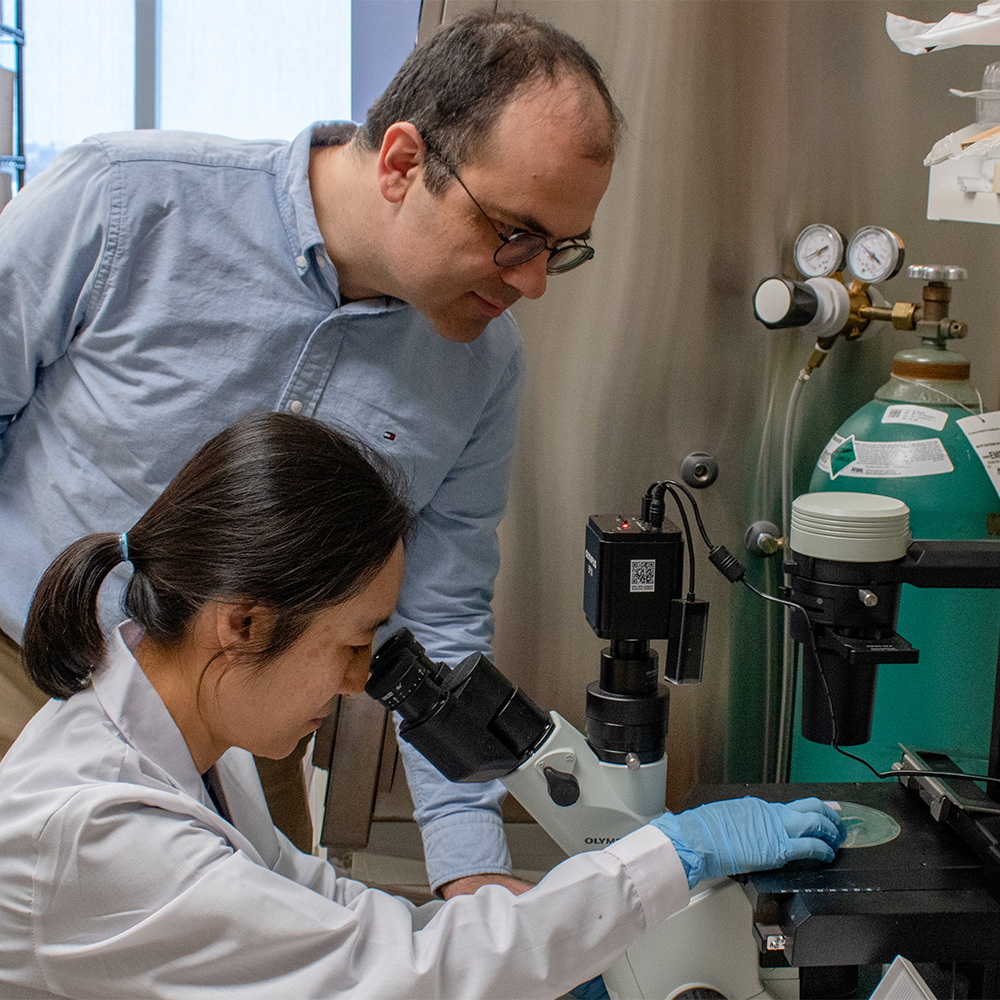

Michalis Agathocleous, Ph.D., Assistant Professor in CRI and of Pediatrics, works with Ji Hyung Jun, Ph.D., Agathocleous Lab Senior Research Scientist at UT Southwestern.

DALLAS – Dec. 29, 2025 – Scientists at

Michalis Agathocleous, Ph.D., Assistant Professor in CRI and of Pediatrics, works with Ji Hyung Jun, Ph.D., Agathocleous Lab Senior Research Scientist at UT Southwestern.

DALLAS – Dec. 29, 2025 – Scientists at