- Dual-Lens Outdoor Cameras Trend Hunter

- Award-Winning Baseus Security X1 Pro: The World’s First Smart AI Dual-Tracking Outdoor Security Camera, Now Crowdfunding on Kickstarter Morningstar

- The smart security camera I’ve been waiting for since…

Blog

-

Dual-Lens Outdoor Cameras – Trend Hunter

-

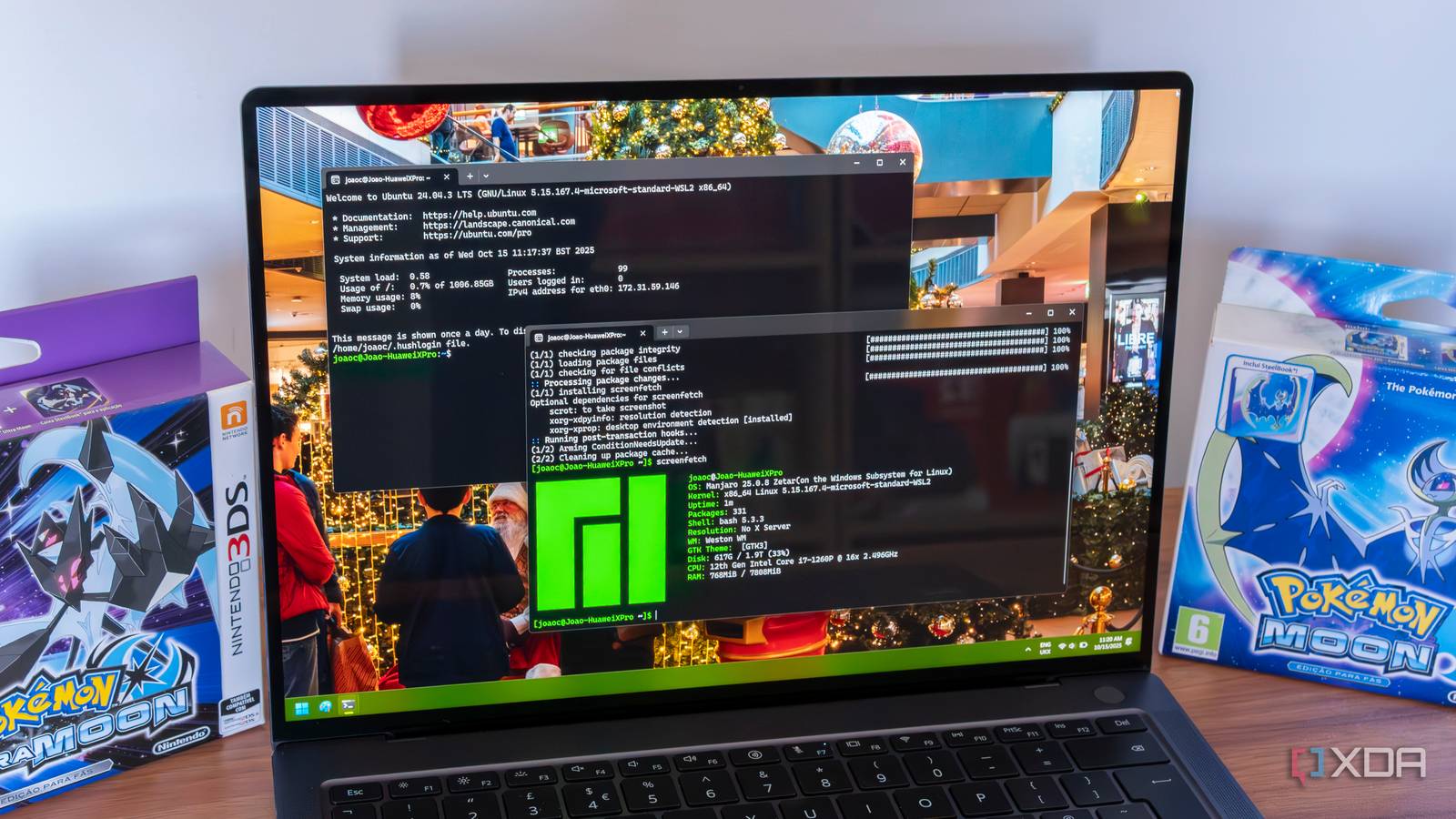

The newest PowerToys update is causing chaos among Windows 11 users

Summary

- PowerToys’ Light Switch accidentally enabled itself after an update, flipping themes.

…

Continue Reading

-

Chinese tech giants pause stablecoin plans after Beijing steps in, FT reports

Oct 18 (Reuters) – Chinese tech giants, including Alibaba-backed Ant Group (688688.SS) and e-commerce group JD.com (9618.HK), have paused plans to issue stablecoins in Hong Kong after the government raised concerns about the rise of currencies controlled by the private sector, the Financial Times reported on Saturday.Companies have put their stablecoin ambitions on hold after receiving instructions from Chinese regulators, including the People’s Bank of China and Cyberspace Administration of China, not to move ahead with the plans, the FT reported, citing people familiar with the matter.

Sign up here.

Hong Kong’s legislature passed a stablecoin bill in May that established a licensing regime for fiat-referenced stablecoin issuers in Hong Kong, providing regulatory clarity for future participants.Under the new regime, any person who issues stablecoins in Hong Kong – or issues stablecoins backed by Hong Kong dollars, whether within or outside the city – must obtain a licence from the Hong Kong Monetary Authority.

Ant Group said in June it would be participating in the pilot stablecoin programme. JD.com has also said it would take part in the pilot, according to the FT.PBOC officials advised against participating in the initial rollout of stablecoins over concerns about allowing tech groups and brokerages to issue any type of currency, the FT report said.

Reuters could not immediately verify the report. Ant Group, JD.com, PBOC, CAC and HKMA did not respond to requests for comment.

Stablecoins, a type of cryptocurrency designed to maintain a constant value, usually pegged to a fiat currency such as the U.S. dollar, are commonly used by crypto traders to move funds between tokens.

Reporting by Chandni Shah in Bengaluru, Editing by Franklin Paul, Michael Perry and Christian Schmollinger

Our Standards: The Thomson Reuters Trust Principles.

Continue Reading

-

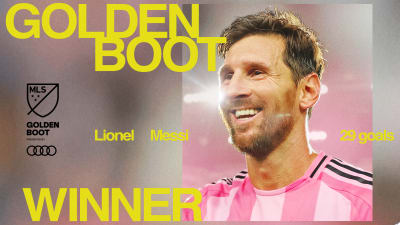

Inter Miami’s Lionel Messi wins 2025 MLS Golden Boot presented by Audi

The iconic No. 10 tallied 3g/1a during Saturday’s 5-2 Decision Day victory at Nashville, giving him 48 goal contributions this year – narrowly shy of Carlos Vela’s MLS-record 49 for LAFC in 2019.

Now, Messi looks poised to…

Continue Reading

-

Witkoff felt ‘betrayed’ by Israeli attack on Hamas in Qatar – Dawn

- Witkoff felt ‘betrayed’ by Israeli attack on Hamas in Qatar Dawn

- Trump had to choose between Israel and Qatar. He chose Qatar Financial Times

- Negotiators share Trump’s reaction to setback in hostage deal CBS News

- “60 MINUTES’” LESLEY…

Continue Reading

-

Karachi, Hyderabad face dengue outbreak as cases spike alarmingly – Dawn

- Karachi, Hyderabad face dengue outbreak as cases spike alarmingly Dawn

- At least 71 new dengue cases confirmed in KP; experts link rise to climate change Dawn

- Dengue surveillance of junkyard ordered The Express Tribune

- Dengue outbreak sparks alarm…

Continue Reading

-

Nexperia says Chinese unit operating as usual as tensions with the Netherlands run high – Reuters

- Nexperia says Chinese unit operating as usual as tensions with the Netherlands run high Reuters

- In rare move, Dutch government takes control of China-owned chipmaker Nexperia Reuters

- New Threat to Auto Sector; AI’s DIY Power; IKEA Prices 富途牛牛

- Dutch government in talks with China over crucial automotive chip supplier Nexperia Automotive News

- Nexperia crisis: Semiconductor supply shock threatens global auto production Automotive Manufacturing Solutions

Continue Reading

-

Penn State loses interim coach Terry Smith’s debut, 0-4 in Big Ten

IOWA CITY, Iowa — Even after a change at the top, it was the same result for Penn State, which suffered its fourth straight loss Saturday.

After firing James Franklin earlier in the week, the Nittany Lions, playing their…

Continue Reading

-

Serie A football match: Roma vs. Inter Milan-Xinhua

Inter Milan’s players celebrate after a Serie A football match between Roma and Inter Milan in Rome, Italy, Oct.18, 2025. (Xinhua)

Inter Milan’s Ange-Yoan Bonny celebrates his goal during a Serie A football match between Roma and Inter Milan in…

Continue Reading

-

EROAD (NZSE:ERD) Is Down 31.9% After Guidance Cut and North American Impairments – What’s Changed

-

In a recent announcement, EROAD downgraded its fiscal 2026 revenue guidance, reported up to NZ$150 million in North American asset impairments, and outlined a renewed focus on Australia and New Zealand alongside scaled-back North American activities.

-

This shift comes as challenges in North America, including a key customer loss and slower enterprise sales, prompt the company to reallocate resources toward emerging opportunities in its core markets.

-

With the company’s refocus on electronic road user charging in Australia and New Zealand, we’ll examine how this shapes EROAD’s investment narrative.

Trump’s oil boom is here – pipelines are primed to profit. Discover the 22 US stocks riding the wave.

To be comfortable holding EROAD shares right now, you’d need conviction in its ability to execute a fresh regional pivot following major shortfalls in North America. The company’s reset, moving growth focus and resources to Australia and New Zealand’s road user charging opportunities, marks a fundamental shift in its investment story. While previous catalysts centered on U.S. expansion and telematics innovation, the market’s sharp reaction to asset impairments and guidance cuts suggests near-term growth drivers will depend on how quickly EROAD can win or retain clients and secure contracts linked to new charging regimes in its home markets. The immediate risk is execution: reestablishing momentum in Australia and New Zealand is not guaranteed, and the heavy NZ$150 million impairment underscores uncertainty over any future North American contributions. The recent share price drop signals these risks are now firmly front and center for investors. On the flip side, the road to recovery in core markets comes with its own hurdles investors need to keep front of mind.

Despite retreating, EROAD’s shares might still be trading 43% above their fair value. Discover the potential downside here.

NZSE:ERD Community Fair Values as at Oct 2025 Seven members of the Simply Wall St Community estimate EROAD’s fair value anywhere from NZ$1.20 to NZ$4.96 per share. This wide range reflects big differences in expectations around EROAD’s growth rebound in Australia and New Zealand after its US setback. Comparing such varied outlooks with the company’s new strategic focus, it pays to see how your own view lines up.

Explore 7 other fair value estimates on EROAD – why the stock might be worth over 2x more than the current price!

Disagree with this assessment? Create your own narrative in under 3 minutes – extraordinary investment returns rarely come from following the herd.

Continue Reading

-