Men with suspected prostate cancer will be able to get a diagnosis from the NHS within a day, under a new trial hailed as a potential “game changer” for identifying and treating the disease.

The 15 hospitals taking part will use AI technology to…

Men with suspected prostate cancer will be able to get a diagnosis from the NHS within a day, under a new trial hailed as a potential “game changer” for identifying and treating the disease.

The 15 hospitals taking part will use AI technology to…

Shaimaa Khalil

Tokyo correspondent

So far, one remark stands out. President Trump is affording Ms Takaichi a lot of good will.

“I want to just let you know – any time you have any question, any doubt, anything you want, any favors you need, anything I can do to help Japan, we will be there.”

It’s a critical moment for Japan and for its new PM Sanae Takaichi – a defining early test of leadership. In her first face-to-face meeting with President Trump, she described him as a partner in a new golden age and praised his role in Middle East peace.

President Trump praised Japan as “a great ally” and said he’ll be there to help Japan whenever needed. But he’s also pushing hard on trade and security, leaving Tokyo backed into a corner.

Trump wants more US access to Japan’s markets – especially in cars, agriculture, and technology. He’s pressing Japan to buy more American rice and soybeans, and to open its market to US vehicles.

Tokyo, heavily reliant on exports, can’t afford a tariff fight – especially when it comes to its auto industry.

But Takaichi also needs to protect domestic industries and doesn’t want to anger crucial interest groups like the powerful farming lobby.

For now, the tone is friendly. But there’s real pressure on Tokyo to deliver on agreements with little room to manoeuvre.

The Memphis Grizzlies didn’t begin the season the way they would’ve liked, even though it started with a win. That’s because several significant players on their team began the year sidelined and will remain there for the near future. Going into…

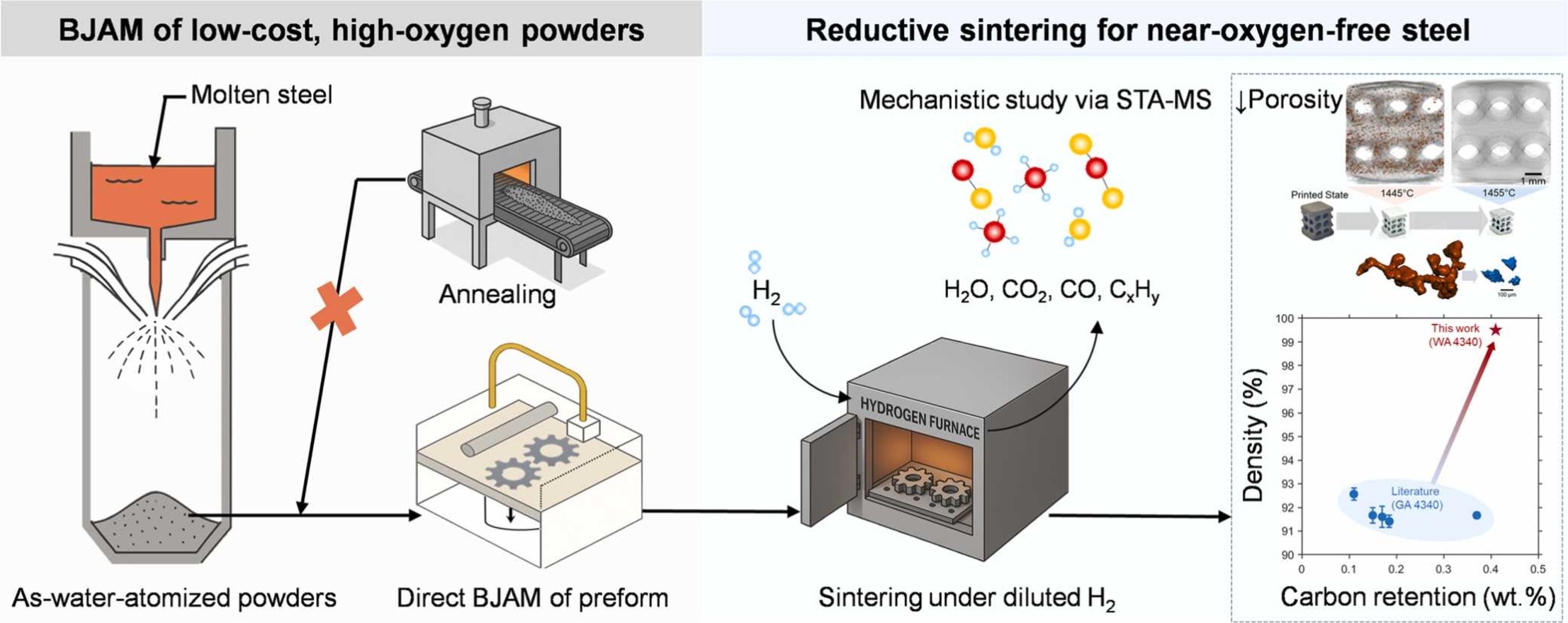

Researchers from the University of Waterloo’s Multi-Scale Additive Manufacturing Laboratory and the Fraunhofer Institute for Manufacturing Technology and Advanced Materials (IFAM) have developed a single-step reductive…

Every second matters when a haemorrhage or clot disrupts blood flow to the brain and cells up there begin to die.

Known as a stroke, it will happen to one in four of us.

It is then a race against time, in which both the public and health…

Get the key facts on this story with our quick, 1-minute read

Novel discovery: Astronomers have identified a completely new, fourth mechanism by which a star or its remnant can be destroyed in the Universe.

Collision course: The star’s…

Significant insider control over Pan-United implies vested interests in company growth

The top 3 shareholders own 64% of the company

Recent sales by insiders

Trump has pledged to “unleash” American oil and gas and these 15 US stocks have developments that are poised to benefit.

If you want to know who really controls Pan-United Corporation Ltd (SGX:P52), then you’ll have to look at the makeup of its share registry. And the group that holds the biggest piece of the pie are individual insiders with 72% ownership. In other words, the group stands to gain the most (or lose the most) from their investment into the company.

And insiders own the top position in the company’s share registry despite recent sales.

Let’s take a closer look to see what the different types of shareholders can tell us about Pan-United.

View our latest analysis for Pan-United

Small companies that are not very actively traded often lack institutional investors, but it’s less common to see large companies without them.

There could be various reasons why no institutions own shares in a company. Typically, small, newly listed companies don’t attract much attention from fund managers, because it would not be possible for large fund managers to build a meaningful position in the company. It is also possible that fund managers don’t own the stock because they aren’t convinced it will perform well. Pan-United might not have the sort of past performance institutions are looking for, or perhaps they simply have not studied the business closely.

Hedge funds don’t have many shares in Pan-United. The company’s largest shareholder is Han Whatt Ng, with ownership of 23%. The second and third largest shareholders are Bee Kiok Ng and Bee Bee Ng, with an equal amount of shares to their name at 21%. Bee Bee Ng, who is the third-largest shareholder, also happens to hold the title of Chairman of the Board.

To make our study more interesting, we found that the top 3 shareholders have a majority ownership in the company, meaning that they are powerful enough to influence the decisions of the company.

While it makes sense to study institutional ownership data for a company, it also makes sense to study analyst sentiments to know which way the wind is blowing. There are plenty of analysts covering the stock, so it might be worth seeing what they are forecasting, too.

The definition of company insiders can be subjective and does vary between jurisdictions. Our data reflects individual insiders, capturing board members at the very least. Company management run the business, but the CEO will answer to the board, even if he or she is a member of it.

Sleep problems affect more than one in five residents in long-term care facilities, with pain, daytime napping and certain medications emerging as key contributors.

An international team led by University of Waterloo researchers…