This request seems a bit unusual, so we need to confirm that you’re human. Please press and hold the button until it turns completely green. Thank you for your cooperation!

Blog

-

Just a moment…

Just a moment… -

Swiatek will lead Poland in November’s Billie Jean King Cup playoff

Less than a month after Italy won its second consecutive Billie Jean King Cup title, rosters have been announced for next month’s playoffs.

The playoffs, which will be held in various locations across the world from Nov….

Continue Reading

-

Japan’s More Rigorous Business Manager Work Permit Requirements Now in Effect – Publications

LawFlash

October 17, 2025

The stricter eligibility requirements for the business manager (“keiei kanri” in Japanese) work permit became effective on October 16, 2025 with additional eligibility criteria.

As we reported in our September 12 LawFlash, as scheduled the Immigration Services Agency of Japan (ISA) has amended the eligibility criteria for business managers and the new rules became effective as of October 16, 2025.[1]

Originally, the ISA proposed that

- the company the applicant manages (Company) shall employ at least one full-time worker[2] resident in Japan;

- the Company shall have JPY 30 million or more of stated capital or capital contribution;

- the applicant shall either (1) hold a doctoral degree, master’s degree, or professional degree in a field related to business management or related to the technical skills or knowledge necessary for the business operations or (2) have at least three years of business management experience; and

- the applicant shall submit a business plan evaluated by a business management expert (such as a CPA, tax lawyer, or certified management consultant).[3]

In addition to this eligibility criteria, the ISA added another requirement concerning Japanese language ability. Under the new rules, either the applicant or a full-time employee[4] shall have a “sufficient level of Japanese language ability” (i.e., “B2 or above” in the “Frame of Reference for Japanese Language Education”).

In other words, the applicant or full-time employee (except for Japanese nationals or special permanent residents) shall have Japanese language ability equivalent to one of the following criteria:

- Have been certified at level N2 or above on the Japanese Language Proficiency Test administered by the Japan Educational Exchanges and Services Public Interest Incorporated Foundation and the Japan Foundation

- Achieve a score of 400 or more on the BJT Business Japanese Proficiency Test administered by the Japan Kanji Aptitude Testing Foundation

- Have resided in Japan for more than 20 years as a mid- to long-term resident

- Are a graduate of a university or other higher education institution in Japan

- Have completed compulsory education in Japan and graduated from high school

Please also note that if the business activities as a business owner are not fully recognized (such as outsourcing most business to a third party), the applicant will not be recognized as engaging in activities that fall under the “Business Manager” status of residence.

Foreigners who are currently living in Japan under a business manager work permit are granted a three-year grace period; that is, if such foreigner applies to extend the period of stay on or before October 16, 2028 (i.e., three years from the enforcement date) the application could be approved considering all aspects of the applicant’s residence status, including that their business situation is good, corporate tax obligations have been properly fulfilled, and it is likely that the applicant will meet the new eligibility criteria by the time of the next renewal application.

Paralegals Mai Ishii and Ayako Hiraiwa contributed to this LawFlash.

Continue Reading

-

I Spotted the Blink Video Doorbell for 50% Off, the Lowest Price I’ve Seen

Having a reliable video doorbell is essential for any home in 2025. These smart home devices make it easier to see visitors at the door. It’s helpful for avoiding unwanted hawkers or guiding delivery drivers to a safe spot. Video doorbells can…

Continue Reading

-

What is fuelling the rise and rise of gold in 2025 and will this surge hold?

2025 is turning into the year of gold.

Prices of the yellow metal are galloping towards historic highs and at such blistering speeds that none imagined.

On Thursday, the spot price crossed a record high of $4,320 per ounce — the highest weekly gain since 2008 — and continued its march on Friday to settle at $4,365 per ounce. As for the domestic market, 24K gold was retailing at an all-time high of Rs 1.33 lakh per 10 grams.

So far in 2025, the precious metal has gained over 60% and nearly 100% since the current rally began in early 2024. The speed of the upswing is much faster than forecasts and as the bullion bonanza continues to reach what could be the third-straight year of double-digit gains for gold, analysts are pegging gold to breach $5,000 per ounce in 2026.

Prices are surging due to a host of factors: geopolitical tensions, aggressive interest rate-cut bets, unprecedented central bank buying, de-dollarisation and robust Exchange Traded Funds (ETFs) inflows. Amid relentless demand from retail and institutional buyers, bullion is on track for its strongest annual performance since 1979 and 1980, when prices jumped by 126%, thanks to the revolution in Tehran, which jacked up oil prices and rocked the global economy, closely followed by the Soviet invasion of Afghanistan. Per estimates, between 1978 and 1980, gold prices quadrupled from about $200 to over $850 per ounce, though prices plunged from their peaks in subsequent years.

Interestingly, the current rally mirrors the previous bull runs in gold. Notably, gold has climbed from $3,500 per ounce to $4,320 in less than two months, compared to an average 30 months it took in ordinary course, according to the World Gold Council (WGC). The biggest question is ‘how much room is left to run?’

There are no clear answers, but what’s certain is that gold prices will continue to sparkle simply because of its scarcity. According to WGC, if all the gold ever mined was gathered into a single cube, it would measure approximately 22 metres on each side.

Other reasons that explain the current record gold run and rally further include global economic uncertainties on account of rising government debt, which forced the US government into a shutdown. Besides, there are growing concerns about the independence of the US Federal Reserve and whether political interference influences interest rate cuts.

But these are only ancillary factors and aren’t the main drivers behind gold’s ongoing price rise, according to some. What’s driving the current rally is the growing demand from gold ETFs.

According to WGC data, ETF inflows topped $26 billion during the September quarter alone and for the nine months ending September inflows stood at $64 billion.

According to Goldman Sachs, buyers of gold fall into two broad groups. Conviction buyers (including central banks, ETFs and speculators) consistently buy gold regardless of the price, and their buying tends sets the price direction. As a rule of thumb, every 100 tonnes of net purchases by these conviction holders corresponds to a 1.7% rise in the gold price.

The other group, classified as opportunistic buyers include households, who step in when they believe the price is right.

In addition to retail investor demand for ETFs, emerging market economies, notably China and Russia, are switching their official reserve assets out of currencies like the US dollar and into gold. According to the IMF, central bank holdings of physical gold in emerging markets rose by 161% since 2006 to about 10,300 tonnes.

Central banks, particularly in emerging markets, have increased the pace of gold purchases roughly fivefold since 2022, when Russia’s foreign currency reserves were frozen following its invasion of Ukraine. Central banks are expected to continue accumulating gold as many view the major Western currencies as carrying unwanted risk of financial sanctions.

As per WGC data, they bought 1,082 tonnes in 2022, 1,037 tonnes in 2023, and a record 1,180 tonnes in 2024, which is more than double the earlier annual average of about 500 tonnes.

Russia became a net buyer of gold in 2006, and has been accumulating gold reserves since and now has one of the largest stockpiles in the world. China too is following suit, buying gold reserves in lieu of government bonds, reducing dependency on the US currency. In fact, several emerging markets including India are piling on the yellow metal.

Analysts expect further de-dollarisation efforts by emerging market economies. Gold then, in the long term, has only one direction it can take. Considering hitching your wagon to the golden star?

Continue Reading

-

Gaza aid still critically scarce, say agencies, as Israel delays convoys | Gaza

Aid remains critically scarce in Gaza one week into the ceasefire, humanitarian agencies have warned, as Israel delays the entry of food convoys into the territory. The Israeli government and Hamas continue to trade blame over violations of the…

Continue Reading

-

Federal Bank Agencies’ Withdrawal of Principles for Climate-Related Financial Risk Management a Political Move

WASHINGTON, D.C. — On Thursday, October 16, the Federal Reserve, Office of the Comptroller of the Currency (OCC), and Federal Deposit Insurance Corporation (FDIC) announced the withdrawal of the interagency Principles for Climate-Related Financial Risk Management for Large Financial Institutions.

The principles, finalized in October 2023, provided guidance for how large banks should manage the climate-related risks in order to protect the stability of the broader financial system. The principles include crucial guidance on net-zero commitments and climate scenario analysis, two critical components for the effective management of physical and transition risks posed by climate change.

In response to the news, Jessye Waxman, Campaign Advisor with the Sierra Club’s Sustainable Finance campaign, issued the following statement:

“Federal regulators in the U.S. and globally recognize that climate change poses a destabilizing, systemic threat to the financial system. From stranded assets and market shocks to supply chain disruptions, political instability, and ‘climateflation,’ the repercussions are expected to be unprecedented. Economists liken the impacts to those of the Great Depression, but permanent.

Federal Reserve chair Jerome Powell oversaw the passage, and now the removal, of this guidance. So what’s changed? The science remains clear, the risks have grown, and financial best practices have become more sophisticated. The only change is political leadership, making this reversal a purely political move. These principles were designed to promote best practices to help avoid another financial crisis like 2008. Abandoning sound oversight to align with climate denialists is alarming, and should concern anyone who doesn’t want to face another Great Recession — or worse.”

BACKGROUND

In October 203, the Sierra Club applauded the publication of the final principles for finally recognizing that climate change poses a threat to financial stability and for acknowledging the risk of greenwashing by financial institutions.

The principles were crafted based on significant feedback during various interagency comment periods held from 2022 to 2023. The Sierra Club signed onto a coalition comment letter led by Public Citizen and signed by 68 organizations submitted to the Federal Reserve, and a comment letter led by Public Citizen submitted to the OCC. Sierra Club supporters also submitted comments to the Federal Reserve.

Continue Reading

-

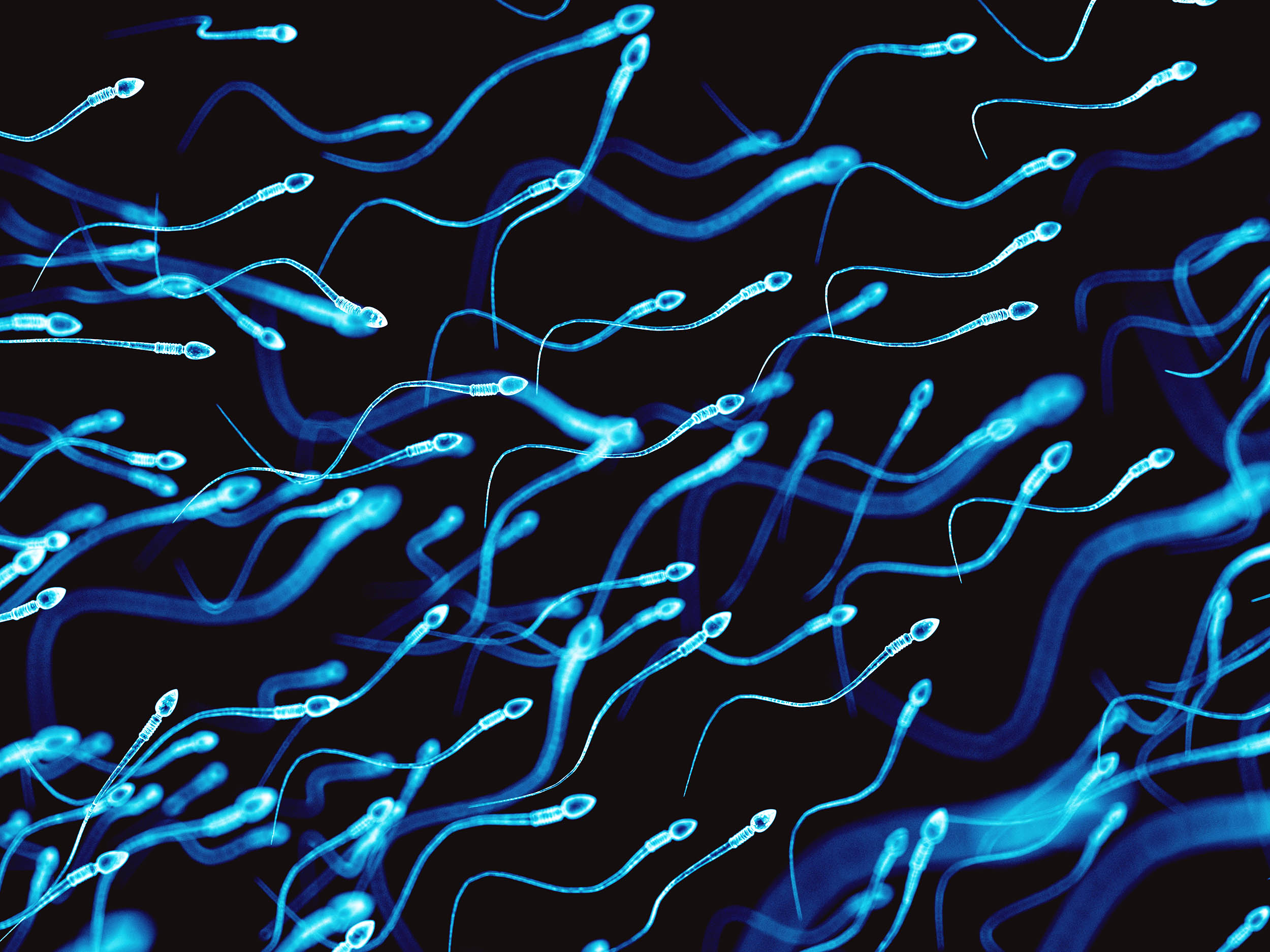

Treatment that helps sperm movement may reverse male infertility

Infertility affects roughly one in six people worldwide, according to a World Health Organization report. In about half of those cases, the problem lies with the man, often because sperm can’t swim properly.

Now, scientists in Japan have found a…

Continue Reading

-

Just a moment…

Just a moment… This request seems a bit unusual, so we need to confirm that you’re human. Please press and hold the button until it turns completely green. Thank you for your cooperation!

Continue Reading