The Purbeck Film Festival is set to open spanning over 30 venues across Dorset including churches, village halls and a museum.

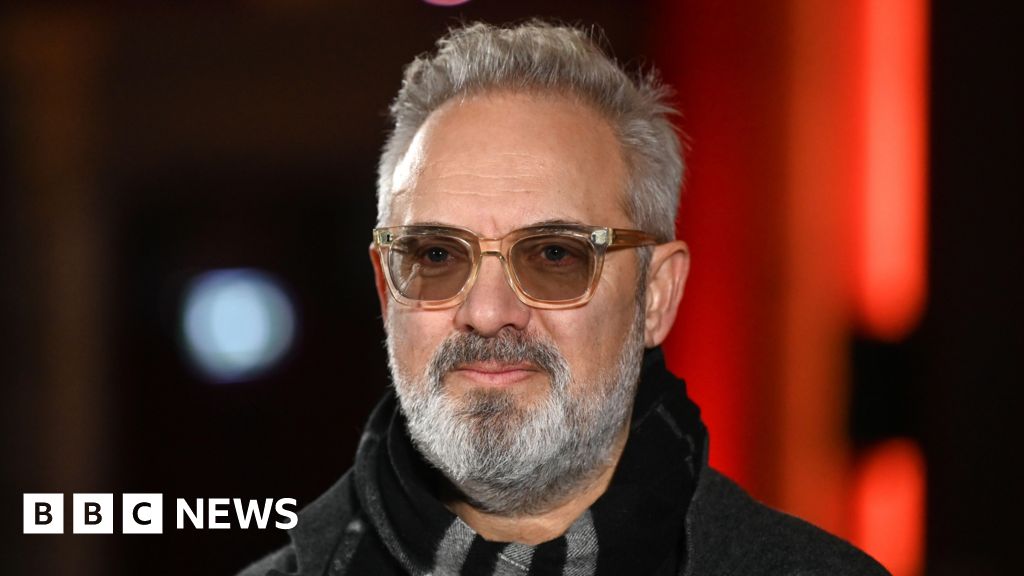

This year, Academy Award-winning director Sir Sam Mendes joins as its newest patron. Mendes said he was “delighted” to…

The Purbeck Film Festival is set to open spanning over 30 venues across Dorset including churches, village halls and a museum.

This year, Academy Award-winning director Sir Sam Mendes joins as its newest patron. Mendes said he was “delighted” to…

New research has found that ADHD (Attention Deficit Hyperactivity Disorder) is linked to higher levels of creativity, and that this creative advantage may stem from a stronger tendency for the mind to wander. The findings, presented at the ECNP…

I booked a Tui river cruise package in Switzerland with flights provided by British Airways.

On the day we were to return home, we discovered our flight had been cancelled. There were about 40 people affected.

BA eventually booked us on to a flight leaving 36 hours later, but has refused to pay us the £220 compensation each due under EC regulations.

It says adverse weather was to blame and is exempted from compensation rules.

I requested a formal confirmation of the cancellation to submit to my travel insurer and, on that form, BA claims “operational reasons” were the cause. Unlike adverse weather, this is not covered by the insurance policy.

AC, Alfreton, Derbyshire

This is outrageous behaviour from a company that once considered itself “the world’s favourite airline”. You can’t get compensation from BA because, it says, bad weather grounded the flight, and you can’t get compensation from the insurer because the airline claims it was an operational issue.

The difference is critical. Airlines are obliged to pay set sums of compensation for delayed or cancelled flights under regulation EC 261/2004. They can only get out of it if the disruption was caused by “extraordinary circumstances”.

The regulation is vague on what these circumstances might be, but years of court rulings have honed the list down. Undefined “operational issues” would not be considered an excuse to avoid a payout; weather sometimes is, but only if it is exceptional and unexpected.

So which was the cause? Both, says BA, hedging its bets. It claims bad weather that had disrupted previous flights had displaced crew, and that had had a knock-on effect on your journey.

It ignored my questions about the whens, wheres and hows but that’s immaterial. “Knock-on” effects of bad weather are not an excuse to withhold compensation, according to the law firm Bott & Co.

BA insisted it couldn’t comment further because, by then, your case was in the hands of its dispute resolution service, CEDR.

This sounded to me like stalling tactics. I pointed this out and suddenly it stumped up. Since the money had to be prised out of it, I fear the other affected passengers may still be empty-handed.

We welcome letters but cannot answer individually. Email us at consumer.champions@theguardian.com or write to Consumer Champions, Money, the Guardian, 90 York Way, London N1 9GU. Please include a daytime phone number. Submission and publication of all letters is subject to our terms and conditions.

This paper is the first outcome of the Alignment Assembly on Culture for AI, a collective intelligence exercise initiated within the data space, which engaged circa 400 professionals. It maps the results of the community…

Originally posted on 6 February 2024. Scroll down for news of the Cavalry 2.5 update.

Scene Group has begun the next big series of releases for Cavalry, its motion design software.

Cavalry 2.0 adds animatable scene cameras, making it…

By Maitane Sardon

Fairfax Financial said it agreed to sell its 80% stake in the insurance business of Eurolife FFH Insurance Group to Eurobank Ergasias for 813 million euros ($944.7 million) in cash.

As part of the deal, Fairfax will buy a 45% stake in ERB Asfalistiki--Eurobank's Cyprus-based property and casualty insurance business--for 59 million euros in cash, the Canadian insurance company said Monday. It will have the right to acquire the remaining 55% equity interest in ERBA over time, it said.

Following the transaction, Fairfax will keep its 80% stake in Eurolife's property and casualty insurance business, while Eurobank will fully own Eurolife's life insurance operations.

"We are very pleased to be able to maintain the focus of our insurance operations on property and casualty insurance and reinsurance, while still benefiting from the continued success of the Eurolife life insurance business through our ownership stake in Eurobank," Fairfax Chief executive Officer Prem Watsa said.

The deal is expected to close in the first quarter of 2026, Fairfax said.

Write to Maitane Sardon at maitane.sardon@wsj.com

(END) Dow Jones Newswires

October 13, 2025 02:59 ET (06:59 GMT)

Copyright (c) 2025 Dow Jones & Company, Inc.

Understanding a customer’s evolving needs starts with asking the right questions and staying closely engaged. For Maersk, working with fast-growing e-commerce brand specialising in mother and baby products, meant staying closely aligned with their evolving supply chain challenges. By keeping the conversation open and ongoing, we were able to spot gaps in their supply chain and find practical ways to simplify, streamline, and bring everything under one roof.

As an existing Warehousing and Distribution (WnD) customer of Maersk, the company was looking to streamline operations at the origin by better managing suppliers and gaining improved visibility over shipments. A qualification discussion highlighted a broader opportunity: strengthening their overall Supply Chain Management (SCM).

During the Internet Summit, the customer was introduced to our Container Freight Station (CFS) solution, which sparked strong interest. This led to a series of focused discussions with their logistics team to assess the potential value of integrating SCM and CFS into a consolidated approach.

Maersk stepped in as more than a logistics provider, offering end-to-end supply chain solutions that bring together logistics, fulfillment, and value-added services in one integrated platform.

The customer faced several challenges across their supply chain that were impacting efficiency and visibility. Key issues included a reliance on cumbersome manual processes and limited visibility into shipments at the SKU or product level, making it difficult to track inventory and plan effectively.

Uncertainty around shipment arrivals further complicated operations, while the use of Less-than-Container Load (LCL) shipments presented missed opportunities for cost-saving through consolidation into Full Container Loads (FCL). Additionally, having too many stakeholders involved created coordination hurdles, with manual follow-ups and milestone tracking adding to the complexity and operational strain.

|

Current challenges |

Maersk solutions |

|---|---|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

We transitioned from a single-solution approach to a more comprehensive one-stop solution (integrator strategy) by asking the right questions and mapping out the end-to-end process to identify gaps and opportunities.

By involving the appropriate stakeholders from Maersk to co-design the solution and present it to the customer, demonstrating our deep supply chain expertise and operational know-how.

The key to lasting partnerships is to treat the customer’s business as if it were your own—because their success is ultimately ours too.

Our value proposition played a pivotal role in reinforcing trust and aligning strategic priorities with the customer’s long-term goals. Specifically, the solution delivered impact in the following key areas:

Our customer saw value in having one Logistics Service Provider (LSP) handle end-to-end solutions, including SCM (CY and CFS consolidation), ocean freight, CHB, and trucking, providing a ‘one source of truth’ for them and internal stakeholders.

The volume awarded was 26,000 cubic meters, with a total revenue of USD 250K over a contract duration of 2 years.

Building on the success of the initial collaboration, we are now focused on expanding the partnership through several strategic initiatives. Phase 2 CFS implementation is underway in Qingdao and Yantian, with further opportunities being explored in Turkey and the UK.

A long-term ocean freight contract is being developed to ensure stability, while Customs House Brokerage and SABER verification are being set up to support smooth imports into Saudi Arabia. Cross-border trucking from the UAE to KSA is also being introduced, marking continued progress toward a more integrated, streamlined and resilient supply chain.

Picture by Allan McKenzie/SWPix.com. Second-team coach Tom Smith has been looking back on the 2025 summer.

Tom Smith says there have been some “really good performances” at second-team level this summer even if the results have been…