Investors bought a net $49.19 billion worth of global equity funds during the week, the most since November 13 last year, data from LSEG Lipper showed.

Sign up here.

Investors snapped up U.S. equity funds of $36.41 billion in their largest weekly net purchase in nearly 11 months. European and Asian funds also saw weekly inflows to the tune of $7.36 billion and $3.94 billion, respectively.

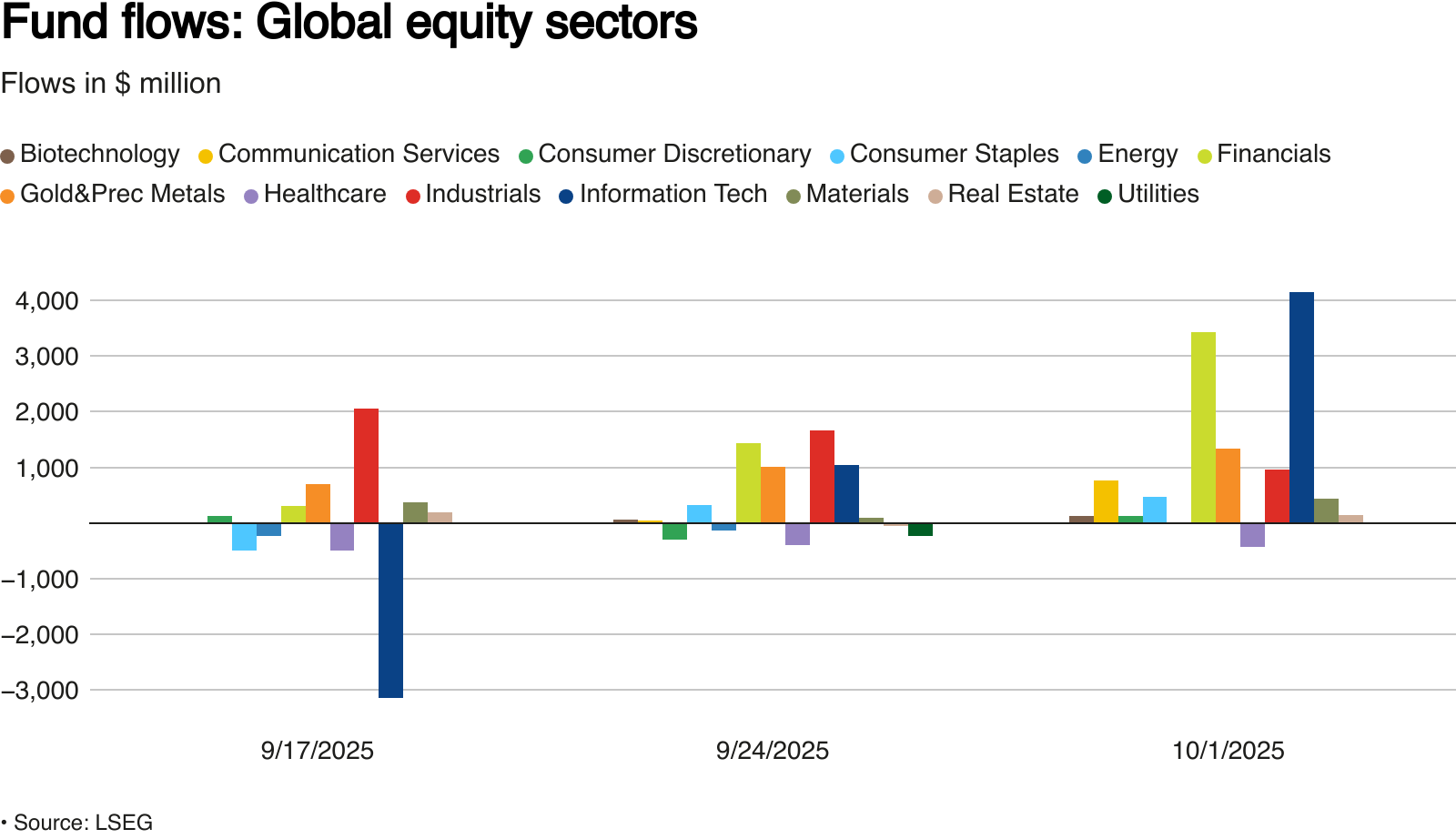

Equity sectoral funds received $11.56 billion, the largest amount for a week since at least January 2022, with tech and financials leading the net purchases at $4.15 billion and $3.43 billion, respectively.

Ned Davies Research upgraded global equities to overweight on Thursday, raising stock allocation to 60% from 55% and cutting cash to 5% from 10%, citing seasonal strength, earnings momentum, and easing inflation pressures.

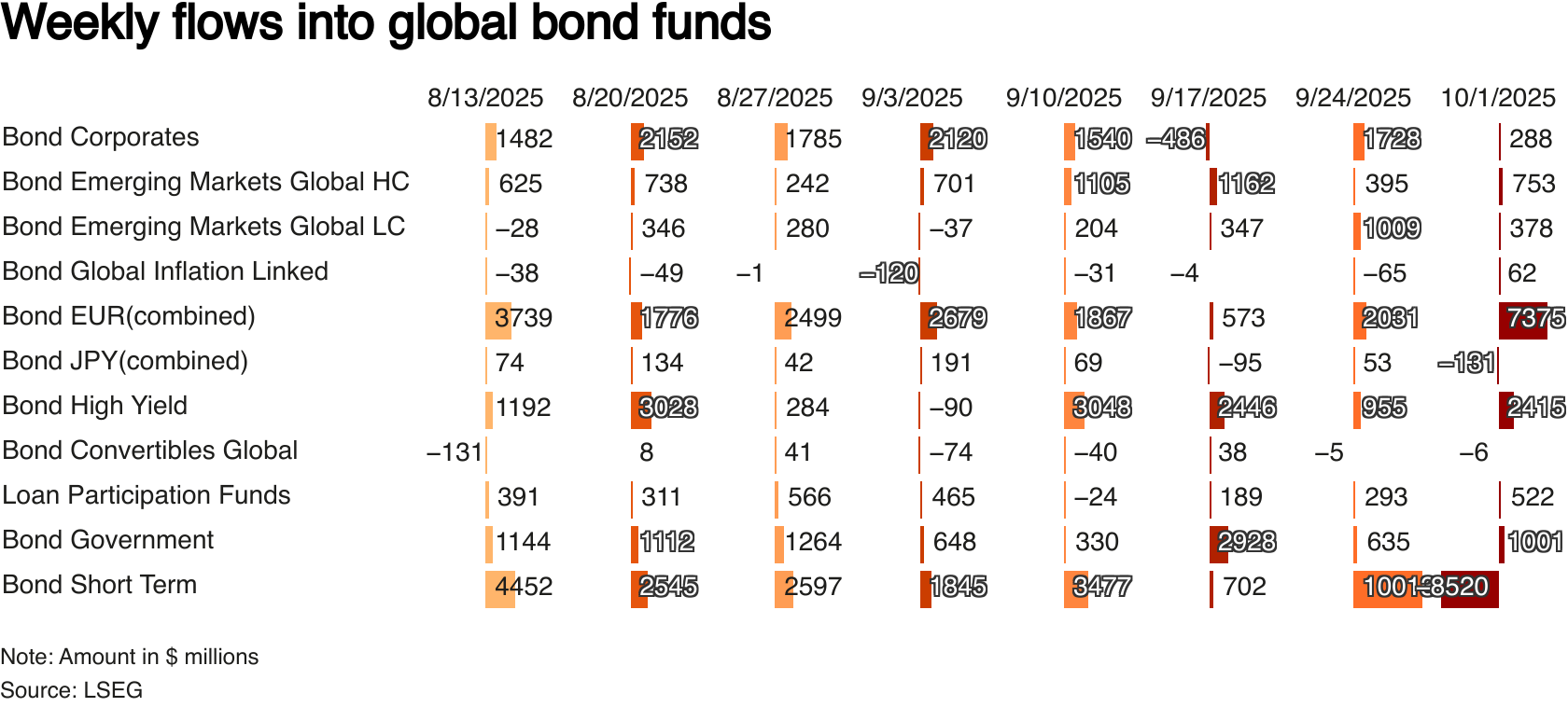

Global bond funds were popular for a 24th straight week, although weekly net investments eased to a 14-week low of $6.06 billion.

Euro-denominated bond funds and high yield bond funds stood out with a net of $7.37 billion and $2.41 billion weekly inflows. In contrast, short-term bond funds saw a net $8.52 billion outflow after 13 weeks of inflows in a row.

Investors parked a net of $8.84 billion into money market funds, posting the first weekly net purchase in three weeks.

Gold and precious metals commodity funds saw a sixth successive weekly inflow, amounting to $4.66 billion on a net basis.

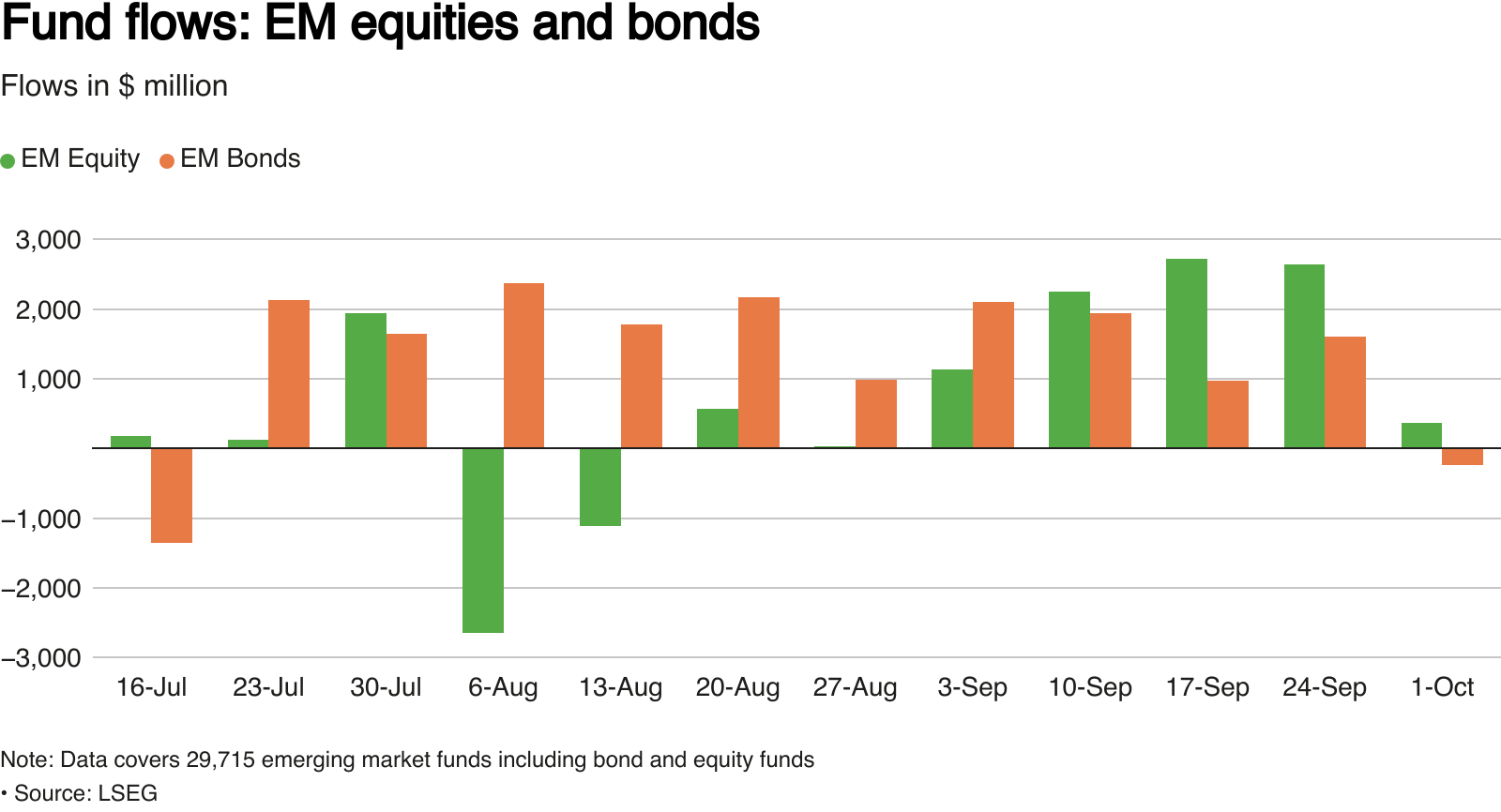

In emerging markets, investment activities were mixed as equity funds faced with $239 million net outflows after 10 weeks of inflows in a row, while bond funds had a net $373 million weekly inflow, data for a combined 29,715 funds showed.

Reporting by Gaurav Dogra and Patturaja Murugaboopathy in Bengaluru; Editing by Leroy Leo

Our Standards: The Thomson Reuters Trust Principles.