UK housebuilding in deepest slump since 2020

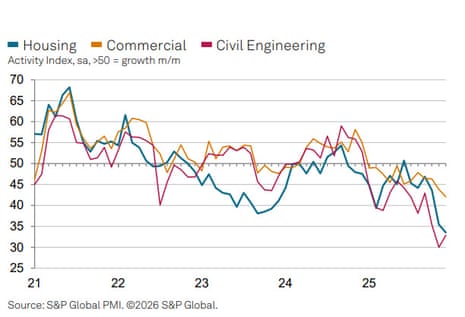

Newsflash: Britain’s construction sector continued to shrink in December, as housing, commercial and civil engineering activity suffered sharp falls again.

Data provider S&P Global has reported that activity across the UK construction sector, and new orders, both fell again last month.

Housebuilding and commercial construction work both decreased at the fastest rate since May 2020, when the Covid-19 lockdown forced building sites to close, S&P Global’s survey of purchasing managers at UK construction firms shows.

That highlights the government’s struggle to hit its housebuilding targets.

Civil engineering was the weakest-performing category of construction activity in December; it also shrank, but not by as much as in November.

This lifted the UK’s construction PMI index slightly to 40.1 in December, up from 39.4 in November, but still showing a contraction – for the 12th month runnng (50 = stagnation).

The drop extended the sector’s downturn to 12 months, its longest unbroken run of contractions since the global financial crisis of 2007-09, Reuters reports.

S&P Global says there is anecdotal evidence that fragile confidence among clients had hit workloads, and that delayed investment decisions ahead of the Budget in November had hurt sales.

More happily, though, business activity expectations for the year ahead rebounded to a five-month high, which suggests that budget uncertainty has lifted.

Tim Moore, economics director at S&P Global Market Intelligence, says:

“UK construction companies once again reported challenging business conditions and falling workloads in December, but the speed of the downturn moderated from the five-and-a-half-year record seen in November. Many firms cited subdued demand and fragile client confidence. Despite a lifting of Budget-related uncertainty, delayed spending decisions were still cited as contributing to weak sales pipelines at the close of the year.

By sector, latest data indicated the fastest reductions in housing and commercial construction since May 2020, while civil engineering was the only segment to signal a slower pace of decline than in the previous month.

Key events

Netflix cheers Paramount’s rejection

Netflix has welcomed Warner Bros’ decision to reject Paramount’s takeover offer, and stick with its bid instead.

Ted Sarandos and Greg Peters, co-CEOs of Netflix, say in a statement:

“The WBD Board remains fully supportive of and continues to recommend Netflix’s merger agreement, recognizing it as the superior proposal that will deliver the greatest value to its stockholders, as well as consumers, creators and the broader entertainment industry.

“Netflix and Warner Bros. will bring together highly complementary strengths and a shared passion for storytelling. By joining forces, we will offer audiences even more of the series and films they love—at home and in theaters—expand opportunities for creators, and help foster a dynamic, competitive, and thriving entertainment industry.”

Warner Bros rejects ‘inferior’ Paramount hostile bid

Warner Brothers Discovery has rejected a hostile takeover offer from Paramount Skydance, and is urging shareholders to back its rival deal with Netflix instead.

Having pondered Paramount’s $108.5bn bid, tabled on December 22, Warner Bros has concluded that it is not in the best interests of WBD and its shareholders and does not meet the criteria of a “Superior Proposal” under the terms of the merger agreement with Netflix, worth $82.7bn.

Warner Brothers says the “extraordinary amount of debt financing” behind Paramount’s bid is a concern, calling it effectively a leveraged buyout.

As a results, Warner Bros “unanimously reiterates” its recommendation in support of the Netflix combination, and recommends that its shareholders reject Paramount’s offer.

Last month Paramount sweetened its offer by saying tech billionaire Larry Ellison would provide a personal guarantee of more than $40bn for the deal.

In response today, Samuel A. Di Piazza Jr, chair of the Warner Bros. Discovery Board of Directors, says:

“The Board unanimously determined that the Paramount’s latest offer remains inferior to our merger agreement with Netflix across multiple key areas.

“Paramount’s offer continues to provide insufficient value, including terms such as an extraordinary amount of debt financing that create risks to close and lack of protections for our shareholders if a transaction is not completed. Our binding agreement with Netflix will offer superior value at greater levels of certainty, without the significant risks and costs Paramount’s offer would impose on our shareholders.”

Paramount is proposing to buy Warner Brothers’ legacy television assets as well as its studio and streaming business, which Netflix has agreed to buy.

UK government debt appears to be in strong demand.

An auction of a £4.25bn government bond attracted offers for three and a half times as much debt as was available – the highest bid-to-cover ratio since last July.

UK government debt has been providing a higher interest rate than rival sovereign debt, making it more attractive to investors.

Inflation across the eurozone has dropped back to the European Central Bank’s target.

Prices rose at an average annual rate of 2% in the year December, statistics body Destatis estimates, with energy prices 1.9% lower than a year ago.

China has denounced the US as a bully following Donald Trump’s announcement that millions of barrels of Venezuela’s oil will be taken to the US and sold.

Chinese foreign ministry spokesperson Mao Ning told a press conference:

“The United States’ brazen use of force against Venezuela and its demand for ‘America First’ when Venezuela disposes of its own oil resources are typical acts of bullying.

“These actions seriously violate international law, gravely infringe upon Venezuela’s sovereignty, and severely damage the rights of the Venezuelan people.”

Elliott Jordan-Doak, senior UK economist at Pantheon Macroeconomics, says negative sentiment appears to be “entrenched” within the construction sector, as there are “few reasons for builders to be more optimistic in 2026”.

He explains:

The Budget’s prioritisation of higher welfare spending rather than investment will come as a disappointment to many builders, and the boost to activity from falling interest rates will be modest this year.

Meanwhile, the Chancellor’s mansion tax will exert further downward pressure on the housing market. So, we expect only modest growth in construction sector activity in 2026, with risks tilted to the downside.

ING expect next Bank of England rate cut in March

ING predict the Bank of England will cut interest rates in March and June, due to the weakening jobs market and easing inflation pressures.

That would help borrowers, and could provide some stimulus to the UK construction sector.

They say:

There are now only four vacancies for every 10 unemployed workers, below pre-Covid levels. Redundancies tentatively appear to be rising, and unusually, more companies are closing than opening. Unemployment is increasing, data quality issues notwithstanding.

This matters for two reasons. First, wage growth is falling rapidly and has further to go. Private sector pay growth was 6% last January, 3.9% in October, and could conceivably fall to 3% within months. That would be below pre-Covid levels. Real disposable incomes are likely to flatline this year as a result.

Fears of another inflation wave are “overblown”, they argue too:

The 2022 energy price spike fell on an economy with conditions ripe for inflation to take hold in a long-lasting way. That isn’t true today; workers – and companies – lack the power to secure higher wages/prices in response to rising costs. Inflation expectations may have risen in response to a spike in food prices, but we struggle to see inflation responding in the sort of long-lasting way it did three or four years ago.

And anyway, food inflation has started to fall. All the evidence from elsewhere – Western Europe and CEE, which tends to lead the UK – suggests it should drop lower. The UN’s gauge of food input prices is falling.

Construction PMI: what the experts say

Despite December’s stumble, there are hopes that the UK construction sector could revive in 2026.

Brian Smith, head of cost management at consultancy AECOM, says:

“This week’s icy conditions somewhat reflect the mood of the construction industry and could prevent a fast start to the year. But, as today’s figures show, things are starting to improve for contractors and January will all be about positioning themselves to gradually expand capacity and be on the front foot to win new work when it comes.

“Everything points towards a further slowdown in inflation and cuts in interest rates to match this year, which will embolden clients and developers to kickstart schemes left on the back burner. However, if everything starts at once, it’s essential that the planning system is equipped to manage the uptick in projects – embracing AI and digital tools to complement the influx of new planners will prove crucial.”

Max Jones, Director & Head of Construction at Lloyds, also sees reasons for optimism:

“Despite today’s figures, there are some encouraging signs as we head into 2026, including investment in major infrastructure projects which could help accelerate activity, offering a more optimistic outlook for the industry.

“Recent supply chain improvements mean firms are well placed to meet increased demand, although the sector could face renewed pressure on labour availability. While project pipelines expand, competition for specialist skills may intensify and firms that can plan for this now will be best positioned to seize opportunities for the months ahead.”

Britain’s short-term government borrowing costs have fallen, as the City reacts to the downturn in UK construction.

UK two-year gilt yields have fallen to their lowest level since August 2024 – they’re down 4 basis points to 3.661%.

That’s a sign that investors are anticipating cuts to UK interest rates.

Currently the money markets are pricing in one cut by June, and possibly a second by the end of 2026.

But earlier this week Goldman Sachs predicted there will be three quarter-point rate cuts by next Christmas, which would bring Bank Rate down to 3%.

But some

This chart shows how activity in UK housebuilding, and commercial construction, both fell to their lowest in over five years in December: