Indonesia’s Jonatan Christie has suffered his first badminton World Tour defeat in over a month after losing a thrilling three-game encounter against Watanabe Koki (21–11, 19–21, 23–25) on Thursday (23 October) at the 2025 BWF French Open…

Blog

-

Blackstone Reports Third-Quarter 2025 Earnings

NEW YORK – October 23, 2025 – To view the full report please click the following link – Blackstone’s Third-Quarter 2025 results.

Blackstone will host its third-quarter 2025 investor conference call via public webcast on October 23, 2025 at 9:00 a.m. ET. To register and listen to the call, please use the following link here.

For those unable to listen to the live broadcast, there will be a webcast replay on the Shareholders section of Blackstone’s website at https://ir.blackstone.com/ beginning about two hours after the event.

About Blackstone

Blackstone is the world’s largest alternative asset manager. Blackstone seeks to deliver compelling returns for institutional and individual investors by strengthening the companies in which the firm invests. Blackstone’s over $1.2 trillion in assets under management include global investment strategies focused on real estate, private equity, credit, infrastructure, life sciences, growth equity, secondaries and hedge funds. Further information is available at www.blackstone.com. Follow @blackstone on LinkedIn, X (Twitter), and Instagram.

Contact

Blackstone Public Affairs

New York

+1 (212) 583-5263

Continue Reading

-

Mitsubishi Shipbuilding Holds Christening and Launch Ceremony in Shimonoseki for Training Ship WAKASHIO MARU Built for National Institute of Technology, Toyama College

The Christening and Launch Ceremony of WAKASHIO MARU

Tokyo, October 23, 2025 – Mitsubishi Shipbuilding Co., Ltd., a Mitsubishi Heavy Industries (MHI) Group company based in Tokyo, today held a christening and launch ceremony for the WAKASHIO MARU, a training ship for National Institute of Technology, Toyama College (NIT, Toyama College). The ceremony took place at the Enoura Plant of MHI’s Shimonoseki Shipyard & Machinery Works in Yamaguchi Prefecture. The handover is scheduled for March 2026, following completion of interior work and sea trials. The new vessel will go into service providing practical training in ocean navigation, and conducting surveys and experiments related to operations and the ocean for purposes such as a variety of educational and community contribution activities to train maritime personnel, contribute to regional societies, and encourage members of the community to think about maritime matters.

This is the fifth-generation training vessel for NIT, Toyama College, and the first ship in 31 years, since 1995. This is the first vessel Mitsubishi Shipbuilding has built for the school. Characteristics of the vessel include comfortable, individually tailored living quarters and design features to foster seamanship, including training all five senses. Specifically, in addition to providing practical training environments with a navigational simulator and a training switchboard so that trainees can learn through repetition, wooden decks that require daily maintenance such as polishing are used and the main machinery room and the generator room are separated so that trainees can learn the difference in the sounds and vibration of different equipment.

It can also function as a disaster support vessel, with the ability to operate an onboard base station, supply water and electricity, transport support resources, and provide living quarters in the event of natural disasters. Extensive oceanographic research equipment, including various acoustic equipment, an A-frame crane, and various winches, is included for marine surveys and research, with consideration for characteristics of Toyama that are unlike almost anywhere else in the world, such as a depth of over 1,000m at the center of the bay and a three-tiered water mass structure.

Going forward, Mitsubishi Shipbuilding will continue to support its customers and the advancement of society by using its synergy with MHI Group to build ships that embody even more advanced development and design for the maritime field, and contribute to the training of next-generation maritime officers, and oceanographic surveys.

■ Main Specifications of the WAKASHIO MARU

Owner National Institute of Technology, Toyama College

(NIT, Toyama College)LOA Approx. 56.3 meters Beam Approx. 10.6 meters Depth Approx. 5.8 meters Gross tonnage Approx. 370 tonnes Capacity Approx. 60 persons Service speed 12.5 knots Continue Reading

-

World’s longest woolly rhino horn discovered in melting Siberian permafrost

Like modern rhinos, woolly rhinos likely also used their horns as weapons. Notches in the middle of some of the horns that have been discovered might have formed when they smacked against the horn of another rhino, according to Kahlke.

Scenes of…

Continue Reading

-

SpaceX Launched a Record-Breaking 133rd Falcon 9 Mission This Year – extremetech.com

- SpaceX Launched a Record-Breaking 133rd Falcon 9 Mission This Year extremetech.com

- SpaceX launches 10,000th Starlink internet satellite The Verge

- Sky’s getting crowded Komando.com

- Nighttime SpaceX rocket launch planned in Florida. What time is…

Continue Reading

-

Streaming Grows, US Ad Revenue Falls

Spanish-language media giant TelevisaUnivision reported higher adjusted profitability for its third quarter, driven by “continued growth” in streaming profits and the impact of previously taken cost efficiency measures.

But the company…

Continue Reading

-

Just a moment…

Just a moment… This request seems a bit unusual, so we need to confirm that you’re human. Please press and hold the button until it turns completely green. Thank you for your cooperation!

Continue Reading

-

Just a moment…

Just a moment… This request seems a bit unusual, so we need to confirm that you’re human. Please press and hold the button until it turns completely green. Thank you for your cooperation!

Continue Reading

-

Gold just stumbled. A JPMorgan strategist says the metal could double in value.

By Barbara Kollmeyer

Goldman Sachs also is bullish on gold

Investor appetite for gold has the potential to double prices of the metal, says JPMorgan.

For those weary of the AI debate, gold’s dramatic swoon this week has at least changed the discussion.

Since its biggest one-day drop in over a decade on Tuesday, the debate has surrounded whether gold will regroup and push higher. Goldman Sachs, for one, is sticking to its end-2026 target of $4,900 per ounce, and sees upside risks from central bank as well as institutional investor demand.

“The speed of recent ETF inflows and client feedback suggest many long-term capital allocators – including sovereign-wealth funds, central banks, pension funds, and both private wealth and asset managers – are planning to increase their exposure to gold as a strategic portfolio diversifier,” said analysts Lina Thomas and Daan Struyven, said in a note.

That segues into our call of the day from a JPMorgan team of strategists led by Nikolaos Panigirtzoglou, who say the price of gold could more than double in three years, as investors increasingly use it to hedge equities.

Firstly, Panigirtzoglou and his colleagues blame the metal’s recent tumble on trend-following commodity trading advisers taking profit on gold futures contracts, rather than retail investors exiting gold ETF exposures. Gold futures (GC00) have soared 56% this year.

“If this assessment is correct and retail investors were not behind [Tuesday’s] gold correction, then it is likely that their buying of gold ETFs has been less motivated by momentum and more driven by other factors,” they said.

The strategists do not believe all of that buying can be explained by this year’s popular debasement trade, which has seen investors turn to gold due to worries of a weakening dollar.

“What the ‘debasement trade’ does not traditionally encompass is the motivation to hedge equity exposures. And this motivation to hedge equity exposures has been more visible this year as retail investors bought equities and gold simultaneously and shunned longer-dated bonds, i.e. their traditional asset to hedge equity risk,” said Panigirtzoglou and his team.

While retail investors flocked to those bonds in 2023 and most of 2024, likely as a hedge against rising stock prices, they haven’t done the same this year, even though equities continue to climb, said the strategists. Instead, as their chart shows, gold has been the draw:

The strategists calculate that nonbank investors globally have boosted their allocation to gold to 2.6% of holdings. They arrive at this number by dividing $6.6 trillion of private investor gold holdings excluding central banks by the total stock of equities, bonds, cash and gold held outside banks. Should their theory that investors have replaced gold with bonds to hedge equity exposures prove correct, then that 2.6% allocation is probably too low, they say.

Another factor driving investors toward gold and away from those longer-dated bonds concerns the investor experience post Liberation Day, when President Donald Trump announced tariff rates he quickly scaled back. As stocks sharply corrected, longer-dated bonds also suffered, which became a problem for strategies that use those bonds as a way to hedge equity risk, said the JPMorgan team.

They calculate, using ETFs as a proxy, that around a tenth of the 20% allocation to bonds is in longer-dated bond funds. If that 2% allocation to those bonds were to be replaced by gold, the overall allocation would rise to 4.6%, implying a near doubling of gold prices factoring in other financial assets.

To be more exact, Panigirtzoglou and his team assume equity prices grow enough in the next three years that equity allocations rise to 54.6%, the previous peak of the dot-com bubble era. They also factor in a projected $7 trillion per year expansion of bonds and cash in the next three years. With both in mind, “the gold price would have to rise by 110% for the gold allocation to increase from 2.6% currently to 4.6% by 2028,” said the JPMorgan team.

Read: Here’s a theory about why gold suffered its biggest one-day fall in more than 10 years, and it’s linked to the U.S. economy

The markets

U.S. stock futures (ES00) (YM00) (NQ00) are mostly flat after Wednesday’s selloff. Oil (CL00) has climbed above $60/barrel after U.S. sanctions on two major Russian oil exporters. Gold (GC00) and silver (SI00) are rising.

Key asset performance Last 5d 1m YTD 1y S&P 500 6699.4 0.42% 0.93% 13.90% 15.56% Nasdaq Composite 22,740.40 0.31% 1.08% 17.76% 24.42% 10-year Treasury 3.965 -0.80 -20.30 -61.10 -25.20 Gold 4107.4 -5.45% 8.65% 55.62% 49.43% Oil 60.66 6.51% -6.99% -15.60% -13.75% Data: MarketWatch. Treasury yields change expressed in basis points

The buzz

Tesla shares (TSLA) are falling after revenue beat, but earnings disappointed. CEO Elon Musk closed out the call asking investors to vote in favor of his $1 trillion compensation package.

IBM shares (IBM) declined on concerns over growth in its software business.

Results from Intel (INTC) and Ford (F) results are due after the close.

Quantum stocks soared after the Wall Street Journal reported the Trump administration is considering making investments in the space.

Molina Healthcare (MOH) cut full-year guidance after the healthcare provider’s underperformance in its marketplace hit sales.

Existing-home sales for September are due at 10 a.m. Fed governor Michael Barr will make another appearance, at 10:25 a.m.

Best of the web

Popular leveraged funds shock investors with huge losses.

Goldman trader answers why the so-called dumb money has been beating the pros this year.

Why these money managers see stocks climbing through 2026.

The chart

Yardeni Research offers a chart showing a bubble for Cathie Wood’s ARK Innovation ETF ARKK during 2020, that burst the next two years “without causing any collateral damage,” and since April has been doing fine. It’s part of a bone Yardeni has to pick with talk over an “everything bubble” that will soon pop. Rising margin debt this summer, SPACs in 2021, bitcoin in 2022 were all bubbly but no global collapse ensued, the firm says.

Top tickers

These were the top-searched tickers on MarketWatch as of 6 a.m.:

Ticker Security name BYND Beyond Meat TSLA Tesla NVDA Nvidia GME GameStop QBTS D-Wave Quantum TSM Taiwan Semiconductor Manufacturing RGTI Rigetti Computing AMD Advanced Micro Devices IONQ IonQ NFLX Netflix

Random reads

Wild bear breaks into California zoo, checks on pals.

That Louvre jewelry heist? Security camera were pointed the other way.

In Spain, a far lower-stakes theft, of restaurant chairs.

-Barbara Kollmeyer

This content was created by MarketWatch, which is operated by Dow Jones & Co. MarketWatch is published independently from Dow Jones Newswires and The Wall Street Journal.

(END) Dow Jones Newswires

10-23-25 0651ET

Copyright (c) 2025 Dow Jones & Company, Inc.

Continue Reading

-

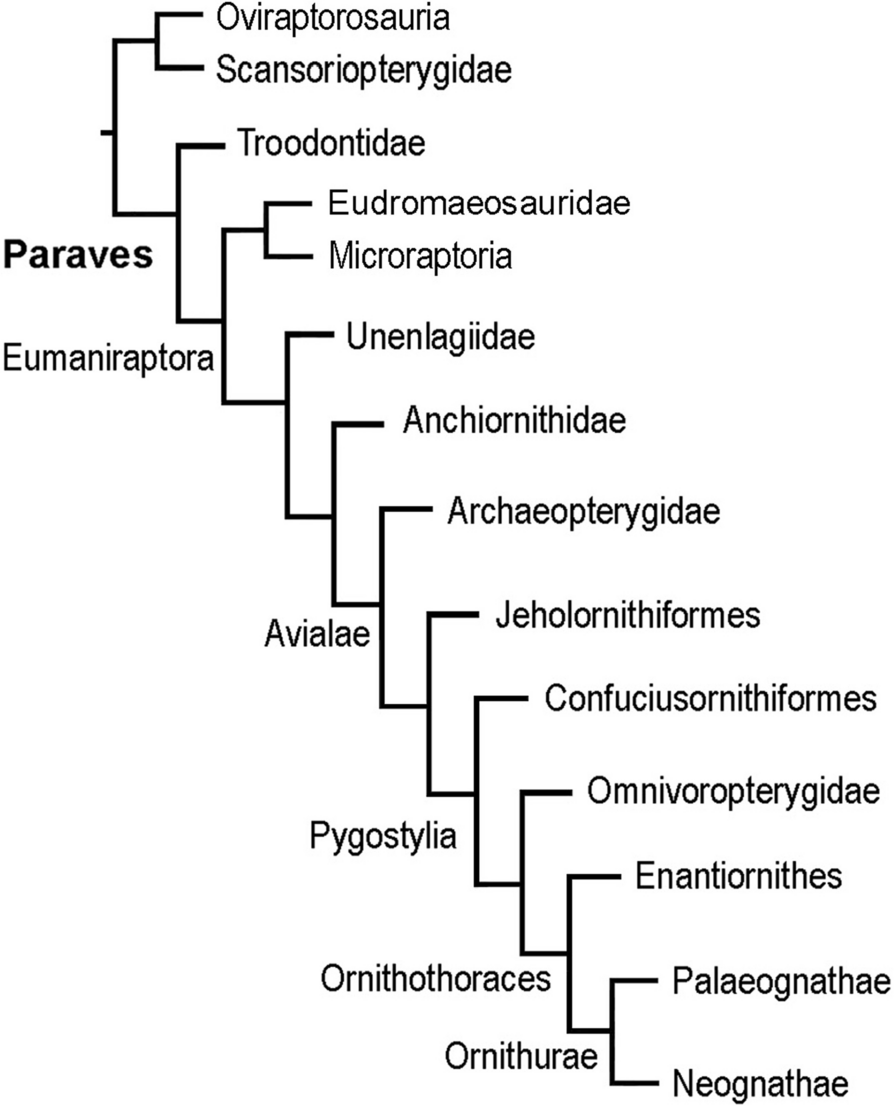

Reconstruction of pectoral musculature in non-avialan paravians and basal birds: implications in the acquisition of flapping flight | BMC Ecology and Evolution

Of the pectoral musculature, we have selected the five muscles (i.e., mm. deltoideus scapularis/major, pectoralis, supracoracoideus, coracobrachialis brevis p. ventralis/p. cranialis, biceps brachii) due to the fact that they are the largest and…

Continue Reading