Introduction

The Tobacco Settlement Asset Securitization Corporation (“TSASC”) is a local development corporation created pursuant to the Not-For-Profit Corporation Law of the State of New York (the “State”). TSASC was created as a financing entity whose purpose is to issue and sell bonds and notes to fund a portion of the capital program of the City of New York (the “City”). The City sold its right to receive tobacco settlement revenues (“TSRs”) to TSASC and issued debt secured by the TSRs, which are paid by cigarette companies as part of their settlement with 46 states, including the State of New York, and other U.S. Territories.

In the late 1990’s the City was faced with the possibility of curtailing its capital program because it was approaching its debt issuance capacity under the Constitutional Debt Limit.[1] To provide for the City’s capital program, the Transitional Finance Authority (“TFA”) and TSASC were created to bridge the gap and provide the City with additional financing capacity beyond the debt limit to continue to meet its capital needs. Without the TFA or TSASC, or other legislative relief, the City’s capital program would have been virtually brought to a halt beginning in early fiscal year 1998.

However, relief was fleeting and TSASC was never able to reach its full potential as the credit structure began to unwind. TSASC suspended issuance for new capital projects in 2003 and has restructured its outstanding debt twice, in 2006 and 2017, to avoid default and deliver debt service savings to the City. As discussed in this fiscal note, the City and the broader market has never been able to effectively forecast revenues or material events in the tobacco market and the TSASC credit has been subject to a suspension of issuance and two restructurings, neither of which has been successful in holding off projected default.

As it stands today, TSASC has fully drawn on the reserve fund related to its outstanding subordinate bonds to make debt service payments. To pay debt service and forestall default, TSASC has entered into a security agreement that provides support from revenues that otherwise would flow to the City. Still, the tobacco market is filled with uncertainty and, as such, the plight of tobacco revenue securitizations, such as TSASC bonds, remains uncertain.

As the June 1, 2027 par call date when TSASC bonds can be refinanced on a tax-exempt basis approaches, the City is in a stronger position – with more margin under the debt limit, high credit ratings and regular market access – such that there are numerous options available that can simplify the structure and deliver meaningful savings. Sifting through history, it is clear that the City cannot continue down a path of half measures and must explore options beyond borrowing against TSRs that allows the outstanding liability secured by those revenues to be paid in full.

The Master Settlement Agreement and the Creation of TSASC

In the mid-1990s, more than 40 states commenced litigation against the tobacco industry, seeking relief under various consumer-protection and antitrust laws.

In 1998, the Master Settlement Agreement (MSA), a legal agreement between the four largest tobacco manufacturers – Philip Morris Inc., R.J. Reynolds, Brown & Williamson, and Lorillard (“Original Participating Manufactures” or “OPMs”) and 46 states,[2] the District of Columbia, and five U.S. territories (the “Settling States”), was agreed upon to address tobacco’s health impact and deceptive marketing. The MSA settled dozens of state lawsuits brought to recover billions of dollars in health care costs associated with treating smoking-related illnesses.

Eventually, more than 41 additional tobacco companies (“Subsequent Participating Manufacturers” or “SPMs”) joined the MSA and must make payments to the Settling States pursuant to the terms of the MSA. Collectively, the OPMs and the SPMs are referred to as the Participating Manufacturers (“PMs”). Any tobacco company that has not signed on to the Master Settlement Agreement is referred to as a Non-Participating Manufacturer (“NPM”). Pursuant to the MSA, the Settling States and PMs agreed to settle all past, present and future smoking-related claims in exchange for an agreement by the PMs to make five payments ranging from $2.4 billion to $2.7 billion between December 1998 and January 2003 (“Initial Payments”), and recurring payments each April, commencing on April 15, 2000, in perpetuity (“Annual Payments”) and certain other payments to the Settling States. Each OPM was required to pay an allocable portion of each Initial Payment and is required to pay an allocable portion of each Annual Payment in perpetuity, subject to certain adjustments, most notably for the number of cigarettes shipped in the preceding calendar year and for CPI inflation. The OPMs also agreed to other conditions such as restricting tobacco advertising and marketing and agreeing to fund educational programs.

According to the formula set forth in the MSA, the State of New York is entitled to 12.7620310% of the total Annual Payments deposited into the national escrow account. The New York Consent Decree and Final Judgement (the “Decree”), which was entered into by the Supreme Court of the State of New York in December 1998 allocated the State’s Annual Payment among governmental subdivisions within the State. Of the Annual Payment made to the State, 51.176% is allocated to the State, 26.670% to New York City, and the remaining 22.154% is allocated to other counties within the State. The Decree became final in August 1999 and is not subject to final appeal. The payments allocated to New York City serve as basis for repayment of TSASC’s outstanding bonds[3].

Annual Settlement Revenue

Initially, under the MSA, the primary drivers of revenue included cigarette consumption, as measured by domestic shipments of cigarettes by the OPMs relative to calendar year 1997, and inflation, as measured by annual changes in CPI-U with a 3% annual inflation floor. As the PMs gradually lost market share to the NPMs, the PMs began asserting that they were due annual “NPM Adjustments”, or annual payment reductions, under the terms of the MSA. These “NPM Adjustment Disputes” were and are subject to a multi-state arbitration process under the MSA which became very time consuming, with the first arbitration completed in 2013 relating to the payment due in April 2004. In order to put an end to future NPM Adjustment Disputes, the State’s Attorney General and the PMs entered into a settlement agreement (the “NY NPM Settlement”) which became effective October 16, 2015. Under the NY NPM Settlement, the PMs are entitled to credits against annual payments to the State primarily based upon the number of NPM manufactured cigarettes sold on Native American reservations in the State to non-Tribal members, otherwise known as the Tribal NPM Packs credit (or the “Tribal Adjustment”).

Consumption

Annual MSA Payments are primarily determined by the volume of cigarettes shipped by the OPMs in the US cigarette market. Consumption is determined annually, and the amounts payable pursuant to the MSA have continued to be reduced due to declining consumption. The amount of Tribal NPM Packs is determined every two years as dictated by an independent investigator.

Domestic cigarette consumption grew dramatically in the 20th century, reaching a peak of 640 billion cigarettes in 1981. Since then, consumption has continued to decline. To illustrate, shipments of approximately 166 billion cigarettes was reported in 2024 vs. approximately 442 billion reported in 1999[4].

Inflation

An Inflation Adjustment is applied each year to the Annual Payments as adjusted by the Volume Adjustment. The inflation adjustment is compounded annually at the greater of 3% or the percentage increase in the actual Consumer Price Index for all Urban Consumers in the prior calendar year as published by the Bureau of Labor Statistics released each January[5]. The Inflation Adjustment always increases annual payments under the MSA because of its 3% floor. For example, if shipments from one year to the next are flat (e.g., and therefore required annual payments are not impacted by a change in the Volume Adjustment), payments would go up by at least 3% vs. the prior year due to the Inflation Adjustment’s floor of 3%.

Disputes

Calculations disputed by any parties of the MSA could result in offsets to, or delays in payments to the Settling States pending resolution of the dispute. Disputes may be raised up to four years after the respective due date of the payment. Dating back to at least 2004, the Annual Payments due under the MSA have been subject to numerous adjustments, many of which have resulted in disputes between the PMs and Settling States.

NPM Adjustment Dispute

For each year since 2003, the PMs asserted their right to an NPM Adjustment under the terms of the MSA which effectively reduced payments to the Settling States since 2006 by diverting payments into a Disputed Payments Account pending the outcome of the mandated multi-state arbitration process. In 2015, the NY NPM Settlement settled all prior years’ disputes and replaced the NPM Adjustment Dispute and arbitration process with annual payment credits due from the State to the PMs based largely on the estimated number of NPM-manufactured cigarettes sold on Native American reservations in the State to non-Tribal members.

TSR Usage by TSASC and other States & Counties

With a dedicated revenue framework in place, many States, counties and certain cities began securitizing the revenues and issued bonds for a variety of purposes. TSASC was the first in the nation to securitize TSRs. TSASC provided New York City with additional debt issuance capacity and proceeds from its bond sales were used for capital purposes. Other issuers around the country used bond proceeds for financing capital, economic development, or simply budget relief. The table below highlights several large state issues and summarizes how proceeds from their respective transactions were applied:

Table 1. Securitized Tobacco Revenue Uses by State

| State | Primary Use of Funds |

| Alabama | Economic Development, Worker Training and Flood Control |

| Alaska | First Deal – Capital Expenditures; Second Deal – Budget Relief |

| California | Budget Relief |

| D.C. | Budget Relief |

| Illinois | Budget Relief |

| Iowa | Capital Projects and Refunding for Budget Relief |

| Louisiana | Endowment |

| Michigan | First Deal – Venture Capital Fund, Second Deal – Budget Relief |

| Minnesota | Budget Relief |

| New Jersey | Budget Relief |

| New York | Budget Relief |

| Ohio | School Construction |

| Pennsylvania | Budget Relief |

| South Carolina | Endowment |

Source: Official Statements, authorizing legislation, and/or bond documents of the respective State issuer

NYC Usage: Debt Limit Definition and Circumvention

In the late 1990’s, around the time the MSA settlement was executed, the City was running out of financing capacity under the Constitutional Debt Limit. Until 1997, the City’s primary source of funding for the cost of capital projects was the General Obligation (“GO”) credit. The creation of the New York City Transitional Finance Authority (“TFA”) in 1997 and TSASC in 1999 allowed the City to continue to enter into capital contracts and finance new capital projects.

The New York State Constitution, Article VIII, sets limits to the amount of indebtedness of local governments (counties, cities, towns, villages, and school districts). Debt limits are set as a percentage of the five-year rolling average of the “full valuation of taxable real estate”. In New York City, the full valuation of taxable real estate is derived from two main sources: the City’s Department of Finance Taxable Billable Assessed Value and the special equalization ratios determined by the New York State Office of Real Property Tax Services (ORPTS).

New York City government’s debt-incurring power, or general debt limit, is set in the New York State Constitution at 10 percent of the 5-year average of the full valuation of real estate located in the city. The City can incur contractual obligations for capital projects, or indebtedness, up to the limit.

The Office of the Comptroller published a detailed analysis and critique of ORPTS’ ratios showing, among other results, how a methodological change in the mid-1990s significantly reduced the Constitutional debt limit. In turn, the City faced the prospect of curtailing its capital program because it had almost exhausted its debt issuance capacity.

To provide financing capacity for the City’s capital program, the TFA was established by the New York State Legislature in 1997. The City subsequently established TSASC in 1999 pursuant to the Not-for-Profit Corporation Law of the State of New York for additional financing capacity. At the time of their respective creation, debt issued by either entity was not subject to the general debt limit of the City. Without the TFA and TSASC, new contractual commitments for the City’s capital program could not continue at the planned levels. The debt-incurring power of TFA and TSASC permitted the City to enter into new contractual commitments to accommodate the capital plan.

Initial TFA Authorization

To enable the City to continue its capital program, The New York City Transitional Finance Authority was created as a public benefit corporation and an instrumentality of the State of New York (the “State”) by the New York City Transitional Finance Authority Act (the “Act”). The Act provides for the issuance of Bonds and Notes to finance and refinance general City capital purposes and issue debt that is not subject to the general debt limit. The initial authorization for the TFA in 1997 was $7.5 billion of debt issuance, which the City exhausted in fiscal year 1999.

Creation of TSASC

After the initial debt capacity of the TFA was exhausted in 1999, the City created TSASC to provide additional financing capacity without need of additional State legislation so soon after the creation of TFA. TSASC was created as a special-purpose, bankruptcy-remote local development corporation incorporated under Section 1411 of the New York State Not-for-Profit Corporation Law. TSASC is an instrumentality of, but separate and apart from the City. With the creation of TSASC in 1999 the City was afforded an additional $2.4 billion of Debt Limit relief and was able to continue its capital program through fiscal year 2000.

Additional TFA capacity and suspension of TSASC Issuance

Faced with the exhaustion of its debt limit once again in fiscal year 2001, the City sought and obtained from the State the authorization to borrow an additional $4 billion through the issuance of TFA bonds.

In 2003 TSASC experienced a “Downgrade Trapping Event” and an “NPM Trapping Event” as defined in the TSASC Indenture (and more fully discussed in the section entitled “Initial Issuance: Series 1999-1”), which required the funding of an additional reserve for the benefit of TSASC bondholders from amounts that would otherwise be paid to the City. As a result of the Trapping Events being triggered, on September 15, 2003, TSASC announced that it did not intend to issue any additional bonds to the public.

TSASC has not borrowed for new money purposes since fiscal year 2002. The total par issued for new money purposes was approximately $1.2 billion. Net of expenses and bond financed reserves, the final amount of proceeds applied to finance capital spending was approximately $1.02 billion. As such, the actual Debt Limit relief afforded was less than initially projected.

Over the next two decades, the City sought and received additional financing capacity for the TFA exempt from the Constitutional Debt Limit. After several legislative changes, the limit was increased to $13.5 billion. However, the City exhausted the TFA’s additional capacity in fiscal year 2007.

In July 2009, the State Legislature authorized TFA to issue debt beyond the $13.5 billion limit, with the additional borrowing subject to the City’s general debt limit. Thus, the incremental TFA debt issued in fiscal year 2010 and beyond, to the extent the amount outstanding exceeds $13.5 billion, has been combined with City GO debt when calculating the City’s indebtedness within the debt limit. In April of 2024 the TFA Act was amended to increase the total amount of TFA Bonds authorized to be outstanding and not subject to the debt limit by a total of $14 billion, from $13.5 billion to $27.5 billion in $8 billion and $6 billion increments on July 1, 2024, and July 1, 2025, respectively.

Most recently, the 2025-2026 Enacted New York State Budget further increased the total amount of Future Tax Secured Bonds authorized to be outstanding and not subject to the City’s debt limit by an additional $3.0 billion beginning July 1, 2025, increasing the total exemption to $30.5 billion. Giving effect to the $30.5 billion statutory exemption, the City had $44.3 billion of remaining debt incurring power as of July 1, 2025. Chart 1 shows the Debt Limit relief afforded by TSASC, TFA’s statutory exemption, and the City’s remaining Debt-Incurring Power as of July 1st, dating back to July 1, 1997.

Chart 1. Remaining Debt-Incurring Power as of July 1st ($ in billions)

Source: Office of the NYC Comptroller.

The History of TSASC’s Bonds

Sale of TSRs and initial TSASC Indenture

On November 18, 1999, Pursuant to a Purchase and Sale Agreement, the City sold to TSASC all of its future rights, title, and interest under the MSA and Decree, including the City’s right to receive its portion of the Initial Payments and Annual Payments made by the PMs. The TSRs were pledged under an Indenture, dated November 1, 1999 and were assigned to the Trustee and made available for the benefit of bondholders.

The Indenture outlined the security for bond payments and how specifically the MSA payments are applied to debt service for the benefit of bondholders and then to the City. Investor protections such as covenants, terms and conditions, and roles of parties such as the Trustee are detailed and serve as legal protection for bondholders, ensuring TSASC upholds its legal obligations.

One notable feature of the Indenture was instructions for the Trustee to hold funds in a segregated trust account (“Trapping Account”) in the event a Trapping Event (described below) was triggered. Trapping Events were created to address rating agency concerns, which led to added bondholder security and higher credit ratings. Under the Indenture, a Trapping Event is triggered upon the occurrence of an adverse event such as a downgrade of the credit rating of an OPM to below investment grade, a significant decline in cigarette consumption, or an increase in market share of the NPMs.

In the event of a Trapping Event, deposits known as Trapping Requirements were to be deposited into the Trapping Account. The Trapping Requirement was determined by the greatest of the Trapping Events (generally 25% of TSASC bonds outstanding) described below.

- Consumption Decline Trapping Event: Means if domestic shipments of cigarettes were less than an amount that was set forth in a schedule provided in the Official Statement. The Consumption Decline Trapping Requirement was 25% of the principal amount of TSASC bonds outstanding.

- Downgrade Trapping Event: Means that an OPM with market share of 7% or more in the prior calendar year is rated below Baa3 by Moody’s or BBB- by S&P. The Downgrade Trapping Requirement was 25% of the principal amount of TSASC bonds outstanding.

- NPM Trapping Event: Means that in any year, if the aggregate Market Share of the NPMs exceeds 7% in the prior calendar year. The NPM Trapping Requirement was the lesser of 6% of TSASC bonds outstanding for each full percentage, the market share of the NPMs that exceeds 7% or 65%of TSASC bonds outstanding preceding the NPM Trapping Event.

- Lump Sum Trapping Event: Upon receipt of any lump sum in lieu of future TSRs, such lump sum was to be deposited into the Trapping Account.

- Model Statute Trapping Event:[6] Means if (a) the share of the NPMs exceeds 3% in the calendar year preceding a given receipt of TSR and (b) the Model Statute is found to be invalid this Trapping Event has been triggered. The Model Statute Trapping Requirement was 25% of the principal amount of TSASC bonds outstanding.

Despite there being an initial expectation that none of these events would be triggered, two of the events were, as discussed in the “Rating and NPM Trapping Event Triggered” section below.

Initial Issuance: Series 1999-1

With a credit structure in place, TSASC issued its first series of four expected series of bonds in November 1999. At the time of issuance TSASC expected to issue approximately $2.8 billion of bonds to generate approximately $2.4 billion of proceeds for new money purposes.

Total par for the transaction was $709,280,000 of bonds with Rated Maturity Dates ranging from 2003 through 2039 and “Planned Principal Payment Dates” ranging from 2000 through 2029.

The Rated Maturities represent the minimum amount of principal that TSASC was required to pay by Rated Maturity Date. The Planned Principal Payments represent the amount of principal that TSASC had covenanted to pay, to the extent of available revenues, as of the specified Planned Principal Date.

The sale of the bonds generated approximately $685.9 million of net proceeds, of which $603.7 million was used for capital projects, $28.6 million was used for capitalized interest, and $53.7 million was deposited into a liquidity reserve account. The reserve account was established to pay debt service on bonds to the extent revenues collected were insufficient in any given year.

Despite nearly identical, and in some instances higher ratings than the City’s General Obligation bonds, the volatility of the revenue source and general tobacco market sentiment resulted in the initial TSASC bonds pricing at higher interest rates than a comparable GO issue. The table below compares yields and spreads to the AAA MMD benchmark between the GO 1999 Series K and L transaction that priced in June 1999 and the TSASC Series 1999-1 transaction that priced several months later in November 1999. Despite higher or similar ratings in most maturities, TSASC’s spreads were at least 25 basis points, and as much as 60 basis points higher in some maturities compared to a similar GO bond.

Table 2. NYC GO 1999 Series K&L and TSASC Series 1999-1 Pricing Comparison

| GO Fiscal 1999 Series K & L Pricing Date: June 18,1999 Ratings (Moody’s/S&P/Fitch): A3/A-/A |

TSASC Series 1999-1 Pricing Date: November 4, 1999 Ratings (Moody’s/S&P/Fitch): Varies |

||||||||||

| Maturity Year |

Yield | AAA MMD (6/18/1999) |

Spread to MMD (bps) | Planned Principal Maturity Year |

Ratings | Yield Range |

AAA MMD (11/3/1999) |

Spread to

MMD (bps) |

Implied TSASC Pricing Penalty (bps) |

||

| 1999 | 3.10% | 3.35% | -25 | 1999 | N/A | N/A | 3.80% | N/A | N/A | ||

| 2000 | 3.40% | 3.35% | 5 | 2000 | Aa1/AA/A+ | 4.10% | 3.80% | 30 | 25 / 25 | ||

| 2001 | 4.00% | 3.93% | 7 | 2001 | Aa1/AA/A+ | 4.55% / 4.70% | 4.15% | 40 / 55 | 33 / 48 | ||

| 2002 | 4.20% | 4.08% | 12 | 2002 | Aa1/A+/A+ | 4.85% / 4.95% | 4.33% | 52 / 62 | 40 / 50 | ||

| 2003 | 4.35% | 4.20% | 15 | 2003 | Aa1/A+/A+ | 5.05% / 5.10% | 4.45% | 60 / 65 | 45 / 50 | ||

| 2004 | 4.45% | 4.30% | 15 | 2004 | Aa1/A+/A+ | 5.20% / 5.25% | 4.58% | 62 / 67 | 47 / 52 | ||

| 2005 | 4.55% | 4.40% | 15 | 2005 | Aa1/A+/A+ | 5.30% / 5.35% | 4.68% | 62 / 67 | 47 / 52 | ||

| 2006 | 4.65% | 4.50% | 15 | 2006 | Aa1/A+/A+ | 5.40% / 5.45% | 4.78% | 62 / 67 | 47 / 52 | ||

| 2007 | 4.80% | 4.60% | 20 | 2007 | Aa1/A+/A+ | 5.50% / 5.55% | 4.88% | 62 / 67 | 42 / 47 | ||

| 2008 | 4.92% | 4.70% | 22 | 2008 | Aa1/A+/A+ | 5.60% / 5.65% | 4.95% | 65 / 70 | 43 / 48 | ||

| 2009 | 5.00% | 4.78% | 22 | 2009 | Aa1/A+/A+ | 5.75% / 5.80% | 5.03% | 72 / 77 | 50 / 55 | ||

| 2010 | 5.08% | 4.85% | 23 | 2010 | Aa1/A+/A+ | 5.90% / 5.95% | 5.10% | 80 / 85 | 57 / 62 | ||

| 2011 | 5.18% | 4.95% | 23 | 2011 | Aa1/A+/A | 6.00% / 6.05% | 5.20% | 80 / 85 | 57 / 62 | ||

| 2012 | 5.27% | 5.00% | 27 | 2012 | Aa1/A+/A | 6.08% / 6.10% | 5.30% | 78 / 80 | 51 / 53 | ||

| 2013 | 5.35% | 5.05% | 30 | 2013 | Aa1/A+/A | 6.13% | 5.40% | 73 | 43 | ||

| 2014 | 5.40% | 5.10% | 30 | 2014 | Aa1/A+/A | 6.15% | 5.50% | 65 | 35 | ||

| 2015 | 5.45% | 5.15% | 30 | 2015* | Aa1/A+/A | 6.35% | 5.77% | 58 | 28 | ||

| 2016 | 5.47% | 5.18% | 29 | 2016* | Aa1/A+/A | 6.35% | 5.77% | 58 | 29 | ||

| 2017 | 5.48% | 5.20% | 28 | 2017* | Aa1/A+/A | 6.35% | 5.77% | 58 | 30 | ||

| 2018 | 5.49% | 5.22% | 27 | 2018* | Aa1/A+/A | 6.35% | 5.77% | 58 | 31 | ||

| 2019 | 5.50% | 5.23% | 27 | 2019* | Aa1/A+/A | 6.35% | 5.77% | 58 | 31 | ||

| 2020 | 5.51% | 5.24% | 27 | 2020** | Aa1/A+/A | 6.40% | 5.83% | 57 | 30 | ||

| 2021 | 5.52% | 5.25% | 27 | 2021-2024** | Aa1/A+/A | 6.40% | 5.83% | 57 | 30 | ||

| 2025-2029*** | Aa1/A+/A | 6.45% | 5.86% | 59 | N/A | ||||||

Source: Office of the NYC Comptroller.

* Sinking Fund Installments of Term Bonds with Planned Payment Dates of July 15, 2019.

** Sinking Fund Installments of Term Bonds with Planned Payment Dates of July 15, 2024.

*** Sinking Fund Installments of Term Bonds with Planned Payment Dates of July 15, 2029.

Second Issuance: 2002-1

In August 2002 TSASC issued its second series of four expected series of bonds for new money purposes.

The Series 2002-1 bonds consisted of serial bonds and Super Sinker Redemption bonds with maturity dates ranging from 2006 to 2014 for serial bonds and two Super Sinker bonds – one with a 2024 stated final maturity and a projected maturity of 2018, and another with a 2032 final maturity and a projected stated maturity of 2025.

The serial bonds bore a stated maturity date while the Super Sinker bonds[7] were subject to additional Super Sinker Redemption provisions. The Super Sinker Redemptions represent the amount of principal TSASC has covenanted to pay on certain bonds, to the extent of available revenues are available. Failure to make Super Sinker Redemptions did not constitute an event of default. However, no payments could flow to the City, and no additional bonds could be issued unless TSASC was current on all Super Sinker Redemptions. The Bonds were subject to an optional par call redemption in 2012.

Total par for the transaction was $500,000,000. Net of expenses, the sale of the bonds generated approximately $481.2 million of proceeds, of which $414.6 million was used for capital projects, $24.9 million was used for capitalized interest, and $41.7 million was deposited into a liquidity reserve account.

Rating and NPM Trapping Events Triggered

In June 2003, Moody’s downgraded R.J. Reynolds Tobacco Holdings to below investment grade (Ba1), which resulted in a “Downgrade Trapping Event” in connection with TSASC’s outstanding bonds. In addition, the market share of the tobacco manufacturers that did not participate in the settlement grew beyond 7% which resulted in a “NPM Trapping Event” in connection with TSASC’s outstanding bonds.

The trapping events required that a portion of TSRs not used for debt service, that would otherwise flow to the City, be deposited in a trapping account until an amount equal to 25% of the outstanding TSASC bonds had been accumulated in that account.

The Trapping Events resulted in TSASC announcing in September 2003 that it did not intend to issue any additional bonds.

By the end of fiscal year 2005, just prior to TSASC’s first restructuring in 2006, $128.6 million had been trapped towards the requirement, which totaled $321 million at the time. Since TSASC only issued approximately 50 percent of the expected program bonds, approximately 50 percent of the residual TSRs, including investment revenues, were to be trapped until the trapping requirement was met.

Absent a restructuring of TSASC outstanding debt, the City estimated the triggered Trapping Events would reduce the flow of residual TSRs to the City by approximately $60 million, $67 million, $54 million and $60 million in 2006, 2007, 2008 and 2009 respectively[8].

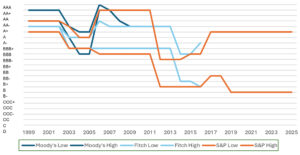

Rating Volatility and Downgrades

TSASC’s bonds, and tobacco-related securities in general, are highly structured products. The results of propriety rating agency cash flow stress tests generally support higher rating levels in earlier maturities and lower ratings are generally assigned to longer maturities due to increased uncertainty related to the tobacco industry’s risk profile and potential for event risk in the tobacco industry. This has generally led to a steady erosion of ratings after initial issuance.

Following the Moody’s downgrade of R.J. Reynolds Tobacco Holdings, and on the back of greater than forecast consumption declines, ratings for TSASC and tobacco-related credit began a steady decline. As shown in the graph below, TSASCs ratings have both declined and the differential between the highest rated and lowest rated bonds has increased. Unlike most issuer credits that carry a single rating for all the bonds of a certain priority under an indenture, TSASC, aside from Fitch at the initial issuance, generally carries multiple ratings across different maturities in the same structure. The first three TSASC transactions only had a senior class of bonds while the refunding in 2017 created a senior and subordinate class of bonds that was intentionally structured to have a variety of ratings across the spectrum.

While it does appear as though TSASC has maintained a higher ratings ceiling since the refunding in 2017, these higher ratings are only on a portion of the bonds. Of the currently outstanding $878.7 million outstanding, $428 senior bonds million carry ratings in the A category, while $175 million subordinate bonds carry BBB- ratings and $275 million were not initially rated.

Chart 2. TSASC Rating History Fiscal Year 1999 to Present

Source: TSASC Rating Reports.

Credit ratings on tobacco bonds including TSASC’s were initially issued by all three major rating agencies – Moody’s, S&P, and Fitch – but have since effectively dwindled to a single rating agency: S&P. Fitch ceased issuing credit ratings for U.S. tobacco settlement bonds altogether in 2016, because of increasing payment complexity and forecasting uncertainty. In withdrawing their ratings, Fitch cited the combination of litigation, exclusions for cigarettes sold by Native American Nations, and future cigarette consumption uncertainty, as reasons they could no longer provide ratings on these types of bonds. Specifically, Fitch wrote:

“However, more recent settlement agreements related to disputed payments connected to the non-participating manufacturer (NPM) adjustment have eroded Fitch’s confidence in the predictability of the calculation of MSA payments going forward. In the past few years, two material settlements, one between New York State (NYS) and the PTMs [Participating Tobacco Manufacturers] (the New York Settlement), and the other among California, 23 other states and the PTMs (the Settling States Agreement, collectively, with the New York Settlement, the Settlement Agreements) modified the calculation of the NPM Adjustment outside of original MSA calculations. The New York Settlement also introduces a new variable, a calculation related to Tribal Sales, which is based on estimates initially and its past and future volatility is unknown.[9]

First Restructure and Release of Trapping Event Funds: Series 2006-1

In February 2006, TSASC issued its Series 2006-1 bonds to restructure all its outstanding indebtedness. The restructuring relieved TSASC of its obligations under the original Indenture and eliminated the need to deposit any TSRs into a Trapping Accounts. The new Indenture provided that a specified percentage of collections are pledged and required to be applied to the payment of debt and operating costs. TSRs which had accumulated in the Trapping Account under the Indenture were released to TSASC, and ultimately the City, free and clear of the lien of the Indenture. The result of this transaction allowed TSASC to withhold the unpledged TSRs in 2006 and 2007 and remit those funds, along with the balance in the trapping account, to provide the City with $555 million of residual tobacco revenue in 2008.

The Series 2006-1 bonds consisted of four Turbo bonds with redemption dates in 2022, 2026, 2034 and 2042, with Projected Final Turbo Redemption Dates in 2015, 2017, 2022 and 2023, respectively.

Turbo Bonds have a stated maturity date and are subject to redemption in accordance with a Sinking Fund Installment schedule. To the extent collections are available from Pledged TSRs, Turbo Redemptions are credited against both the Sinking Fund Installments and Turbo Bond Maturity. Only failure to pay interest when due on the principal on the maturity date constitutes a default. Failure to pay Sinking Fund Installments or Turbo Redemptions on the series did not constitute an event of default.

Pursuant to the new indenture, bondholders were paid solely from Pledged TSRs which represented 37.4% of the TSRs. The remaining 62.6% were defined as Unpledged TSRs, which ultimately flowed through to the City.

NYS AG Settlement of the NPM Adjustment Dispute

For years 2004 through 2014, a portion of the TSRs that otherwise would have been paid to the State, and subsequently TSASC, were deposited into a Disputed Payment Account. The majority of the deposits to the Disputed Payments Account were related to outstanding claims between the State and the PMs attributable to the NPM Adjustment Dispute for payments related to years 2004 through 2014.

Pursuant to the NY NPM Settlement, the NPM Adjustment Disputes for payments related to years 2004 through 2014 were settled and 100% of all of the moneys attributable to the State that were deposited by the PMs during the period 2004 through 2014 into the Disputed Payment Account, together with all accumulated earnings, were released to New York State in 2016. Under the terms of the agreement, New York State received approximately $701 million. TSASC’s share of the settlement was approximately $176 million.

Under other terms of the NY NPM Settlement, the State is no longer subject to the NPM Adjustments provided for in the MSA, except in limited circumstances. For payments related to 2015 and later years, the NY NPM Settlement established a set of circumstances under which the PMs are entitled to credits against future payments to the State, one of which is the Tribal NPM Packs credit. The Tribal NPM Packs credit is based on the estimated number of packs of NPM-manufactured cigarettes sold on Native American reservations to non-Native American consumers in the State. Additionally, like the MSA’s Inflation Adjustment, the Tribal NPM Packs credit is inflated each year by the greater of the annual change in CPI-U or 3%.

The NY NPM Settlement states that, starting in 2017, determinations by an Independent Investigator, who is selected once every four years, will apply for two years (meaning for example, the Investigator’s determination of the 2015 volume of Tribal NPM Packs shall be deemed the volume for 2016 as well). The NY NPM Settlement states that determinations by the Investigator of the number of Tribal NPM Packs shall be conclusive, final and binding on all parties and no appeal, request for vacatur or modification or other challenge to the determination shall be permitted.

Second Restructure and Estimate of Tribal Settlement: Series 2017 A & B

Due to the continued cigarette consumption decline and payment credits under the NY NPM Settlement, Turbo Redemptions of the Series 2006-1 bonds occurred much slower than expected and TSASC faced the possibility of defaulting on its outstanding debt as early as Fiscal Year 2022. The 2006-1 bonds became callable in 2016 and in January 2017, TSASC issued its currently outstanding Series 2017 Series A and B bonds in order to refund all outstanding Series 2006-1 Bonds.

The bonds were restructured on a tax-exempt basis, and the transaction was designed to insulate TSASC from a risk of default and generate future savings for the City by way of maximizing out-year residual payments. Similar to the 2006-1 bonds, the bonds were structured such that bondholders were paid solely from Pledged TSRs which represented 37.4% of the TSRs.

The bonds were structured to include $613.4 million Senior bonds that amortize from 2017 to 2036 and a term bond due in 2041. The transaction also included $489.7 million subordinate bonds that consisted of serial bonds that amortized from 2018 to 2025 as well as exchanged turbo bonds that matured in 2045 and 2048.

Under the NY NPM Settlement, Tribal NPM Packs sales now resulted in reductions of TSRs paid by the PMs to the State, and ultimately TSASC. As such, IHS Global was hired to prepare an estimate of untaxed NPM cigarettes sold by on-reservation cigarette retailers in the State from 2015 through 2048. The report estimated the sales of 54.2 million packs in 2015 and 49.8 million packs in 2016 and forecast Tribal NPM packs would decline 72% to 15.4 million packs by 2048.

Taking into account the projected Tribal Adjustment, the 2017 A and B bonds were structured to withstand a consumption decline of 5.1% at the time of issuance, which represented an improvement to the 3.7% decline the outstanding 2006-1 bonds could withstand at the time.

Initial and subsequent Tribal Adjustment Determinations

In April 2017, the Independent Investigator, selected pursuant to the NY NPM Settlement, released the initial determination of Tribal NPM Packs sold in 2015, which was used in determining the 2017 MSA payment. Leading up to the release, the PMs reported a range between 170 million and 247 million pack Tribal Adjustment and the NYS AG’s office estimated a 118 million Tribal Pack adjustment to be applied for the two-year period 2015 and 2016. The independent investigator determined the adjustment would be 175 million packs after reviewing the reports and conducting its own investigation. This was significantly higher than the forecast which supported the structuring of the 2017 A and B bonds.

In April 2019, the NYS AG’s office agreed with the PMs to a 175 million pack Tribal Adjustment for both 2017 and 2018, without conducting any investigation. This amount does not account for the consumption declines that have occurred in the previous 2 years. At the time of the stipulation the New York Attorney General stated that “this figure is not an admission by either the State or the PMs as to (a) the actual volume of Tribal NPM Packs sold in New York during 2017 and 2018; or (b) the actual collection or non-collection of New York Excise Tax relating to any such actual sales of Tribal NPM Packs during 2017 and 2018.”

In April 2021 the Independent investigator determined 165.9 million Tribal NPM Packs were sold in 2019; this figure was used to determine the payments in 2021, 2022, 2023 and 2024. In 2025 the New York State Attorney General stipulated 165.9 million Tribal NPM Packs to be used again for determining payments in 2025 and 2026.

Subordinate Liquidity Reserve Account Draws

Primarily as a result of the initial determination by the Independent Investigator In 2017, TSASC received reduced payments of TSRs than what was previously forecast, which resulted in a draw upon its Subordinate Liquidity Reserve Account to meet its debt service requirement due December 1, 2017[10].

As a result of continued consumption decline and subsequent Tribal NPM packs adjustments, TSASC has received significantly less TSRs than initially projected at the time of the issuance of the Series 2017 A and B bonds. As such, TSASC has been required to draw upon its Subordinate Liquidity Reserve Account nearly annually.

Prior to the June 1, 2025 draw, a Security Agreement (further described below) was adopted on December 9, 2024. The Security Agreement allowed for the remaining portion of the June 1, 2025 payment to be paid by Unpledged TSRs made available to pay debt service.

Forestalling Default: Adoption of the Security Agreement

The passage of the 2017 Tax Cuts and Jobs Act (“TCJA”) eliminated the tax-exempt status for advance refunding bonds issued after December 31, 2017, meaning TSASC’s ability to restructure its debt has been limited. As a result, TSASC continued to draw on the Subordinate Liquidity Reserve to make debt service payments until the account was exhausted to partially satisfy the June 1, 2025, debt service payment.

Prior to exhausting the Subordinate Liquidity Reserve Account, on December 9, 2024, TSASC entered into a Security Agreement which allows TSASC to use Unpledged TSRs, only to the extent needed, to pay debt service on TSASC’s Fiscal 2017 Series A and Series B bonds, beginning June 1, 2025, through June 1, 2028.

The Security Agreement allowed for a portion of the June 1, 2025 and the entire December 1, 2025 subordinate debt service payments to be paid by Unpledged TSRs. The projected amount to be paid by Unpledged TSRs, pursuant to the Security Agreement, in Fiscal Year 2025 is approximately $12.0 million.

Going forward, the Security Agreement pledges all settlement revenues first to TSASC until June 1, 2028, and is intended to forestall default until the bonds reach their par call date and become eligible to be restructured with tax-exempt bond proceeds. No decision has been reached as to the method or as to the timing of any restructuring.

Conclusion

After 25 years and multiple changes in dynamics to the underlying credit, TSASC has served its purpose and provided the City with a pathway forward to finance its capital needs. However, not long after its second issuance, the revenue stream that was supposed to back the bonds never fully met projections and the credit failed to reach its full anticipated potential.

Fortunately, during that same period, the City’s finances and access to capital markets have improved greatly. The General Obligation and TFA Future Tax Secured credits have performed well and credits such as the TFA’s Building Aid Revenue Bonds and Hudson Yards Infrastructure Corporation have been created and have proven there is a deep investor demand for bonds with more stable revenue streams, even if they are appropriation credits.

MSA payments have continued to become less predictable and continue to decline faster than projections. Despite two restructurings, TSASC has once again found itself in a precarious financial situation and relies on the Security Agreement to avoid default by relying on funds that would otherwise flow through to the City. While there is an opportunity to restructure the debt again in 2027, any opportunity to do so under the existing revenue construct is likely prohibitively expensive or non-existent.

The recent TSASC Security Agreement is a step in the right direction to avoid a default, but it is not permanent, and many uncertainties remain after its expiration. What is almost certain is another restructuring that solely relies on tobacco revenues is the most expensive way for the City to refinance this debt.

The clear recommendation is for the City to go one step further and create a more permanent financing vehicle – one that removes tobacco entirely from the equation and pays the liability in full. A new credit can be structured to take advantage of investor interest and leverage demand to achieve more certainty that provides overall debt service savings to the City.

Acknowledgements

This fiscal note was authored by F. Jay Olson, Deputy Comptroller for Public Finance, Tim Martin, Assistant Comptroller for Public Finance and Christian Hansen, Deputy Director of Debt Management. Archer Hutchinson, Creative Director, and Addison Magrath, Graphic Designer led the report design and layout.

[1] This was due to a dramatic change in the methodology used in the calculation of the debt limit, as documented in Brindisi F. (2024) Special Equalization Ratios and the City’s Debt Limit, Office of the NYC Comptroller, March (see in particular Chart 2).

[2] Although Florida, Minnesota, Mississippi, and Texas are not signatories to the MSA, they have their own individual tobacco settlements, which occurred prior to the MSA.

[3] NY State has received about $20 billion since inception: MSA Payments to States 1999-April 2025.

[4] MSAI total net market shipments as reported by the National Association of Attorneys General

[5] MSA Inflation Adjustment Calculation

[6] The State enacted a Model Statute in 1999, intending to prevent NPMs from gaining profits by avoiding entering into the MSA. The Model Statute was intended to eliminate the economic disadvantage the PMs bore relative to the NPMs by requiring comparable payments of the NPMs to be deposited to an escrow. If the Model Statute were to be invalidated, TSASC would likely receive less TSRs due to the declining market share of the PMs.

[7] Super sinker bonds have a long-term coupon but a potentially short maturity. Investors benefit from a potential brief maturity period while being able to take advantage of longer-term interest rates.

[8] Source: Mayor’s messages of FY 2005 and FY 2006

[9] 2016 Fitch Withdrawal of All Ratings on US Tobacco ABS – TSASC

[10] TSASC Financial Statements, Fiscal Year 2017