US–Vietnam trade continues to grow, with key states leading most of the activity. Vietnam depends on US exports for production inputs, forming an integrated trade network supported by major transport hubs.

Recent data show trade between Vietnam and the US is continuing on its robust growth trajectory, as tariff pressures are partly relieved by the prospect of a new bilateral agreement. Vietnam’s exports to the US reached a record of US$126.16 billion in the first ten months of 2025 – up 28 percent year-on-year.

FIND BUSINESS SUPPORT

The most recent data was released a week after the fifth round of direct negotiations on the US–Vietnam Reciprocal, Fair, and Balanced Trade Agreement, which took place in Washington, D.C., from November 12 to 14. Alongside the negotiation agenda, both sides participated in activities aimed at enhancing bilateral economic and investment cooperation, expanding trade connections, and garnering support for the ongoing negotiations of the reciprocal trade agreement.

Speaking to Vietnam Briefing, Dan Martin – Assistant Manager of International Business Advisor at Dezan Shira & Associates – noted that the US–Vietnam trade relationship has grown into something much more strategic than tariff schedules or export numbers suggest. “What’s taking shape is a new layer of industrial interdependence across the Pacific. Vietnam is moving into higher-value manufacturing, and American supply chains are adapting around that shift. It’s less about diversification for its own sake and more about building a second anchor in Asia that can sustain long-term production stability,” said Martin.

Recent developments present a positive outlook, highlighting resilient growth in trade between the two countries. This growth is fueled by strengthening bilateral relations, the global shift in manufacturing orders, and the increasing demand of the US market for a wide variety of Vietnam’s products, from electronics to agricultural goods.

See also: US-Vietnam Framework for Trade Agreement: Key Terms and Expectations

Start exploring

Two-way trade overview

FIND BUSINESS SUPPORT

The US remained Vietnam’s largest export market in the first 10 months of 2025, accounting for more than 30 percent of Vietnam’s total shipments.

Vietnam-US trade is dominated by Vietnam’s tech-oriented exports, alongside strong traditional sectors such as textiles, footwear, and wood products.

Vietnam’s imports from the US mainly comprise production inputs such as electronics components, cotton, machinery, and plastic raw materials, underscoring a vertically integrated trade relationship in which Vietnam ships finished goods and relies on the US for key manufacturing materials.

Vietnam’s integration with the US economy runs deeper than many realize. The trade balance masks a complex ecosystem in which American inputs feed Vietnam’s factories, and finished goods return to US consumers. That loop has become a critical stabilizer in global manufacturing. For American firms, the competitive edge now lies in how effectively they can manage that loop – through technology transfer, supplier oversight, and resilient logistics. – Dan Martin, Assistant Manager of International Business Advisor, Dezan Shira & Associates

|

Top Commodities in Vietnam-US Trade, January – October 2025 |

|

|

Item |

Value (US$ Billion) |

|

Vietnam’s exports to the US |

|

|

Computers, electronics, and components |

34.14 |

|

Machinery, equipment, and other parts |

19.61 |

|

Textiles and garments |

14.81 |

|

Footwear |

7.39 |

|

Wood and wooden products |

7.8 |

|

Vietnam’s imports from the US |

|

|

Computers, electronic products, and components |

4.4 |

|

Cotton (all types) |

1.21 |

|

Machinery, equipment, tools, and other spare parts |

1.04 |

|

Plastic raw materials |

0.94 |

|

Animal feed and ingredients |

0.68 |

|

Source: Vietnam Customs |

|

Key US transport hubs in Vietnam–US trade flow

FIND BUSINESS SUPPORT

Examining transport destinations, US–Vietnam trade flows are heavily concentrated in just a few key states, with California leading through the ports of Los Angeles and Long Beach, and the Los Angeles and San Francisco international airports. These ports and airports account for the largest share of total value and emphasize the state’s central role in managing electronics-heavy, high-volume shipments.

Illinois follows thanks to Chicago O’Hare’s strong air-cargo throughput, while New Jersey and Georgia contribute mid-tier volumes via Newark and Savannah. Alaska and Washington appear as strategic air and seaport transit points, and Texas rounds out the list with Houston’s energy-linked capacity, showing that while multiple states participate, US–Vietnam trade is overwhelmingly West Coast-centric, with Illinois as the major inland exception.

|

Top US Ports/Airports for Vietnam-US Trade (July 2025) |

|||

|

Rank |

Port/airport |

City, state |

YTD value (US$ billion) |

|

1 |

Port of Los Angeles |

Los Angeles, California |

26.72 |

|

2 |

Chicago O’Hare International Airport |

Chicago, Illinois |

19.12 |

|

3 |

Port of Long Beach |

Long Beach, California |

10.03 |

|

4 |

Los Angeles International Airport (LAX) |

Los Angeles, California |

8.24 |

|

5 |

Port of Newark |

Newark, New Jersey |

5.28 |

|

6 |

Port of Savannah |

Savannah, Georgia |

5.23 |

|

7 |

San Francisco International Airport (SFO) |

San Francisco, California |

3.88 |

|

8 |

Ted Stevens Anchorage International Airport |

Anchorage, Alaska |

3.66 |

|

9 |

Port of Tacoma |

Tacoma, Washington |

3.09 |

|

10 |

Port of Houston |

Houston, Texas |

3.08 |

|

Source: WorldCity |

|||

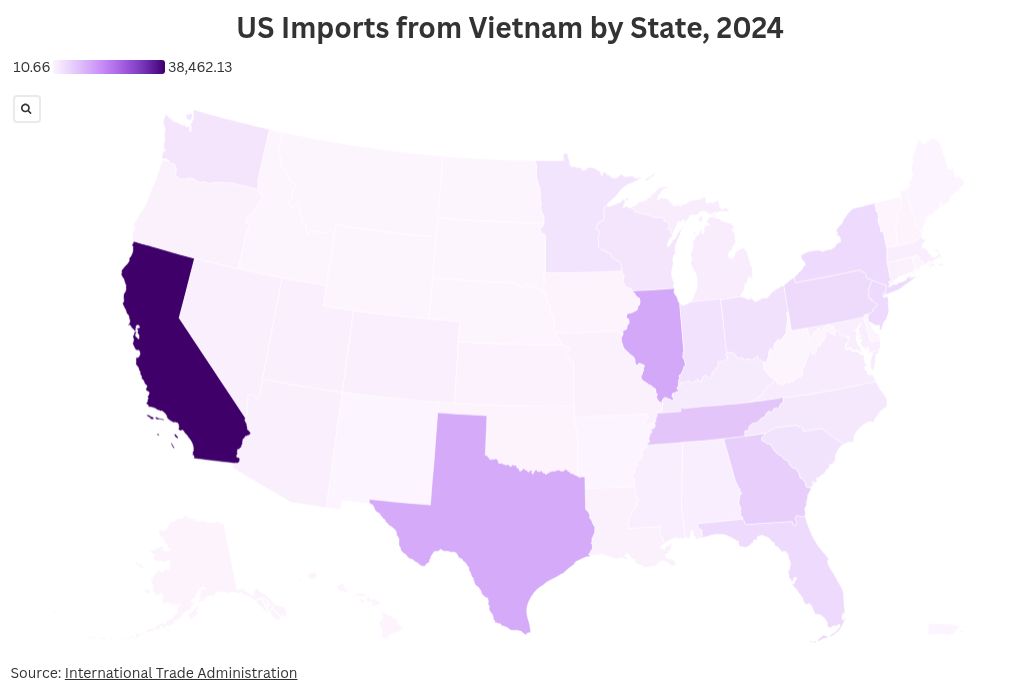

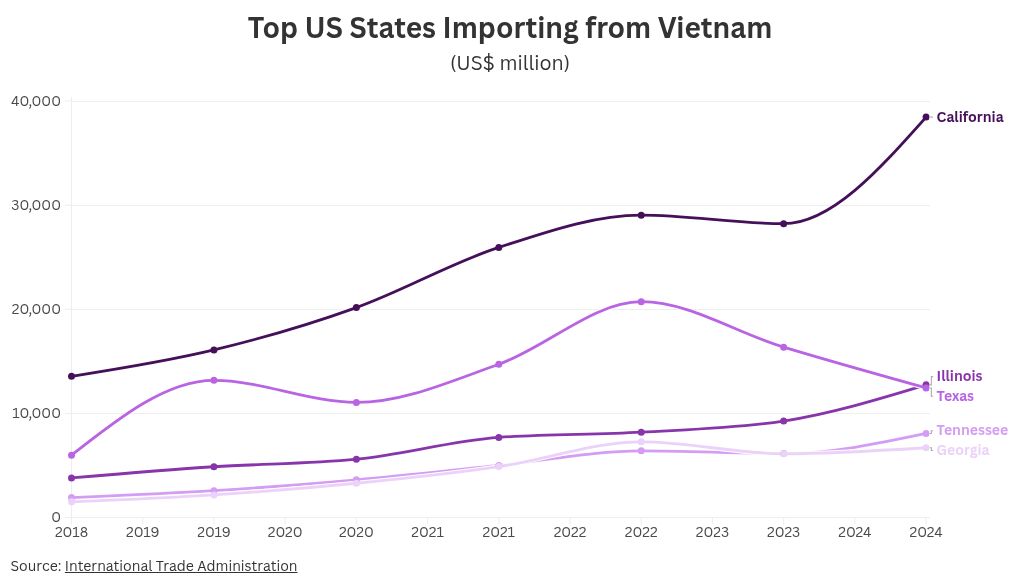

Top US states importing from Vietnam

Imports from Vietnam to the top US states grew steadily from 2018 to 2024, though there were notable shifts. While California continues to dominate, Illinois and the South are emerging markets, and Texas illustrates the importance of monitoring sector trends and diversifying sourcing strategies.

From 2018 to 2024, California was the largest importer of Vietnamese commodities, rising from US$13.6 billion to US$38.5 billion, driven by tech and consumer goods. Illinois also grew rapidly, reaching US$12.7 billion in 2024, signaling emerging demand in manufacturing and logistics.

Texas, meanwhile, showed more volatility, peaking in 2022 before declining, reflecting possible supply chain or sector-specific changes. Southern states like Tennessee and Georgia experienced steady growth, reaching US$8.1 billion and US$6.7 billion, respectively, highlighting their increasing role in industrial and manufacturing trade.

|

Top Commodities Imported from Vietnam by US State, 2024 |

||

|

US state |

NAICS-4 |

Value (US$ million) |

|

California |

Semiconductors and other electronic components |

6,171 |

|

Computer equipment |

5,829 |

|

|

Communications equipment |

4,395 |

|

|

Footwear |

3,233 |

|

|

Apparel |

2,727 |

|

|

Illinois |

Computer equipment |

5,464 |

|

Communications equipment |

2,966 |

|

|

Audio and video equipment |

1,560 |

|

|

Navigational/Medic/Control Instrument |

402 |

|

|

Household and Kitchen Cabinets |

369 |

|

|

Texas |

Communications equipment |

2,582 |

|

Semiconductors and other electronic components |

2,266 |

|

|

Household and kitchen cabinets |

1,069 |

|

|

Apparel |

637 |

|

|

Computer equipment |

543 |

|

|

Tennessee |

Computer equipment |

3,166 |

|

Communications equipment |

793 |

|

|

Apparel |

734 |

|

|

Semiconductors and other electronic components |

703 |

|

|

Footwear |

610 |

|

|

Georgia |

Household and kitchen cabinets |

934 |

|

Plastics products |

757 |

|

|

Apparel |

683 |

|

|

Communications equipment |

495 |

|

|

Semiconductors and other electronic components |

480 |

|

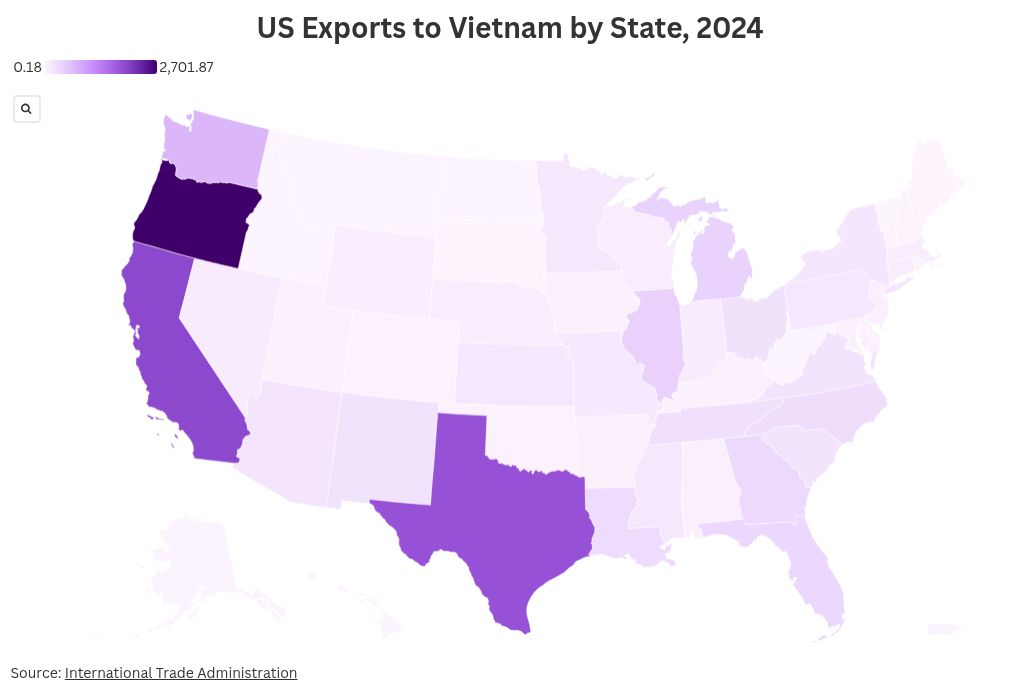

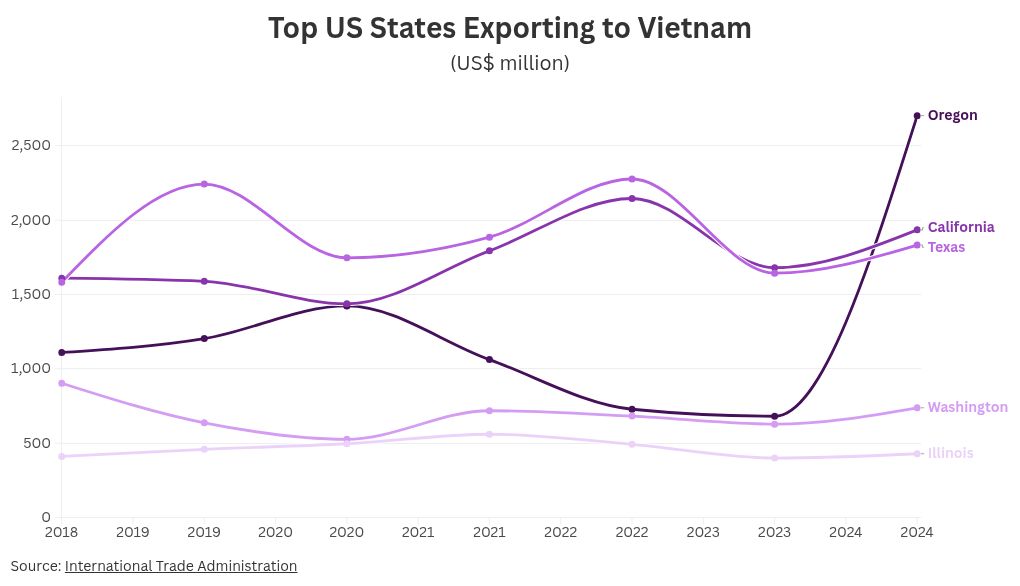

Top US states exporting to Vietnam

FIND BUSINESS SUPPORT

A majority of US exports to Vietnam are concentrated in a small group of states, with Texas and California consistently among the top contributors, each maintaining US$1.6 billion to US$2.3 billion annually, reflecting strong demand for machinery, tech goods, and agricultural products.

Washington and Illinois remain smaller but steady exporters, each following a moderate, stable trend.

|

Top Commodities Exported to Vietnam by US State, 2024 |

||

|

US state |

NAICS-4 |

Value (US$ million) |

|

Oregon |

Semiconductors and other electronic components |

2,405 |

|

Other leather products |

191 |

|

|

Computer equipment |

28 |

|

|

Navigational/medical/control instruments |

8 |

|

|

Cleaning compounds and toilet preparations |

8 |

|

|

California |

Fruits and tree nuts |

424 |

|

Waste and scrap |

346 |

|

|

Semiconductors and other electronic components |

292 |

|

|

Computer equipment |

67 |

|

|

Other agricultural products |

63 |

|

|

Texas |

Communications equipment |

643 |

|

Resin, synthetic rubber, and artificial synthetic fibers |

310 |

|

|

Other agricultural products |

199 |

|

|

Oil and gas |

117 |

|

|

Basic chemicals |

90 |

|

|

Washington |

Grain and oilseed milling products |

226 |

|

Aerospace products and parts |

178 |

|

|

Oilseeds and grains |

120 |

|

|

Fruits and treenuts |

83 |

|

|

Dairy products |

38 |

|

|

Illinois |

Oilseeds and grains |

130 |

|

Beverages |

103 |

|

|

Leather and hide tanning |

21 |

|

|

Animal slaughtering and processing |

19 |

|

|

Other chemical products and preparations |

17 |

|

Oregon case study: How the US can reduce its deficit with Vietnam

While the data shows US exports to Vietnam are anchored mainly by West Coast states and Texas, Oregon’s 2024 spike is an interesting example of how new dynamics are shaping trade between the two countries.

FIND BUSINESS SUPPORT

According to Business Oregon, Vietnam is Oregon’s fifth-largest export market worldwide and the second-largest in Southeast Asia. The sharp increase was fueled by strong growth in electronics and machinery exports, particularly semiconductor-related products. As Vietnam seeks to position itself as a regional hub for emerging technologies, especially in AI and data-driven sectors, Oregon’s high-tech exports have become an important source of critical inputs supporting that ambition.

Oregon is also actively seeking deeper collaboration with Vietnam. The state’s leadership recently explored opportunities in Da Nang City, focusing on priority sectors such as chip technology, logistics, and free trade zone (FTZ) development. Continued investment expansion could further boost exports from Oregon.

Oregon’s experience demonstrates a practical way for the US to cut its trade deficit with Vietnam. By aligning state-level efforts with Vietnam’s strategic goals, other US states and businesses can follow this model. Building partnerships, spotting emerging sectors, and supporting investment in related industries could help balance trade and strengthen long-term economic connections between the countries. – Dan Martin, Assistant Manager of International Business Advisor, Dezan Shira & Associates

Vietnam’s top importers by industry

According to the latest Vietnam customs and importers data, the country has over 32,000 importers operating across different industries. Total imports reached US$379 billion, up 6 percent from the previous year.

|

Industry |

Value in 2024 (US$ billion) |

Description |

Top importers |

|

Electronics and electrical machinery |

139 |

Vietnam’s electronics exports heavily rely on imported components, such as semiconductors, circuit boards, and smartphones. |

Samsung Electronics Vietnam (3.76M units shipped); LG; Foxconn; Canon Vietnam |

|

Machinery and computers |

34.3 |

Essential for auto assembly and industrial operations. |

Toyota Motor Vietnam (3.96M machinery shipments); Thaco Mazda, Isuzu Vietnam, Hyundai Thanh Cong, Hino Vietnam (1.6–2.4 million units each) |

|

Plastics and plastic articles |

19.5 |

Raw plastics used for injection molding, packaging, and automotive parts. |

Polymer-processing firms in Binh Duong and northern industrial clusters (Bac Ninh) |

|

Mineral fuels and oils |

16.1 |

Imports of crude, petroleum products, and refined fuels for energy and industrial use. |

State energy groups and refineries (Dung Quat, Nghi Son); industrial energy buyers (steel mills, petrochemical zones) |

|

Iron and steel |

14.1 |

Key inputs for construction and machinery industries. |

Construction materials traders; steel fabricators in Ho Chi Minh City, Hanoi, Binh Duong, Bac Ninh; steel-intensive FDI investors |

|

Textiles and fabrics |

Knit: 7.2 Manmade filaments: 5.4 |

Yarn, synthetic fibers, and fabrics feed domestic garment manufacturing and export. |

Vinatex; domestic garment exporters in northern clusters; FDI-led apparel groups |

|

Source: Vietnam Export Data |

|||

Takeaways

For US businesses, understanding which states lead trade with Vietnam is critical. Companies should focus on high-growth sectors like semiconductors, machinery, and textiles, align exports with Vietnam’s strategic priorities, and leverage key transport hubs in California, Illinois, and Texas.

Emerging states such as Oregon demonstrate that state-level engagement can expand export potential, while monitoring supply chain shifts ensures resilience and maximizes opportunities in the growing Vietnam-US trade relationship.

Also see

About Us

Vietnam Briefing is one of five regional publications under the Asia Briefing brand. It is supported by Dezan Shira & Associates, a pan-Asia, multi-disciplinary professional services firm that assists foreign investors throughout Asia, including through offices in Hanoi, Ho Chi Minh City, and Da Nang in Vietnam. Dezan Shira & Associates also maintains offices or has alliance partners assisting foreign investors in China, Hong Kong SAR, Indonesia, Singapore, Malaysia, Mongolia, Dubai (UAE), Japan, South Korea, Nepal, The Philippines, Sri Lanka, Thailand, Italy, Germany, Bangladesh, Australia, United States, and United Kingdom and Ireland.

For a complimentary subscription to Vietnam Briefing’s content products, please click here. For support with establishing a business in Vietnam or for assistance in analyzing and entering markets, please contact the firm at vietnam@dezshira.com or visit us at www.dezshira.com