NASA has revealed that Earth is getting darker – here is why this is happening and what it means for humanity.

For the past 24 years, researchers at NASA have been monitoring our planet’s radiation budget. Also known as the Earth’s energy…

NASA has revealed that Earth is getting darker – here is why this is happening and what it means for humanity.

For the past 24 years, researchers at NASA have been monitoring our planet’s radiation budget. Also known as the Earth’s energy…

After remaking every Game Boy model imaginable, Anbernic is ready to take on the next frontier of classic gaming handhelds: the Nintendo DS. In its usual drip-feed fashion, the handheld maker released a teaser video revealing the Anbernic RG DS….

SAVE $30: As of Oct. 11, Amazon is offering a 3-month pass to XBox Game Pass Ultimate for $60 or $20 a month.

The past couple of weeks have been an emotional roller coaster for Xbox Game Pass…

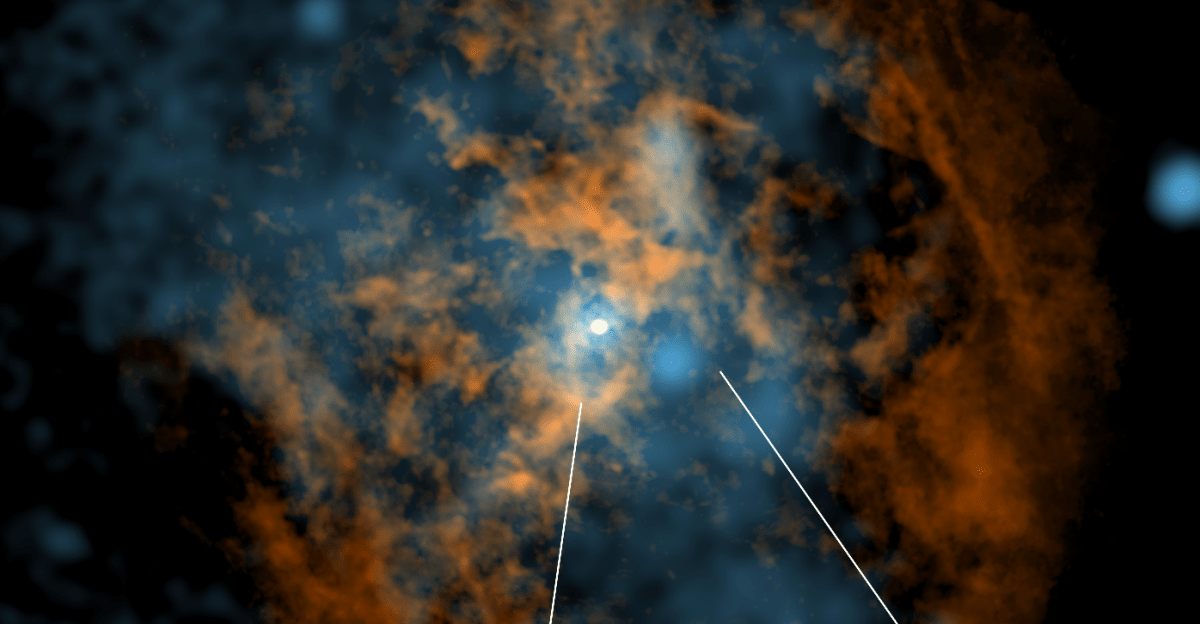

Scientists may have spotted ‘wind’ blowing from the Milky Way’s supermassive black hole.

Most supermassive black holes don’t just swallow up matter, they eject it, sometimes in spectacular jets of super…

By Naeem Aslam

The Fed is making decisions without actual data – but investors are still banking on rate cuts

The U.S. government shutdown has sidelined the release of economic data, impairing the Federal Reserve’s judgment.

A defensive rotation into Treasury bonds, gold, high-grade corporate bonds and solid dividend-paying stocks would be likely.

The irony is rich: The U.S. Federal Reserve is about to walk into its next policy meeting in late October – scheduled for Oct. 28-29 – with less and less reliable information. The U.S. government shutdown has already halted the publication of critical data, including labor statistics, consumer-price index releases and more. At precisely the time when timely economic insight matters most, the Fed – and, by extension, markets – are being forced to navigate in the dark.

In a perceptive statement, Fed governor Stephen Miran stressed on Oct. 3 that shifts in policy should be founded on current availability of data – i.e., monthly jobs and inflation data. He repeated his earlier position that the “neutral interest rate” is above zero – contrary to some models which assume it to be close to zero – and suggested that cuts could be less steep or more fine-tuned than consensus expectation. Dovish but cautious, Miran makes a case for cuts, but not without clarity.

Read: The Fed hawks are battling the doves – and then there’s Stephen Miran

It’s not posturing. As the shutdown cripples Bureau of Labor Statistics activity, the Fed loses its gold-standard measures of labor-market conditions and inflation. Already, private substitutes like ADP’s (ADP) report – which noted a surprising loss of 32,000 jobs in September – are filling in, but they are less complete and less credible than the formal releases. (The BLS, indeed, said it would freeze data collection and releases until funding returns.) The loss hurts at the very center of Fed decision-making: Without new information, the committee might turn reactive rather than proactive.

What does the Fed do without new data?

Here are three likely scenarios:

1. Postpone or hold back: The Fed might decide to wait and hold back on rate cuts in October, giving forward guidance but not putting through additional cuts until data releases pick up again. That approach would signal caution, but it might lose steam if there are market expectations for moves.

2. Continue on trend and proxy data: Or, the Fed uses lagging indicators, staff internal forecasts and proprietary data (e.g., ADP, state employment surveys) to make educated guesses about trends. Here, their decision is more subjective and susceptible to error – especially at a macro turning point.

3. Conduct an aggressive, surprise cut: A daring (and risky) option would be cutting rates even in the absence of new data, on the argument that the risks of a decline are growing. This action could initiate bond rallies and intense equity gains – but also leave the Fed open to criticism for doing something that wasn’t supported by evidence.

History gives only qualified comparables. In prior shutdowns – for example, 2013 and 2018-2019 – there were some delays of data, but the Fed avoided surprise shocks and tended to follow anticipated pathways. This time, however, is unique: There are warning augurs of fissures for the economy, inflation is persisting and markets are on edge. A badly timed misstep or decision will have more spillovers now.

Labor data is the Fed’s guiding star – and the shutdown endangers it

Economic comparisons, even after data reporting returns, will be askew until normalization sets back in.

For decades, U.S. monthly nonfarm payrolls, the unemployment rate and average hourly earnings have been the Fed’s main measures of labor-market slack, wage pressure and the risk of inflation. These measures are used to calibrate whether policy is loose, neutral or too tight.

Without BLS data, the Fed’s compass loses its calibration. Aside from the technical difficulty, the shutdown has real economic impacts: More than 900,000 federal workers are said to be furloughed or working without pay, disrupting consumption, contracting demand and obscuring the baseline off which labor metrics are gauged. The extrication of the federal workforce from routine economic activity means comparisons, even after data reporting returns, will be askew until normalization sets back in.

Traders, confronted with this information void, could rely more on substitutes – regional Fed surveys, state reports and private payroll providers like ADP. Some institutions have already boosted exposure to defensive assets, volatility hedging and cash buffers, expecting broader sentiment swings. The longer the blackout continues, the more market action continues to decouple from fundamentals and turn toward narrative-driven flows and momentum on unwarranted fundamentals.

Market risks and tactical investments

If the markets see policy paralysis from the Fed, the price of risk assets could plummet.

The largest risk for investors right now is misinterpretation. A dovish signal from the Fed, out of alignment with the economy, could instigate runaway inflation or bond-market repricing. A hawkish stance without clarity, on the other hand, might strangle growth a little too soon.

Moreover, if the markets see policy paralysis from the Fed, the price of risk assets could plummet. If that happens, a defensive rotation from investors into Treasury bonds BX:TMUBMUSD10Y, gold (GC00), high-grade corporate bonds and solid dividend-paying stocks would be likely.

Meanwhile, growth stocks (especially AI, semiconductors and technology overall) will remain volatile and reactive to shifts in sentiment or partial surprises.

In a world where macro filters are muted, stock-specific fundamentals may dominate. Companies with strong balance sheets, consistent earnings and secular tailwinds may decouple from the macro noise. This is how active stock pickers could outperform benchmark flows.

Meanwhile, markets based on hopes for global growth will be particularly vulnerable. Oil (CL00) (BRN00), industrial metals and credit-sensitive debt might overshoot on both the upside and downside, especially around events based on geopolitics.

Read: One central bank seems worried about U.S. tech valuations. It’s not the Fed.

Policy and markets reach a crossroads

Resolution of the shutdown and the return of data will be worth as much as the data itself.

We have entered perhaps one of the most problematic policy windows of this decade. The Fed meets at the end of October at exactly the time when its decision-driving inputs are probably most disrupted. Fed governor Miran’s public call for clarity is no empty commentary – it highlights the structural risk embedded in today’s world: policy without transparency.

The markets will shift attention less toward the decision of the Fed, but rather toward the tone, calibration and forward guidance. If the committee projects flexibility and intent to act when clarity is restored, then the Fed might hold on to its credibility. If confusion or erratic shifts become a reality, however, it might erode financial-market confidence in financial stability overall.

In the coming weeks, resolution of the shutdown and the return of data will be worth as much as the data itself. Investors need to prepare for volatility, profit from dislocations, hedge carefully and direct allocations toward structural winners rather than macro timing. Because when there is a blackout, clarity – sector insight, balance-sheet superiority, differentiated themes – can hold outsize advantage.

Naeem Aslam is chief investment officer at Zaye Capital Markets in London.

More: Government shutdown means Fed lacks crucial data as it considers rate cuts

Also read: The Fed now faces a ‘perfect storm’ over inflation, jobs and Americans’ financial stability

-Naeem Aslam

This content was created by MarketWatch, which is operated by Dow Jones & Co. MarketWatch is published independently from Dow Jones Newswires and The Wall Street Journal.

(END) Dow Jones Newswires

10-11-25 1318ET

Copyright (c) 2025 Dow Jones & Company, Inc.

Tadej Pogacar won a fifth straight Il Lombardia to equal Fausto Coppi’s record of total wins in the race as he once again overcame his rivals with a ferocious attack on a climb.

The Slovenian accelerated clear of a select group of favourites with…

India’s Lovepreet Singh finished in eighth position in the men’s 110kg+ category on the final day of the World Weightlifting Championships 2025 in Forde, Norway, on Saturday.

Part of Group B in his weight class at the ongoing World…

Namibia Shock South Africa; Become Only Second Team In 20 Years To Achieve MASSIVE Feat

Photo : Namibia Cricket

It was a historic day for Namibian cricket, as the Namibia Cricket Ground in Windhoek witnessed its first international match, as Namibia…