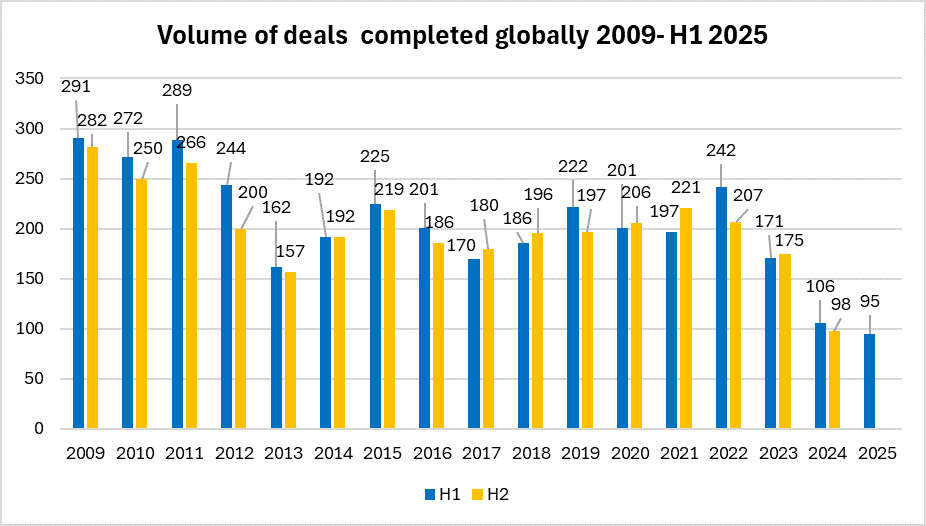

Global insurance carriers stayed on the dealmaking sidelines during the first half of 2025, with activity during the period falling to its lowest level since the financial crisis of 2008.

The first six months of the year saw 95 deals completed. compared with 106 in the same period in 2024, falling short of the 10 year H1 deal activity average of 192 deals.

- H1 activity is the lowest on record with carriers spurning deals amidst ongoing economic, geopolitical and regulatory uncertainty

- Insurers conserving capital, preferring selective deployment of funds through share buybacks and smaller bolt-on acquisitions

- Pent up carrier demand set to focus on opportunities in regional markets and MGA aggregation in second half of the year

Carrier caution was abounded during this period, fuelled by a combination of ongoing geopolitical uncertainty, inflationary concerns and wider economic turbulence, and stubbornly high valuations.

With reported interest from private equity bidders also falling, carriers sought to retain their war chests, instead selectively pursuing smaller bolt-on deals, share buybacks and organic investment projects instead.

Carriers in the US made selective acquisitions, with notable deals crossing the line over the period, including Sentry Insurance’s $1.7bn acquisition of The General from American Family insurance, while Markel’s acquisition of the UK’s MECO, a specialist marine MGA, highlighted the ongoing interest in the MGA market.

However, cross-border deals were few-and-far-between during H1, with carriers focussing on domestic opportunities, including several small-scale tie-ups in the Bermudian market.

In the Middle East, dealmaking generally remained muted, with some activity being seen across the life sector, prompted by international players seeking expansion into regional and healthcare markets.

Carrier activity in the UK and Europe was subdued, with non-carrier deals in the broking and intermediary spaces more evident.

North America posted the largest number of deals completed in the period at 35, compared to 29 across EMEA, 25 in the APAC region and just four deals in Latin America. According to the data there were 21 cross border deals completed over the period.

Share buybacks were a feature of the period, particularly in Japan and across Asia, as listed carriers sought to take advantage of relatively low share prices to buy their own shares.

The first half of the year ended with a number of deals being announced, including Zurich’s acquisition of AIG’s Global Personal Travel Insurance and Assistance business for $600m. The deal is expected to close in the second half of 2025.

Peter Hodgins, Partner and Global Head of Corporate Insurance, said: “There are a host of factors putting the brakes on global carrier M&A including ongoing geopolitical tensions, tough economic conditions and regulatory uncertainty. Getting deals done is hard and they are taking longer to complete. But there’s evidence to suggest that pent up demand from carriers looking for strategic growth will result in higher activity in the second half of the year.”

He added: “There are several large carriers in the market that have voiced their ambitions to make acquisitions this year. There are number of high-profile processes that are continuing, while listed valuations may increase the appetite of some players to make inorganic moves. We also are seeing evidence that international carriers are readying themselves for M&A that gets them access to higher growth emerging markets. The MGA story will continue into the second half of the year and into 2026, with continued aggregation of multi-jurisdictional capabilities that grants carriers access to new markets.”

Research methodology

The Clyde & Co Insurance Growth Report report is based on data by Refinitiv for completed mergers and acquisitions in the global insurance industry in the period 2009 to 2024 to date for businesses with the SIC codes: 6311 Life Insurance, 6321 Accident and Health Insurance, 6331 Fire, Marine, and Casualty Insurance, 6351 Surety Insurance, 6361 Title Insurance and 6399 Insurance Carriers, Not Elsewhere Classified. Additional input, analysis and insight was gathered from face-to-face and telephone interviews with Clyde & Co partners around the world during August 2024, supplemented by existing third-party research.