- Yen, euro head for worst weekly loss in a year Reuters

- US Dollar Forecast: DXY Surges Toward 100.257 as Yen and Euro Slide on Policy Risks FXEmpire

- FX Weekly MUFG Research

- FX Markets Hover as EUR/USD Finds Temporary Calm and USD/JPY Fuels Risk Appetite Investing.com

- Dollar rises amid expectations of Japanese monetary easing equiti.com

Blog

-

Yen, euro head for worst weekly loss in a year – Reuters

-

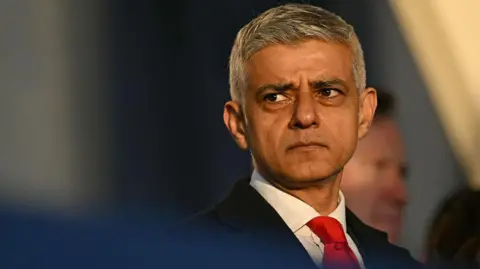

Sir Sadiq Khan calls for pause on new immigration rules

Kumail JafferLocal Democracy Reporting Service and

Harry CraigLondon

WPA Pool/Getty Images

WPA Pool/Getty ImagesSir Sadiq Khan said the changes were “moving the goalposts” and had left TfL staff “in limbo” The mayor of London has called on the government to reconsider its immigration rules, which the TSSA transport union said could leave up to 300 Transport for London (TfL) staff at risk of removal.

In July, changes to visa policies were announced, including increased salary thresholds for visa sponsorship, and removal of some transport roles from the “skilled worker” list.

Sir Sadiq Khan told the London Assembly on 9 October that the changes had “left TfL staff in limbo”, according to the Local Democracy Reporting Service.

He said the deputy mayor for transport, Seb Dance, had written to the migration minister to call for the measures to be paused and for TfL staff to be protected immediately.

The Home Office said it would respond to the letter in due course.

They have previously said the government’s immigration white paper, which includes these measures, will “restore order” to immigration and “end dependence on lower-skilled international recruitment”.

‘Moving the goalposts’

Asked about the issue by the Green Party’s London Assembly leader Caroline Russell at Mayor’s Question Time, Sir Sadiq accused the government of “moving the goalposts”.

He added that TfL staff were “unclear about whether they can stay in the UK and continue the important work they do for us”, and that the rules would “inhibit TfL’s ability to carry out its functions”.

After the meeting, Ms Russell told the Local Democracy Reporting Service she had heard from TfL workers who struggled to sleep at night due to the uncertainty.

“One worker, expecting her first child, should be filled with joy, but instead she’s terrified she’ll be forced to leave the country before her baby is even born,” she said.

“They’ve spent thousands of pounds to be here, worked hard to gain qualifications, invested everything and now they’re being told they have no place here. It’s a complete betrayal of the promise they were given.”

Anadolu via Getty Images

Anadolu via Getty ImagesThe TSSA union estimated as many as 300 TfL staff could face removal under the new visa rules The new rules, which took effect on 22 July, raised the salary threshold for visa sponsorship to £41,700 a year for new applicants.

TfL currently pays a starting salary of £31,000 for graduates, with trainee station staff believed to earn between £35,300 and £41,800.

‘Needless uncertainty’

Eddie Dempsey, general secretary of the RMT union, welcomed the mayor’s intervention, adding: “Transport workers who were hired under clear visa arrangements are facing needless uncertainty which should have been avoided.

“These people are doing essential front-line jobs and helping to keep London moving every day.”

Mr Dempsey said last month that 63 RMT members working for the London Underground were facing removal, some as early as November.

However, Maryam Eslamdoust, general secretary of the TSSA union, estimated as many as 300 TfL staff could be affected.

Most of these came to the UK on skilled worker or graduate visas, and currently work in Tube stations as customer service assistants.

A TfL spokesperson said: “We are working with all colleagues affected by the changes to understand whether they have other routes to work in the UK available to them and to support them where possible.”

Continue Reading

-

Govt Moves Forward with First Women Bank Limited Privatisation

The federal government has taken another key step in the First Women Bank Limited privatisation process as the Privatisation Commission (PC) Board recommended a reference price to the Cabinet Committee on Inter-Governmental Commercial Transactions (CCoIGCT).

The 240th meeting of the PC Board, chaired by Muhammad Ali, Chairman of the Privatisation Commission, finalized the recommendation that will now move to the Cabinet Committee for review. This marks a major milestone toward finalizing the proposed Government-to-Government (G2G) deal for the sale of First Women Bank Limited.

Incorporated in 1989, FWBL is 82.64% owned by the Government of Pakistan. The International Holding Company (IHC), a nominee of the United Arab Emirates (UAE) government under the Inter-Governmental Commercial Transactions Act, 2022, is being considered as a potential investor.

Once approved by the CCoIGCT, the transaction will progress to formal engagement with the UAE’s nominee. The successful completion of the process is expected to attract new foreign direct investment (FDI) and boost investor confidence in Pakistan’s privatisation program.

In another decision, the PC Board approved a consortium led by Raiffeisen as the top-ranked financial advisor for the privatisation of Hyderabad Electric Supply Company (HESCO) and Sukkur Electric Power Company (SEPCO). Competing consortia included groups led by Baker Tilly, Alvarez & Marsal, and EY (Ernst & Young).

The Board also formed a Negotiation Committee to finalize the Financial Advisory Services Agreement (FASA) with the Raiffeisen-led consortium.

The Privatisation Commission reiterated its commitment to transparency and strategic reforms to strengthen Pakistan’s economic outlook and attract sustainable investment.

Continue Reading

-

Just a moment…

Just a moment… This request seems a bit unusual, so we need to confirm that you’re human. Please press and hold the button until it turns completely green. Thank you for your cooperation!

Continue Reading

-

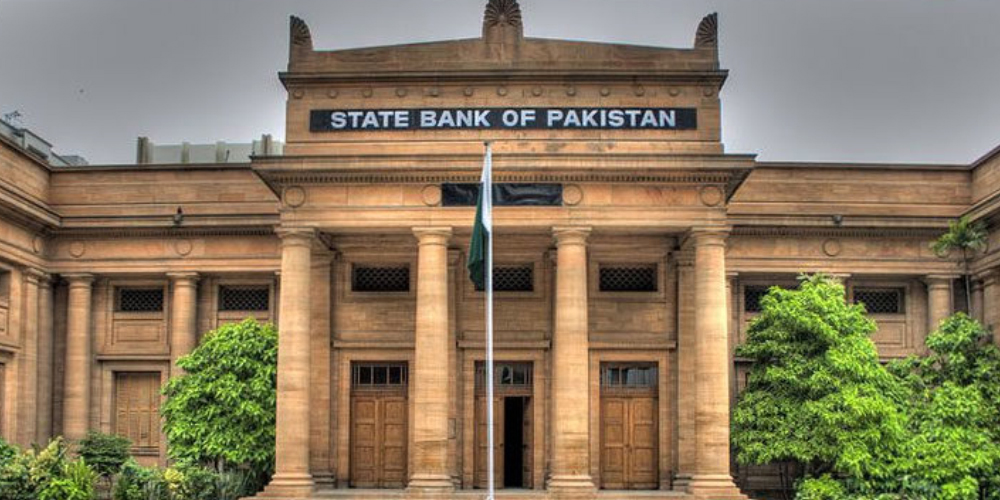

SBP Injects PKR 3.3 Trillion to Stabilize Liquidity

The State Bank of Pakistan (SBP) has injected over PKR 3.3 trillion into the financial system through its latest Open Market Operations (OMOs), aiming to manage liquidity and maintain stability in short-term interest rates.

The central bank conducted both conventional and Shariah-compliant operations. The conventional reverse repo operation saw the injection of PKR 3.258 trillion at a cut-off rate of 11.01% for 7-day and 14-day tenors. Meanwhile, the Islamic Mudarabah-based OMO added PKR 193 billion at a slightly higher rate of 11.11% for a 7-day tenor, indicating stronger demand or tighter liquidity within the Islamic banking sector.

An OMO injection is a key monetary tool that helps banks maintain sufficient cash flow, ensuring smooth market operations and rate stability. Analysts note that the SBP’s large-scale participation highlights its active stance in maintaining liquidity aligned with the ongoing monetary policy.

An official close to the development said, “The SBP’s liquidity support reflects its commitment to balancing monetary stability with sectoral funding needs.”

“The difference in cut-off rates between conventional and Islamic OMOs points to varying liquidity pressures across segments,” said a senior market analyst.

Continue Reading

-

Fungi in deadwood help orchids grow in the dark

In a forest, death feeds life. A fallen tree doesn’t end a story – it starts another. Beneath damp bark and soft moss, fungi grow, feed, and connect.

Scientists at Kobe University discovered that these fungi don’t just recycle wood; they…

Continue Reading

-

Google Search Could Change Forever in the UK

“The decision to formally designate Google with Strategic Market Status is an important step to improving competition in digital markets,” argues Rocio Concha, director of policy and advocacy at UK consumer watchdog Which?. “Online search is evolving as gen AI tools become more widely used, but the CMA must still act to tackle the harmful dominance Google has now and to promote competition between gen AI search tools.”

The CMA claims that Google Search accounts for more than 90 percent of all general search queries in the UK, and that over 200,000 firms in the UK collectively spent more than £10 billion ($13.3 billion) on Google search advertising in 2024.

“Designating Google with SMS enables us to consider proportionate, targeted interventions to ensure that general search services are open to effective competition, and that consumers and businesses that rely on Google can have confidence that they are treated fairly,” the CMA decision report reads.

In a statement shared with WIRED in response to the CMA’s decision, Google’s senior director of competition Oliver Bethell said that many of the ideas for interventions raised in this process would “inhibit UK innovation and growth, potentially slowing product launches at a time of profound AI-based innovation.” It continued: “Others pose direct harm to businesses, with some warning that they may be forced to raise prices for customers.”

This is not a surprising response, says Greg Dowell, senior competition knowledge lawyer at law firm Macfarlanes. “I think we can expect Google and all the other big tech firms that are being subjected to these new rules to try and defend their practices on the basis that they are pro-consumer,” says Dowell. “Ultimately it is natural that Google and other firms in this position don’t want to be constrained in what they can do when it comes to new product development.”

The new regulation will also affect Google Search’s “News” tab and its “Top Stories” carousel, as well as Google Discover. Google News, the company’s stand-alone news product, and AI chatbot Gemini are not affected, the CMA says.

Dowell claims that implementing this roadmap might take a number of months. “The CMA may go further than the EU has done with the [Digital Markets Act], particularly with regards to restrictions relating to Google’s AI services and how they’re integrated into Google search,” he explains.

“The CMA essentially has a huge degree of flexibility in the interventions that it can seek to impose, and so it can continually react to developments as they occur. So that’s one benefit of the UK digital markets regulation regime, particularly when you compare it to the situation in the EU, where these sorts of rules are fixed in the regulation itself.”

Continue Reading

-

Nicole Kidman opens up about feeling ‘broken’ after sudden split

Nicole Kidman talked…

Continue Reading

-

Afghanistan accuses Pakistan of air attacks; Islamabad warns of action against militants

ISLAMABAD/KABUL/NEW DELHI, Oct 10…

Continue Reading

-

Spotify spotlights Samar Jafri as RADAR Pakistan artist

KARACHI: Spotify has selected singer and actor Samar Jafri as its RADAR Pakistan artist for the fourth quarter of 2025, marking a new milestone in his growing musical career.

Known for his heartfelt vocals and emotionally resonant lyrics,…

Continue Reading