An Seyoung completes her comeback

In the women’s singles draw, Olympic champion An Seyoung came back from a game down to beat 19-year-old Miyazaki Tomoka 16-21, 21-9, 21-6. This is the world No.1’s first tournament since finishing as…

In the women’s singles draw, Olympic champion An Seyoung came back from a game down to beat 19-year-old Miyazaki Tomoka 16-21, 21-9, 21-6. This is the world No.1’s first tournament since finishing as…

Did you love “The Serpent & the Wings of Night” by Carissa Broadbent? You’re in luck – the fan-favorite romantasy author has a new adventure due next year.

“The Lion & the Deathless Dark” publishes August 2026 and features one of the…

By Jules Rimmer

Investors face limited options when it comes to allocating capital

Bank of America’s strategist Michael Hartnett makes a couple of eye-catching calls on bonds and gold.

Buy longer-dated Treasury bonds and stay the course on gold.

Those are the two trade recommendations made by a team of strategists at Bank of America led by Michael Hartnett in their latest note to clients released Friday. First, they recommend investors buy 30-year Treasurys BX:TMUBMUSD30Y on the expectation that its yield will dip below 4%, versus its present level of 4.56%, as the Federal Reserve continues to cut interest rates.

As for gold, Hartnett and his colleagues believe the price of the yellow metal (GC00) can peak at $6,000 an ounce next year. Their call on gold (GC00) looks especially bold, as the precious metal is roughly a third higher than where it is now and has already delivered a whopping 65% return so far in 2025.

The current dilemma facing investors, or the ‘zeitgeist’ as Hartnett and his colleagues phrase it, is they are forced to allocate from these choices: a U.S. Treasury market when the government owes $38 trillion; the corporate bond market where yields relative to government debt are the meanest in two decades; equities valued at forty times their cyclically-adjusted price-earnings ratio; or gold, “that’s just gone vertical.”

The strategists make it abundantly clear: there are no easy options at this juncture. Another “zeitgeist” they warn of is the threat posed by “the k-shaped economy” going “pear-shaped if asset prices drop and hit the rich.” The so-called k-shaped economy reflects a pattern in which one sector of the economy rebounds, while another declines. The worry here would be the dent to the consumption patterns of wealthy American households were the stock market or crypto assets to fall sharply.

Hartnett’s team is aware their call on gold is far from unique, “contrarian it ain’t” as long gold is the most crowded trade in Bank of America’s fund management survey for October. They also think the end of the U.S. government shutdown could trigger a concerted bout of profit-taking, but allocations both from retail and institutional investors are still low enough to warrant a continuation of the bull run in gold for now.

They also like international stocks right now and highlight the potential upside for Hong Kong’s Hang Seng index HK:HSI. They see 33% upside to 33,000 as global purchasing manager indices edge above 50 into expansionary territory, Chinese financial conditions ease and Asian export growth improves.

Hartnett and his team identify some contrarian trades without necessarily recommending them, but simply drawing attention to massive disparities in trend and sentiment. Favoring bonds over stocks, the U.K. market UK:UKX over Europe XX:SX5E and energy XLE over tech MAGS would all run strongly against the grain, they also caution that were the White House-led bailout of Argentina to fail then the highly consensual long Emerging Markets call could be called into question.

The number of leveraged equity ETFs at record-high. Trading sentiment is very robust at present.

For now, though, the strategists cite the 123 rate cuts that have occurred globally this year as the main reason why equity sentiment is so bullish, while investor allocations to bonds are the lowest since October 2022 when this bull market began.

-Jules Rimmer

This content was created by MarketWatch, which is operated by Dow Jones & Co. MarketWatch is published independently from Dow Jones Newswires and The Wall Street Journal.

(END) Dow Jones Newswires

10-17-25 0931ET

Copyright (c) 2025 Dow Jones & Company, Inc.

Aston Martin Aramco Formula One Team has confirmed that Young Driver Jak Crawford will make his Formula One weekend debut in Free Practice One at the Mexico City Grand Prix.

The 20-year-old Texan will drive the AMR25 in FP1 at the Autódromo…

This request seems a bit unusual, so we need to confirm that you’re human. Please press and hold the button until it turns completely green. Thank you for your cooperation!

Taylor Hill was noticeably absent from the 2025 Victoria’s Secret runway and she’s quietly calling it out

Everyone noticed: Taylor Hill was missing…

What does ‘lift and coast’ mean and why do drivers use this technique? How do they reduce their speed under a Virtual Safety Car? Why do they use a different engine mode when driving in the pitlane? And what do the buttons on an F1 steering…

Tanvi Sharma secured a medal for India at the BWF World Junior Championships 2025 badminton tournament in Guwahati by winning her quarter-final match of the girls’ singles event on Friday.

With the semi-final place confirmed, Tanvi Sharma is…

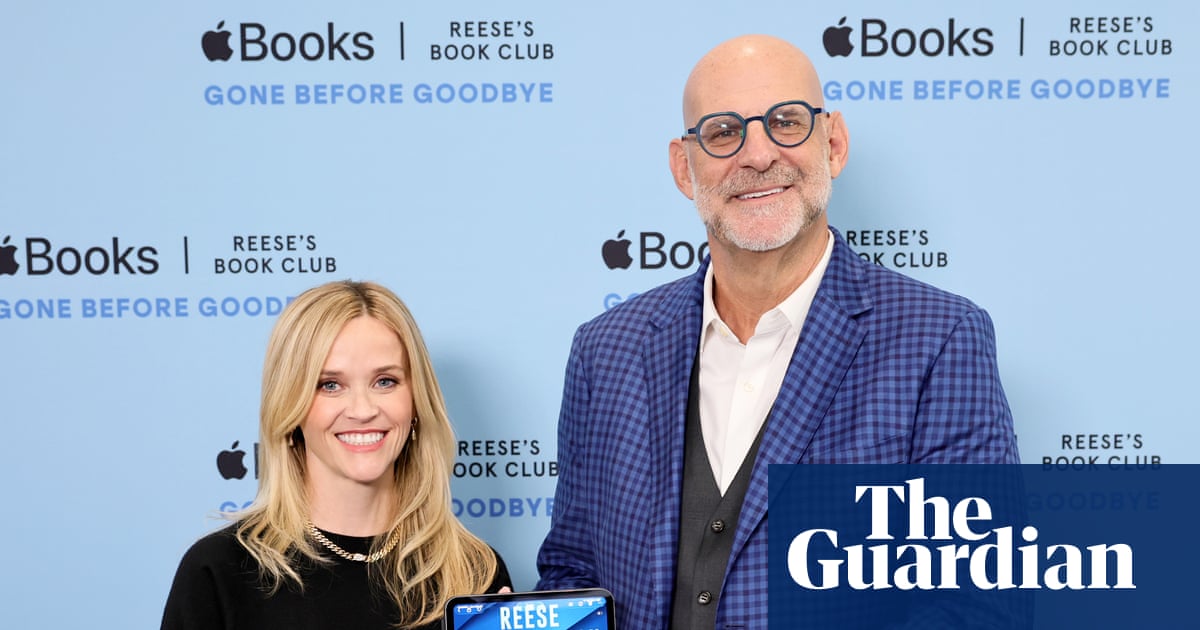

For more than three decades, Reese Witherspoon has been many things to many people: the Oscar-winning star of Walk the Line; the pink-clad Elle Woods of Legally Blonde; the Hollywood producer who brought Gone Girl and Big Little Lies to the screen….