OpenAI’s latest launch gives companies a flexible way to deploy GPTs with team controls

Blog

-

Fresenius Medical Care highlights real-world advances in hemodiafiltration and AI at ASN Kidney Week 2025

- Fresenius Medical Care researchers will present multiple abstracts that demonstrate proven, real-world benefits of hemodiafiltration (HDF), with one accepted as an oral presentation.

- Oral presentation highlights the association between HDF and reduced risk of cardiovascular and fluid-related hospitalization outcomes.

- Research shows how artificial intelligence is moving from theory into practice, supporting clinicians and patients in daily kidney disease care.

Bad Homburg (October 30, 2025) – Fresenius Medical Care AG (FME), the world’s leading provider of products and services for people with kidney diseases, will present new research showing how hemodiafiltration (HDF) is associated with improved outcomes for kidney patients and how innovations in artificial intelligence (AI) can support clinicians in daily care at the American Society of Nephrology (ASN) Kidney Week 2025, November 5-9 in Houston.“This research reflects Fresenius Medical Care’s commitment to patient-centered innovation, demonstrating how advanced therapies like hemodiafiltration can be tailored to improve outcomes in real-world settings,” said Frank Maddux, MD, Global Chief Medical Officer at Fresenius Medical Care. “By applying novel physical principles to kidney replacement therapy, we are leading the field in delivering transformative solutions that elevate the standard of care and advance precision medicine globally.”

FME’s Global Medical Office will present multiple abstracts across a range of critical topics in nephrology, underscoring the company’s commitment to advancing kidney care through innovation and evidence-based science.

Key presentations include:

- Hemodiafiltration is associated with reduced risk of cardiovascular and fluid-related hospitalization outcomes: Highlights how HDF may lower the risk of cardiovascular- and fluid-related hospitalizations.

- Implementation of Online High-Volume Hemodiafiltration in a Chronic Hemodialysis Center in the U.S.: Describes the first chronic dialysis unit to introduce high-volume HDF in the U.S.

- Preventing Falls in Patients on Dialysis Through Artificial Intelligence (AI)-Driven Risk Prediction: Showcases an AI model that predicts patients’ fall risk within a 31-day period.

- Supporting Clinician Adoption of Hemodiafiltration: A Real-Time Artificial Intelligence (AI) Chatbot with Verified Clinical Sources: Introduces a clinician-facing AI chatbot designed to educate and support clinicians implementing HDF.

- From Prompt to Plate: Can ChatGPT Plan a Safe and Clinically Appropriate Diet for Hemodialysis Patients?: Evaluates whether generative AI and large language models can provide safe, nutritionally accurate meal plans for dialysis patients.

“It excites us to see how our research and innovation can translate to everyday practice,” said Maddux. “By combining real-world evidence with innovative technologies, Fresenius Medical Care is helping shape the future of nephrology and set new standards for kidney care.”

In addition to scientific presentations, FME will participate in the following events during ASN Kidney Week:

- FME will host a breakfast symposium, “HighVolumeHDF: The Next Standard of Care for U.S. Patients – Evidence and Practical Use,” as part of the ASN Exhibitor Spotlight series (Thursday, November 6).

- ASN will present an educational symposium, “Hemodiafiltration: Considerations for Incorporation into Dialysis Care,” supported by an educational grant from Fresenius Medical Care (Friday, November 7).

- The Renal Research Institute (RRI), a subsidiary of Fresenius Medical Care, will host its annual symposium, “Reimagining Frontline Care: The Power of Research, AI, and Innovation,” highlighting real-world applications of AI and digital tools in kidney care (Tuesday, November 4).

FME leaders and researchers will also be available onsite at Booth #1815 to discuss research insights, clinical collaborations, and innovations in kidney care. Representatives from RRI will be available at Booth #1838.

To learn more about the company’s presence at ASN this year, please visit https://freseniusmedicalcare.com/en-us/asn-2025/.

Continue Reading

-

Study finds EVs quickly overcome their energy-intensive build to be cleaner than gas cars

DETROIT — Making electric vehicles and their batteries is a dirty process that uses a lot of energy. But a new study says that EVs quickly make up for that with less overall emissions through two years of use than a gas-powered vehicle.

The study also estimated that gas-powered vehicles cause at least twice as much environmental damage over their lifetimes as EVs, and said the benefits of EVs can be expected to increase in coming decades as clean sources of power, such as solar and wind, are brought onto the grid.

The work by researchers from Northern Arizona University and Duke University, published Wednesday in the journal PLOS Climate, offers insight into a transportation sector that makes up a big part of U.S. emissions. It also comes as some EV skeptics have raised concerns about whether the environmental impact of battery production, including mining, makes it worthwhile to switch to electric.

“While there is a bigger carbon footprint in the very short term because of the manufacturing process in creating the batteries for electric vehicles, very quickly you come out ahead in CO2 emissions by year three and then for all of the rest of the vehicle lifetime, you’re far ahead and so cumulatively much lower carbon footprint,” said Drew Shindell, an earth science professor at Duke University and study co-author.

The researchers evaluated several harmful air pollutants monitored by the Environmental Protection Agency, as well as emissions data, to compare the relative impact over time of EVs and internal combustion engines on air quality and climate change.

Their analysis said that EVs produce 30% higher carbon dioxide emissions than gasoline vehicles in their first two years. That can be attributed to the energy-intensive production and manufacturing processes involved in mining lithium for EV batteries.

They also sought to account for how the U.S. energy system might develop in coming years, assuming growth in clean energy. And they modeled four different scenarios for EV adoption, ranging from the lowest — a 31% share of vehicle sales — to the highest, 75% of sales, by 2050. (EV sales accounted for about 8% of new vehicle sales in the U.S. in 2024.)

The researchers said the average of those four models found that for each additional kilowatt hour of lithium-ion battery output, carbon dioxide emissions drop by an average of 220 kilograms (485 pounds) in 2030, and another 127 kilograms (280 pounds) in 2050.

The consistent decrease in CO2 emissions from EVs is “not only driven by the on-road vehicles, but also reduction that has been brought due to electricity production,” said lead author Pankaj Sadavarte, a postdoctoral researcher at Northern Arizona University.

Greg Keoleian, a University of Michigan professor of sustainable systems who wasn’t involved in the research, called it a “valuable study” that echoes other findings and “confirms the environmental and economic benefits” of EVs.

“Accelerating the adoption of battery electric vehicles is a key strategy for decarbonizing the transportation sector which will reduce future damages and costs of climate change,” he said.

Shindell, the Duke researcher, said the grid will evolve to have more solar and wind power.

“When you add a bunch of electric vehicles, nobody’s going to build new coal-fired power plants to run these things because coal is really expensive compared to renewables,” he said. “So the grid just overall becomes much cleaner in both the terms of carbon emissions for climate change, and for air pollution.”

Outside experts agreed — as long as the policy landscape supports it. That hasn’t been the case under President Donald Trump, who has worked to boost fossil fuels and restrain solar and wind power development.

“The great news is the rest of the world isn’t slowing down in terms of its embrace of this technology,” said Ellen Kennedy, principal for carbon-free transportation at RMI, a clean energy nonprofit. As for the U.S., she said, “I think it’s important to keep in mind states and local governments, there’s a lot that’s happening on those fronts.”

One thing the study didn’t address was recycling or disposal of batteries at the end of their life. Kennedy said battery recycling will improve, helping to address one of the environmental impacts of their production.

The study comes at a notable time given the challenges that EVs face in the U.S.

EVs have seen more interest in recent years as an alternative to gas-powered cars and trucks — particularly as they become more affordable and charging infrastructure becomes more available.

But growth has slowed amid shifting federal policy toward EVs and an industry step back from ambitious EV production promises.

Former President Joe Biden set a target for 50% of all new vehicle sales in the U.S. to be electric by 2030. But Trump reversed that policy, and Congress has terminated federal tax credits for an EV purchase. The administration has also targeted vehicle pollution rules that would encourage greater uptake of EVs in the U.S., and the president has attempted to halt a nationwide EV charging buildout.

“The study is important to show how really misguided the current administration’s policies are,” Shindell said. “If we want to protect us from climate change and from the very clear and local damage from poor air quality, this is a really clear way to do it: Incentivize the switch from internal combustion engines to EVs.”

___

Alexa St. John is an Associated Press climate reporter. Follow her on X: @alexa_stjohn. Reach her at ast.john@ap.org.

___

Read more of AP’s climate coverage.

___

The Associated Press’ climate and environmental coverage receives financial support from multiple private foundations. AP is solely responsible for all content. Find AP’s standards for working with philanthropies, a list of supporters and funded coverage areas at AP.org.

Continue Reading

-

3 candidates contesting today’s polls for Senate seat vacated after Shibli Faraz’s disqualification – Dawn

- 3 candidates contesting today’s polls for Senate seat vacated after Shibli Faraz’s disqualification Dawn

- Governor Khyber Pakhtunkhwa Faisal Karim Kundi met with Leader of the Opposition in the Provincial Assembly Dr. Ibadullah Khan, PPP…

Continue Reading

-

BBVA CIB reports record revenues of €4,832 million through September

Sustained growth in client activity, driven by sector specialization

Despite global uncertainty, BBVA CIB has reinforced its commitment to supporting the sustained growth of wholesale clients in 2025, thanks to a sector specialization model built on tailored solutions and a long-term strategic vision.

This approach is reflected in a 16% year-on-year increase in revenues from the corporate segment through September, with particularly strong performance in the energy (+23%), consumer & retail (+19%) and TMT (+16%) sectors. In the institutional segment, growth accelerated to 23% year-on-year, driven by strong performance in the public sector (60%) and among financial sponsors (+49%).

Business unit performance

Global Markets (GM) continued to deliver strong growth across all strategic areas, with currencies (FX) and equities playing a key role. Revenues reached €1,847 million through September, up 27% year-on-year. FX saw exceptional performance in Turkey and Mexico, driven by significantly higher trading volumes and the volatility stemming from geopolitical tensions. The equities business benefited from strong institutional activity in the U.S. and Asia, as well as the integration of BBVA Trader into the retail channels. The positive performance of the rates business was supported by activity in the U.S. and the financing business. Meanwhile, the credit business continued to perform solidly in the U.S., Europe and Mexico, underpinned by strong origination activity.

Global Transaction Banking (GTB) maintained strong momentum in the third quarter of 2025, with cumulative revenues reaching €1,841 million in the first nine months of the year, a 19% increase versus the same period in 2024. This performance reflects the consolidation of structured receivables solutions and notable progress in inventory, liquidity and supply chain management. Sustained growth was recorded in key markets, supported by higher transaction volumes across geographies and business units within the Group. These factors contributed to year-on-year improvements despite a more challenging environment marked by lower returns on interest rates and persistent geopolitical tensions. In this context, activity reached record levels in loans, deposits and guarantees, driving double-digit growth in both net interest income and fees. As a result, GTB’s efficiency ratio remained below industry standards, reflecting highly effective execution.

Investment Banking & Finance (IB&F) delivered an outstanding performance in the first nine months of the year, with results reaching €1,038 million, a 35% increase compared to the same period in 2024. This strong performance was mainly driven by corporate lending activity in the U.S., United Kingdom, Rest of Europe and Mexico, as well as structured trade finance in Spain and Rest of Europe. In addition, project finance continued to show strong momentum, particularly in the U.S. and Europe, with renewable energy and TMT projects as the main drivers of growth.

In a context marked by geopolitical uncertainty and market volatility, corporate finance activity remained resilient and dynamic, posting a significant increase in revenues over the nine-month period.

Cross-border business at BBVA CIB

Cross-border business continues to be one of the key growth drivers for BBVA CIB, strengthening market connectivity and supporting clients in their international expansion. So far this year, it already accounts for 43% of the division’s total revenues, following a strong momentum in recent months that has resulted in 17% growth. Mexico remains the most attractive market for clients, while the franchise continues to deepen its presence in the United States and United Kingdom, and relevant transactions are being closed in Brazil. This progress is underpinned by large structured financing deals and the development of innovative global trade finance solutions, particularly in prepayments and inventory finance.

Sustainability as a business driver

Between January and September 2025, BBVA CIB channelled approximately €49,700 million in sustainable finance, a 36% year-on-year increase. BBVA continues to promote the financing of clean technologies (cleantech) and renewable energy projects in the wholesale segment, as well as solutions such as sustainability-linked supply chain finance (confirming). Notably, financing for renewable energy projects reached €2,100 million through September.

Continue Reading

-

Using Artificial Intelligence To Track Proteins

A database for AI-generated molecular “fingerprints”

Since 2022, MSAID has been marketing a patented successor of the software whose prototype sparked the company’s founding. It streamlines the analysis of complex, large datasets. MSAID COO…

Continue Reading

-

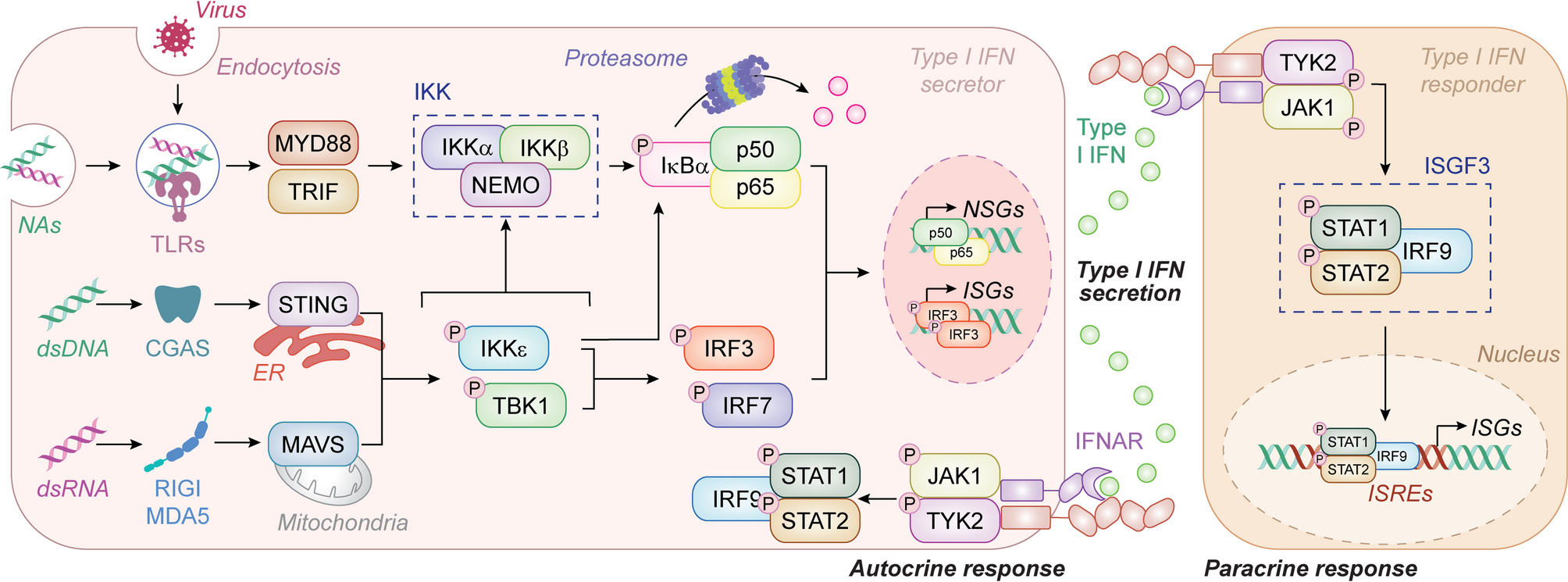

Context-dependent impact of type I interferon signaling in cancer | Molecular Cancer

Hardy MP, Owczarek CM, Jermiin LS, Ejdebäck M, Hertzog PJ. Characterization of the type I interferon locus and identification of novel genes. Genomics. 2004;84:331–45.

Google Scholar

Continue Reading

-

Kourtney Kardashian Opens Up About Rob and Khloe’s unusually Close Relationship on ‘The Kardashians’

Kourtney Kardashian shared insight into Rob and Khloe’s close bond, joking they’re “a little incestual” in new episode

Kourtney Kardashian has…

Continue Reading

-

Virgin set to challenge Eurostar on Channel Tunnel route

Virgin Trains will be able to launch rail services through the Channel Tunnel after the UK’s rail regulator approved its application to share a depot with Eurostar.

The decision by the Office of Rail and Road (ORR) means Eurostar’s monopoly on passenger services is set to be broken for the first time since the tunnel opened in 1994.

Temple Mills railway storehouse in east London is the only depot in the UK able to accommodate the larger trains used in continental Europe and which is already linked to the cross-Channel line.

Virgin says it wants to start running services from 2030, but the ORR says several steps will need to be taken first.

The ORR had said the Temple Mills depot had enough space to either house an expanded Eurostar fleet or accommodate a rival company’s trains – but not both.

The regulator said a number of steps needed to be taken before new international services could run. Virgin needs to enter into a commercial agreement with Eurostar, will have to secure finance, access to track and stations, and have to get safety approvals from UK and EU authorities.

But the ORR said its decision unlocked plans for around £700m of investment and could create 400 new jobs, describing it as “a win for passengers, customer choice, and economic growth”.

Sir Richard Branson, founder of the Virgin Group, said: “The ORR’s decision is the right one for consumers – it’s time to end this 30-year monopoly and bring some Virgin magic to the cross-Channel route.”

Rail Minister Lord Hendy said he was “incredibly pleased” with the ORR’s decision and called it a “significant step forward”.

“Allowing Virgin Trains to share this vital facility will give passengers greater choice, better value and improve connectivity for millions, as well as drive innovation, lower fares and promote greener connections with Europe,” he said.

Martin Jones, deputy director of Access and International at the ORR, said: “While there is still some way to go before the first new services can run, we stand ready to work with Virgin Trains as their plans develop.”

Several firms had wanted to start operating services between London and mainland Europe, including Spanish start-up Evolyn, Richard Branson’s Virgin and a partnership between Gemini Trains and Uber.

The ORR only approved Virgin’s application on Thursday and rejected applications from Evolyn, Gemini and Trenitalia.

Virgin said it planned to launch rail services from London St Pancras to Europe from 2030.

This will include services to Paris Gare du Nord, Brussels-Midi and Amsterdam Centraal, with future plans to expand further across France, and into Germany and Switzerland.

The plans would mean Virgin Trains returning to the rails for the first time since 2019, when the company lost its contract to Avanti West Coast.

Virgin Trains had operated a service running from London Euston via Birmingham and Manchester to Scotland for 22 years before it was disqualified from bidding for the franchise.

Continue Reading

-

Sensors Information | AZoSensors.com – Page not found

Terms

While we only use edited and approved content for Azthena

answers, it may on occasions provide incorrect responses.

Please confirm any data provided with the related suppliers or

…Continue Reading