This article first appeared on GuruFocus.

Netflix (NASDAQ:NFLX) is taking its hit animated film KPop Demon Hunters off the screen and into the real world, partnering with Mattel (NASDAQ:MAT) and Hasbro (NASDAQ:HAS) to bring fans an entire…

This article first appeared on GuruFocus.

Netflix (NASDAQ:NFLX) is taking its hit animated film KPop Demon Hunters off the screen and into the real world, partnering with Mattel (NASDAQ:MAT) and Hasbro (NASDAQ:HAS) to bring fans an entire…

NEW YORK, Oct. 22, 2025 (GLOBE NEWSWIRE) — LayerX Security, the leader in enterprise browser security, today announced that it is the first browser security company to support OpenAI’s newly released agentic AI browser, ChatGPT Atlas. This…

This request seems a bit unusual, so we need to confirm that you’re human. Please press and hold the button until it turns completely green. Thank you for your cooperation!

– Advertisement –

ISLAMABAD, Oct 22 (APP):Prime Minister Muhammad Shehbaz Sharif on Wednesday lauded the services of Federal Secretary for Information and Broadcasting, Ambreen Jan, during her farewell call at the Prime Minister’s…

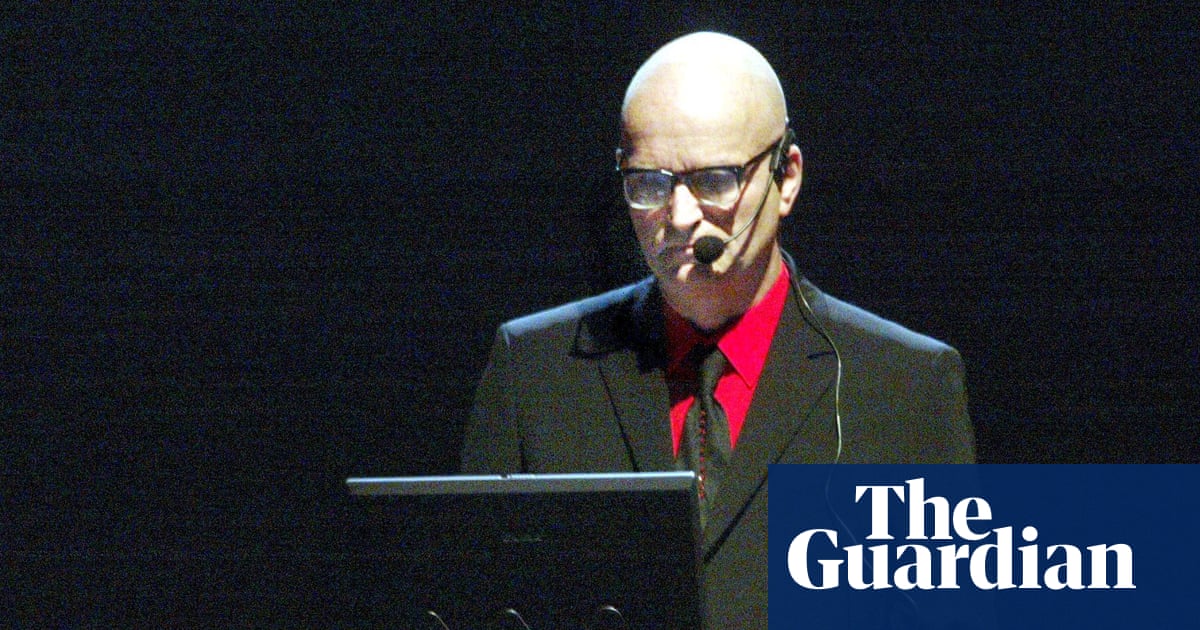

He was a pioneer of electronic music whose band Kraftwerk redefined the sound of pop and influenced artists from David Bowie and New Order to Coldplay and Run-DMC.

Now the electronic equipment and musical instruments Florian Schneider used to…

With 120+ Pre-Built AI Models, the Workday Contract Intelligence Agent Helps Customers Quickly Analyze Contracts, Flag Risks, and Gain Insights Across HR, Finance, Legal, IT, and More

PLEASANTON, Calif., Oct. 22, 2025 /PRNewswire/ — Workday, Inc. (NASDAQ: WDAY), the enterprise AI platform for managing people, money, and agents, today announced a new Custom AI Model Library for the Workday Contract Intelligence Agent, powered by Evisort. The library includes more than 120 pre-built AI models trained to identify key clauses, risks, line items, and terms in contracts — from HR agreements to vendor contracts to sales deals. By giving organizations access to these specialized models, Workday is enabling faster contract reviews, earlier risk detection, and significantly less manual effort.

The Workday Contract Intelligence Agent already helps legal and business teams make smarter decisions by reviewing contracts at scale to flag risks, track obligations, and uncover opportunities. With the addition of the Custom AI Model Library, customers can now automatically analyze a wider range of contract terms — from employment agreements and vendor security clauses to payment schedules, data privacy obligations, and renewal provisions — across HR, Finance, Legal, IT, and Sales. The new models are pre-trained and ready to deploy, but customers can also refine them further by simply providing feedback — no coding required.

“AI in the enterprise often delivers piecemeal automation without true transformation,” said Jerry Ting, vice president, head of agentic AI & Evisort, Workday. “We aren’t just adding features; we are giving our Contract Intelligence Agent new skills that help solve real business problems. Our goal is to make deep, complex contract analysis fast and actionable for every team.”

The Custom AI Model Library delivers a deeper level of contract analysis by enabling models to summarize, calculate, and classify key terms — turning complex documents into actionable insights. With these new models, teams can:

For more information

About Workday

Workday is the enterprise AI platform for managing people, money, and agents. Workday unifies HR and Finance on one intelligent platform with AI at the core to empower people at every level with the clarity, confidence, and insights they need to adapt quickly, make better decisions, and deliver outcomes that matter. Workday is used by more than 11,000 organizations around the world and across industries – from medium-sized businesses to more than 65% of the Fortune 500. For more information about Workday, visit workday.com.

© 2025 Workday, Inc. All rights reserved. Workday and the Workday logo are registered trademarks of Workday, Inc. All other brand and product names are trademarks or registered trademarks of their respective holders.

Forward-Looking Statements

This press release contains forward-looking statements including, among other things, statements regarding Workday’s plans, beliefs, and expectations. These forward-looking statements are based only on currently available information and our current beliefs, expectations, and assumptions. Because forward-looking statements relate to the future, they are subject to inherent risks, uncertainties, assumptions, and changes in circumstances that are difficult to predict and many of which are outside of our control. If the risks materialize, assumptions prove incorrect, or we experience unexpected changes in circumstances, actual results could differ materially from the results implied by these forward-looking statements, and therefore you should not rely on any forward-looking statements. Risks include, but are not limited to, risks described in our filings with the Securities and Exchange Commission (“SEC”), including our most recent report on Form 10-Q or Form 10-K and other reports that we have filed and will file with the SEC from time to time, which could cause actual results to vary from expectations. Workday assumes no obligation to, and does not currently intend to, update any such forward-looking statements after the date of this release, except as required by law.

Any unreleased services, features, or functions referenced in this document, our website, or other press releases or public statements that are not currently available are subject to change at Workday’s discretion and may not be delivered as planned or at all. Customers who purchase Workday services should make their purchase decisions based upon services, features, and functions that are currently available.

SOURCE Workday Inc.

For further information: For further information: Investor Relations: ir@workday.com, Media Inquiries: media@workday.com

This week is the perfect chance to see two of the most talked-about celestial events in recent weeks.

Comet Lemmon is at its closest point to Earth, and the Orionid meteor shower is at peak activity.

What’s more, the Moon is out of the way,…

This request seems a bit unusual, so we need to confirm that you’re human. Please press and hold the button until it turns completely green. Thank you for your cooperation!

It was clear from New York Climate Week (NYCW) that the insurance industry is widely recognized as a cross-cutting enabler of climate action. In the context of resilience, the industry plays an important role in understanding and quantifying risk, pricing it accurately, promoting the adoption of solutions, and incentivizing measures that strengthen resilience against climate impacts. In the context of the energy transition, insurance can be an enabler of investment by mitigating risks associated with projects.

While this was my first experience of NYCW, colleagues who have attended in previous years confirmed that insurance has always been part of the conversation, but it was more central to the dialogue this year. However, although insurance is a key part of the solution to climate change, it cannot provide all the answers.

A central theme to emerge from NYCW was the growing challenges of insurability and affordability amid increasing climate-related losses. Insured losses are rising sharply, driven in part by more frequent and severe climate events, which is putting pressure on the availability and affordability of (re)insurance coverage. As the likelihood and severity of extreme weather events increases, the risk of loss — and consequently, insurance costs — also rise. While homeowners have been more affected to date, this same dynamic increasingly applies to businesses.

Wildfires in California are a case in point. Total insured losses from the California wildfire in January 2025 are estimated to cost between US$25 billion to US$39.4 billion. Meanwhile, the California FAIR Plan, the state’s insurer of last resort, had just US$377 million available to pay claims. These economics are not sustainable, emphasizing the need to focus on building resilience into homes, businesses, and communities.

Given this, participants were keen to better understand how insurance can drive solutions through risk-based pricing and incentives, how to navigate insurer climate risk disclosures, and how to demonstrate the return on investment (ROI) of adaptation measures.

During the week, we presented key findings from the Marsh Climate Adaptation Survey 2025, revealing that 60% of respondents report having sufficient funds allocated for climate adaptation. However, a general consensus at NYCW was that organizations do not have enough resources for these efforts. A missed opportunity may include not using a cost-benefit analysis to build a compelling business case for these investments, as revealed in our survey. Many organizations still struggle to frame such adaptation spending in terms of potential avoided future costs.

Supporting this trend, industry feedback at the event emphasized the importance of including resilience-related questions in client requests for proposals (RFPs). This approach allows companies to underscore the importance of resilience to their leadership. By highlighting long-term financial risks, businesses can strengthen the economic rationale for proactive adaptation, potentially mitigating future losses.

A practical example of successful adaptation investment is New York City’s redevelopment of Brooklyn Bridge Park. This mixed-use space combines residential areas, revitalized public spaces, and resilience-building infrastructure such as elevated structures and saltmarsh grasses that protect against flood waves. Funded partly through property taxes, these flood resilience measures also contribute to lowering insurance premiums, demonstrating a practical synergy between adaptation investment and risk reduction.

The third key theme from NYCW was the growing interest in nature-based solutions. Academic research shows that natural measures — such as restoring mangrove forests — can protect communities and properties from coastal flooding and storm surges.

An inspiring story shared was the US Fish and Wildlife Service’s project in New Mexico’s Carson National Forest, which draws on Indigenous knowledge to manage forests more resilient to wildfires and floods. This initiative integrates ecological restoration, cultural stewardship, and community engagement, highlighting the value of traditional practices in modern climate resilience efforts.

However, scaling nature-based solutions can be challenging. As my colleague Lovey Sidhu explained during the webinar, Harnessing Nature for Resilience, “One of the major issues is the complexity of valuing nature benefits, which are often hard to quantify and accrue over long-time horizons, making them difficult to capture on traditional balance sheets.”

Insurance can play an important role here. One way to quantify the benefits of nature-based solutions is to integrate them into catastrophe models. The reduced risk can potentially lead to lower insurance premiums and improved access to insurance for vulnerable areas.

Enhancing how monetary value is assigned to nature-based solutions is key to addressing the three major themes highlighted in New York: making insurance more affordable by demonstrating measurable risk reductions, supporting adaptation initiatives, and encouraging broader adoption of effective solutions. Together, insurance, adaptation, and nature-based solutions create a powerful, mutually reinforcing pathway toward stronger climate resilience.