Vietnam’s gross domestic product (GDP) surged by a remarkable 8.23 percent in Q3 2025, the fastest growth rate in Southeast Asia, prompting major financial institutions to revise their forecasts upward.

In Q3 2025, Vietnam’s economy grew by 8.23 percent, lifting the nine-month year-on-year expansion to 7.85 percent. Following this performance, several international research institutions have upgraded their economic forecasts for Vietnam.

FIND BUSINESS SUPPORT

The Asian Development Bank (ADB) has raised its 2025 GDP projection for Vietnam from 6.6 percent to 6.7 percent, while forecasting a possible moderation to six percent in 2026. Likewise, United Overseas Bank (UOB) has upgraded its 2025 estimate for Vietnam to 7.7 percent, citing sustained recovery in manufacturing and exports as key growth drivers.

Despite global uncertainties and recent natural disasters, Vietnam’s economy continued to demonstrate resilient and broad-based growth through the third quarter of 2025.

Vietnam’s GDP growth performance

According to the Ministry of Finance, Vietnam’s GDP grew by 8.23 percent in Q3 2025, bringing nine-month growth to 7.85 percent year-on-year, closely tracking the government’s full-year target of around 8 percent. Positive growth across all three main sectors contributed to the robust GDP growth of Vietnam in both Q3 and the first nine months of 2025

Among them, industrial output, particularly manufacturing and processing, remained the primary growth driver, expanding 10 percent in Q3 and nearly 9.9 percent over the nine-month period, in line with growth targets.

|

Vietnam’s GDP Growth by Sector, Q3 2025 |

||

|

Sector |

Growth in Q3 2025 (%) |

Growth in first 9 months 2025 (%) |

|

Agriculture, forestry, and fisheries |

3.7 |

3.8 |

|

Industry and construction |

9.4 |

8.6 |

|

Services |

8.5 |

8.4 |

|

Overall |

8.23 |

7.85 |

Inflation

FIND BUSINESS SUPPORT

Inflation remained under control. Vietnam’s consumer price index (CPI) increased by 3.27 percent over the first 10 months of 2025 compared to the previous year, according to data from the National Statistics Office (NSO) released on Thursday.

In October, the CPI grew by 0.2 percent from September and was up 2.82 percent from December 2024, with a year-on-year increase of 3.25 percent. The NSO also noted that core inflation rose by 3.2 percent during this period.

|

CPI Movements of Key Goods and Services, October 2025 |

||

|

Category |

Monthly change (%) |

Notes/Drivers |

|

Food and catering services |

+0.59 |

Contributed +0.20 ppts to total CPI |

|

Education |

+0.51 |

Higher tuition fees at some private schools and universities (2025–26 year) |

|

Household equipment and appliances |

+0.20 |

General price increases |

|

Clothing, hats, and footwear |

+0.18 |

Higher seasonal demand as weather cooled |

|

Beverages and tobacco |

+0.12 |

– |

|

Culture, entertainment, and tourism |

+0.06 |

Higher hotel, venue, and entertainment costs |

|

Housing, utilities, and construction materials |

+0.01 |

Slight uptick |

|

Transport |

–0.81 |

Lower domestic fuel prices; dragged CPI by –0.08 ppts |

Credit growth

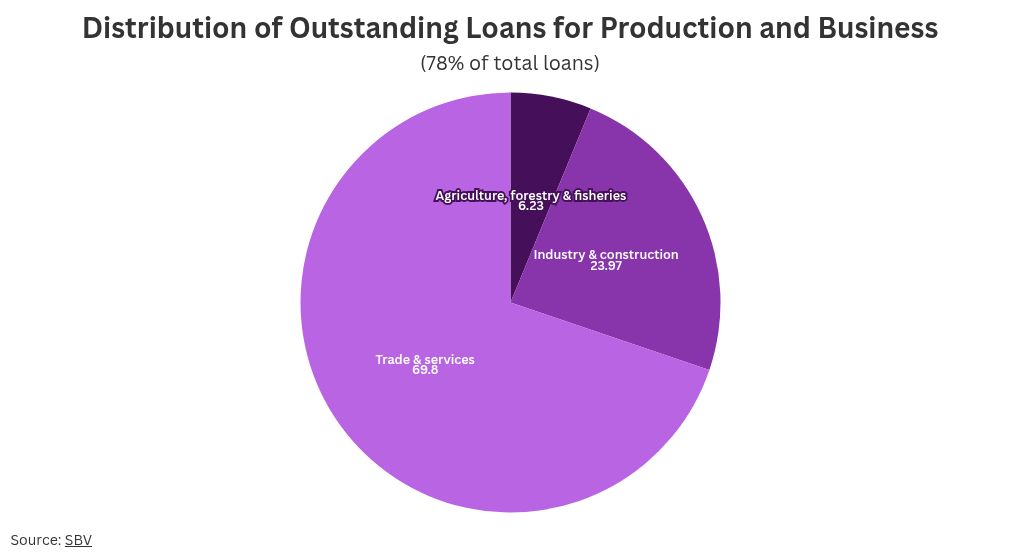

Bank credit in Vietnam has kept climbing this year, rising faster than the same period in 2024 and maintaining a steady upward trend. According to the State Bank of Vietnam (SBV), as of September 29, the country’s bank credit increased by 13.37 percent compared to the end of 2024, the majority directed toward the production and business sectors.

Approximately 78 percent of Vietnam’s outstanding loans during this period supported production and business activities, aligning with the broader economic structure as follows:

|

Vietnam’s Bank Credit Distribution by Priority Sector |

|

|

Priority sector |

Share (%) |

|

Agriculture (priority classification) |

22.76 |

|

Small & medium enterprises (SMEs) |

19.04 |

|

Supporting industries (growth rate) |

23.14 |

|

High-tech application enterprises (growth rate) |

25.02 |

|

Source: SBV |

|

Foreign direct investment

Vietnam attracted US$31.52 billion in foreign direct investment (FDI) during the first 10 months of 2025, marking a 15.6 percent year-on-year increase. FDI disbursements reached US$21.3 billion in the first 10 months, an 8.8 percent increase year-on-year.

FIND BUSINESS SUPPORT

Existing investors added US$12.11 billion to 1,206 projects, up 45 percent in capital injections. Combining new and adjusted capital, manufacturing and processing accounted for US$16.37 billion, or 62.5 percent of total FDI. Real estate attracted US$5.32 billion (20.3 percent).

Meanwhile, capital contributions and share purchases surged 45.1 percent to US$5.34 billion through 2,918 transactions.

Strong momentum in new projects

Vietnam attracted US$14.07 billion in newly registered capital across 3,321 projects, marking a 21.1 percent increase in project count, though total capital value fell 7.6 percent year-on-year.

Notably, manufacturing and processing dominated, accounting for 55.9 percent of new capital at US$5.61 billion, followed by real estate at US$2.75 billion (19.5 percent).

|

Top Sources of Newly Registered Capital, Jan–Oct 2025 |

|

|

Country/Territory |

Newly registered capital (US$ million) |

|

Singapore |

3,760 |

|

Mainland China |

3,210 |

|

Hong Kong (China) |

1,380 |

|

Japan |

1,170 |

|

Sweden |

1,000 |

|

Chinese Taipei |

901.2 |

|

South Korea |

627 |

Trade

Vietnam posted US$762.44 billion in total trade turnover during January–October 2025. The country recorded a US$19.56 billion trade surplus, compared with US$23.18 billion in the same period last year. The domestic sector registered a US$22.83 billion deficit, while the foreign-invested sector (including crude oil) maintained a robust US$42.39 billion surplus.

Export

Vietnam’s exports in October were estimated at US$42.05 billion, down 1.5 percent month-on-month but up 17.5 percent year-on-year. Over the first 10 months of 2025, exports rose 16.2 percent to US$391 billion, including:

- Domestic sector: US$94.17 billion (24.1 percent of total); and

- Foreign-invested sector (including crude oil): US$296.83 billion (75.9 percent), up 22.5 percent.

A total of 36 export commodities exceeded US$1 billion, accounting for 94.1 percent of export turnover. Of these, seven items exceeded US$10 billion, accounting for 67.9 percent of total exports.

|

Vietnam’s Export Structure by Goods Category, Jan–Oct 2025 |

||

|

Category |

Export value (US$ billion) |

Share (%) |

|

Processed & manufactured goods |

346.73 |

88.7 |

|

Agricultural & forestry products |

32.62 |

8.3 |

|

Aquatic products |

9.33 |

2.4 |

|

Fuels & minerals |

2.32 |

0.6 |

Import

FIND BUSINESS SUPPORT

Imports reached US$39.45 billion in October, down one percent month-on-month but up 16.8 percent compared to last year. For the January–October period, imports climbed 18.6 percent to US$371.44 billion, which includes:

- Domestic sector: US$117 billion, up 2.8 percent; and

- Foreign-invested sector: US$254.44 billion, up 27.6 percent

Vietnam imported 47 product categories valued at over US$1 billion each, accounting for 93.9 percent of the total import value. Among these, four categories exceeded US$10 billion, representing 52.7 percent of the total.

Vietnam’s import structure in the first 10 months of 2025 is as follows:

- Capital goods: US$348.23 billion (93.8 percent)

- Machinery, equipment, tools, spare parts: 52.6 percent

- Raw materials & fuels: 41.2 percent

- Consumer goods: US$23.21 billion (6.2 percent)

Additionally, China remained Vietnam’s largest supplier, providing goods worth US$150.9 billion.

Takeaway

Vietnam’s economic performance in 2025 has been robust, with a notable GDP growth of 8.23 percent in Q3, primarily driven by strong industrial output and manufacturing. Business sentiment in the country appears positive, as its FDI grew significantly to $31.52 billion in the first 10 months.

Overall, despite global challenges, Vietnam continues to demonstrate resilience and promising growth prospects across various sectors.

See also: Reshaping Vietnam’s Socio-Economic Zones: A Post-Merger Outlook

About Us

Vietnam Briefing is one of five regional publications under the Asia Briefing brand. It is supported by Dezan Shira & Associates, a pan-Asia, multi-disciplinary professional services firm that assists foreign investors throughout Asia, including through offices in Hanoi, Ho Chi Minh City, and Da Nang in Vietnam. Dezan Shira & Associates also maintains offices or has alliance partners assisting foreign investors in China, Hong Kong SAR, Indonesia, Singapore, Malaysia, Mongolia, Dubai (UAE), Japan, South Korea, Nepal, The Philippines, Sri Lanka, Thailand, Italy, Germany, Bangladesh, Australia, United States, and United Kingdom and Ireland.

For a complimentary subscription to Vietnam Briefing’s content products, please click here. For support with establishing a business in Vietnam or for assistance in analyzing and entering markets, please contact the firm at vietnam@dezshira.com or visit us at www.dezshira.com