions of loans, and the interest rate have all remained arm’s length. With the increases in the interest rates applying to the most recently filed 2023 and 2024 tax returns coupled with the Inland Revenue stepping up its audit activity more generally, we are expecting intercompany loans and financing to become a key area of focus for Inland Revenue. This is starting to come to fruition with the number of risk reviews and audits focusing on intercompany financing increasing.

Now is an opportune time for taxpayers to reflect on their intercompany loans and key risk areas that could be challenged by Inland Revenue. To help with this, we have summarised 9 risk factors when it comes to intercompany loans.

Inland Revenue annually publishes an administrative guidance for small value loans (i.e., for cross-border associated party loans for up to NZD10M principal). This administrative guidance may be applied to cross-border associated party loans.

Inland Revenue has historically provided an interest rate margin (over a relevant base indicator) that it considers to be broadly indicative of an arm’s length rate, in the absence of a readily available market rate for a debt instrument with similar terms and risk characteristics. The most recent change to the interest margin has also introduced (without explanation or consultation) a change in approach to make the interest rate margin backward looking only and in our view, reduces the practical application of this otherwise widely used administrative guidance. The current interest rate margin in the guidance is 250 basis points over the relevant base rate and applies for the period 1 July 2024 to 30 June 2025. There is now no equivalent guidance for interest rates for the year to 30 June 2026. We will continue to provide updates on any developments on the administrative guidance.

If any of the above risk factors concern you please contact your usual Deloitte advisor or one of our award winning transfer pricing team to help navigate the issues.